Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 24/09/2025

Table of Contents

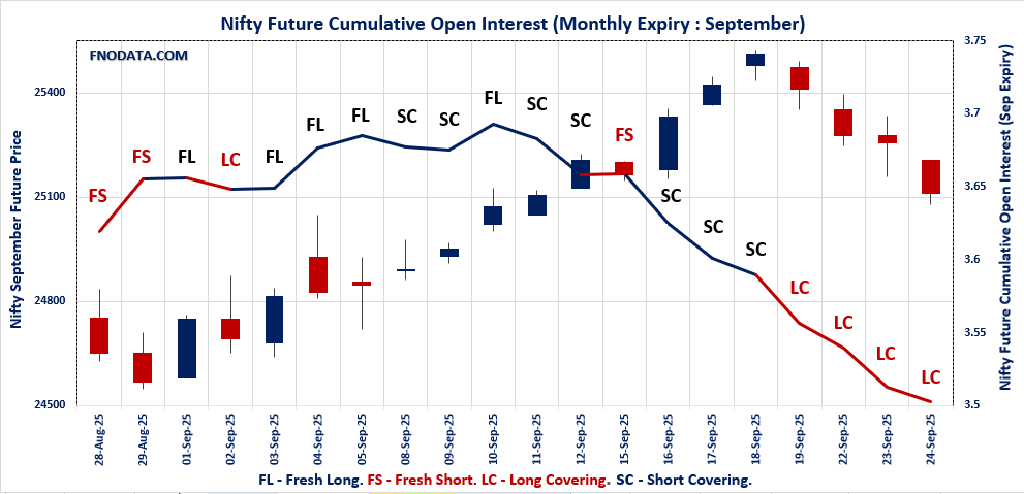

On 24th September 2025, derivatives positioning painted a clear cautionary picture, with indices across the board witnessing long covering. Nifty futures slipped to 25,111 with OI down 1% and premium shrinking to just 55 points, signaling traders closing long bets ahead of expiry rather than building confidence. The monthly option chain further confirmed growing pressure, with PCR (OI) sliding to 0.769 and aggressive call writing at 25,100 acting as immediate resistance.

Bank Nifty mirrored the weakness, down nearly 0.7% with a steep 13.7% drop in OI, highlighting large-scale unwinding of bullish positions. FINNIFTY and MIDCPNIFTY both joined the long covering theme, adding evidence that selling wasn’t isolated but broad-based. Meanwhile, Sensex futures displayed similar trends with shrinking premium and weak OI participation, suggesting traders are reluctant to carry bullish exposure into expiry. The day’s Open Interest Volume Analysis leaves little doubt that traders are shifting to the sidelines, preparing for volatility in the final legs of September expiry.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,056.90 (-0.45%)

NIFTY SEPTEMBER Future closed at: 25,111.90 (-0.57%)

Premium: 55 (Decreased by -31.3 points)

Open Interest Change: -1.0%

Volume Change: 2.4%

Open Interest Analysis: Long Covering

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.769 (Decreased from 0.854)

Put-Call Ratio (Volume): 1.037

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25100

Highest PUT Addition: 25000

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,121.50 (-0.70%)

BANKNIFTY SEPTEMBER Future closed at: 55,252.20 (-0.85%)

Premium: 130.7 (Decreased by -83.35 points)

Open Interest Change: -13.7%

Volume Change: 29.4%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.809 (Decreased from 1.127)

Put-Call Ratio (Volume): 0.989

Max Pain Level: 55200

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55300

Highest PUT Addition: 54800

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,388.45 (-0.64%)

FINNIFTY SEPTEMBER Future closed at: 26,450.60 (-0.77%)

Premium: 62.15 (Decreased by -35.15 points)

Open Interest Change: -4.9%

Volume Change: 186.8%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.931 (Decreased from 1.074)

Put-Call Ratio (Volume): 1.075

Max Pain Level: 26400

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 26200

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,905.35 (-1.30%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,946.35 (-1.31%)

Premium: 41 (Decreased by -2.55 points)

Open Interest Change: -3.6%

Volume Change: 76.9%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.717 (Decreased from 0.963)

Put-Call Ratio (Volume): 0.824

Max Pain Level: 13000

Maximum CALL Open Interest: 13300

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13000

Highest PUT Addition: 12700

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 81,715.63 (-0.47%)

SENSEX Monthly Future closed at: 81,798.95 (-0.62%)

Premium: 83.32 (Decreased by -123.33 points)

Open Interest Change: -0.3%

Volume Change: 39.6%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (25/09/2025) Option Analysis

Put-Call Ratio (OI): 0.600 (Decreased from 0.763)

Put-Call Ratio (Volume): 1.122

Max Pain Level: 81800

Maximum CALL OI: 84000

Maximum PUT OI: 80000

Highest CALL Addition: 82000

Highest PUT Addition: 81400

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,425.75 Cr.

DIIs Net BUY: ₹ 1,211.68 Cr.

FII Derivatives Activity

| FII Trading Stats | 24.09.25 | 23.09.25 | 22.09.25 |

| FII Cash (Provisional Data) | -2,425.75 | -3,551.19 | -2,910.09 |

| Index Future Open Interest Long Ratio | 14.50% | 13.79% | 13.27% |

| Index Future Volume Long Ratio | 46.60% | 53.68% | 54.81% |

| Call Option Open Interest Long Ratio | 46.48% | 47.54% | 48.57% |

| Call Option Volume Long Ratio | 49.72% | 50.05% | 49.58% |

| Put Option Open Interest Long Ratio | 65.14% | 67.97% | 63.62% |

| Put Option Volume Long Ratio | 50.08% | 50.06% | 50.10% |

| Stock Future Open Interest Long Ratio | 61.50% | 61.65% | 61.60% |

| Stock Future Volume Long Ratio | 49.34% | 50.94% | 48.96% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Long Covering | Fresh Long |

| FinNifty Options | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Futures | Long Covering | Long Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Fresh Long | Long Covering |

| Stock Options | Short Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (25/09/2025)

The SENSEX index closed at 81715.63. The SENSEX weekly expiry for SEPTEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.600 against previous 0.763. The 84000CE option holds the maximum open interest, followed by the 83000CE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 82000CE option, with open interest additions also seen in the 81800CE and 84000CE options. On the other hand, open interest reductions were prominent in the 82000PE, 82100PE, and 82300PE options. Trading volume was highest in the 81800PE option, followed by the 81500PE and 81700PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 25-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81715.63 | 0.600 | 0.763 | 1.122 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,18,39,400 | 2,22,82,700 | 1,95,56,700 |

| PUT: | 2,51,21,880 | 1,69,95,220 | 81,26,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 32,62,740 | 16,56,140 | 1,79,03,320 |

| 83000 | 27,72,300 | 11,72,420 | 3,40,25,860 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 24,28,420 | 18,85,660 | 13,00,14,740 |

| 81800 | 17,86,000 | 17,26,380 | 8,67,06,800 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 7,11,020 | -1,03,120 | 70,26,340 |

| 84900 | 1,00,080 | -57,340 | 19,66,560 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 24,28,420 | 18,85,660 | 13,00,14,740 |

| 82200 | 12,68,780 | 8,26,940 | 8,78,83,800 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 19,48,780 | 2,84,880 | 1,46,58,040 |

| 79000 | 15,07,960 | 7,31,420 | 97,75,020 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81400 | 11,82,180 | 9,37,480 | 7,55,13,140 |

| 79000 | 15,07,960 | 7,31,420 | 97,75,020 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 6,06,740 | -5,40,280 | 7,36,03,360 |

| 82100 | 1,29,640 | -3,51,700 | 2,17,97,960 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81800 | 9,56,620 | 2,95,180 | 14,23,06,380 |

| 81500 | 14,79,160 | 7,25,660 | 14,12,16,860 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25056.9. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.769 against previous 0.854. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25100CE option, with open interest additions also seen in the 25300CE and 25200CE options. On the other hand, open interest reductions were prominent in the 25300PE, 25200PE, and 25400PE options. Trading volume was highest in the 25100PE option, followed by the 25000PE and 25100CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,056.90 | 0.769 | 0.854 | 1.037 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,95,35,050 | 10,94,93,550 | 5,00,41,500 |

| PUT: | 12,26,71,050 | 9,35,38,350 | 2,91,32,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,30,23,375 | 26,79,300 | 10,07,451 |

| 25,500 | 1,11,17,325 | 16,98,825 | 12,10,734 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 68,69,175 | 52,13,475 | 33,54,606 |

| 25,300 | 91,08,525 | 36,95,325 | 17,78,798 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,450 | 25,91,325 | -2,95,350 | 6,16,529 |

| 23,500 | 3,10,875 | -65,550 | 1,602 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 68,69,175 | 52,13,475 | 33,54,606 |

| 25,200 | 88,79,475 | 35,19,525 | 27,95,728 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,64,400 | 24,52,125 | 34,45,946 |

| 24,000 | 75,91,650 | 15,04,725 | 4,12,098 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,06,64,400 | 24,52,125 | 34,45,946 |

| 25,050 | 33,30,375 | 21,79,425 | 28,19,682 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 25,24,650 | -9,06,975 | 5,01,286 |

| 25,200 | 37,79,700 | -5,66,850 | 16,61,870 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 57,11,475 | 14,90,400 | 49,71,750 |

| 25,000 | 1,06,64,400 | 24,52,125 | 34,45,946 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55121.5. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.809 against previous 1.127. The 56000CE option holds the maximum open interest, followed by the 54000PE and 58000CE options. Market participants have shown increased interest with significant open interest additions in the 55300CE option, with open interest additions also seen in the 55500CE and 55400CE options. On the other hand, open interest reductions were prominent in the 55000PE, 55500PE, and 55600PE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 55200PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,121.50 | 0.809 | 1.127 | 0.989 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,31,67,065 | 1,84,30,695 | 47,36,370 |

| PUT: | 1,87,51,275 | 2,07,75,165 | -20,23,890 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 17,45,940 | 3,66,660 | 2,82,301 |

| 58,000 | 15,04,125 | 3,28,230 | 87,967 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,300 | 7,65,415 | 5,43,410 | 3,10,281 |

| 55,500 | 14,98,470 | 5,37,775 | 4,03,050 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 5,61,400 | -36,330 | 45,836 |

| 57,200 | 3,78,525 | -33,810 | 30,975 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 14,98,470 | 5,37,775 | 4,03,050 |

| 55,300 | 7,65,415 | 5,43,410 | 3,10,281 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 16,08,135 | -32,835 | 1,06,869 |

| 55,000 | 12,32,805 | -3,70,545 | 4,31,229 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,800 | 3,74,570 | 94,290 | 1,26,509 |

| 53,600 | 2,28,445 | 64,225 | 15,191 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,32,805 | -3,70,545 | 4,31,229 |

| 55,500 | 6,77,590 | -2,64,350 | 2,82,796 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,32,805 | -3,70,545 | 4,31,229 |

| 55,200 | 3,90,845 | -64,715 | 3,66,197 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26388.45. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.931 against previous 1.074. The 27000CE option holds the maximum open interest, followed by the 26000PE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 26200PE option, with open interest additions also seen in the 26500CE and 27500CE options. On the other hand, open interest reductions were prominent in the 26600PE, 26550PE, and 26700PE options. Trading volume was highest in the 26400PE option, followed by the 26500CE and 26600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,388.45 | 0.931 | 1.074 | 1.075 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,34,515 | 11,02,790 | 2,31,725 |

| PUT: | 12,41,825 | 11,84,690 | 57,135 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,95,845 | 24,115 | 8,156 |

| 27,500 | 1,22,460 | 37,895 | 6,160 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,19,730 | 47,905 | 12,477 |

| 27,500 | 1,22,460 | 37,895 | 6,160 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,850 | 18,720 | -11,700 | 1,647 |

| 26,450 | 14,560 | -10,920 | 4,807 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,19,730 | 47,905 | 12,477 |

| 26,600 | 96,330 | 16,380 | 12,425 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,50,605 | -5,720 | 5,954 |

| 26,200 | 1,15,700 | 58,045 | 10,400 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,15,700 | 58,045 | 10,400 |

| 25,400 | 51,805 | 25,740 | 2,063 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 41,665 | -48,230 | 4,338 |

| 26,550 | 6,955 | -27,885 | 2,225 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 49,660 | -5,785 | 16,035 |

| 26,300 | 50,310 | -2,080 | 12,247 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12905.35. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.717 against previous 0.963. The 13300CE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 13100CE and 13500CE options. On the other hand, open interest reductions were prominent in the 67000CE, 67000CE, and 70000CE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 12900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,905.35 | 0.717 | 0.963 | 0.824 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,34,97,820 | 96,01,480 | 38,96,340 |

| PUT: | 96,80,020 | 92,47,140 | 4,32,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 13,92,160 | 2,58,440 | 32,517 |

| 13,000 | 11,91,400 | 9,04,260 | 61,747 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,91,400 | 9,04,260 | 61,747 |

| 13,100 | 10,34,180 | 5,02,320 | 38,673 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 1,63,660 | -1,78,500 | 5,732 |

| 13,075 | 80,780 | -1,05,420 | 6,038 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,91,400 | 9,04,260 | 61,747 |

| 13,200 | 10,39,220 | 1,64,780 | 40,997 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 8,35,660 | 79,520 | 13,444 |

| 12,700 | 7,86,940 | 2,51,720 | 17,894 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 7,86,940 | 2,51,720 | 17,894 |

| 12,850 | 3,22,420 | 1,54,840 | 14,524 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,24,340 | -2,17,000 | 5,761 |

| 13,100 | 4,53,320 | -1,92,360 | 11,548 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,81,900 | 3,360 | 56,236 |

| 12,900 | 5,16,180 | 61,600 | 41,031 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The setup on 24th September 2025 highlights that expiry-week pressure is already weighing on index positioning. Nifty’s max pain at 25,100 with puts clustering at 25,000 reflects that bulls are trying to defend, but falling PCR ratios show bears are pressing their advantage. Bank Nifty’s option data indicates resistances building at 55,300 even as downside risk opens up toward 54,800.

FINNIFTY’s call buildup at 26,500 paired with falling PCR reaffirms caution in financials, while MIDCPNIFTY’s heavy OI unwinding after recent highs hints at declining appetite in the broader market. Even Sensex participation was subdued, with aggressive call writing at 82,000 signaling expiry-driven nerves. In total, the Open Interest Volume Analysis suggests the near-term sentiment has shifted defensive, with rollovers and expiry dynamics dictating the next move. Unless strong fresh longs appear post-expiry, traders should brace for continued choppiness and a cautious undertone.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]