Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 24/10/2025

Table of Contents

Friday’s Open Interest Volume Analysis reveals a cooling-off phase across major indices as traders rolled their positions ahead of monthly expiry. Combined open interest data showed visible long covering in NIFTY, BANKNIFTY, and MIDCPNIFTY, marking a pause in bullish momentum built earlier in the week. Despite rising rollover percentages—an indication that positions are actively shifting into the next series—the tone has turned cautious.

The market seems to be moving from a “buy-the-dip” mentality toward preserving gains as short-term directional clarity fades. Notably, FINNIFTY’s marginal increase in combined OI with fresh shorts suggests that sector-specific pressure, likely from financial midcaps, is contributing to broader fatigue. Overall, the Open Interest Volume Analysis indicates that traders are lightening up ahead of expiry, preferring to stay nimble until the next trend emerges post-rollover.

NSE & BSE F&O Market Signals

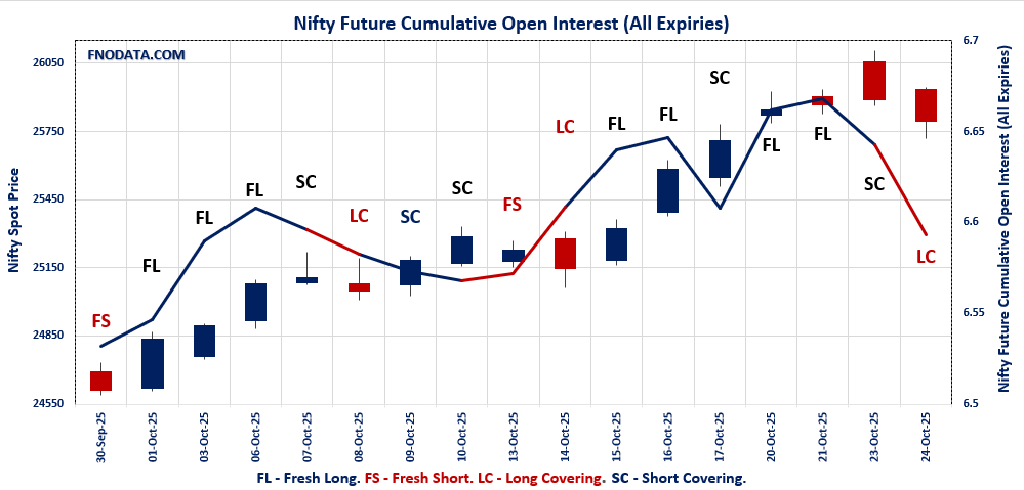

NIFTY Future analysis

NIFTY Spot closed at: 25795.15 (-0.4%)

Combined = October + November + December

Combined Fut Open Interest Change: -5.0%

Combined Fut Volume Change: -8.8%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 33% Previous 22%

NIFTY OCTOBER Future closed at: 25814.8 (-0.6%)

October Fut Premium 19.65 (Decreased by -65.85 points)

October Fut Open Interest Change: -18.3%

October Fut Volume Change: -17.9%

October Fut Open Interest Analysis: Long Covering

NIFTY NOVEMBER Future closed at: 25952 (-0.6%)

November Fut Premium 156.85 (Decreased by -61.45 points)

November Fut Open Interest Change: 46.6%

November Fut Volume Change: 20.2%

November Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.657 (Decreased from 0.859)

Put-Call Ratio (Volume): 1.094

Max Pain Level: 25800

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26000

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 57699.6 (-0.7%)

Combined = October + November + December

Combined Fut Open Interest Change: -0.5%

Combined Fut Volume Change: 2.0%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 43% Previous 33%

BANKNIFTY OCTOBER Future closed at: 57703.2 (-0.7%)

October Fut Premium 3.6 (Decreased by -8.95 points)

October Fut Open Interest Change: -15.2%

October Fut Volume Change: -1.6%

October Fut Open Interest Analysis: Long Covering

BANKNIFTY NOVEMBER Future closed at: 58000.8 (-0.6%)

November Fut Premium 301.2 (Increased by 8.05 points)

November Fut Open Interest Change: 37.1%

November Fut Volume Change: 7.9%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.836 (Decreased from 1.105)

Put-Call Ratio (Volume): 1.033

Max Pain Level: 57400

Maximum CALL Open Interest: 58000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 59500

Highest PUT Addition: 56000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27395.3 (-0.6%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.9%

Combined Fut Volume Change: 5.2%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 19% Previous 15%

FINNIFTY OCTOBER Future closed at: 27400.6 (-0.7%)

October Fut Premium 5.3 (Decreased by -25.25 points)

October Fut Open Interest Change: -4.6%

October Fut Volume Change: -11.8%

October Fut Open Interest Analysis: Long Covering

FINNIFTY NOVEMBER Future closed at: 27528.4 (-0.6%)

November Fut Premium 133.1 (Increased by 4.85 points)

November Fut Open Interest Change: 33.3%

November Fut Volume Change: 64.7%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.029 (Decreased from 1.387)

Put-Call Ratio (Volume): 1.013

Max Pain Level: 27300

Maximum CALL Open Interest: 27600

Maximum PUT Open Interest: 26500

Highest CALL Addition: 27600

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13164.85 (-0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: -5.5%

Combined Fut Volume Change: 57.5%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 46% Previous 16%

MIDCPNIFTY OCTOBER Future closed at: 13168.35 (-0.4%)

October Fut Premium 3.5 (Decreased by -18.4 points)

October Fut Open Interest Change: -39.6%

October Fut Volume Change: 37.5%

October Fut Open Interest Analysis: Long Covering

MIDCPNIFTY NOVEMBER Future closed at: 13223.45 (-0.4%)

November Fut Premium 58.6 (Decreased by -16.35 points)

November Fut Open Interest Change: 175.2%

November Fut Volume Change: 107.6%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.874 (Decreased from 0.995)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 13200

Maximum CALL Open Interest: 13300

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13200

Highest PUT Addition: 13000

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 84,211.88 (-0.41%)

SENSEX Monthly Future closed at: 84,283.75 (-0.67%)

Premium: 71.87 (Decreased by -227.73 points)

Open Interest Change: -21.3%

Volume Change: -58.3%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (30/10/2025) Option Analysis

Put-Call Ratio (OI): 0.548 (Decreased from 0.723)

Put-Call Ratio (Volume): 1.172

Max Pain Level: 84300

Maximum CALL OI: 88000

Maximum PUT OI: 80000

Highest CALL Addition: 88000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 621.51 Cr.

DIIs Net BUY: ₹ 173.13 Cr.

FII Derivatives Activity

| FII Trading Stats | 24.10.25 | 23.10.25 | 20.10.25 |

| FII Cash (Provisional Data) | 621.51 | -1,165.94 | 790.45 |

| Index Future Open Interest Long Ratio | 24.84% | 23.87% | 18.65% |

| Index Future Volume Long Ratio | 53.54% | 63.57% | 56.53% |

| Call Option Open Interest Long Ratio | 51.91% | 53.24% | 53.03% |

| Call Option Volume Long Ratio | 49.91% | 50.23% | 49.99% |

| Put Option Open Interest Long Ratio | 60.69% | 61.32% | 64.43% |

| Put Option Volume Long Ratio | 50.03% | 50.06% | 50.07% |

| Stock Future Open Interest Long Ratio | 61.48% | 61.63% | 60.58% |

| Stock Future Volume Long Ratio | 49.81% | 51.54% | 53.04% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Short | Fresh Long | Short Covering |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Fresh Long | Fresh Long | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Long Covering |

| FinNifty Futures | Fresh Short | Fresh Long | Short Covering |

| FinNifty Options | Fresh Short | Short Covering | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Long | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Short Covering |

| Stock Futures | Long Covering | Fresh Long | Short Covering |

| Stock Options | Short Covering | Fresh Long | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (30/10/2025)

The SENSEX index closed at 84211.88. The SENSEX weekly expiry for OCTOBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.548 against previous 0.723. The 88000CE option holds the maximum open interest, followed by the 85000CE and 87500CE options. Market participants have shown increased interest with significant open interest additions in the 88000CE option, with open interest additions also seen in the 84500CE and 80000PE options. On the other hand, open interest reductions were prominent in the 85000PE, 84900PE, and 84800PE options. Trading volume was highest in the 84000PE option, followed by the 84500PE and 84300PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 30-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84211.88 | 0.548 | 0.723 | 1.172 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,12,67,900 | 44,97,080 | 67,70,820 |

| PUT: | 61,72,220 | 32,50,380 | 29,21,840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 9,21,420 | 5,97,140 | 46,17,260 |

| 85000 | 7,03,460 | 2,52,980 | 1,31,11,840 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 9,21,420 | 5,97,140 | 46,17,260 |

| 84500 | 5,70,720 | 4,26,080 | 1,61,19,180 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83200 | 4,240 | -2,460 | 8,420 |

| 82500 | 65,120 | -1,180 | 7,320 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 5,70,720 | 4,26,080 | 1,61,19,180 |

| 85000 | 7,03,460 | 2,52,980 | 1,31,11,840 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,48,540 | 3,20,740 | 38,32,020 |

| 84000 | 3,39,640 | 1,17,000 | 2,02,46,040 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,48,540 | 3,20,740 | 38,32,020 |

| 84100 | 1,77,140 | 1,40,760 | 1,03,60,060 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 2,65,720 | -56,300 | 28,79,260 |

| 84900 | 27,380 | -37,740 | 12,13,060 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,39,640 | 1,17,000 | 2,02,46,040 |

| 84500 | 2,45,720 | 58,020 | 1,81,86,800 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25795.15. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.657 against previous 0.859. The 26500CE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25900CE and 25800CE options. On the other hand, open interest reductions were prominent in the 25000PE, 26000PE, and 25900PE options. Trading volume was highest in the 25800PE option, followed by the 25900CE and 25700PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,795.15 | 0.657 | 0.859 | 1.094 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 25,63,39,650 | 19,01,15,700 | 6,62,23,950 |

| PUT: | 16,84,02,300 | 16,32,25,125 | 51,77,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 2,02,71,975 | 55,70,625 | 16,55,791 |

| 27,000 | 1,86,55,125 | 19,31,250 | 12,28,798 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,78,44,600 | 63,91,875 | 57,98,524 |

| 25,900 | 1,10,78,025 | 60,40,650 | 59,98,013 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 24,07,800 | -7,98,750 | 1,37,833 |

| 25,000 | 21,47,625 | -3,69,150 | 13,668 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,10,78,025 | 60,40,650 | 59,98,013 |

| 26,000 | 1,78,44,600 | 63,91,875 | 57,98,524 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,28,01,225 | 24,81,900 | 29,15,816 |

| 25,000 | 1,08,54,900 | -44,20,950 | 11,24,959 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 97,51,650 | 28,59,000 | 58,59,914 |

| 25,500 | 1,28,01,225 | 24,81,900 | 29,15,816 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,08,54,900 | -44,20,950 | 11,24,959 |

| 26,000 | 40,02,000 | -28,81,650 | 21,07,749 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 73,07,625 | 8,58,600 | 91,24,604 |

| 25,700 | 97,51,650 | 28,59,000 | 58,59,914 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 57699.6. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.836 against previous 1.105. The 58000CE option holds the maximum open interest, followed by the 56000PE and 58500CE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 58000CE and 59000CE options. On the other hand, open interest reductions were prominent in the 57000PE, 57000CE, and 58000PE options. Trading volume was highest in the 58000CE option, followed by the 57500PE and 58000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,699.60 | 0.836 | 1.105 | 1.033 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,52,12,390 | 2,06,06,355 | 46,06,035 |

| PUT: | 2,10,87,815 | 2,27,63,405 | -16,75,590 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 16,81,085 | 3,99,630 | 8,20,639 |

| 58,500 | 16,45,595 | 3,54,445 | 4,64,552 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,14,730 | 7,42,560 | 2,23,662 |

| 58,000 | 16,81,085 | 3,99,630 | 8,20,639 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 8,71,815 | -3,66,240 | 52,928 |

| 58,800 | 4,11,985 | -1,13,260 | 1,23,556 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 16,81,085 | 3,99,630 | 8,20,639 |

| 58,500 | 16,45,595 | 3,54,445 | 4,64,552 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,62,745 | 2,15,810 | 1,89,401 |

| 57,000 | 15,70,345 | -3,95,045 | 5,05,878 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,62,745 | 2,15,810 | 1,89,401 |

| 52,000 | 5,64,095 | 1,71,675 | 31,568 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 15,70,345 | -3,95,045 | 5,05,878 |

| 58,000 | 7,48,195 | -2,73,910 | 6,45,489 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 9,81,575 | 65,660 | 6,87,271 |

| 58,000 | 7,48,195 | -2,73,910 | 6,45,489 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 27395.3. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.029 against previous 1.387. The 26500PE option holds the maximum open interest, followed by the 27600CE and 27700CE options. Market participants have shown increased interest with significant open interest additions in the 27600CE option, with open interest additions also seen in the 27800CE and 28000CE options. On the other hand, open interest reductions were prominent in the 26500PE, 27300PE, and 27000PE options. Trading volume was highest in the 27600CE option, followed by the 27500PE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,395.30 | 1.029 | 1.387 | 1.013 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,67,320 | 14,58,860 | 4,08,460 |

| PUT: | 19,21,205 | 20,23,450 | -1,02,245 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 1,58,665 | 1,02,570 | 54,319 |

| 27,700 | 1,58,470 | 17,810 | 22,050 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 1,58,665 | 1,02,570 | 54,319 |

| 27,800 | 99,515 | 56,940 | 10,971 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,100 | 64,545 | -13,260 | 4,500 |

| 28,300 | 48,035 | -10,855 | 4,767 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 1,58,665 | 1,02,570 | 54,319 |

| 27,500 | 1,06,405 | 1,625 | 28,783 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,96,495 | -60,190 | 11,952 |

| 27,200 | 1,02,765 | -9,750 | 14,355 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 91,000 | 20,670 | 3,061 |

| 26,300 | 59,735 | 19,370 | 2,382 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,96,495 | -60,190 | 11,952 |

| 27,300 | 78,390 | -50,440 | 22,739 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 81,900 | 3,055 | 31,355 |

| 27,400 | 32,110 | -31,720 | 25,175 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13164.85. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.874 against previous 0.995. The 13300CE option holds the maximum open interest, followed by the 13000PE and 13200CE options. Market participants have shown increased interest with significant open interest additions in the 13200CE option, with open interest additions also seen in the 13300CE and 13000PE options. On the other hand, open interest reductions were prominent in the 68500CE, 69000CE, and 69000CE options. Trading volume was highest in the 13200PE option, followed by the 13200CE and 13300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,164.85 | 0.874 | 0.995 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,31,05,120 | 1,06,31,320 | 24,73,800 |

| PUT: | 1,14,47,940 | 1,05,82,460 | 8,65,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 22,70,520 | 7,28,840 | 1,42,869 |

| 13,200 | 14,86,660 | 7,86,520 | 1,47,387 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 14,86,660 | 7,86,520 | 1,47,387 |

| 13,300 | 22,70,520 | 7,28,840 | 1,42,869 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 2,52,840 | -2,43,600 | 21,634 |

| 13,800 | 4,88,460 | -1,48,400 | 17,295 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 14,86,660 | 7,86,520 | 1,47,387 |

| 13,300 | 22,70,520 | 7,28,840 | 1,42,869 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 16,70,900 | 5,75,820 | 1,40,968 |

| 12,800 | 8,31,460 | 1,34,680 | 31,307 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 16,70,900 | 5,75,820 | 1,40,968 |

| 12,950 | 2,97,920 | 2,08,180 | 24,861 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,95,800 | -1,93,760 | 1,50,034 |

| 12,600 | 6,79,980 | -1,27,120 | 14,337 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,95,800 | -1,93,760 | 1,50,034 |

| 13,000 | 16,70,900 | 5,75,820 | 1,40,968 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

From a derivative strategist’s standpoint, today’s Open Interest Volume Analysis underscores a subtle shift in control from buyers to sellers as long positions were unwound across the board. The fall in combined OI confirms a de-leveraging phase rather than an outright bearish reversal—classic expiry-week dynamics when traders prefer rolling rather than re-building exposure.

With put-call ratios weakening sharply across NIFTY and BANKNIFTY, the setup suggests a consolidation zone forming around the current max pain areas (25800 for NIFTY and 57400 for BANKNIFTY).

The actionable takeaway is simple: avoid aggressive longs till combined open interest stabilizes and fresh build-up emerges in the November contracts. For now, this Open Interest Volume Analysis points toward a transition period in the market—less about chasing momentum and more about waiting for conviction trades to resurface next week.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]