Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 31/10/2025

Table of Contents

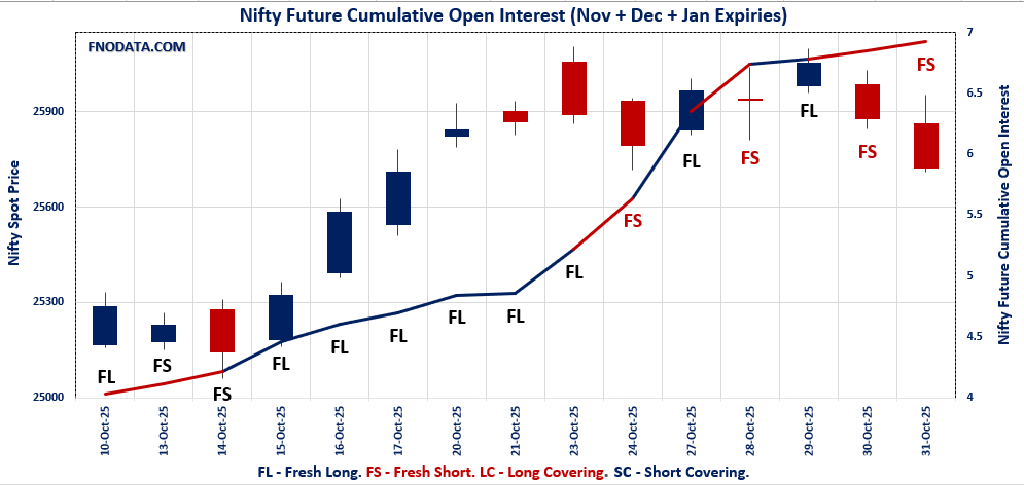

NIFTY’s fresh short build-up dominates today’s Open Interest Volume Analysis: Combined OI up 7.3% and price down signals aggressive new shorts forming as downside pressure grows.

November and December NIFTY futures show uniform short build-up: Both contracts add open interest while falling in price, confirming bears firmly control the near-term.

Rising premium despite falling prices: November and December NIFTY premiums jumped even as prices dropped, often indicating hedged positions by institutional players or expected volatility spikes.

Put-Call Ratio drops further for weekly and monthly options: Sharp fall in PCR (to 0.501 weekly, 1.110 monthly) points to dominance of call writing and limited bottom-fishing.

Max pain remains near current market levels: Option pain at 25800 (weekly) and 26000 (monthly) suggests most traders expect a consolidation zone in coming days.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25722.1 (-0.6%)

Combined = November + December + January

Combined Fut Open Interest Change: 7.3%

Combined Fut Volume Change: 5.8%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 7% Previous 7%

NIFTY NOVEMBER Future closed at: 25905.5 (-0.5%)

November Fut Premium183.4 (Increased by 29.65 points)

November Fut Open Interest Change: 7.0%

November Fut Volume Change: 4.6%

November Fut Open Interest Analysis: Fresh Short

NIFTY DECEMBER Future closed at: 26088.5 (-0.5%)

December Fut Premium366.4 (Increased by 26.15 points)

December Fut Open Interest Change: 8.8%

December Fut Volume Change: 27.8%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (4/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.501 (Decreased from 0.599)

Put-Call Ratio (Volume): 0.998

Max Pain Level: 25800

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25800

Highest PUT Addition: 25000

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.110 (Decreased from 1.143)

Put-Call Ratio (Volume): 0.863

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 25500

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 57776.35 (-0.4%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.2%

Combined Fut Volume Change: 11.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 10% Previous 10%

BANKNIFTY NOVEMBER Future closed at: 58184.6 (-0.4%)

November Fut Premium408.25 (Increased by 13.75 points)

November Fut Open Interest Change: 0.3%

November Fut Volume Change: 10.7%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY DECEMBER Future closed at: 58541 (-0.4%)

December Fut Premium764.65 (Increased by 17.75 points)

December Fut Open Interest Change: -2.1%

December Fut Volume Change: 26.8%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.851 (Decreased from 0.914)

Put-Call Ratio (Volume): 1.065

Max Pain Level: 58000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 60500

Highest PUT Addition: 56000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27138.85 (-0.9%)

Combined = November + December + January

Combined Fut Open Interest Change: 2.8%

Combined Fut Volume Change: 34.4%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 1% Previous 1%

FINNIFTY NOVEMBER Future closed at: 27331 (-0.8%)

November Fut Premium192.15 (Increased by 15.65 points)

November Fut Open Interest Change: 2.1%

November Fut Volume Change: 33.5%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY DECEMBER Future closed at: 27526.8 (-0.8%)

December Fut Premium387.95 (Increased by 23.25 points)

December Fut Open Interest Change: 133.3%

December Fut Volume Change: 133.3%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.847 (Increased from 0.680)

Put-Call Ratio (Volume): 0.851

Max Pain Level: 27500

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 29000

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13467.85 (0.0%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.0%

Combined Fut Volume Change: 42.8%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 2% Previous 2%

MIDCPNIFTY NOVEMBER Future closed at: 13518.5 (0.0%)

November Fut Premium50.65 (Decreased by -0.1 points)

November Fut Open Interest Change: -0.2%

November Fut Volume Change: 42.7%

November Fut Open Interest Analysis: Short Covering

MIDCPNIFTY DECEMBER Future closed at: 13586.75 (0.0%)

December Fut Premium118.9 (Decreased by -2.4 points)

December Fut Open Interest Change: 7.7%

December Fut Volume Change: 48.1%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.930 (Decreased from 1.014)

Put-Call Ratio (Volume): 0.936

Max Pain Level: 13400

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13400

Highest CALL Addition: 14200

Highest PUT Addition: 13500

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 83,938.71 (-0.55%)

SENSEX Monthly Future closed at: 84,624.60 (-0.47%)

Premium: 685.89 (Increased by 62.9 points)

Open Interest Change: -9.9%

Volume Change: 29.4%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (6/11/2025) Option Analysis

Put-Call Ratio (OI): 0.516 (Decreased from 0.640)

Put-Call Ratio (Volume): 1.106

Max Pain Level: 84300

Maximum CALL OI: 85000

Maximum PUT OI: 80000

Highest CALL Addition: 84500

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 6,769.34 Cr.

DIIs Net BUY: ₹ 7,068.44 Cr.

FII Derivatives Activity

| FII Trading Stats | 31.10.25 | 30.10.25 | 29.10.25 |

| FII Cash (Provisional Data) | -6,769.34 | -3,077.59 | -2,540.16 |

| Index Future Open Interest Long Ratio | 16.01% | 16.98% | 18.92% |

| Index Future Volume Long Ratio | 38.19% | 28.58% | 39.94% |

| Call Option Open Interest Long Ratio | 50.41% | 48.92% | 50.36% |

| Call Option Volume Long Ratio | 50.19% | 49.74% | 50.21% |

| Put Option Open Interest Long Ratio | 62.53% | 62.87% | 59.69% |

| Put Option Volume Long Ratio | 50.11% | 50.70% | 49.66% |

| Stock Future Open Interest Long Ratio | 61.74% | 61.95% | 62.48% |

| Stock Future Volume Long Ratio | 48.37% | 44.82% | 51.56% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Long Covering | Fresh Short |

| BankNifty Options | Long Covering | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Short Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (6/11/2025)

The SENSEX index closed at 83938.71. The SENSEX weekly expiry for NOVEMBER 6, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.516 against previous 0.640. The 85000CE option holds the maximum open interest, followed by the 88000CE and 84500CE options. Market participants have shown increased interest with significant open interest additions in the 84500CE option, with open interest additions also seen in the 88000CE and 85000CE options. On the other hand, open interest reductions were prominent in the 87400CE, 85600PE, and 85300PE options. Trading volume was highest in the 84000PE option, followed by the 84200PE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 06-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83938.71 | 0.516 | 0.640 | 1.106 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,29,57,120 | 50,31,180 | 79,25,940 |

| PUT: | 66,86,820 | 32,17,940 | 34,68,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,90,400 | 4,02,760 | 1,43,08,960 |

| 88000 | 8,67,800 | 4,43,680 | 46,70,780 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 8,58,060 | 5,37,420 | 1,57,11,680 |

| 88000 | 8,67,800 | 4,43,680 | 46,70,780 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 87400 | 86,920 | -14,580 | 13,68,680 |

| 82800 | 3,560 | -2,120 | 5,500 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 8,58,060 | 5,37,420 | 1,57,11,680 |

| 85000 | 8,90,400 | 4,02,760 | 1,43,08,960 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,55,120 | 3,51,740 | 26,16,160 |

| 84500 | 4,18,020 | 1,19,620 | 1,26,01,800 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,55,120 | 3,51,740 | 26,16,160 |

| 84000 | 3,82,780 | 2,03,340 | 2,16,91,400 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85600 | 2,620 | -2,700 | 15,360 |

| 85300 | 18,400 | -2,200 | 1,15,700 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,82,780 | 2,03,340 | 2,16,91,400 |

| 84200 | 2,19,760 | 1,63,420 | 1,76,16,100 |

NIFTY Weekly Expiry (4/11/2025)

The NIFTY index closed at 25722.1. The NIFTY weekly expiry for NOVEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.501 against previous 0.599. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25900CE options. Market participants have shown increased interest with significant open interest additions in the 25800CE option, with open interest additions also seen in the 25900CE and 26000CE options. On the other hand, open interest reductions were prominent in the 26000PE, 25900PE, and 25850PE options. Trading volume was highest in the 25800PE option, followed by the 26000CE and 25700PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 04-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,722.10 | 0.501 | 0.599 | 0.998 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 27,73,04,775 | 20,74,60,950 | 6,98,43,825 |

| PUT: | 13,90,15,650 | 12,43,10,025 | 1,47,05,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 2,34,09,750 | 48,37,800 | 11,58,197 |

| 26,000 | 2,13,32,400 | 49,90,050 | 51,75,391 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,01,80,125 | 84,95,850 | 42,02,988 |

| 25,900 | 1,33,99,650 | 60,43,425 | 48,50,312 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 78,54,000 | -8,54,700 | 10,09,050 |

| 26,850 | 21,85,725 | -6,27,000 | 5,74,732 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,13,32,400 | 49,90,050 | 51,75,391 |

| 25,900 | 1,33,99,650 | 60,43,425 | 48,50,312 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,21,48,350 | 32,23,575 | 9,71,307 |

| 25,500 | 83,36,700 | 5,54,625 | 23,35,984 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,21,48,350 | 32,23,575 | 9,71,307 |

| 25,700 | 81,26,925 | 28,70,625 | 50,40,049 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 42,51,825 | -25,08,900 | 18,26,792 |

| 25,900 | 41,85,225 | -22,01,625 | 45,73,764 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 73,15,500 | 18,47,175 | 80,31,582 |

| 25,700 | 81,26,925 | 28,70,625 | 50,40,049 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25722.1. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.110 against previous 1.143. The 26000CE option holds the maximum open interest, followed by the 26000PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 25800CE and 26000CE options. On the other hand, open interest reductions were prominent in the 26700CE, 25700PE, and 27200CE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,722.10 | 1.110 | 1.143 | 0.863 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,88,55,175 | 3,65,78,475 | 22,76,700 |

| PUT: | 4,31,40,750 | 4,18,14,450 | 13,26,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 53,23,575 | 3,91,200 | 1,00,933 |

| 27,000 | 40,05,075 | 2,53,425 | 64,302 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 37,42,800 | 5,16,675 | 75,158 |

| 25,800 | 16,35,450 | 4,15,650 | 34,745 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 10,36,575 | -4,00,425 | 31,593 |

| 27,200 | 5,48,775 | -1,58,175 | 10,728 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 53,23,575 | 3,91,200 | 1,00,933 |

| 26,500 | 37,42,800 | 5,16,675 | 75,158 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 48,87,975 | -65,775 | 90,196 |

| 25,000 | 45,07,800 | 74,025 | 44,218 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 39,98,850 | 2,85,600 | 58,887 |

| 25,800 | 23,57,100 | 2,54,775 | 49,087 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 13,69,200 | -1,98,150 | 32,214 |

| 25,600 | 9,55,425 | -95,025 | 18,313 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 48,87,975 | -65,775 | 90,196 |

| 25,500 | 39,98,850 | 2,85,600 | 58,887 |

BANKNIFTY Monthly Expiry (25/11/2025)

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 57776.35. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.851 against previous 0.914. The 58000PE option holds the maximum open interest, followed by the 57000PE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 60500CE option, with open interest additions also seen in the 56000PE and 60000CE options. On the other hand, open interest reductions were prominent in the 58100PE, 58000PE, and 58600CE options. Trading volume was highest in the 58000PE option, followed by the 58000CE and 58500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,776.35 | 0.851 | 0.914 | 1.065 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,23,63,645 | 1,12,61,670 | 11,01,975 |

| PUT: | 1,05,27,580 | 1,02,95,180 | 2,32,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,78,980 | -10,885 | 6,121 |

| 58,000 | 10,68,130 | 1,04,370 | 1,22,172 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 5,29,655 | 1,99,080 | 30,647 |

| 60,000 | 10,19,865 | 1,10,110 | 56,869 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,600 | 1,40,210 | -30,485 | 20,488 |

| 59,400 | 58,555 | -18,305 | 9,817 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 10,68,130 | 1,04,370 | 1,22,172 |

| 58,500 | 9,30,230 | 67,130 | 98,287 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,16,015 | -32,095 | 2,17,418 |

| 57,000 | 11,91,015 | 29,365 | 71,529 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 6,85,930 | 1,19,245 | 41,695 |

| 57,900 | 1,14,590 | 32,515 | 89,342 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,100 | 1,03,075 | -34,545 | 63,254 |

| 58,000 | 17,16,015 | -32,095 | 2,17,418 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,16,015 | -32,095 | 2,17,418 |

| 57,800 | 1,83,330 | 12,110 | 91,955 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27376. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.680 against previous 0.647. The 27500CE option holds the maximum open interest, followed by the 27500PE and 26500PE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 27900CE and 26500PE options. On the other hand, open interest reductions were prominent in the 28100CE, 28000CE, and 27600PE options. Trading volume was highest in the 27500PE option, followed by the 27500CE and 28000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,138.85 | 0.847 | 0.680 | 0.851 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,82,525 | 3,10,895 | 71,630 |

| PUT: | 3,24,025 | 2,11,510 | 1,12,515 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 70,590 | 20,865 | 2,471 |

| 29,000 | 46,475 | 27,495 | 897 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 46,475 | 27,495 | 897 |

| 27,500 | 70,590 | 20,865 | 2,471 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 9,490 | -10,595 | 602 |

| 30,000 | 19,565 | -4,940 | 196 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 70,590 | 20,865 | 2,471 |

| 28,000 | 26,390 | -2,925 | 1,839 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,730 | 26,130 | 930 |

| 27,500 | 47,645 | 8,775 | 1,520 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,730 | 26,130 | 930 |

| 25,000 | 22,230 | 15,080 | 476 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 11,570 | -2,795 | 237 |

| 27,300 | 7,605 | -1,430 | 1,367 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 47,645 | 8,775 | 1,520 |

| 27,300 | 7,605 | -1,430 | 1,367 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13467.85. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.930 against previous 1.014. The 14000CE option holds the maximum open interest, followed by the 13500CE and 13400PE options. Market participants have shown increased interest with significant open interest additions in the 14200CE option, with open interest additions also seen in the 13800CE and 14000CE options. On the other hand, open interest reductions were prominent in the 66400PE, 66400PE, and 66400CE options. Trading volume was highest in the 13500PE option, followed by the 13500CE and 14000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,467.85 | 0.930 | 1.014 | 0.936 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 52,16,960 | 38,24,660 | 13,92,300 |

| PUT: | 48,53,800 | 38,78,280 | 9,75,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,11,820 | 1,76,960 | 16,664 |

| 13,500 | 6,29,440 | 82,320 | 19,273 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,200 | 4,61,160 | 3,98,020 | 9,383 |

| 13,800 | 3,14,720 | 2,06,500 | 15,698 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 4,04,040 | -44,100 | 2,877 |

| 13,450 | 29,120 | -17,920 | 1,394 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,29,440 | 82,320 | 19,273 |

| 14,000 | 9,11,820 | 1,76,960 | 16,664 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 6,28,180 | 1,21,520 | 9,241 |

| 13,000 | 5,37,460 | 1,28,800 | 9,836 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,45,200 | 1,58,900 | 24,025 |

| 13,000 | 5,37,460 | 1,28,800 | 9,836 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 1,47,560 | -27,720 | 3,069 |

| 13,475 | 16,380 | -9,100 | 3,143 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,45,200 | 1,58,900 | 24,025 |

| 13,000 | 5,37,460 | 1,28,800 | 9,836 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Downside risk persists as shorts keep building: Open Interest Volume Analysis confirms entire index complex (NIFTY, BANKNIFTY, FINNIFTY) reflects persistent shorting with weak PCR recovery.

Actionable feedback: Avoid bottom picking till combined OI shows unwinding or reversal; safer to play with the trend and consider short-side setups on rallies.

Institutional hedges visible in premium action: Watch for a sudden OI drop or sharp up-move as the first signs of short-squeeze—a potential trigger for bulls to re-enter.

Use option data for risk management: Key levels from max pain and OI peaks (e.g., 25800 spot, 26000 in monthly NIFTY) should be central to position sizing and stop placement strategies.

Remain nimble: Open Interest Volume Analysis suggests the market can swing sharply either way after this aggressive short run-up; stay alert for a potential sentiment reversal.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]