Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 14/10/2025

Table of Contents

On 14th October 2025, the combined futures and options landscape signaled an unmistakable shift as Open Interest Volume Analysis revealed aggressive fresh shorting across all major indices. Nifty saw a 3.7% jump in combined futures open interest as prices slipped, indicating that traders are using pullbacks to initiate new short positions rather than defend old longs. This bearish tilt was sharpest in November contracts—where both Nifty and Midcap Nifty recorded nearly double-digit OI increases—all classified as “fresh short” build-ups.

Bank Nifty also reflected heavy unwinding, with OI falling by 4.5% as participants booked profits and retreated from longs, confirming a lack of sectoral leadership for the moment. Finnifty was hit by a stunning surge: its combined OI ballooned by 27.6%—almost exclusively fresh shorts tracking a 0.2% spot decline. In options, the PCR slumped to 0.688 for Nifty weekly expiry, confirming that call writers have strengthened their grip near resistance and that the open interest landscape is leaning hard toward caution.

NSE & BSE F&O Market Signals

NIFTY Future analysis

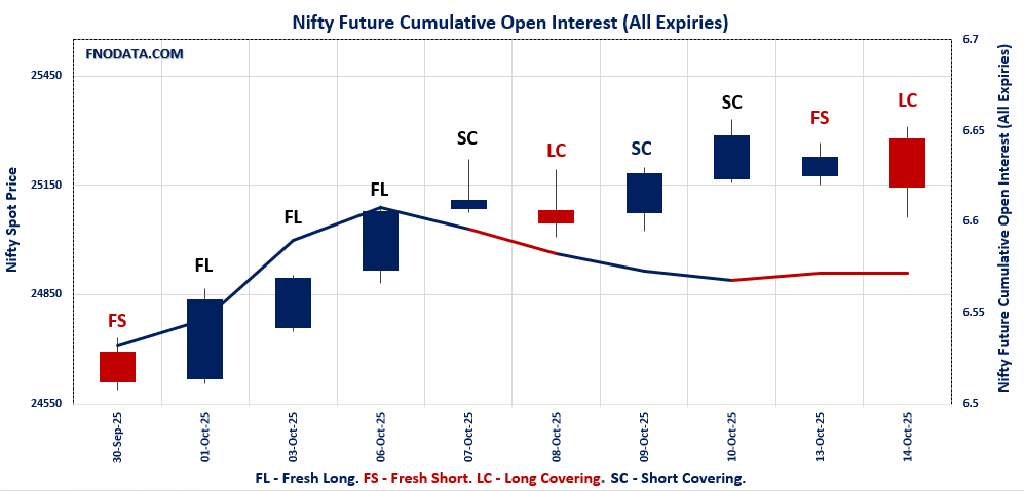

NIFTY Spot closed at: 25145.5 (-0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: 3.7%

Combined Fut Volume Change: 27.6%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 9%

NIFTY OCTOBER Future closed at: 25206 (-0.4%)

October Fut Premium 60.5 (Decreased by -21.45 points)

October Fut Open Interest Change: 3.1%

October Fut Volume Change: 26.9%

October Fut Open Interest Analysis: Fresh Short

NIFTY NOVEMBER Future closed at: 25334.9 (-0.4%)

November Fut Premium 189.4 (Decreased by -29.25 points)

November Fut Open Interest Change: 9.9%

November Fut Volume Change: 35.0%

November Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (20/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.688 (Decreased from 0.881)

Put-Call Ratio (Volume): 0.845

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 26500

Highest PUT Addition: 24000

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.984 (Decreased from 1.007)

Put-Call Ratio (Volume): 0.856

Max Pain Level: 25100

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 25200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 56496.45 (-0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: -4.5%

Combined Fut Volume Change: 36.2%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 13% Previous 12%

BANKNIFTY OCTOBER Future closed at: 56716.4 (-0.2%)

October Fut Premium 219.95 (Decreased by -11.25 points)

October Fut Open Interest Change: -5.1%

October Fut Volume Change: 39.7%

October Fut Open Interest Analysis: Long Covering

BANKNIFTY NOVEMBER Future closed at: 57001.8 (-0.3%)

November Fut Premium 505.35 (Decreased by -21.25 points)

November Fut Open Interest Change: -0.3%

November Fut Volume Change: 15.7%

November Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.959 (Decreased from 1.098)

Put-Call Ratio (Volume): 1.051

Max Pain Level: 56200

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 59500

Highest PUT Addition: 52000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26828.3 (-0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 27.6%

Combined Fut Volume Change: 92.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 6% Previous 6%

FINNIFTY OCTOBER Future closed at: 26925.2 (-0.3%)

October Fut Premium 96.9 (Decreased by -11.25 points)

October Fut Open Interest Change: 27.0%

October Fut Volume Change: 96.7%

October Fut Open Interest Analysis: Fresh Short

FINNIFTY NOVEMBER Future closed at: 27063.5 (-0.3%)

November Fut Premium 235.2 (Decreased by -24.75 points)

November Fut Open Interest Change: 37.5%

November Fut Volume Change: 43.5%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.719 (Increased from 0.707)

Put-Call Ratio (Volume): 0.722

Max Pain Level: 26900

Maximum CALL Open Interest: 27200

Maximum PUT Open Interest: 25700

Highest CALL Addition: 27000

Highest PUT Addition: 27000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13035.1 (-1.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 2.3%

Combined Fut Volume Change: 15.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 4% Previous 4%

MIDCPNIFTY OCTOBER Future closed at: 13074.1 (-1.2%)

October Fut Premium 39 (Decreased by -12.85 points)

October Fut Open Interest Change: 2.1%

October Fut Volume Change: 12.2%

October Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY NOVEMBER Future closed at: 13133.25 (-1.2%)

November Fut Premium 98.15 (Decreased by -5.65 points)

November Fut Open Interest Change: 7.1%

November Fut Volume Change: 76.3%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.053 (Decreased from 1.268)

Put-Call Ratio (Volume): 0.935

Max Pain Level: 13000

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13800

Highest PUT Addition: 11900

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 82,029.98 (-0.36%)

SENSEX Monthly Future closed at: 82,346.45 (-0.41%)

Premium: 316.47 (Decreased by -40.13 points)

Open Interest Change: 2.7%

Volume Change: 38.5%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (16/10/2025) Option Analysis

Put-Call Ratio (OI): 0.694 (Decreased from 1.018)

Put-Call Ratio (Volume): 1.106

Max Pain Level: 82100

Maximum CALL OI: 84000

Maximum PUT OI: 80000

Highest CALL Addition: 84000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,508.53 Cr.

DIIs Net BUY: ₹ 3,661.13 Cr.

FII Derivatives Activity

| FII Trading Stats | 14.10.25 | 13.10.25 | 10.10.25 |

| FII Cash (Provisional Data) | -1,508.53 | -240.1 | 459.2 |

| Index Future Open Interest Long Ratio | 7.16% | 7.31% | 7.53% |

| Index Future Volume Long Ratio | 40.91% | 40.46% | 57.85% |

| Call Option Open Interest Long Ratio | 47.49% | 48.19% | 50.68% |

| Call Option Volume Long Ratio | 50.22% | 49.73% | 50.26% |

| Put Option Open Interest Long Ratio | 70.24% | 64.83% | 62.39% |

| Put Option Volume Long Ratio | 50.04% | 50.19% | 50.13% |

| Stock Future Open Interest Long Ratio | 60.30% | 60.90% | 61.37% |

| Stock Future Volume Long Ratio | 44.29% | 45.74% | 52.11% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Short Covering | Long Covering | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Short Covering | Long Covering | Fresh Long |

| BankNifty Futures | Long Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Options | Fresh Short | Long Covering | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Short | Short Covering |

| MidcpNifty Options | Long Covering | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (16/10/2025)

The SENSEX index closed at 82029.98. The SENSEX weekly expiry for OCTOBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.694 against previous 1.018. The 84000CE option holds the maximum open interest, followed by the 80000PE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 84000CE and 82500CE options. On the other hand, open interest reductions were prominent in the 82200PE, 82300PE, and 75000PE options. Trading volume was highest in the 82000PE option, followed by the 82500CE and 83000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 16-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82029.98 | 0.694 | 1.018 | 1.106 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,70,60,000 | 1,22,62,020 | 1,47,97,980 |

| PUT: | 1,87,66,600 | 1,24,85,100 | 62,81,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 21,66,980 | 13,64,460 | 97,73,680 |

| 85000 | 18,15,140 | 7,39,180 | 86,91,960 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 21,66,980 | 13,64,460 | 97,73,680 |

| 82500 | 17,55,480 | 12,01,820 | 3,00,90,300 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 43,900 | -59,380 | 2,09,260 |

| 86100 | 28,680 | -9,440 | 2,77,540 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 17,55,480 | 12,01,820 | 3,00,90,300 |

| 83000 | 16,08,200 | 9,45,680 | 2,30,03,520 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 19,61,500 | 14,86,600 | 1,10,90,000 |

| 79000 | 14,91,420 | 7,71,320 | 74,67,980 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 19,61,500 | 14,86,600 | 1,10,90,000 |

| 79000 | 14,91,420 | 7,71,320 | 74,67,980 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 3,09,240 | -2,11,000 | 2,10,42,680 |

| 82300 | 1,56,960 | -1,50,260 | 1,53,75,320 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 9,31,780 | -64,540 | 3,85,93,140 |

| 82200 | 3,09,240 | -2,11,000 | 2,10,42,680 |

NIFTY Weekly Expiry (20/10/2025)

The NIFTY index closed at 25145.5. The NIFTY weekly expiry for OCTOBER 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.688 against previous 0.881. The 26000CE option holds the maximum open interest, followed by the 26500CE and 25200CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 25200CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25250PE, 26850CE, and 23050PE options. Trading volume was highest in the 25300CE option, followed by the 25200CE and 25200PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 20-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,145.50 | 0.688 | 0.881 | 0.845 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,77,19,025 | 3,72,64,125 | 5,04,54,900 |

| PUT: | 6,03,65,325 | 3,28,29,000 | 2,75,36,325 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,62,250 | 38,06,700 | 3,33,300 |

| 26,500 | 68,63,925 | 47,36,700 | 2,60,954 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 68,63,925 | 47,36,700 | 2,60,954 |

| 25,200 | 61,77,300 | 39,80,100 | 6,80,035 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,850 | 19,425 | -6,150 | 583 |

| 23,900 | 2,625 | -1,875 | 51 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 57,31,875 | 29,67,525 | 7,28,796 |

| 25,200 | 61,77,300 | 39,80,100 | 6,80,035 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 53,86,800 | 25,44,900 | 2,22,671 |

| 25,000 | 38,48,625 | 13,10,775 | 4,99,407 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 53,86,800 | 25,44,900 | 2,22,671 |

| 25,100 | 28,69,575 | 16,51,125 | 5,07,992 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,250 | 7,19,850 | -1,61,550 | 1,94,551 |

| 23,050 | 12,750 | -4,200 | 969 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 35,16,150 | 9,35,025 | 5,96,059 |

| 25,100 | 28,69,575 | 16,51,125 | 5,07,992 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25145.5. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.984 against previous 1.007. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 25200CE and 25300CE options. On the other hand, open interest reductions were prominent in the 25600CE, 24900PE, and 26300CE options. Trading volume was highest in the 25500CE option, followed by the 25000PE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,145.50 | 0.984 | 1.007 | 0.856 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,17,00,950 | 4,84,40,100 | 32,60,850 |

| PUT: | 5,08,66,725 | 4,87,68,975 | 20,97,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 56,64,225 | 9,13,875 | 1,65,389 |

| 26,000 | 56,35,875 | 375 | 91,841 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 56,64,225 | 9,13,875 | 1,65,389 |

| 25,200 | 33,57,750 | 6,57,900 | 1,34,961 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 18,63,600 | -6,71,325 | 97,695 |

| 26,300 | 7,10,250 | -92,025 | 18,637 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 56,64,225 | 9,13,875 | 1,65,389 |

| 25,200 | 33,57,750 | 6,57,900 | 1,34,961 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 53,33,475 | 65,850 | 1,59,876 |

| 24,000 | 34,54,350 | -61,800 | 61,432 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 29,48,775 | 4,41,000 | 1,22,404 |

| 25,300 | 17,39,175 | 2,38,050 | 79,007 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 17,33,625 | -1,68,075 | 61,455 |

| 26,200 | 1,25,175 | -84,225 | 1,774 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 53,33,475 | 65,850 | 1,59,876 |

| 25,200 | 29,48,775 | 4,41,000 | 1,22,404 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 56496.45. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.959 against previous 1.098. The 57000CE option holds the maximum open interest, followed by the 55000PE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 56500CE and 60500CE options. On the other hand, open interest reductions were prominent in the 54500PE, 54000PE, and 46000PE options. Trading volume was highest in the 56500PE option, followed by the 57000CE and 56500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,496.45 | 0.959 | 1.098 | 1.051 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,87,22,970 | 1,72,94,270 | 14,28,700 |

| PUT: | 1,79,47,055 | 1,89,82,845 | -10,35,790 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,60,260 | 95,585 | 1,60,118 |

| 58,000 | 12,62,380 | 80,395 | 75,933 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 6,68,395 | 2,96,135 | 38,116 |

| 56,500 | 10,07,685 | 2,12,835 | 1,51,138 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 62,500 | 35,385 | -71,085 | 7,744 |

| 58,500 | 7,58,415 | -51,555 | 49,561 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,60,260 | 95,585 | 1,60,118 |

| 56,500 | 10,07,685 | 2,12,835 | 1,51,138 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 15,09,200 | -83,720 | 73,097 |

| 57,000 | 14,43,295 | -61,915 | 62,233 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 6,75,955 | 94,990 | 35,119 |

| 53,000 | 8,89,420 | 72,345 | 41,002 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 11,37,255 | -96,740 | 44,053 |

| 54,000 | 11,45,095 | -92,820 | 41,654 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 6,79,350 | -64,155 | 1,83,204 |

| 56,000 | 12,26,225 | -64,260 | 1,11,197 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26828.3. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.719 against previous 0.707. The 27200CE option holds the maximum open interest, followed by the 27300CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26900CE and 26900CE options. On the other hand, open interest reductions were prominent in the 27300CE, 27500CE, and 26300PE options. Trading volume was highest in the 27000CE option, followed by the 27200CE and 26800PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,828.30 | 0.719 | 0.707 | 0.722 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,86,770 | 11,83,585 | 3,185 |

| PUT: | 8,53,060 | 8,36,225 | 16,835 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 1,57,040 | 5,265 | 3,528 |

| 27,300 | 1,45,990 | -22,100 | 1,770 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,26,360 | 15,015 | 6,788 |

| 26,900 | 64,350 | 5,525 | 2,503 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,45,990 | -22,100 | 1,770 |

| 27,500 | 90,740 | -11,765 | 1,151 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,26,360 | 15,015 | 6,788 |

| 27,200 | 1,57,040 | 5,265 | 3,528 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 81,250 | 1,170 | 199 |

| 26,900 | 77,675 | -2,015 | 2,640 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 57,070 | 5,525 | 2,318 |

| 26,700 | 38,090 | 5,460 | 2,002 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 32,955 | -8,125 | 483 |

| 26,000 | 62,920 | -6,890 | 969 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 41,860 | 3,510 | 2,961 |

| 26,900 | 77,675 | -2,015 | 2,640 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13035.1. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.053 against previous 1.268. The 14000CE option holds the maximum open interest, followed by the 12500PE and 13200CE options. Market participants have shown increased interest with significant open interest additions in the 13800CE option, with open interest additions also seen in the 13200CE and 13100CE options. On the other hand, open interest reductions were prominent in the 68000CE, 68400CE, and 67000PE options. Trading volume was highest in the 13200CE option, followed by the 13000PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,035.10 | 1.053 | 1.268 | 0.935 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 71,66,600 | 61,49,220 | 10,17,380 |

| PUT: | 75,43,200 | 77,98,700 | -2,55,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,97,860 | 86,520 | 4,795 |

| 13,200 | 6,63,040 | 1,64,780 | 21,201 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 2,19,660 | 1,68,000 | 4,298 |

| 13,200 | 6,63,040 | 1,64,780 | 21,201 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 4,46,460 | -97,300 | 13,368 |

| 13,500 | 6,23,980 | -50,120 | 16,691 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,63,040 | 1,64,780 | 21,201 |

| 13,500 | 6,23,980 | -50,120 | 16,691 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 7,32,620 | -11,900 | 4,255 |

| 13,000 | 6,59,960 | -49,840 | 18,323 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,900 | 99,960 | 64,820 | 948 |

| 12,400 | 3,65,120 | 46,900 | 1,945 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 2,52,280 | -1,30,620 | 14,078 |

| 12,700 | 5,81,980 | -93,800 | 6,455 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,59,960 | -49,840 | 18,323 |

| 13,100 | 3,65,120 | 18,480 | 15,909 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

For 14th October 2025, the Open Interest Volume Analysis serves as a cautionary signal for short-term traders and positional investors alike. The steep build-up of fresh shorts in both Nifty and Finnifty, backed by strong call writing in options chains, points to a market expected to correct further unless broader sentiment improves. Bank Nifty and Midcap Nifty, with pronounced long covering and new shorts, signal that even risk-on pockets are being trimmed back, and sector rotation is on pause.

Actionable feedback: If holding long index positions, tighten trailing stops and consider hedging with out-of-the-money puts or by unwinding exposure on sharp bounces—avoid chasing upside until a confirmed reversal in combined OI appears. For aggressive traders, align with the trend: watch for short setups at major resistance points, and track option OI at pivot strikes (such as 25,200 for Nifty and 56,200 for Bank Nifty) for intraday direction. In summary, today’s Open Interest Volume Analysis points to rising caution, building the case for a stealthy correction unless a quick reversal in OI and risk appetite materializes this expiry week.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]