Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 17/09/2025

Table of Contents

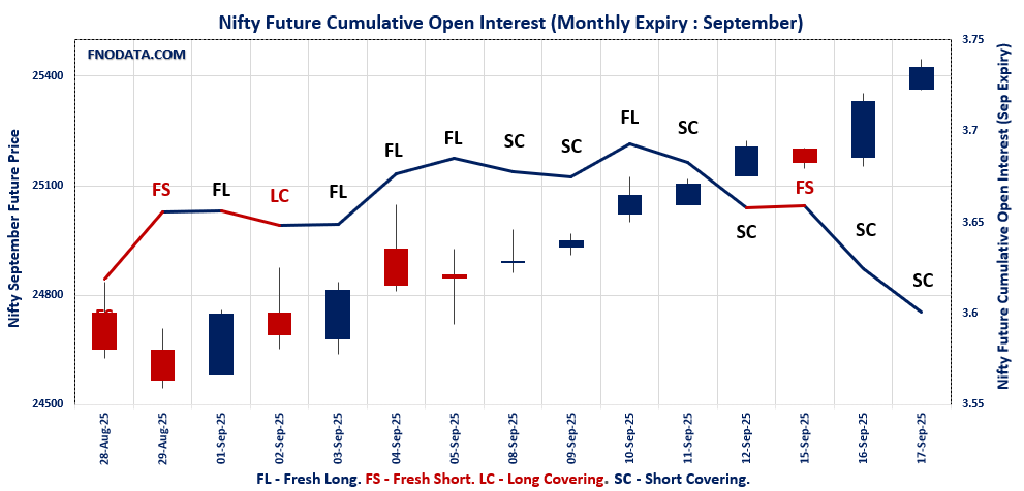

The trading session on 17th September 2025 continued the bullish undertone with short covering at the forefront in Nifty, Bank Nifty, and Sensex futures. Nifty futures closed at 25,423 with a healthy premium of 93 points, but the 2.4% drop in open interest confirmed that the upward move was driven largely by bears unwinding positions rather than aggressive long build-ups. Weekly option dynamics, however, brought balance—PCR (OI) dipped to 1.167 as call writers emerged at 25,500, yet strong put additions at 25,300 highlighted defense at that level.

Bank Nifty followed suit, gaining strength through short covering with OI down by 6.8%, but the monthly option chain showed call writing at 65,000 alongside firm put interest at 55,500, hinting at a wide trading band. FINNIFTY broke rank with fresh long positions despite lower volumes, lending sector-specific positivity, while MIDCPNIFTY mirrored Nifty’s short covering tone. Meanwhile, SENSEX futures also reflected unwinding shorts but with lower intensity, reinforcing a cautious yet positive outlook. This Open Interest Volume Analysis showcases a market that is leaning bullish, but still heavily dependent on short covering for its upward momentum.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,330.25 (0.36%)

NIFTY SEPTEMBER Future closed at: 25,423.40 (0.36%)

Premium: 93.15 (Increased by 0.85 points)

Open Interest Change: -2.4%

Volume Change: -25.8%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (23/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.167 (Decreased from 1.310)

Put-Call Ratio (Volume): 0.898

Max Pain Level: 25300

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25200

Highest CALL Addition: 25500

Highest PUT Addition: 25300

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.144 (Decreased from 1.157)

Put-Call Ratio (Volume): 1.067

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25700

Highest PUT Addition: 25100

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,493.30 (0.63%)

BANKNIFTY SEPTEMBER Future closed at: 55,699.80 (0.65%)

Premium: 206.5 (Increased by 14.5 points)

Open Interest Change: -6.8%

Volume Change: 36.0%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.094 (Increased from 1.082)

Put-Call Ratio (Volume): 0.754

Max Pain Level: 55100

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 65000

Highest PUT Addition: 55500

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,563.55 (0.26%)

FINNIFTY SEPTEMBER Future closed at: 26,669.00 (0.28%)

Premium: 105.45 (Increased by 6.35 points)

Open Interest Change: 1.3%

Volume Change: -38.8%

Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.028 (Decreased from 1.073)

Put-Call Ratio (Volume): 0.757

Max Pain Level: 26300

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26700

Highest PUT Addition: 25500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,151.90 (0.04%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,194.95 (0.02%)

Premium: 43.05 (Decreased by -3.25 points)

Open Interest Change: -0.7%

Volume Change: -11.6%

Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.082 (Decreased from 1.181)

Put-Call Ratio (Volume): 0.987

Max Pain Level: 13050

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13150

Highest PUT Addition: 12900

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 82,693.71 (0.38%)

SENSEX Monthly Future closed at: 82,920.20 (0.39%)

Premium: 226.49 (Increased by 7.83 points)

Open Interest Change: -6.2%

Volume Change: 7.5%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (18/09/2025) Option Analysis

Put-Call Ratio (OI): 1.094 (Decreased from 1.451)

Put-Call Ratio (Volume): 0.952

Max Pain Level: 82600

Maximum CALL OI: 84000

Maximum PUT OI: 81000

Highest CALL Addition: 84000

Highest PUT Addition: 82700

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,124.54 Cr.

DIIs Net BUY: ₹ 2,293.53 Cr.

FII Derivatives Activity

| FII Trading Stats | 17.09.25 | 16.09.25 | 15.09.25 |

| FII Cash (Provisional Data) | -1,124.54 | 308.32 | -1,268.59 |

| Index Future Open Interest Long Ratio | 13.22% | 12.44% | 11.85% |

| Index Future Volume Long Ratio | 69.77% | 67.04% | 55.20% |

| Call Option Open Interest Long Ratio | 49.29% | 49.16% | 48.24% |

| Call Option Volume Long Ratio | 49.99% | 50.77% | 49.57% |

| Put Option Open Interest Long Ratio | 64.23% | 68.13% | 62.51% |

| Put Option Volume Long Ratio | 49.76% | 50.20% | 50.13% |

| Stock Future Open Interest Long Ratio | 62.01% | 62.07% | 62.06% |

| Stock Future Volume Long Ratio | 49.67% | 51.14% | 46.73% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Short Covering | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Short Covering |

| FinNifty Options | Fresh Long | Fresh Short | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Long Covering | Fresh Long |

| Stock Futures | Fresh Short | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (23/09/2025)

The NIFTY index closed at 25330.25. The NIFTY weekly expiry for SEPTEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.167 against previous 1.310. The 26000CE option holds the maximum open interest, followed by the 25200PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25300PE option, with open interest additions also seen in the 25500CE and 25250PE options. On the other hand, open interest reductions were prominent in the 25200CE, 23600PE, and 25100CE options. Trading volume was highest in the 25300PE option, followed by the 25300CE and 25400CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,330.25 | 1.167 | 1.310 | 0.898 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,20,74,575 | 5,40,11,100 | 3,80,63,475 |

| PUT: | 10,74,35,475 | 7,07,75,400 | 3,66,60,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 86,02,350 | 15,31,800 | 5,84,146 |

| 25,500 | 72,23,625 | 39,47,100 | 19,99,138 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 72,23,625 | 39,47,100 | 19,99,138 |

| 26,500 | 58,52,625 | 30,89,550 | 3,43,896 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 30,95,775 | -7,06,575 | 6,71,606 |

| 25,100 | 10,45,275 | -4,20,300 | 1,24,401 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 47,84,025 | 19,86,075 | 28,88,632 |

| 25,400 | 51,93,375 | 28,75,575 | 24,75,897 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 76,14,300 | 19,71,075 | 14,48,461 |

| 25,300 | 69,21,525 | 51,87,225 | 33,83,323 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 69,21,525 | 51,87,225 | 33,83,323 |

| 25,250 | 47,99,700 | 32,80,725 | 12,43,452 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 3,45,225 | -4,30,650 | 59,973 |

| 23,800 | 17,14,275 | -3,82,875 | 1,33,311 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 69,21,525 | 51,87,225 | 33,83,323 |

| 25,350 | 30,23,775 | 27,94,050 | 18,77,212 |

SENSEX Weekly Expiry (18/09/2025)

The SENSEX index closed at 82693.71. The SENSEX weekly expiry for SEPTEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.094 against previous 1.451. The 84000CE option holds the maximum open interest, followed by the 81000PE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 82700PE and 81000PE options. On the other hand, open interest reductions were prominent in the 81800PE, 81600PE, and 82400CE options. Trading volume was highest in the 83000CE option, followed by the 82500PE and 82700CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82693.71 | 1.094 | 1.451 | 0.952 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,61,57,340 | 1,59,34,780 | 1,02,22,560 |

| PUT: | 2,86,19,860 | 2,31,22,160 | 54,97,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 27,74,240 | 10,73,220 | 2,24,21,620 |

| 85000 | 16,88,140 | 7,39,000 | 1,00,34,220 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 27,74,240 | 10,73,220 | 2,24,21,620 |

| 85000 | 16,88,140 | 7,39,000 | 1,00,34,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82400 | 1,71,800 | -2,26,720 | 1,24,19,980 |

| 82300 | 1,33,340 | -1,70,260 | 62,23,200 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 15,09,480 | 5,56,180 | 10,35,85,340 |

| 82700 | 9,04,920 | 3,58,660 | 8,87,05,920 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 19,30,320 | 7,90,000 | 1,30,33,080 |

| 80000 | 18,54,840 | 1,54,760 | 1,10,31,660 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82700 | 9,48,860 | 8,93,400 | 8,11,29,140 |

| 81000 | 19,30,320 | 7,90,000 | 1,30,33,080 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81800 | 8,91,060 | -2,52,920 | 1,96,61,740 |

| 81600 | 5,54,460 | -2,39,760 | 97,29,940 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 12,57,440 | 7,04,940 | 9,23,46,460 |

| 82600 | 7,67,940 | 6,89,040 | 8,67,31,740 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25330.25. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.144 against previous 1.157. The 25000PE option holds the maximum open interest, followed by the 26000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25100PE option, with open interest additions also seen in the 25300PE and 25700CE options. On the other hand, open interest reductions were prominent in the 25100CE, 25600CE, and 25000PE options. Trading volume was highest in the 25000PE option, followed by the 25500CE and 25300PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,330.25 | 1.144 | 1.157 | 1.067 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,22,91,500 | 4,91,62,275 | 31,29,225 |

| PUT: | 5,98,43,775 | 5,69,04,450 | 29,39,325 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 55,58,550 | 3,36,375 | 1,02,124 |

| 25,500 | 44,28,075 | -1,51,725 | 1,25,907 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 26,67,600 | 12,21,900 | 78,726 |

| 27,000 | 28,47,150 | 5,27,250 | 22,034 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 13,75,200 | -4,19,025 | 25,659 |

| 25,600 | 20,61,300 | -4,17,600 | 86,819 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 44,28,075 | -1,51,725 | 1,25,907 |

| 26,000 | 55,58,550 | 3,36,375 | 1,02,124 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,71,575 | -3,71,850 | 1,37,020 |

| 24,500 | 45,46,050 | -4,050 | 57,594 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 35,55,225 | 15,49,275 | 89,517 |

| 25,300 | 20,97,225 | 12,41,475 | 1,10,874 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,71,575 | -3,71,850 | 1,37,020 |

| 24,900 | 24,15,975 | -3,20,250 | 56,152 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 56,71,575 | -3,71,850 | 1,37,020 |

| 25,300 | 20,97,225 | 12,41,475 | 1,10,874 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55493.3. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.094 against previous 1.082. The 54000PE option holds the maximum open interest, followed by the 55000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 55500PE option, with open interest additions also seen in the 55300PE and 55400PE options. On the other hand, open interest reductions were prominent in the 57000PE, 57000CE, and 55000CE options. Trading volume was highest in the 55500CE option, followed by the 56000CE and 55300CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,493.30 | 1.094 | 1.082 | 0.754 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,56,02,075 | 1,56,08,635 | -6,560 |

| PUT: | 1,70,70,165 | 1,68,86,255 | 1,83,910 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,62,515 | -25,900 | 1,73,192 |

| 57,000 | 12,29,305 | -2,23,460 | 1,08,231 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 4,92,170 | 1,06,785 | 67,123 |

| 55,600 | 2,42,165 | 1,00,800 | 79,963 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,29,305 | -2,23,460 | 1,08,231 |

| 55,000 | 10,08,175 | -2,09,755 | 92,216 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,43,880 | 66,575 | 2,48,768 |

| 56,000 | 13,62,515 | -25,900 | 1,73,192 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,78,920 | -40,700 | 75,002 |

| 55,000 | 14,04,025 | 40,285 | 1,23,285 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 6,31,225 | 2,44,440 | 1,40,401 |

| 55,300 | 3,33,830 | 1,76,750 | 1,16,018 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 2,97,075 | -3,19,845 | 17,020 |

| 51,000 | 4,74,975 | -2,01,155 | 33,545 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 6,31,225 | 2,44,440 | 1,40,401 |

| 55,000 | 14,04,025 | 40,285 | 1,23,285 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26563.55. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.028 against previous 1.073. The 26500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 26600PE and 26700CE options. On the other hand, open interest reductions were prominent in the 23000PE, 26300PE, and 26500CE options. Trading volume was highest in the 27000CE option, followed by the 26500PE and 26600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,563.55 | 1.028 | 1.073 | 0.757 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,14,225 | 8,58,130 | 56,095 |

| PUT: | 9,39,640 | 9,20,595 | 19,045 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,11,475 | -7,930 | 4,280 |

| 27,000 | 1,00,555 | 4,745 | 7,555 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 14,625 | 14,625 | 891 |

| 27,500 | 83,135 | 13,390 | 1,590 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,11,475 | -7,930 | 4,280 |

| 26,100 | 23,530 | -4,745 | 75 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,00,555 | 4,745 | 7,555 |

| 26,600 | 47,905 | 7,020 | 5,025 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 96,980 | 8,710 | 2,343 |

| 25,500 | 96,395 | 26,390 | 1,521 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 96,395 | 26,390 | 1,521 |

| 26,600 | 30,940 | 16,705 | 2,533 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 15,080 | -28,665 | 1,012 |

| 26,300 | 35,035 | -11,440 | 967 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 77,870 | 11,505 | 5,479 |

| 26,600 | 30,940 | 16,705 | 2,533 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13151.9. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.082 against previous 1.181. The 13500CE option holds the maximum open interest, followed by the 14000CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 12900PE option, with open interest additions also seen in the 13150CE and 13600CE options. On the other hand, open interest reductions were prominent in the 56000PE, 67500CE, and 67500PE options. Trading volume was highest in the 13200CE option, followed by the 13200PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,151.90 | 1.082 | 1.181 | 0.987 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 72,42,200 | 67,64,940 | 4,77,260 |

| PUT: | 78,39,160 | 79,91,760 | -1,52,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,34,500 | -34,300 | 13,973 |

| 14,000 | 7,72,940 | 35,280 | 3,438 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,150 | 2,43,880 | 1,50,780 | 11,317 |

| 13,600 | 2,78,180 | 91,560 | 4,005 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 2,72,580 | -52,640 | 3,488 |

| 13,100 | 3,41,320 | -41,300 | 5,819 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,88,140 | 48,860 | 20,543 |

| 13,500 | 9,34,500 | -34,300 | 13,973 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,85,160 | 13,160 | 2,150 |

| 13,000 | 6,21,740 | -49,840 | 11,343 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 4,56,960 | 1,76,820 | 6,842 |

| 13,400 | 1,06,400 | 79,800 | 955 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 1,38,740 | -1,64,080 | 1,808 |

| 12,800 | 5,25,700 | -1,06,960 | 8,550 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 3,10,520 | 70,280 | 15,696 |

| 13,000 | 6,21,740 | -49,840 | 11,343 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives setup on 17th September 2025 tells us that while the market’s advance continues, the foundation is still tentative. Nifty’s max pain at 25,300 with simultaneous call writing at 25,500 and strong put support shows that traders are gearing up for consolidation before a larger move. Bank Nifty’s max pain at 55,100, coupled with stable PCR levels, signals resilience, but aggressive call buildup at higher strikes (like 65,000) reflects hedging against extended upside.

FINNIFTY’s fresh longs indicate selective confidence in financials, whereas MIDCPNIFTY’s option positioning suggests range-bound sentiment centered around 13,000. The broad-market barometer, SENSEX, ending with short covering, keeps the bias mildly positive into the weekly expiry. Altogether, the Open Interest Volume Analysis suggests that the rally is currently powered by short unwinding, but unless fresh long positions broaden beyond FINNIFTY, the move risks stalling into a consolidation phase.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]