Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 25/09/2025

Table of Contents

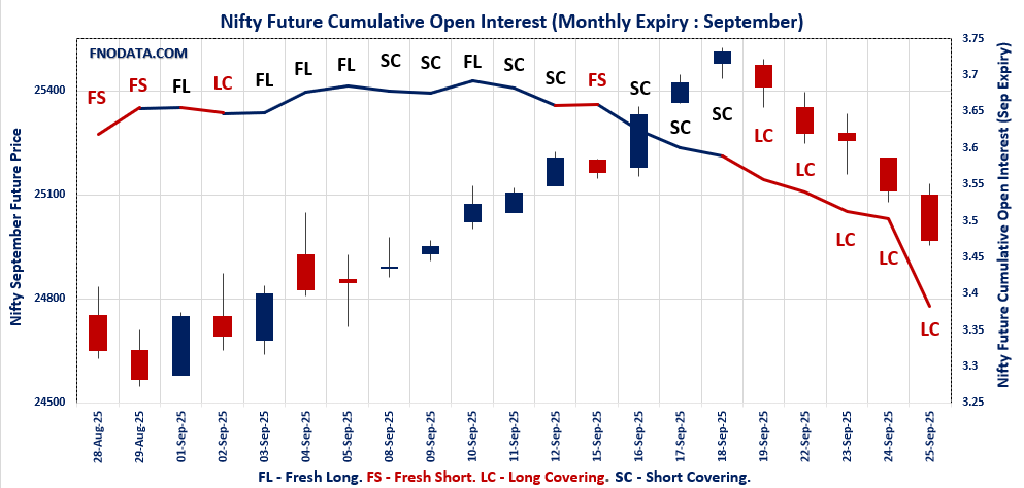

On 25th September 2025, the F&O markets displayed a decisive shift toward caution, with long covering dominating across Nifty, Bank Nifty, Finnifty, and Midcap Nifty futures. Nifty slipped to 24,967 with a steep 12% OI fall, sending a clear signal that traders were exiting longs rather than building fresh downside bets. This caution was echoed in the monthly option chain, where PCR (OI) dropped sharply to 0.571, reinforcing a bearish tilt as call OI spiked at 25,000 while puts clustered at 24,900.

Bank Nifty followed in similar fashion, with a 3.2% OI drop alongside long unwinding, even as strong resistance built at 56,000 levels. A broader wave of long covering was visible in FINNIFTY and MIDCPNIFTY as well, with volumes rising, showing traders are cutting positions across financials and midcaps. Interestingly, Sensex futures stood apart with a massive 119% OI jump, but this was on the back of fresh shorts, turning the spotlight on institutional bearish flows. The Open Interest Volume Analysis of the day captures a market losing upward momentum, with expiry volatility amplifying defensive positioning.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,890.85 (-0.66%)

NIFTY SEPTEMBER Future closed at: 24,967.70 (-0.57%)

Premium: 76.85 (Increased by 21.85 points)

Open Interest Change: -12.0%

Volume Change: 19.8%

Open Interest Analysis: Long Covering

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.571 (Decreased from 0.769)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24900

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,976.20 (-0.26%)

BANKNIFTY SEPTEMBER Future closed at: 55,152.20 (-0.18%)

Premium: 176 (Increased by 45.3 points)

Open Interest Change: -3.2%

Volume Change: -16.5%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.765 (Decreased from 0.809)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 55200

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 57000

Highest PUT Addition: 54300

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,247.40 (-0.53%)

FINNIFTY SEPTEMBER Future closed at: 26,340.10 (-0.42%)

Premium: 92.7 (Increased by 30.55 points)

Open Interest Change: -13.2%

Volume Change: -17.8%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.776 (Decreased from 0.931)

Put-Call Ratio (Volume): 0.973

Max Pain Level: 26300

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 27000

Highest PUT Addition: 25500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,822.30 (-0.64%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,847.60 (-0.76%)

Premium: 25.3 (Decreased by -15.7 points)

Open Interest Change: -14.4%

Volume Change: 46.4%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.745 (Increased from 0.717)

Put-Call Ratio (Volume): 0.787

Max Pain Level: 13000

Maximum CALL Open Interest: 13300

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13000

Highest PUT Addition: 12650

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 81,159.68 (-0.68%)

SENSEX Monthly Future closed at: 81,978.30 (-0.55%)

Premium: 818.62 (Increased by 100.85 points)

Open Interest Change: 119.6%

Volume Change: 99.3%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/10/2025) Option Analysis

Put-Call Ratio (OI): 0.664 (Decreased from 0.724)

Put-Call Ratio (Volume): 0.922

Max Pain Level: 81500

Maximum CALL OI: 82000

Maximum PUT OI: 81500

Highest CALL Addition: 81500

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 5,097.51 Cr.

DIIs Net BUY: ₹ 5,105.60 Cr.

FII Derivatives Activity

| FII Trading Stats | 25.09.25 | 24.09.25 | 23.09.25 |

| FII Cash (Provisional Data) | -5,097.51 | -2,425.75 | -3,551.19 |

| Index Future Open Interest Long Ratio | 15.61% | 14.50% | 13.79% |

| Index Future Volume Long Ratio | 48.32% | 46.60% | 53.68% |

| Call Option Open Interest Long Ratio | 46.41% | 46.48% | 47.54% |

| Call Option Volume Long Ratio | 49.85% | 49.72% | 50.05% |

| Put Option Open Interest Long Ratio | 65.92% | 65.14% | 67.97% |

| Put Option Volume Long Ratio | 50.44% | 50.08% | 50.06% |

| Stock Future Open Interest Long Ratio | 61.45% | 61.50% | 61.65% |

| Stock Future Volume Long Ratio | 49.88% | 49.34% | 50.94% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Short | Fresh Short | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Short Covering | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Long |

| MidcpNifty Futures | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Short Covering | Short Covering | Short Covering |

resh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/10/2025)

The SENSEX index closed at 81159.68. The SENSEX weekly expiry for OCTOBER 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.664 against previous 0.724. The 82000CE option holds the maximum open interest, followed by the 81500CE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 81500CE option, with open interest additions also seen in the 85000CE and 82000CE options. On the other hand, open interest reductions were prominent in the 84400CE, 82400PE, and 83400PE options. Trading volume was highest in the 81500PE option, followed by the 82000CE and 81500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81159.68 | 0.664 | 0.724 | 0.922 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 48,90,260 | 17,32,780 | 31,57,480 |

| PUT: | 32,48,160 | 12,55,240 | 19,92,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,31,800 | 2,06,940 | 21,66,120 |

| 81500 | 3,72,880 | 3,13,000 | 20,23,580 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,72,880 | 3,13,000 | 20,23,580 |

| 85000 | 3,47,420 | 2,28,960 | 8,34,140 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84400 | 7,500 | -780 | 31,540 |

| 84900 | 320 | – | 180 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,31,800 | 2,06,940 | 21,66,120 |

| 81500 | 3,72,880 | 3,13,000 | 20,23,580 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 2,68,460 | 1,92,840 | 25,77,440 |

| 82000 | 2,46,100 | 19,160 | 8,87,260 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 2,68,460 | 1,92,840 | 25,77,440 |

| 78000 | 2,07,800 | 1,41,300 | 6,87,740 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82400 | 5,740 | -640 | 14,680 |

| 83400 | 800 | -380 | 640 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 2,68,460 | 1,92,840 | 25,77,440 |

| 81000 | 2,38,060 | 1,40,800 | 17,57,000 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24890.85. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.571 against previous 0.769. The 26000CE option holds the maximum open interest, followed by the 25000CE and 25100CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 25100CE and 25050CE options. On the other hand, open interest reductions were prominent in the 25100PE, 25050PE, and 25000PE options. Trading volume was highest in the 25000PE option, followed by the 25100CE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,890.85 | 0.571 | 0.769 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 23,24,70,900 | 15,95,35,050 | 7,29,35,850 |

| PUT: | 13,27,75,725 | 12,26,71,050 | 1,01,04,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,87,50,825 | 57,27,450 | 11,02,533 |

| 25,000 | 1,67,82,525 | 1,15,15,950 | 29,74,857 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,67,82,525 | 1,15,15,950 | 29,74,857 |

| 25,100 | 1,43,31,075 | 74,61,900 | 31,59,432 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,650 | 23,00,625 | -3,36,450 | 3,56,736 |

| 25,850 | 20,03,550 | -3,27,975 | 3,97,333 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,43,31,075 | 74,61,900 | 31,59,432 |

| 25,000 | 1,67,82,525 | 1,15,15,950 | 29,74,857 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 95,94,150 | 20,02,500 | 5,11,961 |

| 25,000 | 93,08,700 | -13,55,700 | 47,43,950 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 84,82,275 | 25,81,425 | 24,37,426 |

| 24,200 | 53,07,825 | 25,15,725 | 4,24,655 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 40,62,075 | -16,49,400 | 23,64,320 |

| 25,050 | 18,91,275 | -14,39,100 | 24,62,111 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 93,08,700 | -13,55,700 | 47,43,950 |

| 25,050 | 18,91,275 | -14,39,100 | 24,62,111 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54976.2. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.765 against previous 0.809. The 56000CE option holds the maximum open interest, followed by the 54000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 54300PE option, with open interest additions also seen in the 57000CE and 55100PE options. On the other hand, open interest reductions were prominent in the 55500PE, 51000PE, and 51500PE options. Trading volume was highest in the 55000PE option, followed by the 55200PE and 55500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,976.20 | 0.765 | 0.809 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,37,44,050 | 2,31,67,065 | 5,76,985 |

| PUT: | 1,81,52,995 | 1,87,51,275 | -5,98,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 18,21,505 | 75,565 | 2,18,619 |

| 57,000 | 15,41,925 | 1,92,830 | 1,20,984 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,41,925 | 1,92,830 | 1,20,984 |

| 55,000 | 9,37,475 | 1,53,580 | 3,01,026 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 14,03,955 | -1,00,170 | 78,947 |

| 60,000 | 7,66,220 | -89,040 | 21,633 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 14,19,750 | -78,720 | 4,24,292 |

| 55,200 | 6,85,860 | 1,14,310 | 4,16,896 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 15,61,490 | -46,645 | 1,13,835 |

| 55,000 | 11,54,125 | -78,680 | 5,76,143 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,300 | 5,28,150 | 2,08,040 | 60,862 |

| 55,100 | 4,52,060 | 1,82,245 | 3,82,683 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 4,99,145 | -1,78,445 | 1,83,926 |

| 51,000 | 4,92,125 | -1,52,880 | 29,246 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 11,54,125 | -78,680 | 5,76,143 |

| 55,200 | 3,82,655 | -8,190 | 4,77,257 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26247.4. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.776 against previous 0.931. The 27000CE option holds the maximum open interest, followed by the 26500CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 27000CE and 27100CE options. On the other hand, open interest reductions were prominent in the 26500PE, 26200PE, and 27500CE options. Trading volume was highest in the 26300PE option, followed by the 26500CE and 26400CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,247.40 | 0.776 | 0.931 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,97,310 | 13,34,515 | 2,62,795 |

| PUT: | 12,39,420 | 12,41,825 | -2,405 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 2,34,065 | 38,220 | 8,568 |

| 26,500 | 1,53,465 | 33,735 | 16,882 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 2,34,065 | 38,220 | 8,568 |

| 27,100 | 70,850 | 37,960 | 4,471 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,09,720 | -12,740 | 5,507 |

| 27,200 | 63,505 | -10,270 | 3,927 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,53,465 | 33,735 | 16,882 |

| 26,400 | 68,900 | 31,265 | 13,594 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,38,645 | 56,030 | 3,933 |

| 26,000 | 1,38,060 | -12,545 | 9,422 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,38,645 | 56,030 | 3,933 |

| 26,300 | 70,720 | 20,410 | 18,073 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 51,155 | -32,175 | 4,272 |

| 26,200 | 86,905 | -28,795 | 12,903 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 70,720 | 20,410 | 18,073 |

| 26,350 | 18,980 | -9,880 | 13,238 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12822.3. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.745 against previous 0.717. The 13300CE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12650PE option, with open interest additions also seen in the 12550PE and 13000CE options. On the other hand, open interest reductions were prominent in the 70400CE, 69000PE, and 68600PE options. Trading volume was highest in the 13000CE option, followed by the 12900PE and 12800PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,822.30 | 0.745 | 0.717 | 0.787 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,37,99,100 | 1,34,97,820 | 3,01,280 |

| PUT: | 1,02,74,320 | 96,80,020 | 5,94,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 15,30,620 | 1,38,460 | 29,467 |

| 13,000 | 14,70,000 | 2,78,600 | 77,824 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,70,000 | 2,78,600 | 77,824 |

| 12,900 | 5,57,480 | 2,14,340 | 31,219 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,450 | 1,06,540 | -2,13,080 | 7,036 |

| 13,500 | 9,96,940 | -1,89,840 | 18,969 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,70,000 | 2,78,600 | 77,824 |

| 13,200 | 9,20,080 | -1,19,140 | 31,910 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 9,22,880 | 87,220 | 20,691 |

| 12,000 | 8,60,860 | 2,51,300 | 16,579 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,650 | 4,30,220 | 3,11,080 | 11,065 |

| 12,550 | 3,45,100 | 3,00,440 | 5,383 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,850 | 1,58,340 | -1,64,080 | 17,013 |

| 12,900 | 3,85,700 | -1,30,480 | 46,298 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 3,85,700 | -1,30,480 | 46,298 |

| 12,800 | 7,42,700 | 44,660 | 36,121 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives landscape on 25th September 2025 reveals expiry-driven nervousness dominating market sentiment. Nifty’s falling PCR and heavy call buildup at 25,000 suggest that sentiment has weakened, with downside risks if 24,900 fails to hold. Bank Nifty’s OI contraction reflects liquidation pressure, and its options chain around 55,200–56,000 highlights clear overhead supply zones.

Finnifty’s long unwinding reaffirms caution in financial-heavy segments, while Midcap Nifty’s OI drop shows traders are equally defensive in the broader markets. But the most striking signal comes from Sensex futures, where unusually high OI addition of over 119% highlights fresh institutional shorting, hinting that bigger players are preparing for more downside risk.

Taken together, today’s Open Interest Volume Analysis indicates that the weakness may not just be expiry-related profit booking, but could set the stage for deeper correction if supports give way in the near term.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]