Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 29/09/2025

Table of Contents

On 29th September 2025, the combined futures and options setup showed that traders are tactically repositioning ahead of expiry. Nifty’s combined futures OI rose 3.9% with volumes up 8.8%, clearly indicating fresh short build-up, even as September contracts saw heavy long covering and October added new shorts. The rollover jumped sharply to 71% from 52%, showing that positions are shifting aggressively into the new series, but under a bearish tilt. Bank Nifty presented a different flavor—combined OI fell 6% with strong rollover (67% vs 48%), reflecting short covering in the near contract and simultaneously fresh longs being built in October.

Finnifty’s combined OI was marginally up by 0.9%, but the real signal was rollover strength, with fresh longs in October signifying sectoral resilience in financials. Midcap Nifty too echoed this pattern, with combined OI softening as September saw unwinding, but October carried forward meaningful fresh long interest. Sensex futures, however, stayed muted with marginal OI drop, showing short covering in the index. The day’s Open Interest Volume Analysis clearly highlights expiry-driven reshuffling where shorts dominate Nifty, but selective long build-up in Bank Nifty, Finnifty, and Midcap Nifty gives the market pockets of support.

NSE & BSE F&O Market Signals

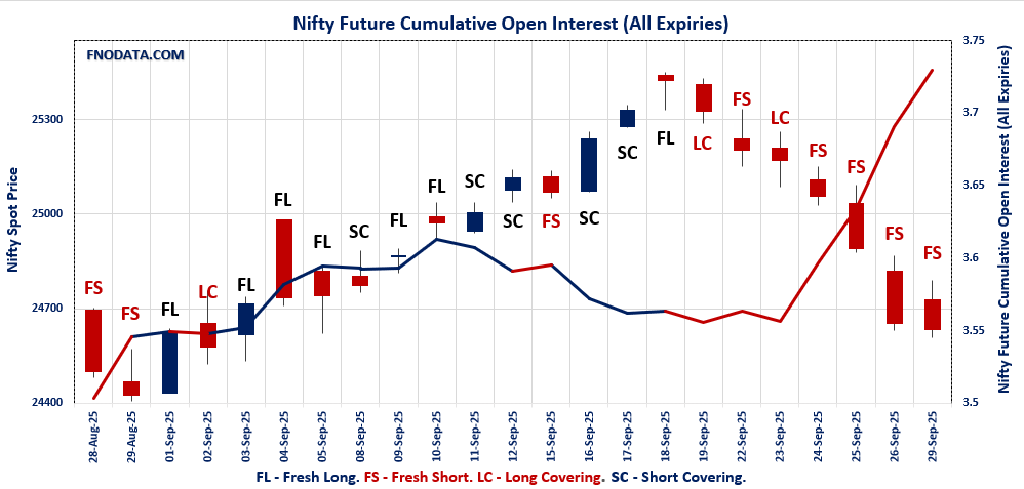

NIFTY Future analysis

NIFTY Spot closed at: 24634.9 (-0.1%)

Combined Fut Open Interest Change: 3.9%

Combined Fut Volume Change: 8.8%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 71% Previous 52%

NIFTY SEPTEMBER Future closed at: 24685 (0.0%)

September Fut Premium50.1 (Increased by 14.9 points)

September Fut Open Interest Change: -36.7%

September Fut Volume Change: -1.9%

September Fut Open Interest Analysis: Long Covering

NIFTY OCTOBER Future closed at: 24809.2 (0.0%)

October Fut Premium174.3 (Increased by 17 points)

October Fut Open Interest Change: 43.4%

October Fut Volume Change: 23.9%

October Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.613 (Increased from 0.524)

Put-Call Ratio (Volume): 1.111

Max Pain Level: 24750

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24700

Highest PUT Addition: 24000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 54461 (0.1%)

Combined Fut Open Interest Change: -6.0%

Combined Fut Volume Change: 32.4%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 67% Previous 48%

BANKNIFTY SEPTEMBER Future closed at: 54550.2 (0.1%)

September Fut Premium89.2 (Increased by 3.75 points)

September Fut Open Interest Change: -41.1%

September Fut Volume Change: 25.3%

September Fut Open Interest Analysis: Short Covering

BANKNIFTY OCTOBER Future closed at: 54885.4 (0.1%)

October Fut Premium424.4 (Increased by 10.55 points)

October Fut Open Interest Change: 36.0%

October Fut Volume Change: 50.4%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.821 (Increased from 0.636)

Put-Call Ratio (Volume): 1.074

Max Pain Level: 54700

Maximum CALL Open Interest: 55000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 54500

Highest PUT Addition: 54500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26007 (0.1%)

Combined Fut Open Interest Change: 0.9%

Combined Fut Volume Change: -4.8%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 37% Previous 27%

FINNIFTY SEPTEMBER Future closed at: 26059.9 (0.1%)

September Fut Premium52.9 (Increased by 10.75 points)

September Fut Open Interest Change: -13.0%

September Fut Volume Change: -32.0%

September Fut Open Interest Analysis: Short Covering

FINNIFTY OCTOBER Future closed at: 26226.9 (0.1%)

October Fut Premium219.9 (Increased by 17.25 points)

October Fut Open Interest Change: 38.0%

October Fut Volume Change: 63.6%

October Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.962 (Increased from 0.678)

Put-Call Ratio (Volume): 1.107

Max Pain Level: 26100

Maximum CALL Open Interest: 26100

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26100

Highest PUT Addition: 25850

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12613.4 (0.4%)

Combined Fut Open Interest Change: -1.5%

Combined Fut Volume Change: -42.2%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 78% Previous 65%

MIDCPNIFTY SEPTEMBER Future closed at: 12642.85 (0.5%)

September Fut Premium29.45 (Increased by 8.1 points)

September Fut Open Interest Change: -36.6%

September Fut Volume Change: -45.5%

September Fut Open Interest Analysis: Short Covering

MIDCPNIFTY OCTOBER Future closed at: 12691.1 (0.4%)

October Fut Premium77.7 (Increased by 2.2 points)

October Fut Open Interest Change: 17.2%

October Fut Volume Change: -39.0%

October Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.778 (Increased from 0.633)

Put-Call Ratio (Volume): 1.028

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12600

Highest CALL Addition: 12700

Highest PUT Addition: 12600

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 80,364.94 (-0.08%)

SENSEX Monthly Future closed at: 81,132.45 (0.08%)

Premium: 767.51 (Increased by 127.07 points)

Open Interest Change: -0.8%

Volume Change: -14.1%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (1/10/2025) Option Analysis

Put-Call Ratio (OI): 0.694 (Increased from 0.576)

Put-Call Ratio (Volume): 1.156

Max Pain Level: 80600

Maximum CALL OI: 81000

Maximum PUT OI: 78000

Highest CALL Addition: 80500

Highest PUT Addition: 78500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,831.59 Cr.

DIIs Net BUY: ₹ 3,845.87 Cr.

FII Derivatives Activity

| FII Trading Stats | 29.09.25 | 26.09.25 | 25.09.25 |

| FII Cash (Provisional Data) | -2,831.59 | -5,687.58 | -5,097.51 |

| Index Future Open Interest Long Ratio | 16.03% | 14.34% | 15.61% |

| Index Future Volume Long Ratio | 48.91% | 42.94% | 48.32% |

| Call Option Open Interest Long Ratio | 49.07% | 47.83% | 46.41% |

| Call Option Volume Long Ratio | 50.13% | 50.10% | 49.85% |

| Put Option Open Interest Long Ratio | 62.23% | 64.33% | 65.92% |

| Put Option Volume Long Ratio | 49.95% | 50.09% | 50.44% |

| Stock Future Open Interest Long Ratio | 61.63% | 61.12% | 61.45% |

| Stock Future Volume Long Ratio | 50.88% | 49.72% | 49.88% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Short Covering |

| FinNifty Options | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Long Covering | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Long Covering | Short Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/10/2025)

The SENSEX index closed at 80364.94. The SENSEX weekly expiry for OCTOBER 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.694 against previous 0.576. The 81000CE option holds the maximum open interest, followed by the 82000CE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 78500PE option, with open interest additions also seen in the 77500PE and 80000PE options. On the other hand, open interest reductions were prominent in the 84000CE, 82900CE, and 84500CE options. Trading volume was highest in the 80500PE option, followed by the 80600PE and 80400PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80364.94 | 0.694 | 0.576 | 1.156 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,34,53,080 | 1,08,26,680 | 26,26,400 |

| PUT: | 93,41,040 | 62,32,440 | 31,08,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,10,700 | 1,75,540 | 2,19,60,940 |

| 82000 | 8,35,520 | 1,81,300 | 89,55,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 5,19,520 | 2,46,760 | 1,70,52,680 |

| 80600 | 3,63,240 | 2,07,660 | 1,74,25,080 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 4,03,980 | -2,14,120 | 34,58,900 |

| 82900 | 1,52,520 | -1,12,420 | 14,76,960 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,10,700 | 1,75,540 | 2,19,60,940 |

| 80700 | 3,35,500 | 1,42,780 | 1,86,73,760 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 5,89,300 | 2,58,000 | 40,18,340 |

| 80000 | 5,56,500 | 2,63,000 | 2,17,29,300 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78500 | 4,90,940 | 3,37,100 | 45,66,440 |

| 77500 | 4,51,500 | 2,69,720 | 31,26,960 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79500 | 2,20,520 | -47,820 | 79,88,860 |

| 81300 | 45,960 | -36,140 | 7,11,360 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 5,41,500 | 1,36,740 | 3,41,06,980 |

| 80600 | 2,70,120 | 1,41,240 | 2,24,23,640 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24634.9. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.613 against previous 0.524. The 25000CE option holds the maximum open interest, followed by the 25500CE and 24800CE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 24700CE and 24750CE options. On the other hand, open interest reductions were prominent in the 26000CE, 26500CE, and 26300CE options. Trading volume was highest in the 24700PE option, followed by the 24800CE and 24650PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,634.90 | 0.613 | 0.524 | 1.111 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 25,54,62,750 | 26,83,47,600 | -1,28,84,850 |

| PUT: | 15,65,59,875 | 14,05,91,025 | 1,59,68,850 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,86,44,775 | 6,20,475 | 37,90,877 |

| 25,500 | 1,69,94,475 | 10,58,775 | 16,43,492 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 1,31,90,100 | 55,70,625 | 81,36,046 |

| 24,750 | 81,61,125 | 37,05,450 | 77,44,241 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,30,24,875 | -43,88,700 | 10,07,303 |

| 26,500 | 45,45,000 | -37,23,750 | 3,27,862 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,58,02,950 | 31,93,875 | 95,15,624 |

| 24,700 | 1,31,90,100 | 55,70,625 | 81,36,046 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,46,00,550 | 56,01,075 | 16,82,868 |

| 24,600 | 1,17,92,625 | 25,71,075 | 85,28,193 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,46,00,550 | 56,01,075 | 16,82,868 |

| 24,650 | 81,13,350 | 29,95,725 | 87,01,366 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 21,41,175 | -17,79,600 | 11,32,048 |

| 24,500 | 1,10,84,775 | -13,03,800 | 51,13,935 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 78,45,075 | 19,19,925 | 1,29,03,210 |

| 24,650 | 81,13,350 | 29,95,725 | 87,01,366 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54461. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.821 against previous 0.636. The 54000PE option holds the maximum open interest, followed by the 55000CE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 54500PE option, with open interest additions also seen in the 54100PE and 54000PE options. On the other hand, open interest reductions were prominent in the 55500CE, 58000CE, and 55300CE options. Trading volume was highest in the 54500PE option, followed by the 54400PE and 54500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,461.00 | 0.821 | 0.636 | 1.074 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,26,48,185 | 2,77,81,060 | -51,32,875 |

| PUT: | 1,86,03,975 | 1,76,78,880 | 9,25,095 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,79,020 | -2,93,545 | 10,04,082 |

| 56,000 | 12,87,720 | -2,68,520 | 2,70,452 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 10,16,190 | 1,57,605 | 13,21,127 |

| 54,600 | 6,10,260 | 1,06,295 | 11,90,382 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 12,42,465 | -5,08,640 | 4,10,667 |

| 58,000 | 7,86,835 | -3,65,750 | 80,640 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 10,16,190 | 1,57,605 | 13,21,127 |

| 54,600 | 6,10,260 | 1,06,295 | 11,90,382 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 18,68,320 | 2,28,545 | 11,19,231 |

| 54,500 | 11,11,950 | 3,96,480 | 16,64,529 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 11,11,950 | 3,96,480 | 16,64,529 |

| 54,100 | 6,22,930 | 3,45,100 | 5,29,497 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 4,44,910 | -2,67,265 | 1,37,042 |

| 55,000 | 6,90,130 | -1,71,850 | 1,64,752 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 11,11,950 | 3,96,480 | 16,64,529 |

| 54,400 | 8,65,795 | 1,53,580 | 13,23,738 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26007. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.962 against previous 0.678. The 26100CE option holds the maximum open interest, followed by the 26500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 25850PE option, with open interest additions also seen in the 25900PE and 25950PE options. On the other hand, open interest reductions were prominent in the 27000CE, 27500CE, and 26700CE options. Trading volume was highest in the 26100CE option, followed by the 26000PE and 25900PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,007.00 | 0.962 | 0.678 | 1.107 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,72,815 | 21,95,440 | -2,22,625 |

| PUT: | 18,96,960 | 14,87,980 | 4,08,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,77,840 | 46,735 | 1,25,904 |

| 26,500 | 1,76,215 | 18,460 | 17,825 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,77,840 | 46,735 | 1,25,904 |

| 26,150 | 79,560 | 39,845 | 71,228 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,16,480 | -81,705 | 8,502 |

| 27,500 | 21,970 | -34,840 | 3,126 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,77,840 | 46,735 | 1,25,904 |

| 26,200 | 1,24,930 | 27,235 | 89,731 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,60,745 | 36,270 | 1,17,646 |

| 25,900 | 1,60,030 | 68,185 | 1,13,380 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,850 | 1,26,685 | 98,995 | 46,254 |

| 25,900 | 1,60,030 | 68,185 | 1,13,380 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 49,855 | -19,370 | 7,626 |

| 24,000 | 13,390 | -8,840 | 1,308 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,60,745 | 36,270 | 1,17,646 |

| 25,900 | 1,60,030 | 68,185 | 1,13,380 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12613.4. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.778 against previous 0.633. The 13000CE option holds the maximum open interest, followed by the 12600PE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 12600PE option, with open interest additions also seen in the 12700CE and 12650PE options. On the other hand, open interest reductions were prominent in the 69500CE, 69500CE, and 67400CE options. Trading volume was highest in the 12600PE option, followed by the 12700CE and 12650CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,613.40 | 0.778 | 0.633 | 1.028 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,36,42,160 | 1,64,87,520 | -28,45,360 |

| PUT: | 1,06,09,760 | 1,04,30,840 | 1,78,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,43,860 | -4,95,460 | 52,434 |

| 12,900 | 9,09,020 | 1,30,340 | 66,203 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 9,02,860 | 3,07,860 | 2,73,427 |

| 12,625 | 2,52,000 | 1,85,220 | 88,151 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 7,54,320 | -5,10,300 | 21,444 |

| 13,000 | 13,43,860 | -4,95,460 | 52,434 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 9,02,860 | 3,07,860 | 2,73,427 |

| 12,650 | 4,63,120 | 57,260 | 1,87,424 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 10,75,060 | 6,03,260 | 2,84,193 |

| 12,500 | 10,48,180 | 1,26,840 | 1,83,227 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 10,75,060 | 6,03,260 | 2,84,193 |

| 12,650 | 4,04,600 | 2,14,900 | 1,68,927 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,21,380 | -2,45,560 | 33,343 |

| 12,450 | 3,70,580 | -2,26,660 | 65,629 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 10,75,060 | 6,03,260 | 2,84,193 |

| 12,500 | 10,48,180 | 1,26,840 | 1,83,227 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives picture for 29th September 2025 sends a mixed but insightful message. On one side, Nifty’s rollover-led fresh short positions and falling PCR (OI) at 0.613 highlight a cautious tone, with resistance clustering around the 24,700–25,000 band. On the other, Bank Nifty’s combined setup indicates that traders are leaning toward dip-buying, as fresh longs sneak into the October series supported by max pain at 54,700.

Finnifty’s futures rollover into longs and slightly improved PCR confirm selective strength in financial-led segments, while Midcap Nifty’s short-term unwinding but rollover-backed long build-up hints at renewed positioning in the broader market beyond expiry. Sensex continues as the balancing act with mild covering, but PCR below 0.70 shows overhead weight remains. Altogether, today’s Open Interest Volume Analysis suggests expiry will likely stay choppy with Nifty under selling pressure, but Bank Nifty and midcaps could surprise with resilience in the new series, keeping the longer-term direction contest alive.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]