Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 17/10/2025

Table of Contents

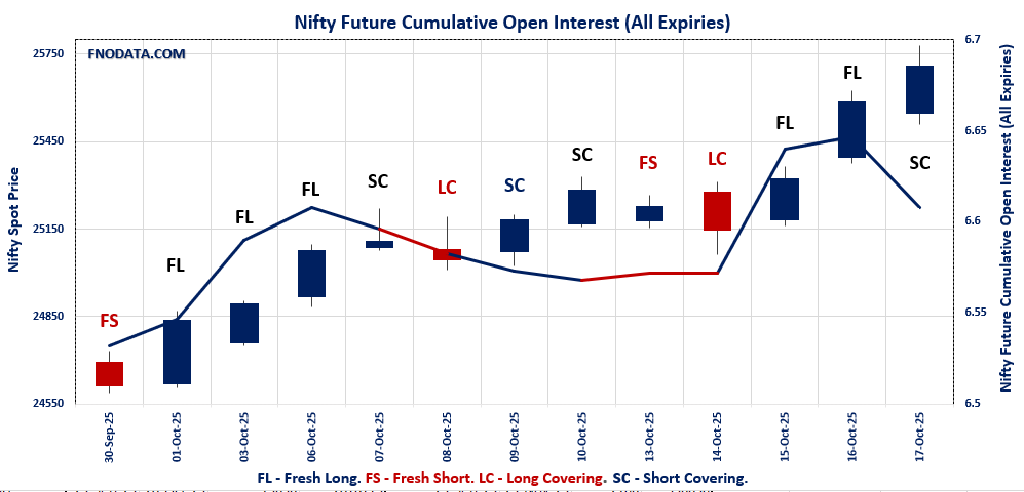

On 17th October 2025, India’s derivative markets showed a mixed but insightful posture through the lens of Open Interest Volume Analysis. Nifty’s combined futures open interest dropped 3.8% even as prices edged 0.5% higher—this is classic short covering, a sign that bears are backing out while bulls quietly reclaim control.

The real strength, though, lies in Nifty’s November contracts, where fresh long build‑up of nearly 8% indicates traders are rolling their optimism into the next series. Bank Nifty echoed this structure, with combined OI down 1.4% but even stronger fresh longs in November (+12.4%), showing that financials continue to shoulder directional support for the market.

Finnifty maintained composure with modest OI unwinding at higher levels, counterbalanced by a 40% long buildup in November contracts—a healthy renewal of buying interest. The broader market was more hesitant: Midcap Nifty saw long liquidation and new shorts emerging, reflecting profit‑taking after recent strength. Overall, today’s Open Interest Volume Analysis presents a market transitioning from defensive short covering to proactive long repositioning for the weeks ahead.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25709.85 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: -3.8%

Combined Fut Volume Change: 22.4%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 15% Previous 13%

NIFTY OCTOBER Future closed at: 25757.8 (0.4%)

October Fut Premium 47.95 (Decreased by -22.85 points)

October Fut Open Interest Change: -5.8%

October Fut Volume Change: 22.6%

October Fut Open Interest Analysis: Short Covering

NIFTY NOVEMBER Future closed at: 25892.4 (0.4%)

November Fut Premium 182.55 (Decreased by -18.55 points)

November Fut Open Interest Change: 7.9%

November Fut Volume Change: 4.7%

November Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (20/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.230 (Decreased from 1.527)

Put-Call Ratio (Volume): 0.775

Max Pain Level: 25650

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26000

Highest PUT Addition: 25700

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.064 (Decreased from 1.085)

Put-Call Ratio (Volume): 0.804

Max Pain Level: 25500

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26500

Highest PUT Addition: 25800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 57713.35 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.4%

Combined Fut Volume Change: 27.0%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 17% Previous 15%

BANKNIFTY OCTOBER Future closed at: 57757.2 (0.5%)

October Fut Premium 43.85 (Decreased by -19.8 points)

October Fut Open Interest Change: -3.8%

October Fut Volume Change: 27.6%

October Fut Open Interest Analysis: Short Covering

BANKNIFTY NOVEMBER Future closed at: 58057.6 (0.5%)

November Fut Premium 344.25 (Decreased by -18 points)

November Fut Open Interest Change: 12.4%

November Fut Volume Change: 36.3%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.168 (Increased from 1.163)

Put-Call Ratio (Volume): 0.712

Max Pain Level: 57000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 62000

Highest PUT Addition: 50000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27538.6 (0.6%)

Combined = October + November + December

Combined Fut Open Interest Change: -0.8%

Combined Fut Volume Change: 38.1%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 6%

FINNIFTY OCTOBER Future closed at: 27559.3 (0.5%)

October Fut Premium 20.7 (Decreased by -7.5 points)

October Fut Open Interest Change: -3.7%

October Fut Volume Change: 48.1%

October Fut Open Interest Analysis: Short Covering

FINNIFTY NOVEMBER Future closed at: 27676.6 (0.5%)

November Fut Premium 138 (Decreased by -7.7 points)

November Fut Open Interest Change: 41.9%

November Fut Volume Change: -6.6%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.233 (Increased from 0.939)

Put-Call Ratio (Volume): 0.816

Max Pain Level: 27200

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26500

Highest CALL Addition: 29500

Highest PUT Addition: 26500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13160.8 (-0.8%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.8%

Combined Fut Volume Change: 18.3%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 5% Previous 4%

MIDCPNIFTY OCTOBER Future closed at: 13189.85 (-1.0%)

October Fut Premium 29.05 (Decreased by -31.9 points)

October Fut Open Interest Change: -2.6%

October Fut Volume Change: 14.5%

October Fut Open Interest Analysis: Long Covering

MIDCPNIFTY NOVEMBER Future closed at: 13248.05 (-0.9%)

November Fut Premium 87.25 (Decreased by -22.25 points)

November Fut Open Interest Change: 16.4%

November Fut Volume Change: 75.5%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.061 (Decreased from 1.350)

Put-Call Ratio (Volume): 0.837

Max Pain Level: 13125

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13250

Highest PUT Addition: 13200

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 83,952.19 (0.58%)

SENSEX Monthly Future closed at: 84,121.55 (0.51%)

Premium: 169.36 (Decreased by -60.33 points)

Open Interest Change: 19.9%

Volume Change: 8.7%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (23/10/2025) Option Analysis

Put-Call Ratio (OI): 1.074 (Decreased from 1.218)

Put-Call Ratio (Volume): 0.780

Max Pain Level: 83400

Maximum CALL OI: 86000

Maximum PUT OI: 80000

Highest CALL Addition: 86500

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 308.98 Cr.

DIIs Net BUY: ₹ 1,526.61 Cr.

FII Derivatives Activity

| FII Trading Stats | 17.10.25 | 16.10.25 | 15.10.25 |

| FII Cash (Provisional Data) | 308.98 | 997.29 | 68.64 |

| Index Future Open Interest Long Ratio | 16.60% | 13.80% | 8.15% |

| Index Future Volume Long Ratio | 69.26% | 73.70% | 59.88% |

| Call Option Open Interest Long Ratio | 53.84% | 54.88% | 49.85% |

| Call Option Volume Long Ratio | 49.96% | 50.74% | 50.31% |

| Put Option Open Interest Long Ratio | 60.79% | 62.57% | 63.64% |

| Put Option Volume Long Ratio | 49.97% | 50.23% | 49.68% |

| Stock Future Open Interest Long Ratio | 60.33% | 60.50% | 60.42% |

| Stock Future Volume Long Ratio | 49.47% | 50.75% | 51.39% |

| Index Futures | Short Covering | Fresh Long | Fresh Long |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Short Covering | Short Covering | Fresh Long |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Long |

| FinNifty Futures | Short Covering | Fresh Long | Short Covering |

| FinNifty Options | Fresh Long | Fresh Long | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Short | Long Covering | Fresh Long |

| Stock Futures | Fresh Short | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (23/10/2025)

The SENSEX index closed at 83952.19. The SENSEX weekly expiry for OCTOBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.074 against previous 1.218. The 80000PE option holds the maximum open interest, followed by the 86000CE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 86500CE and 81500PE options. On the other hand, open interest reductions were prominent in the 83500CE, 83000CE, and 83300CE options. Trading volume was highest in the 84000CE option, followed by the 83500PE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 23-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83952.19 | 1.074 | 1.218 | 0.780 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 97,91,540 | 41,60,580 | 56,30,960 |

| PUT: | 1,05,19,240 | 50,66,400 | 54,52,840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 7,37,200 | 1,91,660 | 1,24,05,880 |

| 85000 | 5,51,120 | 2,39,100 | 1,80,55,500 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86500 | 5,50,680 | 4,20,980 | 76,72,600 |

| 87000 | 5,36,400 | 3,32,920 | 76,87,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 2,00,400 | -72,880 | 1,28,71,280 |

| 83000 | 1,76,660 | -35,740 | 14,20,780 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 5,14,260 | 2,64,940 | 2,73,47,580 |

| 84500 | 4,23,660 | 1,69,860 | 1,81,90,080 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,88,700 | 4,79,500 | 61,71,720 |

| 83000 | 5,34,080 | 31,100 | 1,43,99,600 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,88,700 | 4,79,500 | 61,71,720 |

| 81500 | 5,33,160 | 3,82,260 | 52,25,060 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77500 | 51,160 | -15,860 | 12,67,340 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 4,52,360 | 1,22,320 | 2,01,31,480 |

| 84000 | 4,33,020 | 3,49,140 | 1,78,62,540 |

NIFTY Weekly Expiry (20/10/2025)

The NIFTY index closed at 25709.85. The NIFTY weekly expiry for OCTOBER 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.230 against previous 1.527. The 26000CE option holds the maximum open interest, followed by the 25800CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25700PE and 25900CE options. On the other hand, open interest reductions were prominent in the 24500PE, 25600CE, and 25400PE options. Trading volume was highest in the 25800CE option, followed by the 25700CE and 25600PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 20-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,709.85 | 1.230 | 1.527 | 0.775 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,17,92,675 | 11,69,11,350 | 2,48,81,325 |

| PUT: | 17,43,65,700 | 17,85,57,975 | -41,92,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,67,67,750 | 55,50,150 | 66,49,159 |

| 25,800 | 1,18,80,975 | 28,82,925 | 97,32,256 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,67,67,750 | 55,50,150 | 66,49,159 |

| 25,900 | 1,03,52,625 | 52,41,600 | 63,03,010 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 33,94,650 | -33,80,625 | 51,26,710 |

| 25,550 | 11,29,200 | -17,64,375 | 18,90,067 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,18,80,975 | 28,82,925 | 97,32,256 |

| 25,700 | 65,55,450 | -7,43,250 | 91,67,120 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,16,77,425 | 15,21,225 | 59,35,135 |

| 25,000 | 1,02,37,650 | 12,66,525 | 13,68,472 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 66,21,975 | 53,46,525 | 70,48,306 |

| 25,650 | 46,60,425 | 33,66,075 | 49,13,426 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 76,54,650 | -41,85,750 | 12,44,113 |

| 25,400 | 66,54,525 | -31,93,950 | 32,37,954 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 75,39,450 | 16,30,500 | 72,85,541 |

| 25,700 | 66,21,975 | 53,46,525 | 70,48,306 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25709.85. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.064 against previous 1.085. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 27000CE and 25800PE options. On the other hand, open interest reductions were prominent in the 25400CE, 25500CE, and 25050PE options. Trading volume was highest in the 26000CE option, followed by the 25800CE and 25500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,709.85 | 1.064 | 1.085 | 0.804 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,33,48,275 | 5,88,78,000 | 1,44,70,275 |

| PUT: | 7,80,42,975 | 6,38,56,275 | 1,41,86,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,07,300 | -2,73,000 | 5,70,167 |

| 26,500 | 53,37,225 | 18,51,825 | 2,59,650 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 53,37,225 | 18,51,825 | 2,59,650 |

| 27,000 | 42,12,150 | 17,33,850 | 1,14,056 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 18,16,875 | -6,70,425 | 57,306 |

| 25,500 | 41,92,725 | -3,49,200 | 1,72,692 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,07,300 | -2,73,000 | 5,70,167 |

| 25,800 | 40,94,475 | 7,35,600 | 3,38,338 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 76,87,200 | 9,34,800 | 2,19,462 |

| 25,500 | 56,87,475 | 6,46,350 | 3,27,033 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 21,27,750 | 17,17,350 | 1,76,768 |

| 25,700 | 25,91,775 | 16,25,925 | 2,73,101 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 4,90,875 | -2,79,450 | 36,602 |

| 24,750 | 4,61,925 | -1,51,425 | 26,877 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 56,87,475 | 6,46,350 | 3,27,033 |

| 25,700 | 25,91,775 | 16,25,925 | 2,73,101 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 57713.35. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.168 against previous 1.163. The 57000PE option holds the maximum open interest, followed by the 57000CE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 62000CE option, with open interest additions also seen in the 60500CE and 50000PE options. On the other hand, open interest reductions were prominent in the 61000CE, 57000CE, and 51000PE options. Trading volume was highest in the 57500CE option, followed by the 58000CE and 57500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,713.35 | 1.168 | 1.163 | 0.712 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,84,53,785 | 1,77,12,975 | 7,40,810 |

| PUT: | 2,15,57,375 | 2,05,96,695 | 9,60,680 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 19,62,905 | -1,11,125 | 79,145 |

| 58,000 | 13,34,585 | 1,41,365 | 3,02,832 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 3,62,390 | 2,24,980 | 44,145 |

| 60,500 | 6,10,645 | 2,10,280 | 75,631 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 3,64,140 | -1,20,960 | 72,780 |

| 57,000 | 19,62,905 | -1,11,125 | 79,145 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 8,25,615 | -35,490 | 3,25,704 |

| 58,000 | 13,34,585 | 1,41,365 | 3,02,832 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,01,775 | 1,68,560 | 1,97,818 |

| 55,000 | 16,17,105 | 93,765 | 89,930 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 4,78,100 | 1,86,830 | 27,786 |

| 57,000 | 23,01,775 | 1,68,560 | 1,97,818 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 1,71,465 | -98,140 | 19,993 |

| 55,100 | 1,93,480 | -72,870 | 10,276 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 6,44,315 | 1,45,495 | 2,41,576 |

| 57,000 | 23,01,775 | 1,68,560 | 1,97,818 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 27538.6. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.233 against previous 0.939. The 26500PE option holds the maximum open interest, followed by the 27200PE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 26500PE option, with open interest additions also seen in the 27100PE and 27200PE options. On the other hand, open interest reductions were prominent in the 27600CE, 27800CE, and 27000CE options. Trading volume was highest in the 27500CE option, followed by the 28000CE and 27600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,538.60 | 1.233 | 0.939 | 0.816 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,32,980 | 10,33,890 | -910 |

| PUT: | 12,74,130 | 9,71,035 | 3,03,095 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 93,145 | -15,405 | 9,691 |

| 28,000 | 80,145 | 31,460 | 9,455 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 44,915 | 32,240 | 1,316 |

| 28,000 | 80,145 | 31,460 | 9,455 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 47,385 | -63,180 | 6,591 |

| 27,800 | 54,145 | -33,345 | 6,333 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 93,145 | -15,405 | 9,691 |

| 28,000 | 80,145 | 31,460 | 9,455 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,31,690 | 66,755 | 2,239 |

| 27,200 | 1,07,380 | 56,225 | 4,060 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,31,690 | 66,755 | 2,239 |

| 27,100 | 89,505 | 59,280 | 2,943 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 76,310 | -24,570 | 1,461 |

| 26,200 | 12,610 | -15,275 | 802 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 53,105 | 20,150 | 6,554 |

| 27,400 | 37,440 | 13,325 | 6,343 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13160.8. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.061 against previous 1.350. The 12500PE option holds the maximum open interest, followed by the 13000PE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13250CE option, with open interest additions also seen in the 13200CE and 13800CE options. On the other hand, open interest reductions were prominent in the 68400CE, 67500PE, and 68700PE options. Trading volume was highest in the 13500CE option, followed by the 13200PE and 13300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,160.80 | 1.061 | 1.350 | 0.837 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 83,26,500 | 69,77,740 | 13,48,760 |

| PUT: | 88,30,780 | 94,22,140 | -5,91,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,30,900 | 60,900 | 10,797 |

| 13,500 | 8,21,800 | 28,700 | 43,874 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,250 | 4,04,880 | 2,81,400 | 21,833 |

| 13,200 | 7,35,140 | 2,25,260 | 34,917 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,55,960 | -88,480 | 1,522 |

| 13,575 | 1,08,220 | -40,600 | 2,639 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 8,21,800 | 28,700 | 43,874 |

| 13,300 | 5,30,600 | 99,680 | 41,293 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 11,28,120 | -280 | 12,394 |

| 13,000 | 8,65,340 | -1,84,800 | 26,177 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,71,160 | 1,64,360 | 42,942 |

| 13,150 | 2,77,200 | 1,54,280 | 11,179 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,22,740 | -2,30,580 | 18,952 |

| 13,000 | 8,65,340 | -1,84,800 | 26,177 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,71,160 | 1,64,360 | 42,942 |

| 13,000 | 8,65,340 | -1,84,800 | 26,177 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The combined data on 17th October 2025 clearly reveals that the tide is gradually turning in favor of the bulls. Heavy short covering in the front‑month contracts and concurrent long additions in November signify renewed confidence under the surface. Nifty’s open interest liquidation with a price rise adds conviction that shorts are being forced out, while incremental longs in November suggest follow‑through buying might keep momentum alive into the coming week.

Bank Nifty continues to outperform, and its dense put writing near 57,000 adds a safety cushion. On the other hand, midcaps are showing fatigue—long liquidation paired with fresh shorts implies the broader market could consolidate before joining the rally.

Actionable feedback: Positionally, traders can look for opportunities to enter new longs on dips near support zones (Nifty 25,600–25,700; Bank Nifty 57,000–57,200) but must trail stops tightly due to high rollover and expiry volatility ahead. In sum, the current Open Interest Volume Analysis signals that the market’s bullish engine is revving again, yet it demands discipline—ride the emerging trend, but stay alert to quick reversals driven by end‑of‑series adjustments.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]