Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 28/10/2025

Table of Contents

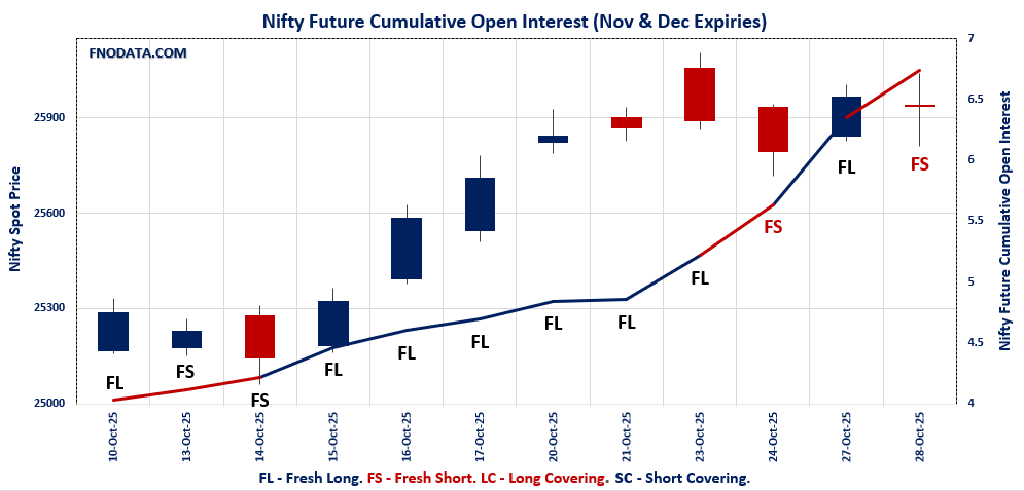

NIFTY and FINNIFTY saw a sharp jump in combined open interest and volume, but this came with fresh short positions instead of long buildup.

Both November and December NIFTY Futures posted key open interest gains, confirming that sellers are actively betting against further upside rather than covering shorts.

Option data for NIFTY reflected bearish undertones: Put-Call Ratios dipped for both weekly and monthly series, and maximum call open interest clustered far above spot levels.

BANKNIFTY was the exception, with combined open interest rising alongside long additions in both November and December contracts, suggesting aggressive buyers are backing the next rally.

MIDCPNIFTY also logged fresh long build-up, signaling selective midcap strength in an otherwise choppy index landscape.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25936.2 (-0.1%)

Combined = November + December

Combined Fut Open Interest Change: 39.3%

Combined Fut Volume Change: 33.2%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 6% Previous 7%

NIFTY NOVEMBER Future closed at: 26090.1 (-0.3%)

November Fut Premium 153.9 (Decreased by -48.45 points)

November Fut Open Interest Change: 41.5%

November Fut Volume Change: 34.0%

November Fut Open Interest Analysis: Fresh Short

NIFTY DECEMBER Future closed at: 26265.2 (-0.3%)

December Fut Premium 329 (Decreased by -52.25 points)

December Fut Open Interest Change: 11.2%

December Fut Volume Change: 18.2%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (4/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.782 (Decreased from 0.783)

Put-Call Ratio (Volume): 0.874

Max Pain Level: 25950

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 27000

Highest PUT Addition: 25400

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.203 (Decreased from 1.305)

Put-Call Ratio (Volume): 0.898

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58214.1 (0.2%)

Combined = November + December

Combined Fut Open Interest Change: 29.0%

Combined Fut Volume Change: 57.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 7% Previous 9%

BANKNIFTY NOVEMBER Future closed at: 58518.6 (0.0%)

November Fut Premium 304.5 (Decreased by -82.85 points)

November Fut Open Interest Change: 30.7%

November Fut Volume Change: 55.8%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY DECEMBER Future closed at: 58834.2 (0.0%)

December Fut Premium 620.1 (Decreased by -75.85 points)

December Fut Open Interest Change: 11.3%

December Fut Volume Change: 82.4%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.975 (Decreased from 1.099)

Put-Call Ratio (Volume): 0.896

Max Pain Level: 58000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 62000

Highest PUT Addition: 58000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27453.95 (-0.2%)

Combined = November + December

Combined Fut Open Interest Change: 93.6%

Combined Fut Volume Change: 58.9%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 0% Previous 0%

FINNIFTY NOVEMBER Future closed at: 27577.8 (-0.4%)

November Fut Premium 123.85 (Decreased by -35.15 points)

November Fut Open Interest Change: 93.6%

November Fut Volume Change: 58.9%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY DECEMBER Future closed at: 27727.8 (-0.3%)

December Fut Premium 273.85 (Decreased by -4.95 points)

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.764 (Decreased from 1.226)

Put-Call Ratio (Volume): 0.849

Max Pain Level: 27500

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27500

Highest PUT Addition: 27500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13366.2 (0.2%)

Combined = November + December

Combined Fut Open Interest Change: 11.7%

Combined Fut Volume Change: -9.6%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 2% Previous 2%

MIDCPNIFTY NOVEMBER Future closed at: 13436.45 (0.2%)

November Fut Premium 70.25 (Decreased by -0.2 points)

November Fut Open Interest Change: 11.8%

November Fut Volume Change: -8.9%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY DECEMBER Future closed at: 13500 (0.2%)

December Fut Premium 133.8 (Increased by 5 points)

December Fut Open Interest Change: 4.6%

December Fut Volume Change: -33.7%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.984 (Decreased from 1.079)

Put-Call Ratio (Volume): 0.909

Max Pain Level: 13300

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13300

Highest CALL Addition: 13400

Highest PUT Addition: 13400

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 84,628.16 (-0.18%)

SENSEX Monthly Future closed at: 84,737.30 (-0.29%)

Premium: 109.14 (Decreased by -92.52 points)

Open Interest Change: -0.3%

Volume Change: -15.0%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (30/10/2025) Option Analysis

Put-Call Ratio (OI): 0.739 (Decreased from 1.088)

Put-Call Ratio (Volume): 0.973

Max Pain Level: 84500

Maximum CALL OI: 85000

Maximum PUT OI: 82000

Highest CALL Addition: 85000

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 10,339.80 Cr.

DIIs Net BUY: ₹ 1,081.55 Cr.

FII Derivatives Activity

| FII Trading Stats | 28.10.25 | 27.10.25 | 24.10.25 |

| FII Cash (Provisional Data) | 10,339.80 | -55.58 | 621.51 |

| Index Future Open Interest Long Ratio | 19.51% | 25.69% | 24.84% |

| Index Future Volume Long Ratio | 43.31% | 49.53% | 53.54% |

| Call Option Open Interest Long Ratio | 48.73% | 52.03% | 51.91% |

| Call Option Volume Long Ratio | 50.16% | 49.98% | 49.91% |

| Put Option Open Interest Long Ratio | 65.28% | 58.78% | 60.69% |

| Put Option Volume Long Ratio | 50.16% | 49.86% | 50.03% |

| Stock Future Open Interest Long Ratio | 61.43% | 61.98% | 61.48% |

| Stock Future Volume Long Ratio | 50.65% | 50.93% | 49.81% |

| Index Futures | Long Covering | Fresh Short | Short Covering |

| Index Options | Short Covering | Long Covering | Fresh Short |

| Nifty Futures | Long Covering | Fresh Short | Short Covering |

| Nifty Options | Short Covering | Long Covering | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Short | Fresh Long |

| BankNifty Options | Long Covering | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Short |

| FinNifty Options | Long Covering | Short Covering | Fresh Short |

| MidcpNifty Futures | Long Covering | Fresh Short | Short Covering |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Short Covering |

| NiftyNxt50 Options | Short Covering | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Fresh Long | Long Covering |

| Stock Options | Long Covering | Long Covering | Short Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (30/10/2025)

The SENSEX index closed at 84628.16. The SENSEX weekly expiry for OCTOBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.739 against previous 1.088. The 85000CE option holds the maximum open interest, followed by the 88000CE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 86500CE and 88000CE options. On the other hand, open interest reductions were prominent in the 84800PE, 87200CE, and 78000PE options. Trading volume was highest in the 84500PE option, followed by the 85000CE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 30-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84628.16 | 0.739 | 1.088 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,15,19,760 | 1,02,84,780 | 1,12,34,980 |

| PUT: | 1,59,10,480 | 1,11,94,320 | 47,16,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 14,86,560 | 7,63,320 | 2,42,13,180 |

| 88000 | 13,52,600 | 7,30,580 | 73,55,280 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 14,86,560 | 7,63,320 | 2,42,13,180 |

| 86500 | 10,99,240 | 7,42,840 | 79,95,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 87200 | 1,82,440 | -86,660 | 18,23,500 |

| 87600 | 1,19,720 | -45,360 | 10,47,280 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 14,86,560 | 7,63,320 | 2,42,13,180 |

| 84500 | 8,02,400 | 5,14,020 | 1,66,16,280 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 9,55,940 | 2,96,100 | 64,75,820 |

| 84500 | 9,24,520 | 3,00,460 | 2,62,94,980 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 6,93,220 | 4,18,920 | 44,51,660 |

| 83800 | 5,58,160 | 3,87,840 | 59,54,080 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84800 | 1,94,720 | -1,26,320 | 1,05,06,340 |

| 78000 | 1,02,000 | -48,420 | 5,52,660 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 9,24,520 | 3,00,460 | 2,62,94,980 |

| 84400 | 3,78,700 | 1,02,520 | 1,60,86,680 |

NIFTY Weekly Expiry (4/11/2025)

The NIFTY index closed at 25936.2. The NIFTY weekly expiry for NOVEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.782 against previous 0.783. The 27000CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000CE and 25400PE options. On the other hand, open interest reductions were prominent in the 26400PE, 26250PE, and 25350CE options. Trading volume was highest in the 26000CE option, followed by the 25900PE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 04-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,936.20 | 0.782 | 0.783 | 0.874 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,74,45,200 | 4,04,05,650 | 4,70,39,550 |

| PUT: | 6,83,83,875 | 3,16,33,350 | 3,67,50,525 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 84,22,425 | 54,45,675 | 2,89,485 |

| 26,000 | 68,74,050 | 42,75,600 | 7,09,253 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 84,22,425 | 54,45,675 | 2,89,485 |

| 26,000 | 68,74,050 | 42,75,600 | 7,09,253 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,350 | 21,600 | -975 | 269 |

| 24,550 | 300 | – | 4 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 68,74,050 | 42,75,600 | 7,09,253 |

| 26,200 | 49,12,425 | 23,89,500 | 4,34,306 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,61,000 | 26,93,700 | 2,92,932 |

| 25,000 | 46,13,325 | 21,27,975 | 1,67,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 43,71,525 | 30,57,150 | 2,09,887 |

| 24,000 | 44,46,300 | 29,70,675 | 1,69,479 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 1,24,950 | -4,425 | 4,685 |

| 26,250 | 80,025 | -1,800 | 6,319 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 27,47,625 | 13,32,750 | 5,32,639 |

| 26,000 | 45,82,050 | 23,85,975 | 4,98,439 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25936.2. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.203 against previous 1.305. The 25000PE option holds the maximum open interest, followed by the 26000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26000PE and 26700CE options. On the other hand, open interest reductions were prominent in the 26900CE, 27100CE, and 24500PE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 27000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,936.20 | 1.203 | 1.305 | 0.898 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,97,67,500 | 2,43,10,575 | 54,56,925 |

| PUT: | 3,58,02,600 | 3,17,13,300 | 40,89,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 36,79,350 | 9,68,100 | 1,15,632 |

| 27,000 | 31,58,025 | -12,300 | 71,339 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 36,79,350 | 9,68,100 | 1,15,632 |

| 26,700 | 13,18,650 | 6,53,775 | 30,986 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 4,41,150 | -1,54,650 | 14,962 |

| 27,100 | 2,85,900 | -58,200 | 13,087 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 36,79,350 | 9,68,100 | 1,15,632 |

| 27,000 | 31,58,025 | -12,300 | 71,339 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 43,96,650 | 1,77,975 | 43,858 |

| 26,000 | 35,06,775 | 7,36,050 | 1,05,066 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 35,06,775 | 7,36,050 | 1,05,066 |

| 25,500 | 33,90,375 | 2,88,675 | 49,817 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 13,88,775 | -42,075 | 20,012 |

| 23,500 | 7,07,625 | -14,325 | 6,911 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 35,06,775 | 7,36,050 | 1,05,066 |

| 25,500 | 33,90,375 | 2,88,675 | 49,817 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58214.1. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.975 against previous 1.099. The 58000PE option holds the maximum open interest, followed by the 57000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 58000PE option, with open interest additions also seen in the 62000CE and 58500CE options. On the other hand, open interest reductions were prominent in the 57000PE, 57000CE, and 55500PE options. Trading volume was highest in the 58000PE option, followed by the 58000CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,214.10 | 0.975 | 1.099 | 0.896 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 85,48,470 | 62,98,565 | 22,49,905 |

| PUT: | 83,31,960 | 69,19,605 | 14,12,355 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,92,105 | -9,485 | 9,851 |

| 58,000 | 8,61,735 | 1,32,580 | 81,512 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,000 | 5,01,480 | 2,43,460 | 28,638 |

| 58,500 | 6,50,825 | 2,36,495 | 59,102 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,92,105 | -9,485 | 9,851 |

| 57,300 | 6,230 | -840 | 287 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 8,61,735 | 1,32,580 | 81,512 |

| 60,000 | 7,45,885 | 1,76,085 | 66,368 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 14,99,715 | 5,85,235 | 1,04,474 |

| 57,000 | 11,41,840 | -4,73,550 | 55,696 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 14,99,715 | 5,85,235 | 1,04,474 |

| 55,000 | 4,40,160 | 1,05,945 | 14,324 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 11,41,840 | -4,73,550 | 55,696 |

| 55,500 | 1,89,000 | -7,735 | 15,139 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 14,99,715 | 5,85,235 | 1,04,474 |

| 57,000 | 11,41,840 | -4,73,550 | 55,696 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27453.95. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.764 against previous 1.226. The 27500CE option holds the maximum open interest, followed by the 27500PE and 26500PE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 27500PE and 26500PE options. On the other hand, open interest reductions were prominent in the 25600PE, 22500PE, and 22500PE options. Trading volume was highest in the 27500CE option, followed by the 27500PE and 27400PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,453.95 | 0.764 | 1.226 | 0.849 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 56,420 | 15,210 | 41,210 |

| PUT: | 43,095 | 18,655 | 24,440 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 25,675 | 20,345 | 891 |

| 27,000 | 4,420 | 455 | 10 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 25,675 | 20,345 | 891 |

| 30,500 | 3,575 | 3,445 | 106 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 25,675 | 20,345 | 891 |

| 28,000 | 2,210 | 2,145 | 114 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 17,680 | 9,815 | 702 |

| 26,500 | 7,930 | 6,695 | 144 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 17,680 | 9,815 | 702 |

| 26,500 | 7,930 | 6,695 | 144 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 910 | -65 | 1 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 17,680 | 9,815 | 702 |

| 27,400 | 2,275 | 520 | 192 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13366.2. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.984 against previous 1.079. The 14000CE option holds the maximum open interest, followed by the 13400CE and 13300PE options. Market participants have shown increased interest with significant open interest additions in the 13400CE option, with open interest additions also seen in the 13400PE and 13300PE options. On the other hand, open interest reductions were prominent in the 69600PE, 69600PE, and 69600CE options. Trading volume was highest in the 13300PE option, followed by the 13300CE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,366.20 | 0.984 | 1.079 | 0.909 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 22,38,040 | 9,81,960 | 12,56,080 |

| PUT: | 22,01,500 | 10,59,800 | 11,41,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,59,620 | 1,05,000 | 6,006 |

| 13,400 | 4,14,260 | 3,60,780 | 5,826 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 4,14,260 | 3,60,780 | 5,826 |

| 13,300 | 3,28,020 | 2,15,180 | 6,415 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 420 | -140 | 1 |

| 12,600 | 420 | -140 | 1 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,28,020 | 2,15,180 | 6,415 |

| 13,500 | 3,68,900 | 1,33,140 | 6,326 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,73,800 | 2,61,100 | 7,157 |

| 13,400 | 3,39,780 | 3,22,700 | 5,329 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 3,39,780 | 3,22,700 | 5,329 |

| 13,300 | 3,73,800 | 2,61,100 | 7,157 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,175 | 1,120 | -420 | 13 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,73,800 | 2,61,100 | 7,157 |

| 13,400 | 3,39,780 | 3,22,700 | 5,329 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

NIFTY and FINNIFTY’s fresh shorting in the face of rising open interest and volume make them candidates for further downside or at least increased volatility; caution is advised for aggressive bullish positions.

In contrast, BANKNIFTY and MIDCPNIFTY’s sustained long build-up may offer relative strength as traders rotate into outperforming segments.

Option chain data across all indices continues to reflect defensive positioning, with spot prices near max pain and call open interest accumulating above current levels.

The Open Interest Volume Analysis for today highlights a tactical shift: focus short setups in weak indices and consider selective longs in strong banks and midcaps, always tracking changes in OI for actionable signals.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]