Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 30/10/2025

Table of Contents

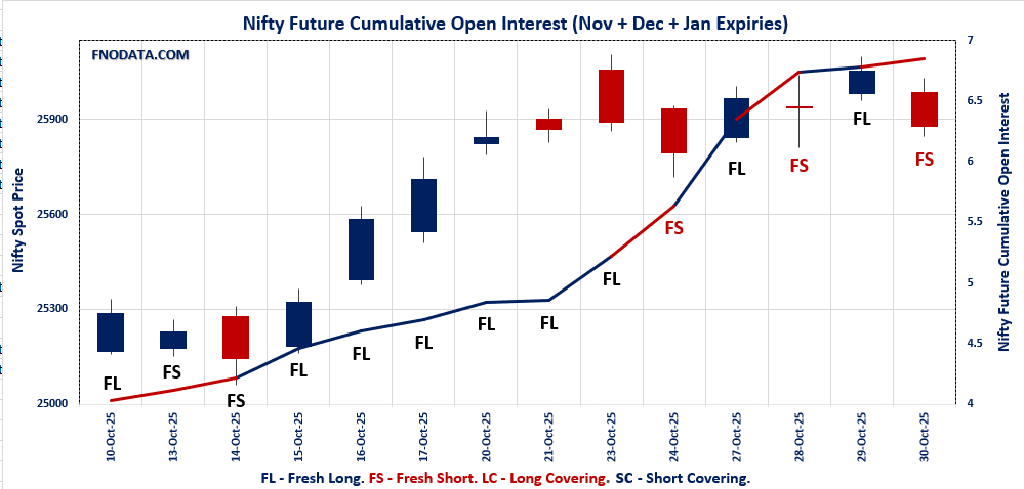

NIFTY spot dropped 0.7%, with combined futures for November, December, and January showing a sharp 7.2% increase in open interest, indicating aggressive fresh short build-up from institutional traders.

Weak momentum is evident with only a small 2.2% rise in combined volume, implying that fresh shorts were added without much new participation and conviction remains cautious.

November and December futures each saw clear fresh short signals—open interest up nearly 7-10%, premiums reduced sharply, confirming dominance of sellers across near-term contracts.

Option chains reflect strong resistance at 26,000–27,000 strike, with highest call additions and max pain at 25,950–26,000—strengthening the bearish sentiment in Open Interest Volume Analysis.

Both weekly and monthly expiry put-call ratios dropped, signifying fading put support and persistence of call writing at higher strikes.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25877.85 (-0.7%)

Combined = November + December + January

Combined Fut Open Interest Change: 7.2%

Combined Fut Volume Change: 2.2%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 7% Previous 6%

NIFTY NOVEMBER Future closed at: 26031.6 (-0.8%)

November Fut Premium 153.75 (Decreased by -31.05 points)

November Fut Open Interest Change: 6.8%

November Fut Volume Change: 3.0%

November Fut Open Interest Analysis: Fresh Short

NIFTY DECEMBER Future closed at: 26218.1 (-0.7%)

December Fut Premium 340.25 (Decreased by -17.05 points)

December Fut Open Interest Change: 9.8%

December Fut Volume Change: -9.0%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (4/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.599 (Decreased from 1.057)

Put-Call Ratio (Volume): 0.968

Max Pain Level: 25950

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 25600

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.143 (Decreased from 1.230)

Put-Call Ratio (Volume): 0.852

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58031.1 (-0.6%)

Combined = November + December + January

Combined Fut Open Interest Change: -2.0%

Combined Fut Volume Change: -32.6%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 10% Previous 9%

BANKNIFTY NOVEMBER Future closed at: 58425.6 (-0.6%)

November Fut Premium 394.5 (Increased by 13.75 points)

November Fut Open Interest Change: -2.8%

November Fut Volume Change: -32.7%

November Fut Open Interest Analysis: Long Covering

BANKNIFTY DECEMBER Future closed at: 58778 (-0.5%)

December Fut Premium 746.9 (Increased by 39.15 points)

December Fut Open Interest Change: 4.6%

December Fut Volume Change: -34.6%

December Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.914 (Decreased from 1.029)

Put-Call Ratio (Volume): 1.107

Max Pain Level: 58000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 60000

Highest PUT Addition: 57800

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27376 (-0.8%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.9%

Combined Fut Volume Change: -0.3%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 1% Previous 0%

FINNIFTY NOVEMBER Future closed at: 27552.5 (-0.7%)

November Fut Premium 176.5 (Increased by 3.65 points)

November Fut Open Interest Change: 0.8%

November Fut Volume Change: -0.6%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY DECEMBER Future closed at: 27740.7 (-0.8%)

December Fut Premium 364.7 (Decreased by -2.65 points)

December Fut Open Interest Change: 50.0%

December Fut Volume Change: 50.0%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.680 (Increased from 0.647)

Put-Call Ratio (Volume): 0.915

Max Pain Level: 27500

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27500

Highest PUT Addition: 26500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13467.65 (0.3%)

Combined = November + December + January

Combined Fut Open Interest Change: -0.7%

Combined Fut Volume Change: -11.7%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 2% Previous 2%

MIDCPNIFTY NOVEMBER Future closed at: 13518.4 (0.0%)

November Fut Premium 50.75 (Decreased by -31.85 points)

November Fut Open Interest Change: -0.7%

November Fut Volume Change: -11.1%

November Fut Open Interest Analysis: Short Covering

MIDCPNIFTY DECEMBER Future closed at: 13588.95 (0.2%)

December Fut Premium 121.3 (Decreased by -16.25 points)

December Fut Open Interest Change: 3.6%

December Fut Volume Change: -31.2%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.014 (Decreased from 1.054)

Put-Call Ratio (Volume): 1.084

Max Pain Level: 13400

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13400

Highest CALL Addition: 14400

Highest PUT Addition: 13500

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 84,404.46 (-0.70%)

SENSEX Monthly Future closed at: 85,027.45 (-0.72%)

Premium: 622.99 (Decreased by -24.13 points)

Open Interest Change: 47.1%

Volume Change: 58.2%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (6/11/2025) Option Analysis

Put-Call Ratio (OI): 0.640 (Decreased from 1.005)

Put-Call Ratio (Volume): 0.856

Max Pain Level: 84500

Maximum CALL OI: 85000

Maximum PUT OI: 84500

Highest CALL Addition: 85000

Highest PUT Addition: 84500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,077.59 Cr.

DIIs Net BUY: ₹ 2,469.34 Cr.

FII Derivatives Activity

| FII Trading Stats | 30.10.25 | 29.10.25 | 28.10.25 |

| FII Cash (Provisional Data) | -3,077.59 | -2,540.16 | 10,339.80 |

| Index Future Open Interest Long Ratio | 16.98% | 18.92% | 19.51% |

| Index Future Volume Long Ratio | 28.58% | 39.94% | 43.31% |

| Call Option Open Interest Long Ratio | 48.92% | 50.36% | 48.73% |

| Call Option Volume Long Ratio | 49.74% | 50.21% | 50.16% |

| Put Option Open Interest Long Ratio | 62.87% | 59.69% | 65.28% |

| Put Option Volume Long Ratio | 50.70% | 49.66% | 50.16% |

| Stock Future Open Interest Long Ratio | 61.95% | 62.48% | 61.43% |

| Stock Future Volume Long Ratio | 44.82% | 51.56% | 50.65% |

| Index Futures | Fresh Short | Fresh Short | Long Covering |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Long Covering |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Long Covering | Fresh Short | Long Covering |

| BankNifty Options | Fresh Short | Fresh Long | Long Covering |

| FinNifty Futures | Long Covering | Short Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Long | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Short Covering |

| Stock Futures | Long Covering | Fresh Long | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (6/11/2025)

The SENSEX index closed at 84404.46. The SENSEX weekly expiry for NOVEMBER 6, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.640 against previous 1.005. The 85000CE option holds the maximum open interest, followed by the 88000CE and 84500CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 88000CE and 84500CE options. On the other hand, open interest reductions were prominent in the 85100PE, 85200PE, and 85400PE options. Trading volume was highest in the 84500PE option, followed by the 85000CE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 06-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84404.46 | 0.640 | 1.005 | 0.856 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 50,31,180 | 12,03,400 | 38,27,780 |

| PUT: | 32,17,940 | 12,09,780 | 20,08,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,87,640 | 3,54,100 | 25,93,660 |

| 88000 | 4,24,120 | 3,00,680 | 11,43,200 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,87,640 | 3,54,100 | 25,93,660 |

| 88000 | 4,24,120 | 3,00,680 | 11,43,200 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 91200 | 1,520 | -140 | 1,020 |

| 92200 | 180 | -100 | 240 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,87,640 | 3,54,100 | 25,93,660 |

| 84500 | 3,20,640 | 2,83,880 | 19,36,880 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,98,400 | 2,32,840 | 28,13,840 |

| 85000 | 2,47,360 | 1,01,260 | 13,95,040 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,98,400 | 2,32,840 | 28,13,840 |

| 80000 | 2,03,380 | 1,55,440 | 4,75,340 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85100 | 13,880 | -4,240 | 66,180 |

| 85200 | 16,620 | -3,640 | 69,100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,98,400 | 2,32,840 | 28,13,840 |

| 84600 | 96,860 | 76,880 | 15,11,960 |

NIFTY Weekly Expiry (4/11/2025)

The NIFTY index closed at 25877.85. The NIFTY weekly expiry for NOVEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.599 against previous 1.057. The 27000CE option holds the maximum open interest, followed by the 26000CE and 26200CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 27000CE and 25900CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26100PE, and 26050PE options. Trading volume was highest in the 25900PE option, followed by the 26000CE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 04-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,877.85 | 0.599 | 1.057 | 0.968 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,74,60,950 | 11,43,40,500 | 9,31,20,450 |

| PUT: | 12,43,10,025 | 12,08,55,225 | 34,54,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,85,71,950 | 76,51,050 | 12,34,519 |

| 26,000 | 1,63,42,350 | 94,65,150 | 33,92,686 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,63,42,350 | 94,65,150 | 33,92,686 |

| 27,000 | 1,85,71,950 | 76,51,050 | 12,34,519 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,17,150 | -51,600 | 1,085 |

| 25,000 | 2,96,775 | -50,100 | 5,011 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,63,42,350 | 94,65,150 | 33,92,686 |

| 25,900 | 73,56,225 | 59,16,525 | 20,28,984 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 89,24,775 | 2,94,375 | 5,17,206 |

| 25,500 | 77,82,075 | 14,47,800 | 9,84,733 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 49,93,200 | 14,77,425 | 10,17,961 |

| 25,500 | 77,82,075 | 14,47,800 | 9,84,733 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,60,725 | -37,44,675 | 28,42,269 |

| 26,100 | 22,42,575 | -19,45,800 | 8,28,768 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 63,86,850 | 9,09,675 | 37,26,116 |

| 26,000 | 67,60,725 | -37,44,675 | 28,42,269 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25877.85. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.143 against previous 1.230. The 26000PE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26600CE and 26000PE options. On the other hand, open interest reductions were prominent in the 26800CE, 25700PE, and 26700CE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,877.85 | 1.143 | 1.230 | 0.852 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,65,78,475 | 3,20,86,875 | 44,91,600 |

| PUT: | 4,18,14,450 | 3,94,61,325 | 23,53,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,32,375 | 15,39,600 | 1,02,883 |

| 27,000 | 37,51,650 | 2,72,100 | 68,769 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,32,375 | 15,39,600 | 1,02,883 |

| 26,600 | 14,05,725 | 7,68,600 | 30,770 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 12,96,000 | -6,12,075 | 35,935 |

| 26,700 | 14,37,000 | -91,425 | 25,100 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,32,375 | 15,39,600 | 1,02,883 |

| 26,500 | 32,26,125 | 6,79,125 | 79,077 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,53,750 | 6,99,975 | 1,02,161 |

| 25,000 | 44,33,775 | 1,22,775 | 37,275 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,53,750 | 6,99,975 | 1,02,161 |

| 25,800 | 21,02,325 | 4,10,250 | 35,794 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 15,67,350 | -2,10,375 | 24,463 |

| 22,700 | 3,37,575 | -54,375 | 3,043 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,53,750 | 6,99,975 | 1,02,161 |

| 25,500 | 37,13,250 | -4,650 | 50,165 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 58031.1. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.914 against previous 1.029. The 58000PE option holds the maximum open interest, followed by the 57000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 60000CE option, with open interest additions also seen in the 61000CE and 60500CE options. On the other hand, open interest reductions were prominent in the 58500PE, 57600CE, and 58300PE options. Trading volume was highest in the 58000PE option, followed by the 58200PE and 58500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,031.10 | 0.914 | 1.029 | 1.107 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,12,61,670 | 1,01,41,880 | 11,19,790 |

| PUT: | 1,02,95,180 | 1,04,31,050 | -1,35,870 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,89,865 | -805 | 3,399 |

| 58,000 | 9,63,760 | 93,800 | 51,990 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 9,09,755 | 1,33,735 | 52,017 |

| 61,000 | 5,78,585 | 1,30,410 | 29,338 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,600 | 56,455 | -56,910 | 9,661 |

| 62,000 | 5,21,815 | -43,610 | 25,094 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 8,63,100 | 1,11,685 | 87,809 |

| 59,000 | 7,19,880 | 95,235 | 69,931 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,48,110 | -10,605 | 1,31,632 |

| 57,000 | 11,61,650 | -36,330 | 54,996 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,800 | 1,71,220 | 56,455 | 24,896 |

| 54,500 | 2,29,005 | 46,095 | 13,235 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 5,20,100 | -75,005 | 75,006 |

| 58,300 | 1,73,040 | -53,515 | 72,310 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,48,110 | -10,605 | 1,31,632 |

| 58,200 | 1,97,470 | -14,245 | 1,13,134 |

FINNIFTY Monthly Expiry (25/11/2025)

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27376. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.680 against previous 0.647. The 27500CE option holds the maximum open interest, followed by the 27500PE and 26500PE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 27900CE and 26500PE options. On the other hand, open interest reductions were prominent in the 28100CE, 28000CE, and 27600PE options. Trading volume was highest in the 27500PE option, followed by the 27500CE and 28000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,376.00 | 0.680 | 0.647 | 0.915 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,10,895 | 2,47,065 | 63,830 |

| PUT: | 2,11,510 | 1,59,770 | 51,740 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 49,725 | 24,245 | 2,580 |

| 28,000 | 29,315 | -7,215 | 1,749 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 49,725 | 24,245 | 2,580 |

| 27,900 | 20,085 | 17,420 | 1,075 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,100 | 7,215 | -15,080 | 750 |

| 28,000 | 29,315 | -7,215 | 1,749 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 49,725 | 24,245 | 2,580 |

| 28,000 | 29,315 | -7,215 | 1,749 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 38,870 | 10,010 | 3,059 |

| 26,500 | 33,215 | 14,820 | 874 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 33,215 | 14,820 | 874 |

| 27,500 | 38,870 | 10,010 | 3,059 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 11,375 | -6,110 | 674 |

| 27,400 | 6,630 | -1,950 | 1,375 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 38,870 | 10,010 | 3,059 |

| 27,400 | 6,630 | -1,950 | 1,375 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13467.65. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.014 against previous 1.054. The 14000CE option holds the maximum open interest, followed by the 13500CE and 13400PE options. Market participants have shown increased interest with significant open interest additions in the 13500PE option, with open interest additions also seen in the 14400CE and 14000CE options. On the other hand, open interest reductions were prominent in the 70000PE, 69000CE, and 69000PE options. Trading volume was highest in the 13500CE option, followed by the 13400PE and 13500PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,467.65 | 1.014 | 1.054 | 1.084 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 38,24,660 | 32,40,020 | 5,84,640 |

| PUT: | 38,78,280 | 34,13,620 | 4,64,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,34,860 | 78,400 | 7,667 |

| 13,500 | 5,47,120 | 77,980 | 10,043 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,400 | 1,40,700 | 80,360 | 1,575 |

| 14,000 | 7,34,860 | 78,400 | 7,667 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 4,48,140 | -33,880 | 7,737 |

| 13,200 | 58,520 | -3,220 | 218 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,47,120 | 77,980 | 10,043 |

| 13,400 | 4,48,140 | -33,880 | 7,737 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,06,660 | -13,580 | 9,992 |

| 13,300 | 4,70,120 | 13,580 | 5,063 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 2,86,300 | 1,04,300 | 7,998 |

| 12,700 | 1,75,280 | 60,060 | 1,695 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,350 | 58,520 | -23,940 | 1,435 |

| 13,400 | 5,06,660 | -13,580 | 9,992 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 5,06,660 | -13,580 | 9,992 |

| 13,500 | 2,86,300 | 1,04,300 | 7,998 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The current Open Interest Volume Analysis suggests traders are proactively positioning for further downside, with shorts controlling November and December futures, and overall premium erosion confirming underlying market weakness.

The weak uptick in volumes means aggressive shorting may face limited momentum unless broader market sentiment worsens, so immediate rallies are likely to face supply near 26,000–26,200 while downside risks persist.

Strategic feedback: Avoid long trades until there is visible short covering or reversal; traders should trail stops tightly on shorts and look for fresh breakdowns if NIFTY breaches recent supports near 25,800.

Option data confirms a defensive stance; use resistance and max pain levels to scale into shorts and manage exits—any bounce near 26,000 is an opportunity for contrarian sellers.

Open Interest Volume Analysis for today supports continued caution, active risk management, and readiness to play both sides only upon clear confirmation of a reversal or change in volume dynamics.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]