Turning Complex Derivative Data into Clear Market Insights

NSE Indices Futures and Options Open Interest Volume Analysis for 6/10/2025

Table of Contents

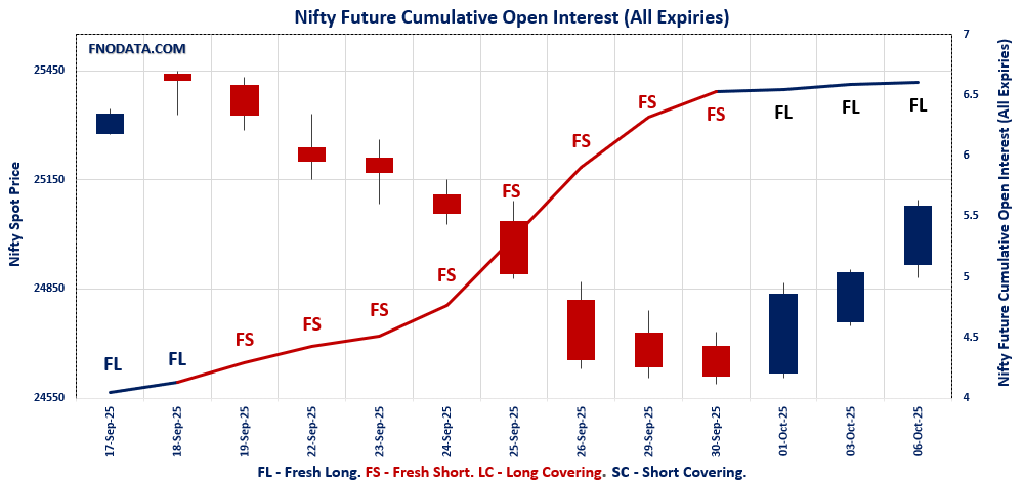

On 6th October 2025, Open Interest Volume Analysis across the combined futures contracts revealed a clear uptick in bullish spirit. Nifty’s combined open interest ticked up 1.8% as spot and futures prices moved higher, making it evident that traders are starting this week with a fresh long bias and not just riding on short covering. Rollover activity still hovers at a slow 7%, so the interest appears concentrated in new contracts rather than legacy positions.

In options, a powerful move was the jump in weekly PCR beyond 1.5, meaning there’s an influx of put writing at higher strikes, further emboldening the bulls and offering downside cushion. Bank Nifty’s combined futures OI on the other hand contracted by 3.3% alongside a surge in volumes, providing evidence of aggressive short covering.

The real story, however, is in Finnifty and Midcap Nifty—where combined OI declined sharply as price rallied, a classic case of trapped shorts being forced out and momentum shifting in buyers’ favor. Overall, today’s Open Interest Volume Analysis shows a broadening long bias but with evidence that financials and midcaps have more unwinding to complete before all segments are fully aligned.

NSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25077.65 (0.7%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.8%

Combined Fut Volume Change: 21.9%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 7% Previous 6%

NIFTY OCTOBER Future closed at: 25185.4 (0.7%)

October Fut Premium 107.75 (Decreased by -4.6 points)

October Fut Open Interest Change: 1.6%

October Fut Volume Change: 20.8%

October Fut Open Interest Analysis: Fresh Long

NIFTY NOVEMBER Future closed at: 25314.2 (0.7%)

November Fut Premium 236.55 (Decreased by -6.6 points)

November Fut Open Interest Change: 2.9%

November Fut Volume Change: 38.1%

November Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (7/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.513 (Increased from 1.207)

Put-Call Ratio (Volume): 0.883

Max Pain Level: 25050

Maximum CALL Open Interest: 25200

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25200

Highest PUT Addition: 25000

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.015 (Decreased from 1.035)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 24600

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 56104.85 (0.9%)

Combined = October + November + December

Combined Fut Open Interest Change: -3.3%

Combined Fut Volume Change: 29.9%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 9%

BANKNIFTY OCTOBER Future closed at: 56297.8 (0.8%)

October Fut Premium 192.95 (Decreased by -72 points)

October Fut Open Interest Change: -3.5%

October Fut Volume Change: 29.4%

October Fut Open Interest Analysis: Short Covering

BANKNIFTY NOVEMBER Future closed at: 56597.2 (0.8%)

November Fut Premium 492.35 (Decreased by -70.6 points)

November Fut Open Interest Change: -0.5%

November Fut Volume Change: 22.5%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.099 (Decreased from 1.127)

Put-Call Ratio (Volume): 0.874

Max Pain Level: 55800

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 60000

Highest PUT Addition: 56000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26712.05 (1.1%)

Combined = October + November + December

Combined Fut Open Interest Change: -12.1%

Combined Fut Volume Change: 139.7%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 3% Previous 3%

FINNIFTY OCTOBER Future closed at: 26798.6 (0.9%)

October Fut Premium 86.55 (Decreased by -36.4 points)

October Fut Open Interest Change: -12.0%

October Fut Volume Change: 146.4%

October Fut Open Interest Analysis: Short Covering

FINNIFTY NOVEMBER Future closed at: 26930 (0.9%)

November Fut Premium 217.95 (Decreased by -55.7 points)

November Fut Open Interest Change: -16.7%

November Fut Volume Change: 0.0%

November Fut Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.712 (Increased from 0.583)

Put-Call Ratio (Volume): 0.623

Max Pain Level: 26600

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27200

Highest PUT Addition: 25000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12944.95 (1.2%)

Combined = October + November + December

Combined Fut Open Interest Change: -0.9%

Combined Fut Volume Change: 23.4%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 13014.4 (1.2%)

October Fut Premium 69.45 (Decreased by -2.1 points)

October Fut Open Interest Change: -1.2%

October Fut Volume Change: 17.1%

October Fut Open Interest Analysis: Short Covering

MIDCPNIFTY NOVEMBER Future closed at: 13072.45 (1.2%)

November Fut Premium 127.5 (Increased by 5.55 points)

November Fut Open Interest Change: 7.7%

November Fut Volume Change: 189.0%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.393 (Increased from 1.357)

Put-Call Ratio (Volume): 1.256

Max Pain Level: 12800

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13400

Highest PUT Addition: 12500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 213.54 Cr.

DIIs Net BUY: ₹ 4,881.60 Cr.

FII Derivatives Activity

| FII Trading Stats | 6.10.25 | 3.10.25 | 1.10.25 |

| FII Cash (Provisional Data) | -213.54 | -1,503.12 | -1,605.20 |

| Index Future Open Interest Long Ratio | 7.08% | 6.73% | 6.80% |

| Index Future Volume Long Ratio | 38.17% | 29.81% | 48.91% |

| Call Option Open Interest Long Ratio | 51.46% | 49.73% | 48.99% |

| Call Option Volume Long Ratio | 50.17% | 50.08% | 50.44% |

| Put Option Open Interest Long Ratio | 61.56% | 62.77% | 66.17% |

| Put Option Volume Long Ratio | 49.95% | 50.07% | 50.08% |

| Stock Future Open Interest Long Ratio | 61.43% | 61.52% | 61.74% |

| Stock Future Volume Long Ratio | 49.24% | 47.53% | 49.42% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Long | Short Covering |

| BankNifty Options | Fresh Long | Short Covering | Fresh Long |

| FinNifty Futures | Short Covering | Fresh Short | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Fresh Short | Fresh Short |

| Stock Options | Fresh Long | Fresh Short | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE Option market Trends : Options Insights

NIFTY Weekly Expiry (7/10/2025)

The NIFTY index closed at 25077.65. The NIFTY weekly expiry for OCTOBER 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.513 against previous 1.207. The 25000PE option holds the maximum open interest, followed by the 24900PE and 25200CE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 24950PE and 25100PE options. On the other hand, open interest reductions were prominent in the 24900CE, 25000CE, and 26000CE options. Trading volume was highest in the 25000CE option, followed by the 25100CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,077.65 | 1.513 | 1.207 | 0.883 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,89,12,950 | 16,69,75,125 | -1,80,62,175 |

| PUT: | 22,53,70,275 | 20,16,07,350 | 2,37,62,925 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,35,12,000 | 50,61,225 | 65,00,517 |

| 25,100 | 1,22,83,500 | 33,80,400 | 1,03,90,235 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,35,12,000 | 50,61,225 | 65,00,517 |

| 25,300 | 1,15,46,625 | 46,67,700 | 38,07,546 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 25,56,900 | -72,89,625 | 44,74,941 |

| 25,000 | 61,08,675 | -66,33,225 | 1,04,97,791 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 61,08,675 | -66,33,225 | 1,04,97,791 |

| 25,100 | 1,22,83,500 | 33,80,400 | 1,03,90,235 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,71,71,175 | 1,35,95,550 | 86,37,415 |

| 24,900 | 1,43,07,525 | 38,60,775 | 76,78,705 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,71,71,175 | 1,35,95,550 | 86,37,415 |

| 24,950 | 1,00,46,250 | 83,20,575 | 62,49,451 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,10,19,525 | -46,25,250 | 16,25,288 |

| 24,550 | 38,79,450 | -22,32,675 | 7,88,341 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,71,71,175 | 1,35,95,550 | 86,37,415 |

| 24,900 | 1,43,07,525 | 38,60,775 | 76,78,705 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25077.65. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.015 against previous 1.035. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 24600PE and 25700CE options. On the other hand, open interest reductions were prominent in the 24800CE, 25400CE, and 25000CE options. Trading volume was highest in the 25500CE option, followed by the 25000CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,077.65 | 1.015 | 1.035 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,43,67,825 | 4,37,84,325 | 5,83,500 |

| PUT: | 4,50,23,925 | 4,53,22,800 | -2,98,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 50,37,000 | 1,03,350 | 56,890 |

| 25,500 | 49,73,700 | -83,400 | 1,09,771 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 23,26,350 | 11,42,625 | 52,120 |

| 25,700 | 13,34,475 | 3,50,325 | 33,475 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 20,49,225 | -5,13,075 | 34,273 |

| 25,400 | 12,01,650 | -4,79,850 | 41,142 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 49,73,700 | -83,400 | 1,09,771 |

| 25,000 | 42,47,100 | -4,18,650 | 1,02,728 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 42,22,950 | 78,225 | 94,604 |

| 24,000 | 36,80,325 | -1,18,725 | 55,682 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 25,31,100 | 6,13,950 | 57,890 |

| 25,100 | 8,26,800 | 2,89,800 | 22,843 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 35,76,450 | -3,95,925 | 64,968 |

| 24,400 | 11,28,675 | -3,70,725 | 30,997 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 42,22,950 | 78,225 | 94,604 |

| 24,500 | 35,76,450 | -3,95,925 | 64,968 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 56104.85. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.099 against previous 1.127. The 57000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 56000PE option, with open interest additions also seen in the 54000PE and 60000CE options. On the other hand, open interest reductions were prominent in the 52500PE, 55500CE, and 53500PE options. Trading volume was highest in the 56000CE option, followed by the 56000PE and 57000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,104.85 | 1.099 | 1.127 | 0.874 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,43,20,320 | 1,30,84,295 | 12,36,025 |

| PUT: | 1,57,39,360 | 1,47,47,215 | 9,92,145 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,44,065 | 34,335 | 1,10,523 |

| 58,000 | 11,07,785 | 23,310 | 76,912 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 6,05,150 | 1,78,710 | 33,280 |

| 59,500 | 2,74,190 | 1,49,695 | 22,206 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 5,97,310 | -1,64,290 | 35,589 |

| 55,600 | 1,47,700 | -85,050 | 14,963 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,73,905 | -17,850 | 1,68,663 |

| 57,000 | 21,44,065 | 34,335 | 1,10,523 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,08,425 | 1,64,955 | 79,686 |

| 54,000 | 13,87,295 | 1,90,155 | 71,777 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 8,63,240 | 3,48,810 | 1,47,194 |

| 54,000 | 13,87,295 | 1,90,155 | 71,777 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 4,22,380 | -2,41,115 | 34,182 |

| 53,500 | 6,40,780 | -1,21,555 | 38,712 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 8,63,240 | 3,48,810 | 1,47,194 |

| 55,000 | 16,08,425 | 1,64,955 | 79,686 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26712.05. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.712 against previous 0.583. The 27000CE option holds the maximum open interest, followed by the 25000PE and 27200CE options. Market participants have shown increased interest with significant open interest additions in the 27200CE option, with open interest additions also seen in the 25000PE and 27500CE options. On the other hand, open interest reductions were prominent in the 26800CE, 26000CE, and 26900CE options. Trading volume was highest in the 27000CE option, followed by the 26400PE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,712.05 | 0.712 | 0.583 | 0.623 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,45,485 | 3,91,820 | 3,53,665 |

| PUT: | 5,30,725 | 2,28,540 | 3,02,185 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,02,960 | 48,685 | 12,626 |

| 27,200 | 88,075 | 88,010 | 1,536 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 88,075 | 88,010 | 1,536 |

| 27,500 | 74,490 | 59,800 | 2,145 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 41,795 | -46,345 | 4,345 |

| 26,000 | 12,610 | -2,145 | 46 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,02,960 | 48,685 | 12,626 |

| 26,800 | 41,795 | -46,345 | 4,345 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 89,245 | 60,515 | 2,525 |

| 26,400 | 56,485 | 39,000 | 4,371 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 89,245 | 60,515 | 2,525 |

| 26,400 | 56,485 | 39,000 | 4,371 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 2,665 | -780 | 89 |

| 23,500 | 910 | -65 | 3 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 56,485 | 39,000 | 4,371 |

| 26,600 | 32,110 | 23,465 | 3,125 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 12944.95. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.393 against previous 1.357. The 12500PE option holds the maximum open interest, followed by the 13500CE and 12600PE options. Market participants have shown increased interest with significant open interest additions in the 12500PE option, with open interest additions also seen in the 12900PE and 12850PE options. On the other hand, open interest reductions were prominent in the 67900CE, 73200PE, and 73200CE options. Trading volume was highest in the 13000CE option, followed by the 12700PE and 12900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,944.95 | 1.393 | 1.357 | 1.256 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 42,24,640 | 40,06,240 | 2,18,400 |

| PUT: | 58,85,600 | 54,34,520 | 4,51,080 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,01,580 | 1,17,600 | 9,290 |

| 13,000 | 4,82,860 | -31,360 | 12,590 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 3,43,560 | 1,22,640 | 6,394 |

| 13,500 | 6,01,580 | 1,17,600 | 9,290 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,33,660 | -97,860 | 6,441 |

| 12,750 | 1,00,520 | -76,440 | 1,001 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,82,860 | -31,360 | 12,590 |

| 12,900 | 1,47,420 | -40,880 | 11,759 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 9,55,220 | 1,73,320 | 8,546 |

| 12,600 | 5,11,560 | 1,04,720 | 5,681 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 9,55,220 | 1,73,320 | 8,546 |

| 12,900 | 1,98,240 | 1,35,380 | 6,855 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,02,180 | -3,44,820 | 8,874 |

| 11,000 | 90,440 | -2,45,000 | 3,794 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 3,76,320 | 6,580 | 12,458 |

| 12,400 | 3,38,940 | 1,10,320 | 9,220 |

Conclusion: What the NSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The setup for 6th October 2025 tells a nuanced story. While Nifty and its monthly contract show steady long build-up, Bank Nifty, Finnifty, and Midcap Nifty reflect that the move is propelled by rally-induced short covering rather than widespread accumulation—at least for now. The marked rise in weekly PCR for both Nifty and Midcap Nifty signals supportive put writing and a positive risk-reward for bulls, though cooling PCR in monthly options tempers runaway excitement.

Finnifty’s and Midcap’s interest remains tactical, driven by shorts being squeezed. For a true, sustainable upside, the Open Interest Volume Analysis suggests traders will need to see fresh long build-up in financials and broader market indices over the next few sessions. Until then, the market finds itself at an inflection point, powered by momentum but still seeking robust confirmation from all corners.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]