Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 30/09/2025

Table of Contents

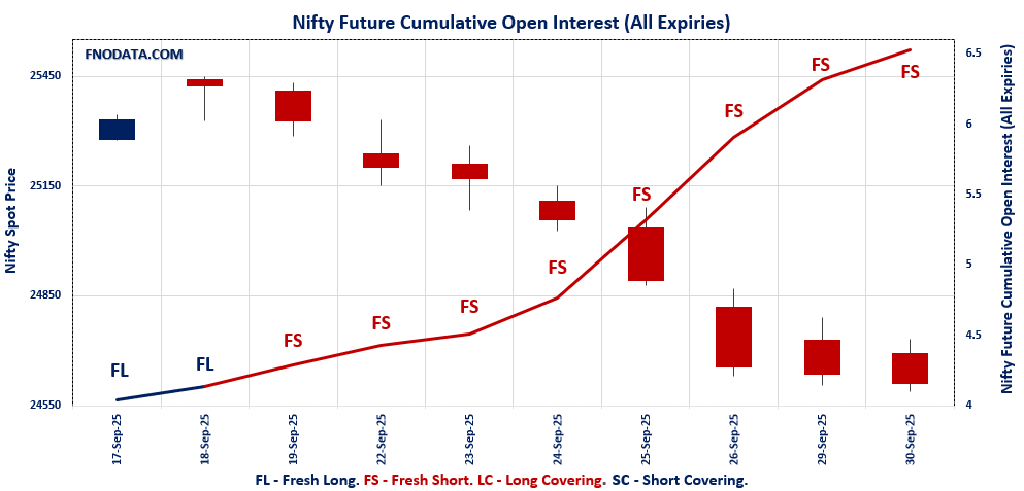

On 30th September 2025, the combined futures and options landscape was marked by aggressive repositioning—unmistakable in today’s Open Interest Volume Analysis. Nifty’s combined futures OI jumped 21.6% even as price dipped slightly, signaling that traders are building up fresh shorts across October, November, and December contracts. Rollover activity was muted at 6%, indicating this wave of new OI comes primarily from active short bets instead of extended bullish carry-overs.

Bank Nifty was the notable outlier, showing 17.4% combined OI growth driven by fresh long positions in both October and November contracts, suggesting a sector rotation toward banking strength while Nifty faces headwinds. Finnifty and Midcap Nifty reflected mixed trends: Finnifty had significant OI increases from new long buildup in November, even as October contracts saw shorts, while Midcap Nifty showed persistent shorting across all expiries.

In options, most indices reported low PCR, except MIDCPNIFTY, which saw improved put activity hinting at some bottom-fishing in midcaps. Today’s Open Interest Volume Analysis highlights a market split between determined shorting in benchmarks and selective accumulation in financials and midcaps.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 24611.1 (-0.1%)

Combined = October + November + December

Combined Fut Open Interest Change: 21.6%

Combined Fut Volume Change: -8.4%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 6% Previous 6%

NIFTY OCTOBER Future closed at: 24778.3 (-0.1%)

October Fut Premium167.2 (Decreased by -7.1 points)

October Fut Open Interest Change: 22.1%

October Fut Volume Change: -8.3%

October Fut Open Interest Analysis: Fresh Short

NIFTY NOVEMBER Future closed at: 24914.3 (-0.1%)

November Fut Premium303.2 (Decreased by -6.7 points)

November Fut Open Interest Change: 14.0%

November Fut Volume Change: -10.1%

November Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (7/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.724 (Increased from 0.714)

Put-Call Ratio (Volume): 0.915

Max Pain Level: 24700

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24600

Highest CALL Addition: 24700

Highest PUT Addition: 24600

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.039 (Decreased from 1.085)

Put-Call Ratio (Volume): 0.862

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 24800

Highest PUT Addition: 24800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 54635.85 (0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: 17.4%

Combined Fut Volume Change: -17.0%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 10% Previous 10%

BANKNIFTY OCTOBER Future closed at: 55012.2 (0.2%)

October Fut Premium376.35 (Decreased by -48.05 points)

October Fut Open Interest Change: 18.3%

October Fut Volume Change: -17.5%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY NOVEMBER Future closed at: 55333.4 (0.2%)

November Fut Premium697.55 (Decreased by -58.45 points)

November Fut Open Interest Change: 10.0%

November Fut Volume Change: -7.0%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.955 (Decreased from 0.976)

Put-Call Ratio (Volume): 0.831

Max Pain Level: 55200

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 55000

Highest PUT Addition: 55000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26022.1 (0.1%)

Combined = October + November + December

Combined Fut Open Interest Change: 39.1%

Combined Fut Volume Change: 64.8%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 2% Previous 0%

FINNIFTY OCTOBER Future closed at: 26215.8 (0.0%)

October Fut Premium193.7 (Decreased by -26.2 points)

October Fut Open Interest Change: 36.4%

October Fut Volume Change: 61.4%

October Fut Open Interest Analysis: Fresh Short

FINNIFTY NOVEMBER Future closed at: 26267.6 (0.0%)

November Fut Premium245.5 (Decreased by -3.8 points)

November Fut Open Interest Change: 900.0%

November Fut Volume Change: 1100.0%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.509 (Decreased from 0.726)

Put-Call Ratio (Volume): 0.559

Max Pain Level: 26000

Maximum CALL Open Interest: 26800

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12599.25 (-0.1%)

Combined = October + November + December

Combined Fut Open Interest Change: 12.8%

Combined Fut Volume Change: -15.3%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 12665.65 (-0.2%)

October Fut Premium66.4 (Decreased by -11.3 points)

October Fut Open Interest Change: 12.9%

October Fut Volume Change: -15.0%

October Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY NOVEMBER Future closed at: 12726.9 (-0.2%)

November Fut Premium127.65 (Decreased by -13.95 points)

November Fut Open Interest Change: 8.8%

November Fut Volume Change: -29.4%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.128 (Increased from 1.039)

Put-Call Ratio (Volume): 0.936

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12700

Highest PUT Addition: 12000

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 80,267.62 (-0.12%)

SENSEX Monthly Future closed at: 80,977.00 (-0.19%)

Premium: 709.38 (Decreased by -58.13 points)

Open Interest Change: 9.1%

Volume Change: -29.9%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/10/2025) Option Analysis

Put-Call Ratio (OI): 0.692 (Decreased from 0.694)

Put-Call Ratio (Volume): 1.017

Max Pain Level: 80500

Maximum CALL OI: 81000

Maximum PUT OI: 79000

Highest CALL Addition: 81000

Highest PUT Addition: 79000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,061.72 Cr.

DIIs Net BUY: ₹ 5,242.78 Cr.

FII Derivatives Activity

| FII Trading Stats | 30.09.25 | 29.09.25 | 26.09.25 |

| FII Cash (Provisional Data) | -2,061.72 | -2,831.59 | -5,687.58 |

| Index Future Open Interest Long Ratio | 5.98% | 16.03% | 14.34% |

| Index Future Volume Long Ratio | 42.36% | 48.91% | 42.94% |

| Call Option Open Interest Long Ratio | 44.24% | 49.07% | 47.83% |

| Call Option Volume Long Ratio | 50.09% | 50.13% | 50.10% |

| Put Option Open Interest Long Ratio | 72.24% | 62.23% | 64.33% |

| Put Option Volume Long Ratio | 50.08% | 49.95% | 50.09% |

| Stock Future Open Interest Long Ratio | 61.86% | 61.63% | 61.12% |

| Stock Future Volume Long Ratio | 50.39% | 50.88% | 49.72% |

| Index Futures | Long Covering | Fresh Short | Fresh Short |

| Index Options | Short Covering | Fresh Long | Fresh Long |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Short Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Long Covering | Fresh Long | Fresh Short |

| BankNifty Options | Long Covering | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Long Covering |

| FinNifty Options | Long Covering | Long Covering | Fresh Long |

| MidcpNifty Futures | Long Covering | Short Covering | Long Covering |

| MidcpNifty Options | Short Covering | Long Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Long Covering | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Fresh Long | Long Covering |

| Stock Options | Long Covering | Long Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/10/2025)

The SENSEX index closed at 80267.62. The SENSEX weekly expiry for OCTOBER 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.692 against previous 0.694. The 81000CE option holds the maximum open interest, followed by the 82000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 82000CE and 84000CE options. On the other hand, open interest reductions were prominent in the 82700CE, 82400CE, and 86500CE options. Trading volume was highest in the 80500PE option, followed by the 80500CE and 80400PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80267.62 | 0.692 | 0.694 | 1.017 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,29,30,200 | 1,34,53,080 | 94,77,120 |

| PUT: | 1,58,75,420 | 93,41,040 | 65,34,380 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 20,83,960 | 11,73,260 | 2,63,34,840 |

| 82000 | 19,90,860 | 11,55,340 | 1,07,16,160 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 20,83,960 | 11,73,260 | 2,63,34,840 |

| 82000 | 19,90,860 | 11,55,340 | 1,07,16,160 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82700 | 1,38,940 | -1,72,000 | 16,93,480 |

| 82400 | 1,41,220 | -1,31,500 | 16,09,520 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 10,81,800 | 5,62,280 | 2,94,53,520 |

| 81000 | 20,83,960 | 11,73,260 | 2,63,34,840 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 10,68,660 | 6,60,420 | 88,25,560 |

| 80000 | 9,35,760 | 3,79,260 | 2,67,20,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 10,68,660 | 6,60,420 | 88,25,560 |

| 79500 | 7,79,400 | 5,58,880 | 96,73,140 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80600 | 1,97,560 | -72,560 | 1,41,22,520 |

| 77500 | 3,91,820 | -59,680 | 29,54,300 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 5,64,160 | 22,660 | 3,11,09,140 |

| 80400 | 5,42,980 | 2,27,080 | 2,87,72,940 |

NIFTY Weekly Expiry (7/10/2025)

The NIFTY index closed at 24611.1. The NIFTY weekly expiry for OCTOBER 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.724 against previous 0.714. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24700CE options. Market participants have shown increased interest with significant open interest additions in the 24700CE option, with open interest additions also seen in the 25000CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25550CE, 25950CE, and 25900PE options. Trading volume was highest in the 24700PE option, followed by the 24600PE and 24700CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,611.10 | 0.724 | 0.714 | 0.915 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,72,70,625 | 4,34,23,575 | 3,38,47,050 |

| PUT: | 5,59,34,325 | 3,10,17,750 | 2,49,16,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 69,08,925 | 31,62,000 | 3,90,998 |

| 26,000 | 64,68,000 | 28,32,525 | 1,93,303 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 49,19,250 | 34,18,725 | 5,68,463 |

| 25,000 | 69,08,925 | 31,62,000 | 3,90,998 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,550 | 4,16,925 | -63,300 | 49,435 |

| 25,950 | 4,55,250 | -5,250 | 18,402 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 49,19,250 | 34,18,725 | 5,68,463 |

| 24,800 | 38,99,250 | 15,61,125 | 5,31,342 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 41,01,600 | 24,71,850 | 5,73,137 |

| 24,000 | 40,68,150 | 19,00,650 | 1,89,646 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 41,01,600 | 24,71,850 | 5,73,137 |

| 24,300 | 35,25,675 | 24,28,425 | 2,04,937 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 3,750 | -1,500 | 108 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 35,34,900 | 15,19,650 | 5,82,403 |

| 24,600 | 41,01,600 | 24,71,850 | 5,73,137 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 24611.1. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.039 against previous 1.085. The 26000CE option holds the maximum open interest, followed by the 25000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24800PE and 24700CE options. On the other hand, open interest reductions were prominent in the 26800CE, 25800CE, and 26100CE options. Trading volume was highest in the 25000CE option, followed by the 25500CE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,611.10 | 1.039 | 1.085 | 0.862 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,66,50,775 | 2,75,00,700 | 91,50,075 |

| PUT: | 3,80,72,625 | 2,98,33,275 | 82,39,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 41,99,100 | 3,04,050 | 38,477 |

| 25,000 | 39,45,825 | 8,92,200 | 65,477 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 22,05,225 | 12,71,475 | 53,424 |

| 24,700 | 15,32,250 | 10,35,000 | 46,637 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 5,53,575 | -93,000 | 6,409 |

| 25,800 | 7,08,675 | -71,775 | 15,283 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,45,825 | 8,92,200 | 65,477 |

| 25,500 | 37,20,450 | 9,06,300 | 61,139 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 32,98,575 | 2,13,525 | 35,472 |

| 24,000 | 32,78,250 | 4,86,450 | 48,074 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 27,57,600 | 12,49,650 | 49,814 |

| 24,600 | 17,56,725 | 9,57,375 | 43,686 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 2,05,275 | -6,150 | 4,517 |

| 22,900 | 27,750 | -3,750 | 338 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 28,68,375 | 8,18,625 | 53,530 |

| 24,800 | 27,57,600 | 12,49,650 | 49,814 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 54635.85. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.955 against previous 0.976. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 55000CE option, with open interest additions also seen in the 55000PE and 54000PE options. On the other hand, open interest reductions were prominent in the 59800CE, 55300PE, and 51900PE options. Trading volume was highest in the 55000CE option, followed by the 56000CE and 55000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,635.85 | 0.955 | 0.976 | 0.831 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 91,35,700 | 71,29,570 | 20,06,130 |

| PUT: | 87,25,045 | 69,57,055 | 17,67,990 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,32,985 | 1,67,160 | 30,415 |

| 56,000 | 9,90,080 | 1,96,595 | 47,162 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,39,960 | 2,09,090 | 51,022 |

| 56,000 | 9,90,080 | 1,96,595 | 47,162 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,800 | 3,360 | -1,575 | 229 |

| 53,400 | 9,590 | -455 | 27 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,39,960 | 2,09,090 | 51,022 |

| 56,000 | 9,90,080 | 1,96,595 | 47,162 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,49,860 | 34,930 | 1,649 |

| 54,000 | 8,69,155 | 1,98,555 | 26,519 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 8,01,010 | 2,05,345 | 35,432 |

| 54,000 | 8,69,155 | 1,98,555 | 26,519 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,300 | 29,015 | -1,365 | 1,099 |

| 51,900 | 10,570 | -1,330 | 603 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 8,01,010 | 2,05,345 | 35,432 |

| 54,500 | 5,08,550 | 82,670 | 32,645 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26022.1. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.509 against previous 0.726. The 26000PE option holds the maximum open interest, followed by the 26800CE and 29000CE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26000CE and 26800CE options. On the other hand, open interest reductions were prominent in the 24600PE, 24700PE, and 24700PE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,022.10 | 0.509 | 0.726 | 0.559 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 52,325 | 18,980 | 33,345 |

| PUT: | 26,650 | 13,780 | 12,870 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 9,685 | 5,395 | 222 |

| 29,000 | 9,360 | 4,225 | 96 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 8,060 | 5,525 | 301 |

| 26,800 | 9,685 | 5,395 | 222 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 8,060 | 5,525 | 301 |

| 26,800 | 9,685 | 5,395 | 222 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 12,090 | 8,125 | 382 |

| 25,000 | 8,450 | 2,470 | 170 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 12,090 | 8,125 | 382 |

| 25,000 | 8,450 | 2,470 | 170 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 195 | -65 | 2 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 12,090 | 8,125 | 382 |

| 25,000 | 8,450 | 2,470 | 170 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 12599.25. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.128 against previous 1.039. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 12600PE and 12700CE options. On the other hand, open interest reductions were prominent in the 78000PE, 78000PE, and 78000PE options. Trading volume was highest in the 12500PE option, followed by the 12700CE and 12000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,599.25 | 1.128 | 1.039 | 0.936 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,73,300 | 9,99,880 | 9,73,420 |

| PUT: | 22,25,580 | 10,38,380 | 11,87,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 2,97,360 | 90,720 | 3,595 |

| 12,700 | 2,79,860 | 1,98,520 | 6,552 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,79,860 | 1,98,520 | 6,552 |

| 13,500 | 1,72,060 | 1,07,660 | 1,589 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,79,860 | 1,98,520 | 6,552 |

| 12,600 | 1,31,600 | 1,00,380 | 3,794 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,44,280 | 3,16,400 | 4,755 |

| 12,500 | 4,16,080 | 1,97,540 | 6,889 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,44,280 | 3,16,400 | 4,755 |

| 12,600 | 2,50,740 | 2,07,060 | 4,623 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 7,280 | -1,260 | 24 |

| 13,025 | 140 | -280 | 2 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 4,16,080 | 1,97,540 | 6,889 |

| 12,000 | 6,44,280 | 3,16,400 | 4,755 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivative tale for 30th September 2025 is one of cautious bearishness but with nuanced detail. Nifty’s sharp rise in combined OI, especially fresh shorts in upcoming contracts, suggests traders expect more downside, a view reinforced by the persistently low PCR in both weekly and monthly options. Bank Nifty stands apart, as long rolls and improved PCR signal that participants continue to buy dips in banking stocks even as index-wide sentiment chills.

Finnifty’s split between shorting and runaway long rolls for November reflects trader hesitancy about broader financials, while Midcap Nifty’s steady fresh short moves point to risk aversion in segments that previously led rallies. Sensex, with over 9% fresh shorts in its combined future, rounds out the picture of rising institutional caution. Overall, the Open Interest Volume Analysis points to near-term market stress and downside bias in headline indices, but savvy investors should watch banking and select midcap baskets for resilience as expiry season plays out.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]