Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 29/10/2025

Table of Contents

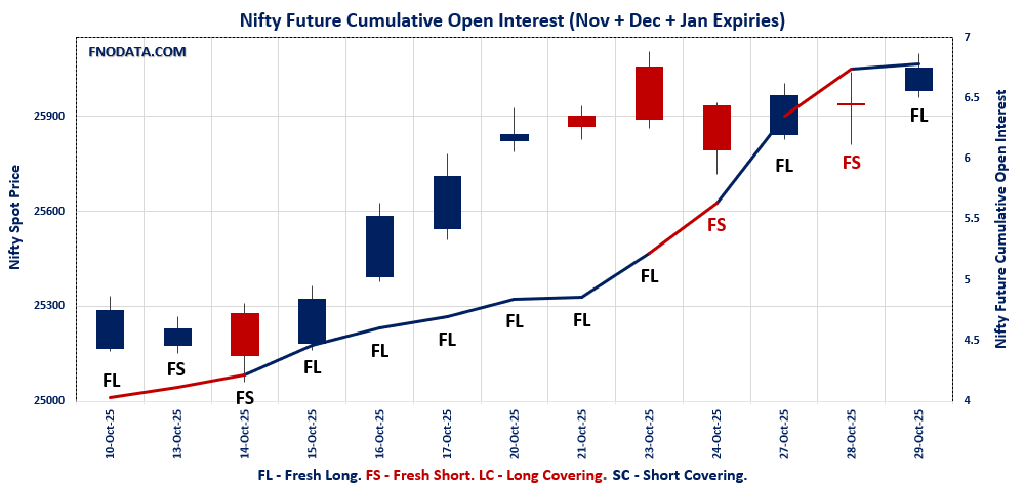

NIFTY’s combined future open interest shows a clear fresh long build-up (+3.9%) even as overall volume remains subdued, signaling quiet accumulation into November, December, and January contracts.

Premiums expanded notably for both November and December futures, reflecting additional buyer conviction despite the drop in traded volumes—potential sign of positional long players taking charge.

Put-Call Ratios (both weekly and monthly) saw a solid jump above 1.05, supported by matching high put open interest at-the-money (26000)—indicative of a bullish bias in options positioning as well.

Highest call addition occurs above current spot levels (27000), so upside targets for fresh long setups appear at 26200–27000.

Actionable feedback: Open Interest Volume Analysis suggests traders should favor initiating fresh long trades on dips above max pain (26000), maintaining stops below short-term moving averages, and aiming for newly marked resistance zones.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26053.9 (0.5%)

Combined = November + December + January

Combined Fut Open Interest Change: 3.9%

Combined Fut Volume Change: -32.9%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 6% Previous 6%

NIFTY NOVEMBER Future closed at: 26238.7 (0.6%)

November Fut Premium184.8 (Increased by 30.9 points)

November Fut Open Interest Change: 3.7%

November Fut Volume Change: -34.8%

November Fut Open Interest Analysis: Fresh Long

NIFTY DECEMBER Future closed at: 26411.2 (0.6%)

December Fut Premium357.3 (Increased by 28.3 points)

December Fut Open Interest Change: 2.4%

December Fut Volume Change: -15.3%

December Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (4/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.057 (Increased from 0.782)

Put-Call Ratio (Volume): 0.854

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.230 (Increased from 1.203)

Put-Call Ratio (Volume): 1.114

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26200

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58385.25 (0.3%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.3%

Combined Fut Volume Change: -31.3%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 7%

BANKNIFTY NOVEMBER Future closed at: 58766 (0.4%)

November Fut Premium380.75 (Increased by 76.25 points)

November Fut Open Interest Change: -2.1%

November Fut Volume Change: -33.0%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY DECEMBER Future closed at: 59093 (0.4%)

December Fut Premium707.75 (Increased by 87.65 points)

December Fut Open Interest Change: 17.3%

December Fut Volume Change: -20.2%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.029 (Increased from 0.975)

Put-Call Ratio (Volume): 0.875

Max Pain Level: 58000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 63000

Highest PUT Addition: 58000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27587.65 (0.5%)

Combined = November + December + January

Combined Fut Open Interest Change: -1.8%

Combined Fut Volume Change: -51.2%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 0% Previous 0%

FINNIFTY NOVEMBER Future closed at: 27760.5 (0.7%)

November Fut Premium172.85 (Increased by 49 points)

November Fut Open Interest Change: -2.2%

November Fut Volume Change: -51.5%

November Fut Open Interest Analysis: Short Covering

FINNIFTY DECEMBER Future closed at: 27955 (0.8%)

December Fut Premium367.35 (Increased by 93.5 points)

December Fut Open Interest Change: #DIV/0!

December Fut Volume Change: #DIV/0!

December Fut Open Interest Analysis: #DIV/0!

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.647 (Decreased from 0.764)

Put-Call Ratio (Volume): 0.559

Max Pain Level: 27500

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 27500

Highest CALL Addition: 28000

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13430.75 (0.5%)

Combined = November + December + January

Combined Fut Open Interest Change: 8.4%

Combined Fut Volume Change: -32.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 2% Previous 2%

MIDCPNIFTY NOVEMBER Future closed at: 13513.35 (0.6%)

November Fut Premium82.6 (Increased by 12.35 points)

November Fut Open Interest Change: 8.3%

November Fut Volume Change: -33.7%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY DECEMBER Future closed at: 13568.3 (0.5%)

December Fut Premium137.55 (Increased by 3.75 points)

December Fut Open Interest Change: 11.0%

December Fut Volume Change: 26.6%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.054 (Increased from 0.984)

Put-Call Ratio (Volume): 0.863

Max Pain Level: 13400

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13400

Highest CALL Addition: 14000

Highest PUT Addition: 13400

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 84,997.13 (0.44%)

SENSEX Monthly Future closed at: 85,118.50 (0.45%)

Premium: 121.37 (Increased by 12.23 points)

Open Interest Change: -3.0%

Volume Change: 107.1%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (30/10/2025) Option Analysis

Put-Call Ratio (OI): 1.161 (Increased from 0.739)

Put-Call Ratio (Volume): 0.991

Max Pain Level: 85000

Maximum CALL OI: 87000

Maximum PUT OI: 82000

Highest CALL Addition: 87000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,540.16 Cr.

DIIs Net BUY: ₹ 5,692.81 Cr.

FII Derivatives Activity

| FII Trading Stats | 29.10.25 | 28.10.25 | 27.10.25 |

| FII Cash (Provisional Data) | -2,540.16 | 10,339.80 | -55.58 |

| Index Future Open Interest Long Ratio | 18.92% | 19.51% | 25.69% |

| Index Future Volume Long Ratio | 39.94% | 43.31% | 49.53% |

| Call Option Open Interest Long Ratio | 50.36% | 48.73% | 52.03% |

| Call Option Volume Long Ratio | 50.21% | 50.16% | 49.98% |

| Put Option Open Interest Long Ratio | 59.69% | 65.28% | 58.78% |

| Put Option Volume Long Ratio | 49.66% | 50.16% | 49.86% |

| Stock Future Open Interest Long Ratio | 62.48% | 61.43% | 61.98% |

| Stock Future Volume Long Ratio | 51.56% | 50.65% | 50.93% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Short | Short Covering | Long Covering |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Short | Short Covering | Long Covering |

| BankNifty Futures | Fresh Short | Long Covering | Fresh Short |

| BankNifty Options | Fresh Long | Long Covering | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Long | Long Covering | Short Covering |

| MidcpNifty Futures | Fresh Long | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Short Covering | Fresh Long |

| Stock Futures | Fresh Long | Short Covering | Fresh Long |

| Stock Options | Fresh Short | Long Covering | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (30/10/2025)

The SENSEX index closed at 84997.13. The SENSEX weekly expiry for OCTOBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.161 against previous 0.739. The 82000PE option holds the maximum open interest, followed by the 87000CE and 83000PE options. Market participants have shown increased interest with significant open interest additions in the 82000PE option, with open interest additions also seen in the 85000PE and 84400PE options. On the other hand, open interest reductions were prominent in the 84500CE, 84700CE, and 84600CE options. Trading volume was highest in the 85000CE option, followed by the 85000PE and 85500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 30-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84997.13 | 1.161 | 0.739 | 0.991 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,69,85,060 | 2,15,19,760 | 54,65,300 |

| PUT: | 3,13,17,960 | 1,59,10,480 | 1,54,07,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 21,88,560 | 10,03,020 | 1,55,27,860 |

| 88000 | 16,65,900 | 3,13,300 | 1,04,57,200 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 21,88,560 | 10,03,020 | 1,55,27,860 |

| 88500 | 8,34,020 | 5,72,760 | 47,85,680 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 3,11,200 | -4,91,200 | 87,06,940 |

| 84700 | 1,59,660 | -2,72,600 | 2,29,81,100 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 14,93,120 | 6,560 | 11,07,62,040 |

| 85500 | 11,92,960 | 3,72,060 | 9,21,22,660 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 22,27,640 | 12,71,700 | 1,10,83,540 |

| 83000 | 16,94,880 | 8,50,040 | 1,53,47,420 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 22,27,640 | 12,71,700 | 1,10,83,540 |

| 85000 | 16,27,340 | 10,60,120 | 10,52,21,600 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 72300 | 2,14,420 | -42,720 | 4,76,580 |

| 83200 | 2,53,300 | -14,260 | 54,54,840 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 16,27,340 | 10,60,120 | 10,52,21,600 |

| 84500 | 15,87,500 | 6,62,980 | 8,21,83,960 |

NIFTY Weekly Expiry (4/11/2025)

The NIFTY index closed at 26053.9. The NIFTY weekly expiry for NOVEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.057 against previous 0.782. The 27000CE option holds the maximum open interest, followed by the 26000PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 25000PE and 26100PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25950CE, and 25800CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 04-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,053.90 | 1.057 | 0.782 | 0.854 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,43,40,500 | 8,74,45,200 | 2,68,95,300 |

| PUT: | 12,08,55,225 | 6,83,83,875 | 5,24,71,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,20,900 | 24,98,475 | 7,43,662 |

| 27,500 | 72,04,800 | 24,06,075 | 3,95,599 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,20,900 | 24,98,475 | 7,43,662 |

| 27,500 | 72,04,800 | 24,06,075 | 3,95,599 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 14,39,700 | -10,56,450 | 5,31,735 |

| 25,950 | 8,45,025 | -5,48,025 | 6,32,667 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 68,77,200 | 3,150 | 28,55,275 |

| 26,100 | 50,43,675 | 12,05,625 | 27,60,758 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,05,05,400 | 59,23,350 | 39,33,714 |

| 25,000 | 86,30,400 | 40,17,075 | 4,93,071 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,05,05,400 | 59,23,350 | 39,33,714 |

| 25,000 | 86,30,400 | 40,17,075 | 4,93,071 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 2,83,200 | -31,350 | 45,076 |

| 27,150 | 225 | -75 | 1 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,05,05,400 | 59,23,350 | 39,33,714 |

| 26,050 | 29,99,475 | 25,12,575 | 18,86,134 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 26053.9. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.230 against previous 1.203. The 25000PE option holds the maximum open interest, followed by the 26000PE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 26000PE and 26200PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25900CE, and 25800CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,053.90 | 1.230 | 1.203 | 1.114 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,20,86,875 | 2,97,67,500 | 23,19,375 |

| PUT: | 3,94,61,325 | 3,58,02,600 | 36,58,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 34,79,550 | 3,21,525 | 63,039 |

| 26,000 | 33,92,775 | -2,86,575 | 82,015 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 22,01,850 | 3,25,050 | 53,172 |

| 27,500 | 15,44,325 | 3,23,625 | 18,910 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 33,92,775 | -2,86,575 | 82,015 |

| 25,900 | 4,88,625 | -1,46,100 | 14,251 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 33,92,775 | -2,86,575 | 82,015 |

| 26,500 | 25,47,000 | 2,63,550 | 65,671 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 43,11,000 | -85,650 | 44,465 |

| 26,000 | 42,53,775 | 7,47,000 | 1,18,599 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 17,77,725 | 8,70,600 | 32,945 |

| 26,000 | 42,53,775 | 7,47,000 | 1,18,599 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 12,14,175 | -1,05,525 | 21,104 |

| 25,300 | 10,94,325 | -1,00,950 | 19,901 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 42,53,775 | 7,47,000 | 1,18,599 |

| 25,500 | 37,17,900 | 3,27,525 | 59,322 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58385.25. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.029 against previous 0.975. The 58000PE option holds the maximum open interest, followed by the 57000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 58000PE option, with open interest additions also seen in the 58500PE and 63000CE options. On the other hand, open interest reductions were prominent in the 58100CE, 56500PE, and 56500CE options. Trading volume was highest in the 58000PE option, followed by the 58500CE and 59000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,385.25 | 1.029 | 0.975 | 0.875 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,01,41,880 | 85,48,470 | 15,93,410 |

| PUT: | 1,04,31,050 | 83,31,960 | 20,99,090 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,90,670 | -1,435 | 4,483 |

| 58,000 | 8,69,960 | 8,225 | 52,071 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 4,15,275 | 1,15,465 | 21,626 |

| 58,500 | 7,51,415 | 1,00,590 | 1,08,808 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,100 | 88,270 | -29,155 | 28,423 |

| 56,500 | 80,115 | -9,835 | 688 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 7,51,415 | 1,00,590 | 1,08,808 |

| 59,000 | 6,24,645 | 93,940 | 86,638 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,58,715 | 2,59,000 | 1,16,252 |

| 57,000 | 11,97,980 | 56,140 | 83,021 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,58,715 | 2,59,000 | 1,16,252 |

| 58,500 | 5,95,105 | 1,91,310 | 64,589 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 4,19,720 | -16,555 | 21,388 |

| 56,800 | 62,580 | -5,530 | 6,045 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,58,715 | 2,59,000 | 1,16,252 |

| 58,200 | 2,11,715 | 1,02,725 | 85,563 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27587.65. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.647 against previous 0.764. The 28000CE option holds the maximum open interest, followed by the 27500PE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 28000CE option, with open interest additions also seen in the 26000PE and 30000CE options. On the other hand, open interest reductions were prominent in the 27000CE, 27000CE, and 28700PE options. Trading volume was highest in the 28000CE option, followed by the 27500PE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,587.65 | 0.647 | 0.764 | 0.559 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,47,065 | 56,420 | 1,90,645 |

| PUT: | 1,59,770 | 43,095 | 1,16,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 36,530 | 34,320 | 3,797 |

| 27,500 | 25,480 | -195 | 2,463 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 36,530 | 34,320 | 3,797 |

| 30,000 | 23,010 | 22,490 | 603 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 4,225 | -195 | 33 |

| 27,000 | 4,225 | -195 | 33 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 36,530 | 34,320 | 3,797 |

| 27,500 | 25,480 | -195 | 2,463 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 28,860 | 11,180 | 2,605 |

| 26,000 | 27,820 | 23,725 | 531 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 27,820 | 23,725 | 531 |

| 27,600 | 17,485 | 17,160 | 1,022 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 28,860 | 11,180 | 2,605 |

| 27,600 | 17,485 | 17,160 | 1,022 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13430.75. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.054 against previous 0.984. The 14000CE option holds the maximum open interest, followed by the 13400PE and 13400CE options. Market participants have shown increased interest with significant open interest additions in the 14000CE option, with open interest additions also seen in the 13400PE and 13000PE options. On the other hand, open interest reductions were prominent in the 76500CE, 76500CE, and 76500PE options. Trading volume was highest in the 14000CE option, followed by the 13400PE and 13400CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,430.75 | 1.054 | 0.984 | 0.863 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 32,40,020 | 22,38,040 | 10,01,980 |

| PUT: | 34,13,620 | 22,01,500 | 12,12,120 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,56,460 | 1,96,840 | 11,824 |

| 13,400 | 4,82,020 | 67,760 | 10,765 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,56,460 | 1,96,840 | 11,824 |

| 14,500 | 3,51,960 | 1,38,460 | 4,298 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 3,18,220 | -9,800 | 3,613 |

| 13,275 | 2,100 | -1,540 | 62 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,56,460 | 1,96,840 | 11,824 |

| 13,400 | 4,82,020 | 67,760 | 10,765 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,20,240 | 1,80,460 | 11,135 |

| 13,300 | 4,56,540 | 82,740 | 6,891 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,20,240 | 1,80,460 | 11,135 |

| 13,000 | 4,01,520 | 1,40,560 | 5,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,280 | -1,120 | 68 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,20,240 | 1,80,460 | 11,135 |

| 13,300 | 4,56,540 | 82,740 | 6,891 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The Open Interest Volume Analysis confirms the strength of buyers—fresh long OI and rising premiums point to positive sentiment heading into November expiry.

Lack of volume suggests moves are driven by large positional traders, so expectation is for slow, steady upside rather than sharp spikes.

Avoid aggressive shorts as long as combined OI continues to expand and the 26000 level is defended; monitor any reversal in the Put-Call Ratio for first signs of trend fatigue.

Short to medium-term bull strategies look viable with first targets at 26200, extended upside possible toward highest call additions at 27000.

Key takeaway: Stay long NIFTY above max pain, watch for OI and PCR as primary trend signals, and use dip opportunities for further accumulation in line with Open Interest Volume Analysis.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]