Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 1/10/2025

Table of Contents

On 1st October 2025, the combined futures and options data revealed a growing optimism in the market, marked distinctly by fresh long positions dominating major indices. Nifty’s combined futures open interest rose a modest 1.5% despite a slight uptick in price, highlighting selective buying in October contracts and some short covering in November. Meanwhile, rollover levels remained steady at 6%, indicating traders are cautiously building fresh exposure rather than unwinding.

Bank Nifty showed stronger conviction with combined futures OI broadly stable but clear evidence of fresh long additions in October, signaling confidence in the banking sector’s near-term prospects despite muted rollover movement.

Finnifty and Midcap Nifty both participated in the bullish sentiment with combined futures OI inching higher, while options data reflected rising put-call ratios, demonstrating a more balanced yet positive risk appetite. Sensex futures also added small fresh longs, rounding out a market environment rooted in selective accumulation ahead of the weekly and monthly expiries. Today’s Open Interest Volume Analysis captures this nuanced pivot from cautious to confident investor positioning.

NSE & BSE F&O Market Signals

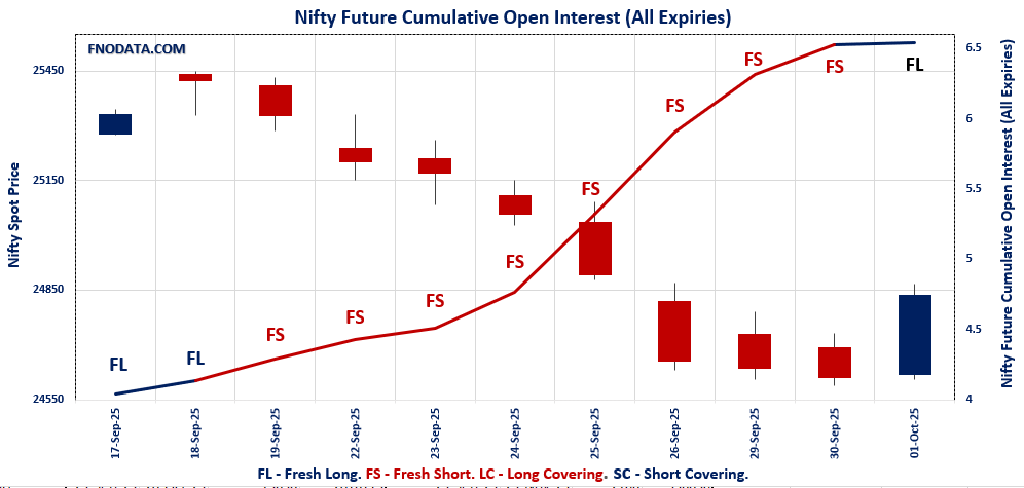

NIFTY Future analysis

NIFTY Spot closed at: 24836.3 (0.9%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.5%

Combined Fut Volume Change: -5.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 6% Previous 6%

NIFTY OCTOBER Future closed at: 24967.2 (0.8%)

October Fut Premium130.9 (Decreased by -36.3 points)

October Fut Open Interest Change: 0.9%

October Fut Volume Change: -9.1%

October Fut Open Interest Analysis: Fresh Long

NIFTY NOVEMBER Future closed at: 25093.6 (0.7%)

November Fut Premium257.3 (Decreased by -45.9 points)

November Fut Open Interest Change: -2.1%

November Fut Volume Change: 12.8%

November Fut Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (7/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.242 (Increased from 0.724)

Put-Call Ratio (Volume): 0.905

Max Pain Level: 24800

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24700

Highest CALL Addition: 25000

Highest PUT Addition: 24800

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.051 (Increased from 1.039)

Put-Call Ratio (Volume): 0.938

Max Pain Level: 25000

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 24400

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 55347.95 (1.3%)

Combined = October + November + December

Combined Fut Open Interest Change: -0.2%

Combined Fut Volume Change: 82.1%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 10%

BANKNIFTY OCTOBER Future closed at: 55663.2 (1.2%)

October Fut Premium315.25 (Decreased by -61.1 points)

October Fut Open Interest Change: 0.6%

October Fut Volume Change: 77.7%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY NOVEMBER Future closed at: 55968.4 (1.1%)

November Fut Premium620.45 (Decreased by -77.1 points)

November Fut Open Interest Change: -16.5%

November Fut Volume Change: 99.3%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.100 (Increased from 0.955)

Put-Call Ratio (Volume): 0.843

Max Pain Level: 55500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 55500

Highest PUT Addition: 55000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26382.2 (1.4%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.7%

Combined Fut Volume Change: -44.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 2%

FINNIFTY OCTOBER Future closed at: 26519.1 (1.2%)

October Fut Premium136.9 (Decreased by -56.8 points)

October Fut Open Interest Change: 0.0%

October Fut Volume Change: -44.3%

October Fut Open Interest Analysis: Short Covering

FINNIFTY NOVEMBER Future closed at: 26659.1 (1.5%)

November Fut Premium276.9 (Increased by 31.4 points)

November Fut Open Interest Change: 30.0%

November Fut Volume Change: -41.7%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.641 (Increased from 0.509)

Put-Call Ratio (Volume): 0.559

Max Pain Level: 26300

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12698.15 (0.8%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.7%

Combined Fut Volume Change: -22.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 12776.7 (0.9%)

October Fut Premium78.55 (Increased by 12.15 points)

October Fut Open Interest Change: 0.7%

October Fut Volume Change: -23.4%

October Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY NOVEMBER Future closed at: 12835 (0.8%)

November Fut Premium136.85 (Increased by 9.2 points)

November Fut Open Interest Change: 0.2%

November Fut Volume Change: 10.2%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.241 (Increased from 1.128)

Put-Call Ratio (Volume): 0.818

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 12700

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 80,983.31 (0.89%)

SENSEX Monthly Future closed at: 81,546.35 (0.70%)

Premium: 563.04 (Decreased by -146.34 points)

Open Interest Change: 0.3%

Volume Change: 96.7%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (9/10/2025) Option Analysis

Put-Call Ratio (OI): 1.224 (Increased from 0.723)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 81000

Maximum CALL OI: 81000

Maximum PUT OI: 77000

Highest CALL Addition: 81000

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,605.20 Cr.

DIIs Net BUY: ₹ 2,916.14 Cr.

FII Derivatives Activity

| FII Trading Stats | 1.10.25 | 30.09.25 | 29.09.25 |

| FII Cash (Provisional Data) | -1,605.20 | -2,061.72 | -2,831.59 |

| Index Future Open Interest Long Ratio | 6.80% | 5.98% | 16.03% |

| Index Future Volume Long Ratio | 48.91% | 42.36% | 48.91% |

| Call Option Open Interest Long Ratio | 48.99% | 44.24% | 49.07% |

| Call Option Volume Long Ratio | 50.44% | 50.09% | 50.13% |

| Put Option Open Interest Long Ratio | 66.17% | 72.24% | 62.23% |

| Put Option Volume Long Ratio | 50.08% | 50.08% | 49.95% |

| Stock Future Open Interest Long Ratio | 61.74% | 61.86% | 61.63% |

| Stock Future Volume Long Ratio | 49.42% | 50.39% | 50.88% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Long | Short Covering | Fresh Long |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Long | Short Covering | Fresh Long |

| BankNifty Futures | Short Covering | Long Covering | Fresh Long |

| BankNifty Options | Fresh Long | Long Covering | Fresh Long |

| FinNifty Futures | Fresh Short | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Futures | Fresh Long | Long Covering | Short Covering |

| MidcpNifty Options | Fresh Long | Short Covering | Long Covering |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Long |

| Stock Futures | Fresh Short | Short Covering | Fresh Long |

| Stock Options | Fresh Long | Long Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (9/10/2025)

The SENSEX index closed at 80983.31. The SENSEX weekly expiry for OCTOBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.224 against previous 0.723. The 81000CE option holds the maximum open interest, followed by the 77000PE and 81000PE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 81000PE and 77000PE options. On the other hand, open interest reductions were prominent in the 80300CE, 80400CE, and 80000CE options. Trading volume was highest in the 81000CE option, followed by the 80500PE and 81000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 09-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80983.31 | 1.224 | 0.723 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 32,55,680 | 11,87,380 | 20,68,300 |

| PUT: | 39,84,440 | 8,59,040 | 31,25,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 4,35,900 | 2,93,620 | 24,74,000 |

| 82000 | 2,70,240 | 1,83,540 | 15,44,460 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 4,35,900 | 2,93,620 | 24,74,000 |

| 82000 | 2,70,240 | 1,83,540 | 15,44,460 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80300 | 11,420 | -4,740 | 1,65,640 |

| 80400 | 13,760 | -3,980 | 3,62,820 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 4,35,900 | 2,93,620 | 24,74,000 |

| 82000 | 2,70,240 | 1,83,540 | 15,44,460 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 3,21,480 | 2,26,640 | 9,50,760 |

| 81000 | 3,17,940 | 2,85,360 | 16,85,440 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 3,17,940 | 2,85,360 | 16,85,440 |

| 77000 | 3,21,480 | 2,26,640 | 9,50,760 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82600 | 660 | -180 | 720 |

| 83400 | 40 | – | 80 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 2,45,940 | 1,35,120 | 20,17,100 |

| 81000 | 3,17,940 | 2,85,360 | 16,85,440 |

NIFTY Weekly Expiry (7/10/2025)

The NIFTY index closed at 24836.3. The NIFTY weekly expiry for OCTOBER 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.242 against previous 0.724. The 24700PE option holds the maximum open interest, followed by the 25000CE and 24600PE options. Market participants have shown increased interest with significant open interest additions in the 24800PE option, with open interest additions also seen in the 24700PE and 24600PE options. On the other hand, open interest reductions were prominent in the 24700CE, 24600CE, and 24750CE options. Trading volume was highest in the 24800CE option, followed by the 24700PE and 24700CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,836.30 | 1.242 | 0.724 | 0.905 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,10,67,725 | 7,72,70,625 | 3,37,97,100 |

| PUT: | 13,79,30,625 | 5,59,34,325 | 8,19,96,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 98,66,700 | 29,57,775 | 23,71,190 |

| 26,000 | 82,35,900 | 17,67,900 | 4,01,260 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 98,66,700 | 29,57,775 | 23,71,190 |

| 24,950 | 42,05,625 | 27,97,575 | 11,80,957 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 33,91,875 | -15,27,375 | 28,77,462 |

| 24,600 | 15,67,125 | -12,28,125 | 12,60,778 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 42,53,175 | 3,53,925 | 33,94,414 |

| 24,700 | 33,91,875 | -15,27,375 | 28,77,462 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 99,07,050 | 63,72,150 | 30,51,278 |

| 24,600 | 97,17,450 | 56,15,850 | 27,12,173 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 81,46,200 | 64,00,875 | 25,44,414 |

| 24,700 | 99,07,050 | 63,72,150 | 30,51,278 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 4,87,875 | -85,800 | 19,060 |

| 25,300 | 4,27,500 | -30,450 | 4,313 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 99,07,050 | 63,72,150 | 30,51,278 |

| 24,600 | 97,17,450 | 56,15,850 | 27,12,173 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 24836.3. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.051 against previous 1.039. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 24400PE and 25000PE options. On the other hand, open interest reductions were prominent in the 25300CE, 24200PE, and 23900PE options. Trading volume was highest in the 25000CE option, followed by the 25500CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,836.30 | 1.051 | 1.039 | 0.938 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,12,52,175 | 3,66,50,775 | 46,01,400 |

| PUT: | 4,33,37,100 | 3,80,72,625 | 52,64,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 46,09,200 | 8,88,750 | 88,935 |

| 26,000 | 44,62,725 | 2,63,625 | 44,857 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 46,09,200 | 8,88,750 | 88,935 |

| 25,800 | 13,22,775 | 6,14,100 | 29,062 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 12,12,900 | -2,05,725 | 33,478 |

| 24,500 | 13,40,775 | -42,150 | 22,734 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 44,44,275 | 4,98,450 | 96,628 |

| 25,500 | 46,09,200 | 8,88,750 | 88,935 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,80,850 | 6,82,275 | 54,380 |

| 24,000 | 38,01,825 | 5,23,575 | 76,200 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 14,25,000 | 7,68,375 | 32,574 |

| 25,000 | 39,80,850 | 6,82,275 | 54,380 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 11,26,275 | -1,13,625 | 31,886 |

| 23,900 | 4,91,025 | -73,650 | 16,401 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 38,01,825 | 5,23,575 | 76,200 |

| 24,800 | 30,98,550 | 3,40,950 | 67,721 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 55347.95. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.100 against previous 0.955. The 57000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55000PE option, with open interest additions also seen in the 55500PE and 55500CE options. On the other hand, open interest reductions were prominent in the 54700CE, 54500CE, and 55000CE options. Trading volume was highest in the 55000PE option, followed by the 56000CE and 55000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,347.95 | 1.100 | 0.955 | 0.843 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,20,67,825 | 91,35,700 | 29,32,125 |

| PUT: | 1,32,74,905 | 87,25,045 | 45,49,860 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 20,66,995 | 2,34,010 | 1,44,176 |

| 56,000 | 10,03,905 | 13,825 | 1,60,099 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,46,970 | 3,03,100 | 1,18,780 |

| 57,000 | 20,66,995 | 2,34,010 | 1,44,176 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,700 | 69,895 | -53,900 | 39,341 |

| 54,500 | 2,79,825 | -39,095 | 24,125 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,03,905 | 13,825 | 1,60,099 |

| 55,000 | 9,09,125 | -30,835 | 1,44,450 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,67,170 | 5,66,160 | 1,65,375 |

| 54,000 | 11,23,010 | 2,53,855 | 88,992 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,67,170 | 5,66,160 | 1,65,375 |

| 55,500 | 6,35,530 | 3,62,460 | 71,892 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 1,25,265 | -700 | 494 |

| 60,000 | 1,18,685 | -560 | 895 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,67,170 | 5,66,160 | 1,65,375 |

| 54,000 | 11,23,010 | 2,53,855 | 88,992 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26382.2. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.641 against previous 0.509. The 27000CE option holds the maximum open interest, followed by the 26000PE and 29000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000PE and 29000CE options. On the other hand, open interest reductions were prominent in the 25950PE, 25950PE, and 25950PE options. Trading volume was highest in the 26000PE option, followed by the 26800CE and 26500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,382.20 | 0.641 | 0.509 | 0.559 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,90,840 | 52,325 | 1,38,515 |

| PUT: | 1,22,265 | 26,650 | 95,615 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 33,605 | 30,225 | 1,842 |

| 29,000 | 27,170 | 17,810 | 1,234 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 33,605 | 30,225 | 1,842 |

| 29,000 | 27,170 | 17,810 | 1,234 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 21,060 | 11,375 | 1,978 |

| 26,500 | 16,120 | 11,570 | 1,862 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 30,940 | 18,850 | 2,315 |

| 25,000 | 17,550 | 9,100 | 579 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 30,940 | 18,850 | 2,315 |

| 26,300 | 10,920 | 10,855 | 897 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 30,940 | 18,850 | 2,315 |

| 26,300 | 10,920 | 10,855 | 897 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 12698.15. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.241 against previous 1.128. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12700PE option, with open interest additions also seen in the 12500PE and 12800CE options. On the other hand, open interest reductions were prominent in the 62200PE, 62200PE, and 62200CE options. Trading volume was highest in the 13000CE option, followed by the 12700CE and 12000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,698.15 | 1.241 | 1.128 | 0.818 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 36,18,300 | 19,73,300 | 16,45,000 |

| PUT: | 44,91,760 | 22,25,580 | 22,66,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,82,440 | 1,85,080 | 22,388 |

| 12,700 | 4,42,820 | 1,62,960 | 15,742 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,00,720 | 2,13,780 | 9,096 |

| 13,000 | 4,82,440 | 1,85,080 | 22,388 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 1,22,780 | -6,720 | 2,094 |

| 12,550 | 6,720 | -4,340 | 259 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,82,440 | 1,85,080 | 22,388 |

| 12,700 | 4,42,820 | 1,62,960 | 15,742 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,34,400 | 1,90,120 | 12,255 |

| 12,500 | 7,05,040 | 2,88,960 | 11,691 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 3,88,920 | 2,91,060 | 11,079 |

| 12,500 | 7,05,040 | 2,88,960 | 11,691 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,550 | 24,640 | -13,160 | 1,154 |

| 12,900 | 33,460 | -3,500 | 383 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,34,400 | 1,90,120 | 12,255 |

| 12,500 | 7,05,040 | 2,88,960 | 11,691 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives positioning on 1st October 2025 points to a carefully measured shift towards bullishness, though tempered by lingering caution. Nifty’s slight rise in combined OI and stable rollover suggests traders are tentatively embracing fresh longs while balancing risk.

Bank Nifty’s fresh October long interest with decreasing November OI hints at tactical rotation and confidence in sectoral strength, supported by a generous increase in put-call ratios signaling better risk management. Finnifty and Midcap Nifty’s quiet accumulation contrasts with earlier volatility, signaling growing underlying support.

Meanwhile, Sensex futures maintaining their longs despite muted price change suggest institutional investors are positioning for a broader recovery. Overall, the Open Interest Volume Analysis indicates a market cautiously gearing up for a sustainable uptrend, but with eyes wide open to near-term expiry unease and global macro uncertainties.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]