Turning Complex Derivative Data into Clear Market Insights

What Just Happened? A Sharp Turn in Index Derivatives Trend Analysis – April 24, 2025

Table of Contents

The Indian markets witnessed a quiet expiry session on April 24, 2025, marked by heavy open interest spikes across major indices. A deeper look into the Index Derivatives Trend Analysis reveals that while the spot prices largely closed negative, MAY futures saw massive build-up in open interest, especially in NIFTY, BANKNIFTY, and MIDCPNIFTY. This sharp contrast between price action and positioning suggests a tactical shift by institutional players. Option data further supports the view that participants are hedging aggressively near max pain levels, with unusual buildup seen at higher strike prices, potentially signaling an anticipation of a bounce or range-bound expiry.

Index Derivatives Trend | NSE & BSE

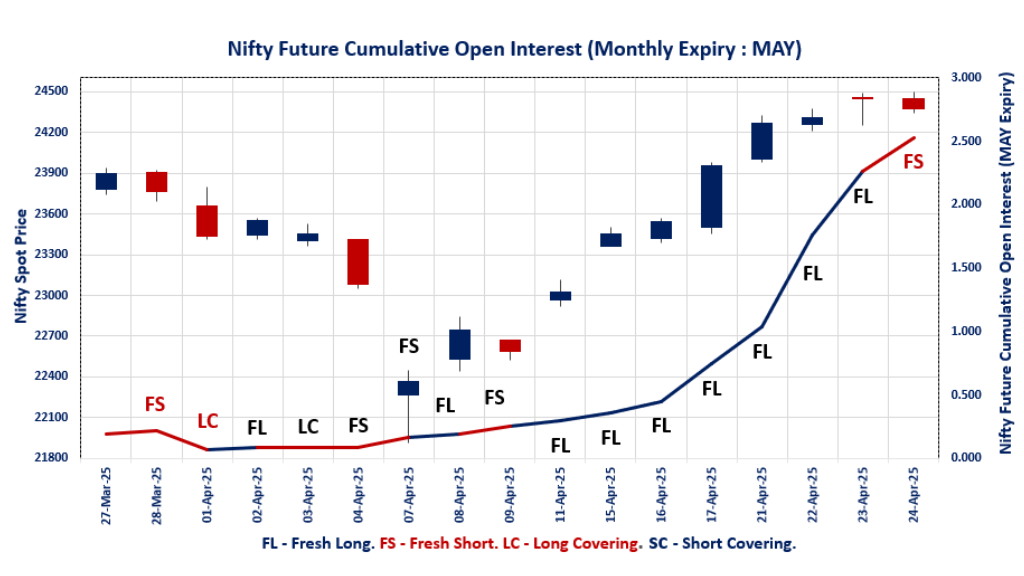

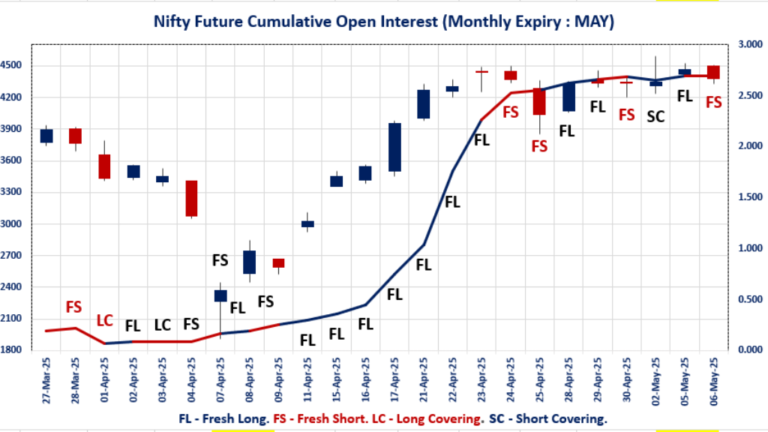

NIFTY may Future

NIFTY Spot closed at: 24,246.70 (-0.34%)

NIFTY April Future closed at: 24,373.00 (0.25%)

Premium: 126.3 (Increased by 142.55 points)

Open Interest Change: 107.3%

Volume Change: -23.0%

NIFTY Weekly Expiry (30/04/2025) Option Analysis

Put-Call Ratio (OI): 0.814 (Decreased from 0.926)

Put-Call Ratio (Volume): 0.900

Max Pain Level: 24200

Maximum CALL OI: 25500

Maximum PUT OI: 24000

Highest CALL Addition: 26100

Highest PUT Addition: 23500

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.500 (Decreased from 1.539)

Put-Call Ratio (Volume): 1.183

Max Pain Level: 24000

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,201.40 (-0.30%)

BANKNIFTY April Future closed at: 55,326.40 (-0.13%)

Premium: 125 (Increased by 94.45 points)

Open Interest Change: 111.3%

Volume Change: 4.8%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.127 (Decreased from 1.239)

Put-Call Ratio (Volume): 1.286

Max Pain Level: 54000

Maximum CALL OI: 53000

Maximum PUT OI: 53000

Highest CALL Addition: 55500

Highest PUT Addition: 55500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,305.65 (-0.53%)

FINNIFTY April Future closed at: 26,368.90 (-0.32%)

Premium: 63.25 (Increased by 55.65 points)

Open Interest Change: 2.0%

Volume Change: 12.1%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.985 (Increased from 0.940)

Put-Call Ratio (Volume): 1.034

Max Pain Level: 26500

Maximum CALL OI: 26500

Maximum PUT OI: 26500

Highest CALL Addition: 26500

Highest PUT Addition: 26500

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,243.05 (-0.19%)

MIDCPNIFTY April Future closed at: 12,268.10 (0.09%)

Premium: 25.05 (Increased by 34.45 points)

Open Interest Change: 294.5%

Volume Change: -8.0%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.937 (Increased from 0.801)

Put-Call Ratio (Volume): 0.781

Max Pain Level: 12200

Maximum CALL OI: 13000

Maximum PUT OI: 11000

Highest CALL Addition: 13000

Highest PUT Addition: 12300

SENSEX Weekly Expiry (29.04.25) Future

SENSEX Spot closed at: 79,801.43 (-0.39%)

SENSEX Weekly Future closed at: 79,829.25 (-0.39%)

Premium: 27.82 (Increased by 4.61 points)

Open Interest Change: -2.8%

Volume Change: -46.6%

SENSEX Weekly Expiry (29/04/2025) Option Analysis

Put-Call Ratio (OI): 0.663 (Decreased from 0.792)

Put-Call Ratio (Volume): 0.842

Max Pain Level: 79800

Maximum CALL OI: 83000

Maximum PUT OI: 75000

Highest CALL Addition: 82000 Highest PUT Addition: 75000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 8,250.53 Cr

DIIs Net Sell: ₹ 534.54 Cr

FII Derivatives Activity

| FII Trading Stats | 24.04.25 | 23.04.25 | 22.04.25 |

| FII Cash (Provisional Data) | 8,250.53 | 3,332.93 | 1,290.43 |

| Index Future Open Interest Long Ratio | 40.86% | 33.04% | 31.60% |

| Index Future Volume Long Ratio | 53.13% | 53.10% | 49.59% |

| Call Option Open Interest Long Ratio | 66.97% | 53.67% | 54.64% |

| Call Option Volume Long Ratio | 49.88% | 49.95% | 49.92% |

| Put Option Open Interest Long Ratio | 63.08% | 52.32% | 54.39% |

| Put Option Volume Long Ratio | 50.03% | 49.77% | 49.92% |

| Stock Future Open Interest Long Ratio | 64.17% | 64.92% | 64.27% |

| Stock Future Volume Long Ratio | 51.52% | 51.04% | 49.92% |

| Index Futures | Short Covering | Short Covering | Fresh Short |

| Index Options | Long Covering | Fresh Short | Fresh Short |

| Nifty Futures | Short Covering | Short Covering | Long Covering |

| Nifty Options | Long Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Short Covering | Fresh Long |

| BankNifty Options | Short Covering | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Fresh Long |

| FinNifty Options | Long Covering | Fresh Short | Fresh Long |

| MidcpNifty Futures | Long Covering | Short Covering | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Options | Long Covering | Short Covering | Long Covering |

| Stock Futures | Short Covering | Fresh Long | Fresh Long |

| Stock Options | Long Covering | Fresh Short | Fresh Short |

NSE & BSE Options Analysis | Options Insights

NIFTY Weekly Expiry (30.04.2025)

The NIFTY index closed at 24246.7. The NIFTY weekly expiry for April 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.814 against previous 0.926. The 25500CE option holds the maximum open interest, followed by the 25000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 25500CE and 26000CE options. On the other hand, open interest reductions were prominent in the 23750PE, 23700CE, and 22700CE options. Trading volume was highest in the 24300PE option, followed by the 24300CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 30-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,246.70 | 0.814 | 0.926 | 0.900 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,51,96,800 | 4,08,95,025 | 3,43,01,775 |

| PUT: | 6,12,28,275 | 3,78,85,200 | 2,33,43,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 62,15,025 | 32,61,150 | 2,22,430 |

| 25,000 | 58,51,575 | 18,83,100 | 2,61,238 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 40,92,525 | 40,92,525 | 1,25,374 |

| 25,500 | 62,15,025 | 32,61,150 | 2,22,430 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 3,01,050 | -68,850 | 4,301 |

| 22,700 | 77,625 | -26,700 | 511 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 31,82,550 | 14,61,975 | 2,98,075 |

| 25,000 | 58,51,575 | 18,83,100 | 2,61,238 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 43,17,675 | 14,50,875 | 2,83,307 |

| 23,000 | 40,53,000 | 14,51,925 | 1,32,289 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 37,42,575 | 17,74,500 | 1,42,861 |

| 22,000 | 32,96,100 | 16,61,250 | 1,05,578 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,750 | 5,40,675 | -1,05,375 | 40,722 |

| 23,450 | 1,37,550 | -12,525 | 11,585 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 25,95,750 | 9,69,750 | 3,18,922 |

| 24,000 | 43,17,675 | 14,50,875 | 2,83,307 |

SENSEX Weekly Expiry (29.04.2025)

The SENSEX index closed at 79801.43. The SENSEX weekly expiry for April 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.663 against previous 0.792. The 83000CE option holds the maximum open interest, followed by the 82000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 82000CE option, with open interest additions also seen in the 83000CE and 75000PE options. On the other hand, open interest reductions were prominent in the 69000PE, 80100PE, and 80200PE options. Trading volume was highest in the 80000CE option, followed by the 80000PE and 79900PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 79801.43 | 0.663 | 0.792 | 0.842 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 94,24,580 | 47,42,529 | 46,82,051 |

| PUT: | 62,52,980 | 37,53,760 | 24,99,220 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,70,700 | 3,87,020 | 35,08,700 |

| 82000 | 6,66,280 | 4,91,800 | 31,97,380 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 6,66,280 | 4,91,800 | 31,97,380 |

| 83000 | 7,70,700 | 3,87,020 | 35,08,700 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84100 | 28,000 | -8,640 | 3,89,460 |

| 86900 | 87,040 | -8,080 | 4,12,040 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,98,680 | 1,58,020 | 65,61,400 |

| 79900 | 1,78,000 | 1,18,020 | 42,92,960 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 4,62,040 | 2,99,040 | 22,54,220 |

| 77000 | 3,38,400 | 1,16,440 | 15,90,880 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 4,62,040 | 2,99,040 | 22,54,220 |

| 74000 | 3,38,160 | 1,88,060 | 17,44,960 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 69000 | 93,440 | -53,260 | 6,39,360 |

| 80100 | 53,800 | -20,720 | 23,54,280 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,24,540 | 59,420 | 64,77,620 |

| 79900 | 1,28,080 | 58,640 | 47,13,720 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55201.4. The BANKNIFTY monthly expiry for May 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.127 against previous 1.239. The 53000PE option holds the maximum open interest, followed by the 53000CE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 55500PE and 63000CE options. On the other hand, open interest reductions were prominent in the 55800PE, 50500PE, and 52900CE options. Trading volume was highest in the 55500CE option, followed by the 55000PE and 55500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,201.40 | 1.127 | 1.239 | 1.286 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,07,28,360 | 73,81,989 | 33,46,371 |

| PUT: | 1,20,92,100 | 91,48,770 | 29,43,330 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 12,94,290 | 22,080 | 6,274 |

| 55,500 | 8,70,270 | 4,79,670 | 58,929 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,70,270 | 4,79,670 | 58,929 |

| 63,000 | 4,21,440 | 3,03,990 | 24,778 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,900 | 7,230 | -1,680 | 93 |

| 53,100 | 8,640 | -780 | 118 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,70,270 | 4,79,670 | 58,929 |

| 56,000 | 5,90,640 | 1,15,140 | 37,073 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 17,32,140 | 2,34,840 | 42,532 |

| 54,000 | 9,06,300 | 2,88,240 | 46,103 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,54,110 | 3,49,140 | 54,704 |

| 54,000 | 9,06,300 | 2,88,240 | 46,103 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,800 | 21,180 | -4,740 | 1,749 |

| 50,500 | 1,33,950 | -1,800 | 4,589 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,55,250 | 1,48,830 | 58,514 |

| 55,500 | 7,54,110 | 3,49,140 | 54,704 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24246.7. The NIFTY monthly expiry for May 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.500 against previous 1.539. The 24000PE option holds the maximum open interest, followed by the 24500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 24500CE and 26000CE options. On the other hand, open interest reductions were prominent in the 21300PE, 23500CE, and 21700PE options. Trading volume was highest in the 24000PE option, followed by the 24500CE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,246.70 | 1.500 | 1.539 | 1.183 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,36,29,500 | 2,05,57,725 | 30,71,775 |

| PUT: | 3,54,33,675 | 3,16,47,600 | 37,86,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 32,40,600 | 5,17,050 | 40,687 |

| 24,000 | 27,57,675 | 2,62,425 | 20,055 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 32,40,600 | 5,17,050 | 40,687 |

| 26,000 | 4,05,375 | 4,05,375 | 12,019 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 12,71,550 | -40,575 | 4,310 |

| 23,300 | 1,35,225 | -20,400 | 832 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 32,40,600 | 5,17,050 | 40,687 |

| 25,000 | 21,99,150 | 20,925 | 37,248 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 37,66,650 | 5,43,300 | 41,964 |

| 23,000 | 31,84,575 | 2,74,275 | 22,829 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 37,66,650 | 5,43,300 | 41,964 |

| 22,000 | 25,34,700 | 3,63,375 | 20,045 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,300 | 1,05,075 | -42,825 | 1,653 |

| 21,700 | 1,60,650 | -21,225 | 962 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 37,66,650 | 5,43,300 | 41,964 |

| 23,500 | 27,73,050 | 81,075 | 24,774 |

Nifty Big Premium Signaling a Trap or a Tactical Build-Up?

The spike in open interest across NIFTY, BANKNIFTY, and MIDCPNIFTY despite price drops should be traded cautiously. While NIFTY premium surge and 100%+ OI rise might tempt bulls, the falling PCR suggests caution. BANKNIFTY and MIDCPNIFTY are seeing smart money building complex strategies around max pain levels. With max pain zones tightening and straddles dominating the mid-week landscape, expect volatile, range-bound action unless key levels break. NIFTY witnessed maximum PUT built-up near 24000 – 23500 levels suggesting probable support range.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]