Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 26/09/2025

Table of Contents

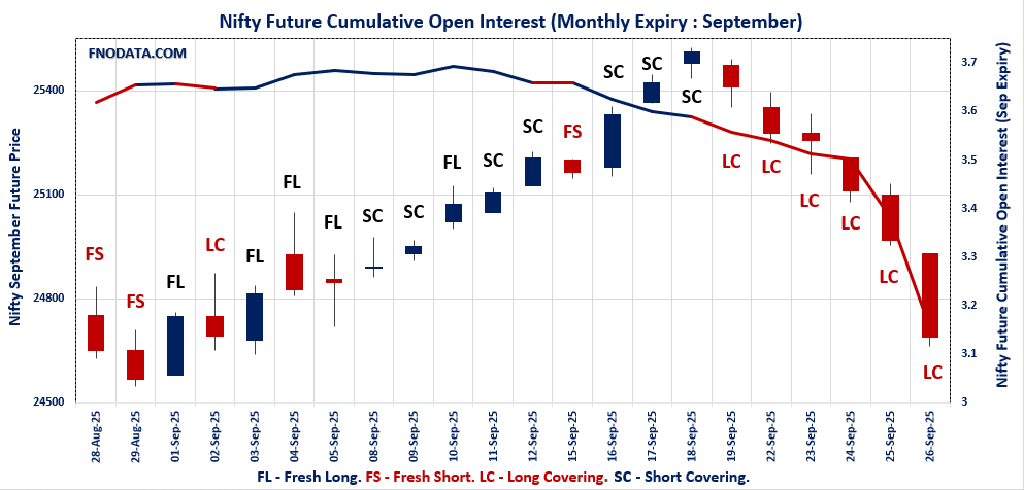

On 26th September 2025, the derivatives market sent a clear cautionary signal, with long covering dominating across all major indices. Nifty futures slipped to 24,689 with a sharp 22.5% OI drop, reflecting aggressive unwinding of bullish positions rather than conviction selling. The Nifty option chain showed a PCR (OI) sliding further to 0.524, with calls building strongly at 25,000 while puts clustered at 24,500, confirming a shift of control towards call writers.

Bank Nifty mirrored this weakness, losing over 1% with OI falling 9%, yet fresh call additions at 55,000 hinted at overhead resistance caps. FINNIFTY and MIDCPNIFTY followed a similar script, experiencing deep long unwinding as traders avoided carry-forward risks ahead of expiry. The most notable divergence came from Sensex futures where fresh shorts surged with a massive 21.8% OI rise, underlining institutional bearish bets creeping in. The day’s Open Interest Volume Analysis reveals that the rally fatigue has turned into a defensive unwind with short bias at higher levels building in selectively.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,654.70 (-0.95%)

NIFTY SEPTEMBER Future closed at: 24,689.90 (-1.11%)

Premium: 35.2 (Decreased by -41.65 points)

Open Interest Change: -22.5%

Volume Change: 25.5%

Open Interest Analysis: Long Covering

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.524 (Decreased from 0.571)

Put-Call Ratio (Volume): 1.107

Max Pain Level: 24800

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 24800

Highest PUT Addition: 24500

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,389.35 (-1.07%)

BANKNIFTY SEPTEMBER Future closed at: 54,474.80 (-1.23%)

Premium: 85.45 (Decreased by -90.55 points)

Open Interest Change: -9.0%

Volume Change: 19.3%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.636 (Decreased from 0.765)

Put-Call Ratio (Volume): 1.116

Max Pain Level: 54800

Maximum CALL Open Interest: 55000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55000

Highest PUT Addition: 54400

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,985.25 (-1.00%)

FINNIFTY SEPTEMBER Future closed at: 26,027.40 (-1.19%)

Premium: 42.15 (Decreased by -50.55 points)

Open Interest Change: -22.9%

Volume Change: 26.7%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.678 (Decreased from 0.776)

Put-Call Ratio (Volume): 1.169

Max Pain Level: 26100

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26250

Highest PUT Addition: 25900

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,563.35 (-2.02%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,584.70 (-2.05%)

Premium: 21.35 (Decreased by -3.95 points)

Open Interest Change: -48.2%

Volume Change: 119.6%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.633 (Decreased from 0.745)

Put-Call Ratio (Volume): 1.088

Max Pain Level: 12750

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 12450

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 80,426.46 (-0.90%)

SENSEX Monthly Future closed at: 81,066.90 (-1.11%)

Premium: 640.44 (Decreased by -178.18 points)

Open Interest Change: 21.8%

Volume Change: 9.3%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/10/2025) Option Analysis

Put-Call Ratio (OI): 0.576 (Decreased from 0.664)

Put-Call Ratio (Volume): 1.264

Max Pain Level: 80800

Maximum CALL OI: 81000

Maximum PUT OI: 77000

Highest CALL Addition: 81000

Highest PUT Addition: 77000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 5,687.58 Cr.

DIIs Net BUY: ₹ 5,843.21 Cr.

FII Derivatives Activity

| FII Trading Stats | 26.09.25 | 25.09.25 | 24.09.25 |

| FII Cash (Provisional Data) | -5,687.58 | -5,097.51 | -2,425.75 |

| Index Future Open Interest Long Ratio | 14.34% | 15.61% | 14.50% |

| Index Future Volume Long Ratio | 42.94% | 48.32% | 46.60% |

| Call Option Open Interest Long Ratio | 47.83% | 46.41% | 46.48% |

| Call Option Volume Long Ratio | 50.10% | 49.85% | 49.72% |

| Put Option Open Interest Long Ratio | 64.33% | 65.92% | 65.14% |

| Put Option Volume Long Ratio | 50.09% | 50.44% | 50.08% |

| Stock Future Open Interest Long Ratio | 61.12% | 61.45% | 61.50% |

| Stock Future Volume Long Ratio | 49.72% | 49.88% | 49.34% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Short Covering | Long Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Long Covering |

| Stock Options | Short Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/10/2025)

The SENSEX index closed at 80426.46. The SENSEX weekly expiry for OCTOBER 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.576 against previous 0.664. The 81000CE option holds the maximum open interest, followed by the 82000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 84000CE and 77000PE options. On the other hand, open interest reductions were prominent in the 81500PE, 82000PE, and 81200PE options. Trading volume was highest in the 80800PE option, followed by the 80500PE and 81000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80426.46 | 0.576 | 0.664 | 1.264 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,08,26,680 | 48,90,260 | 59,36,420 |

| PUT: | 62,32,440 | 32,48,160 | 29,84,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,35,160 | 5,42,240 | 1,75,58,860 |

| 82000 | 6,54,220 | 1,22,420 | 87,70,220 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,35,160 | 5,42,240 | 1,75,58,860 |

| 84000 | 6,18,100 | 3,63,460 | 43,04,860 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83200 | 87,460 | -32,460 | 13,28,080 |

| 83400 | 65,520 | -29,680 | 10,19,340 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,35,160 | 5,42,240 | 1,75,58,860 |

| 80800 | 3,21,180 | 3,17,060 | 1,03,76,660 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 4,38,840 | 3,23,940 | 40,07,760 |

| 80500 | 4,04,760 | 2,92,580 | 1,76,05,720 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 4,38,840 | 3,23,940 | 40,07,760 |

| 80500 | 4,04,760 | 2,92,580 | 1,76,05,720 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 1,15,580 | -1,52,880 | 13,60,920 |

| 82000 | 1,50,740 | -95,360 | 3,10,520 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 1,57,960 | 1,10,160 | 2,01,73,000 |

| 80500 | 4,04,760 | 2,92,580 | 1,76,05,720 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24654.7. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.524 against previous 0.571. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24900CE and 24700CE options. On the other hand, open interest reductions were prominent in the 24900PE, 25000PE, and 24800PE options. Trading volume was highest in the 24800PE option, followed by the 24700PE and 24800CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,654.70 | 0.524 | 0.571 | 1.107 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 26,83,47,600 | 23,24,70,900 | 3,58,76,700 |

| PUT: | 14,05,91,025 | 13,27,75,725 | 78,15,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,80,24,300 | 12,41,775 | 35,09,370 |

| 26,000 | 1,74,13,575 | -13,37,250 | 11,93,803 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,26,09,075 | 1,07,44,425 | 54,58,921 |

| 24,900 | 1,20,14,550 | 75,83,100 | 37,44,923 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 75,60,300 | -21,24,675 | 10,53,319 |

| 25,550 | 31,93,425 | -15,23,850 | 5,90,267 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,26,09,075 | 1,07,44,425 | 54,58,921 |

| 24,900 | 1,20,14,550 | 75,83,100 | 37,44,923 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,23,88,575 | 41,98,275 | 32,23,846 |

| 24,600 | 92,21,550 | 38,91,000 | 43,00,298 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,23,88,575 | 41,98,275 | 32,23,846 |

| 24,600 | 92,21,550 | 38,91,000 | 43,00,298 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 39,20,775 | -45,61,500 | 24,77,983 |

| 25,000 | 49,82,475 | -43,26,225 | 9,68,114 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 52,38,975 | -25,68,375 | 75,62,946 |

| 24,700 | 59,25,150 | 98,550 | 60,94,951 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54389.35. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.636 against previous 0.765. The 55000CE option holds the maximum open interest, followed by the 55500CE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55000CE option, with open interest additions also seen in the 54800CE and 54700CE options. On the other hand, open interest reductions were prominent in the 54500PE, 55100PE, and 55000PE options. Trading volume was highest in the 54500PE option, followed by the 54000PE and 54600PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,389.35 | 0.636 | 0.765 | 1.116 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,77,81,060 | 2,37,44,050 | 40,37,010 |

| PUT: | 1,76,78,880 | 1,81,52,995 | -4,74,115 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 19,72,565 | 10,35,090 | 5,90,089 |

| 55,500 | 17,51,105 | 3,31,355 | 3,34,912 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 19,72,565 | 10,35,090 | 5,90,089 |

| 54,800 | 7,56,735 | 6,56,670 | 4,21,072 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,56,240 | -2,65,265 | 2,58,001 |

| 58,000 | 11,52,585 | -2,51,370 | 1,11,502 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 19,72,565 | 10,35,090 | 5,90,089 |

| 54,800 | 7,56,735 | 6,56,670 | 4,21,072 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 16,39,775 | 78,285 | 6,49,939 |

| 55,000 | 8,61,980 | -2,92,145 | 3,01,347 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,400 | 7,12,215 | 4,79,185 | 5,33,017 |

| 54,300 | 6,73,260 | 1,45,110 | 4,51,944 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 7,15,470 | -3,34,775 | 8,54,440 |

| 55,100 | 1,40,665 | -3,11,395 | 71,894 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 7,15,470 | -3,34,775 | 8,54,440 |

| 54,000 | 16,39,775 | 78,285 | 6,49,939 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25985.25. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.678 against previous 0.776. The 27000CE option holds the maximum open interest, followed by the 25500PE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26250CE option, with open interest additions also seen in the 26100CE and 26000CE options. On the other hand, open interest reductions were prominent in the 27500CE, 26300PE, and 27000CE options. Trading volume was highest in the 26000PE option, followed by the 26100PE and 26250CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,985.25 | 0.678 | 0.776 | 1.169 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 21,95,440 | 15,97,310 | 5,98,130 |

| PUT: | 14,87,980 | 12,39,420 | 2,48,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | -35,880 | 10,118 |

| 26,500 | 1,57,755 | 4,290 | 15,383 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 1,25,710 | 1,17,260 | 36,719 |

| 26,100 | 1,31,105 | 1,09,070 | 22,737 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 56,810 | -52,910 | 5,392 |

| 27,000 | 1,98,185 | -35,880 | 10,118 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 1,25,710 | 1,17,260 | 36,719 |

| 26,200 | 97,695 | 65,780 | 30,817 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,60,030 | 21,385 | 10,615 |

| 26,000 | 1,24,475 | -13,585 | 64,744 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 91,845 | 57,915 | 28,246 |

| 25,950 | 41,665 | 28,535 | 22,086 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 33,605 | -37,115 | 3,055 |

| 26,200 | 69,225 | -17,680 | 14,825 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,24,475 | -13,585 | 64,744 |

| 26,100 | 61,100 | 10,075 | 51,726 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12563.35. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.633 against previous 0.745. The 13000CE option holds the maximum open interest, followed by the 13300CE and 13100CE options. Market participants have shown increased interest with significant open interest additions in the 12800CE option, with open interest additions also seen in the 12700CE and 12450PE options. On the other hand, open interest reductions were prominent in the 67500PE, 67000PE, and 66000CE options. Trading volume was highest in the 12600PE option, followed by the 12500PE and 12700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,563.35 | 0.633 | 0.745 | 1.088 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,64,87,520 | 1,37,99,100 | 26,88,420 |

| PUT: | 1,04,30,840 | 1,02,74,320 | 1,56,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 18,39,320 | 3,69,320 | 73,725 |

| 13,300 | 12,64,620 | -2,66,000 | 40,735 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 7,35,840 | 5,43,900 | 94,826 |

| 12,700 | 5,95,000 | 5,13,660 | 71,788 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 12,64,620 | -2,66,000 | 40,735 |

| 13,600 | 3,08,280 | -2,45,560 | 9,633 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 7,35,840 | 5,43,900 | 94,826 |

| 13,000 | 18,39,320 | 3,69,320 | 73,725 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 10,66,940 | 2,06,080 | 26,681 |

| 12,500 | 9,21,340 | -1,540 | 1,24,828 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,450 | 5,97,240 | 4,97,700 | 30,762 |

| 12,300 | 6,27,200 | 2,84,340 | 37,855 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,09,960 | -4,32,740 | 45,077 |

| 12,700 | 4,42,260 | -3,91,020 | 1,11,117 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 4,71,800 | -66,640 | 1,33,105 |

| 12,500 | 9,21,340 | -1,540 | 1,24,828 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives setup on 26th September 2025 captures a market under stress as expiry dynamics intensify bearish tones. Nifty’s max pain shifted to 24,800, while call writers strengthened their grip at 25,000, leaving limited room for upside recovery. Bank Nifty’s max pain at 54,800 with falling PCR shows that support levels are fragile, with sellers keeping a lid on rallies.

FINNIFTY and MIDCPNIFTY’s heavy unwinding reflects broad-based risk aversion, with midcaps hit the hardest after almost 48% OI contraction. Sensex’s fresh short buildup, with OI spiking nearly 22%, is the biggest red flag, signaling that institutional participation is turning bearish, likely dragging the broader index complex lower if global sentiment worsens. Overall, today’s Open Interest Volume Analysis indicates that the market is not just reacting to expiry-week jitters but could be preparing for a deeper correction unless strong buying interest re-emerges next week.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]