Turning Complex Derivative Data into Clear Market Insights

Index Future & Option Chain Analysis For 2/06/2025: Is Nifty’s 24,700 Support at Risk?

Table of Contents

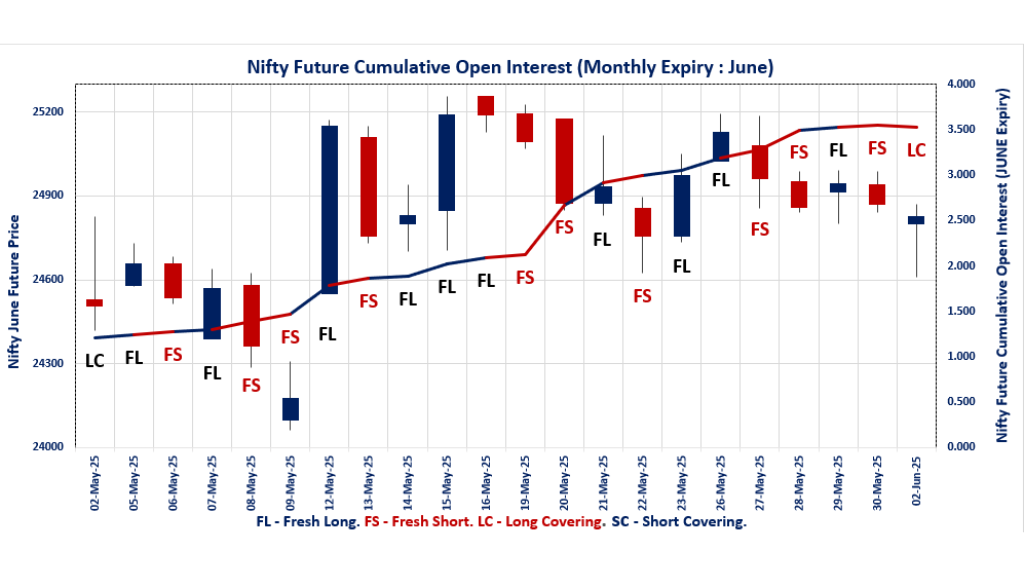

The Index Future & Option Chain Analysis on 2nd June 2025 revealed heightened caution as NIFTY Future slid to 24,826.30 (-0.18%) amid a shrinking premium (-10.8 points) and long unwinding (-2.7% OI). BANKNIFTY Future struggled at 56,180.40 (+0.19%), but a PCR (OI) drop to 1.000 and max pain shift to 81,300 signaled institutional skepticism. NIFTY’s weekly PCR (OI) rebounded to 0.676, heavy PUT Open Interest at 24,000 and PUT additions at 24,500 highlighted a 24,000–24,500 battleground. MIDCPNIFTY’s PCR surge to 1.170 and max pain at 12,725 hinted at midcap resilience, while FIIs’ net short positions in index futures amplified downside risks. Let’s decode these critical F&O market signals shaping June’s trajectory.

NSE & BSE Index Future & Option Chain Analysis

NIFTY JUNE Future

NIFTY Spot closed at: 24,716.60 (-0.14%)

NIFTY JUNE Future closed at: 24,826.30 (-0.18%)

Premium: 109.7 (Decreased by -10.8 points)

Open Interest Change: -2.7%

Volume Change: 33.9%

NIFTY Weekly Expiry (05/06/2025) Option Analysis

Put-Call Ratio (OI): 0.676 (Increased from 0.580)

Put-Call Ratio (Volume): 0.745

Max Pain Level: 24700

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 25700

Highest PUT Addition: 24500

NIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.097 (Decreased from 1.119)

Put-Call Ratio (Volume): 0.764

Max Pain Level: 24800

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 26300

Highest PUT Addition: 21000

BANKNIFTY JUNE Future

BANKNIFTY Spot closed at: 55,903.40 (0.28%)

BANKNIFTY JUNE Future closed at: 56,180.40 (0.19%)

Premium: 277 (Decreased by -49.7 points)

Open Interest Change: 0.1%

Volume Change: -3.0%

BANKNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.000 (Decreased from 1.016)

Put-Call Ratio (Volume): 0.802

Max Pain Level: 55700

Maximum CALL OI: 56000

Maximum PUT OI: 56000

Highest CALL Addition: 61000

Highest PUT Addition: 56000

FINNIFTY JUNE Future

FINNIFTY Spot closed at: 26,448.40 (-0.19%)

FINNIFTY JUNE Future closed at: 26,602.10 (-0.22%)

Premium: 153.7 (Decreased by -7.15 points)

Open Interest Change: 29.4%

Volume Change: 29.1%

FINNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.780 (Increased from 0.775)

Put-Call Ratio (Volume): 0.625

Max Pain Level: 26450

Maximum CALL OI: 27500

Maximum PUT OI: 25500

Highest CALL Addition: 26500

Highest PUT Addition: 26500

MIDCPNIFTY JUNE Future

MIDCPNIFTY Spot closed at: 12,771.00 (0.46%)

MIDCPNIFTY JUNE Future closed at: 12,817.30 (0.34%)

Premium: 46.3 (Decreased by -14.8 points)

Open Interest Change: -0.6%

Volume Change: -12.1%

MIDCPNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.170 (Increased from 1.103)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 12725

Maximum CALL OI: 14000

Maximum PUT OI: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 12750

SENSEX Weekly Expiry (03/06/2025) Future

SENSEX Spot closed at: 81,373.75 (-0.09%)

SENSEX Weekly Future closed at: 81,334.95 (-0.21%)

Discount: -38.8 (Decreased by -90.94 points)

Open Interest Change: 17.2%

Volume Change: 145.9%

SENSEX Weekly Expiry (03/06/2025) Option Analysis

Put-Call Ratio (OI): 0.718 (Increased from 0.714)

Put-Call Ratio (Volume): 0.723

Max Pain Level: 81500

Maximum CALL OI: 84000

Maximum PUT OI: 79000

Highest CALL Addition: 84000

Highest PUT Addition: 79000

FII & DII Cash Market Activity

FIIs Net Sell: ₹ 2,589.47 Cr

DIIs Net Buy: ₹ 5,313.76 Cr

FII Derivatives Activity

| FII Trading Stats | 2.06.25 | 30.05.25 | 29.05.25 |

| FII Cash (Provisional Data) | -2,589.47 | -6,449.74 | 884.03 |

| Index Future Open Interest Long Ratio | 18.73% | 19.23% | 19.71% |

| Index Future Volume Long Ratio | 43.93% | 43.14% | 42.74% |

| Call Option Open Interest Long Ratio | 61.47% | 58.91% | 56.40% |

| Call Option Volume Long Ratio | 50.71% | 50.92% | 50.06% |

| Put Option Open Interest Long Ratio | 64.62% | 61.55% | 61.52% |

| Put Option Volume Long Ratio | 51.03% | 50.64% | 49.91% |

| Stock Future Open Interest Long Ratio | 64.11% | 64.00% | 63.95% |

| Stock Future Volume Long Ratio | 50.59% | 49.34% | 49.11% |

| Index Futures | Fresh Short | Fresh Short | Long Covering |

| Index Options | Fresh Long | Fresh Long | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Long Covering |

| Nifty Options | Fresh Long | Fresh Long | Short Covering |

| BankNifty Futures | Fresh Short | Fresh Short | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Long Covering |

| FinNifty Futures | Fresh Long | Fresh Long | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Futures | Short Covering | Short Covering | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Long Covering |

| NiftyNxt50 Futures | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Long Covering |

| Stock Futures | Short Covering | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Long Covering |

NSE & BSE Future & Option Chain Analysis

SENSEX Weekly Expiry (03/06/2025)

The SENSEX index closed at 81373.75. The SENSEX weekly expiry for JUNE 03, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.718 against previous 0.714. The 84000CE option holds the maximum open interest, followed by the 83000CE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 83000CE and 79000PE options. On the other hand, open interest reductions were prominent in the 86000CE, 70000PE, and 81500PE options. Trading volume was highest in the 83000CE option, followed by the 82500CE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 03-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81373.75 | 0.718 | 0.714 | 0.723 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,59,74,160 | 1,69,20,949 | 90,53,211 |

| PUT: | 1,86,56,640 | 1,20,79,320 | 65,77,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 21,56,700 | 10,54,360 | 2,31,54,380 |

| 83000 | 16,54,120 | 8,79,660 | 6,70,40,880 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 21,56,700 | 10,54,360 | 2,31,54,380 |

| 83000 | 16,54,120 | 8,79,660 | 6,70,40,880 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 6,86,880 | -3,44,980 | 36,77,600 |

| 87000 | 5,52,500 | -1,43,600 | 18,55,720 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 16,54,120 | 8,79,660 | 6,70,40,880 |

| 82500 | 10,80,660 | 6,64,280 | 4,54,40,580 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 15,39,700 | 8,25,300 | 3,31,01,600 |

| 78000 | 13,62,740 | 5,45,040 | 1,36,80,940 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 15,39,700 | 8,25,300 | 3,31,01,600 |

| 78000 | 13,62,740 | 5,45,040 | 1,36,80,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 70000 | 4,13,320 | -1,75,340 | 16,90,780 |

| 81500 | 8,65,960 | -1,60,580 | 60,90,720 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 8,86,220 | 4,35,100 | 4,43,04,320 |

| 79000 | 15,39,700 | 8,25,300 | 3,31,01,600 |

NIFTY Weekly Expiry (05/06/2025)

The NIFTY index closed at 24716.6. The NIFTY weekly expiry for JUNE 5, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.676 against previous 0.580. The 26000CE option holds the maximum open interest, followed by the 26800CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 25700CE and 24600PE options. On the other hand, open interest reductions were prominent in the 26800CE, 24800PE, and 26500CE options. Trading volume was highest in the 25000CE option, followed by the 24600PE and 24700CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 05-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,716.60 | 0.676 | 0.580 | 0.745 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,46,77,875 | 14,33,06,475 | 2,13,71,400 |

| PUT: | 11,13,91,725 | 8,30,48,625 | 2,83,43,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,30,91,850 | 22,92,525 | 9,80,421 |

| 26,800 | 1,21,80,150 | -13,36,725 | 5,94,335 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 75,65,850 | 27,36,000 | 6,99,011 |

| 25,600 | 56,95,650 | 24,90,750 | 6,93,862 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,21,80,150 | -13,36,725 | 5,94,335 |

| 26,500 | 94,30,575 | -9,42,750 | 4,54,548 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 86,55,525 | 10,57,875 | 19,41,820 |

| 24,700 | 38,82,450 | 20,31,000 | 16,91,495 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 77,57,850 | 20,88,900 | 13,33,562 |

| 24,500 | 67,63,425 | 28,61,175 | 16,32,043 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 67,63,425 | 28,61,175 | 16,32,043 |

| 24,600 | 53,93,550 | 27,23,100 | 17,62,891 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 35,52,750 | -11,04,075 | 4,95,785 |

| 22,300 | 17,89,425 | -8,21,775 | 1,81,030 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 53,93,550 | 27,23,100 | 17,62,891 |

| 24,500 | 67,63,425 | 28,61,175 | 16,32,043 |

NIFTY Monthly Expiry (26/06/2025)

The NIFTY index closed at 24716.6. The NIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.097 against previous 1.119. The 26000CE option holds the maximum open interest, followed by the 24000PE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 26300CE option, with open interest additions also seen in the 26000CE and 21000PE options. On the other hand, open interest reductions were prominent in the 30000CE, 24000PE, and 25000PE options. Trading volume was highest in the 26000CE option, followed by the 25000CE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,716.60 | 1.097 | 1.119 | 0.764 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,35,66,775 | 4,06,75,025 | 28,91,750 |

| PUT: | 4,77,77,800 | 4,55,03,875 | 22,73,925 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 52,49,650 | 4,69,400 | 90,130 |

| 25,000 | 47,88,450 | 2,94,675 | 80,929 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 11,04,150 | 5,89,725 | 26,038 |

| 26,000 | 52,49,650 | 4,69,400 | 90,130 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 30,000 | 33,54,075 | -2,59,050 | 21,726 |

| 24,000 | 15,69,550 | -43,800 | 7,134 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 52,49,650 | 4,69,400 | 90,130 |

| 25,000 | 47,88,450 | 2,94,675 | 80,929 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,71,500 | -1,97,625 | 55,528 |

| 24,500 | 43,02,000 | 1,22,325 | 51,637 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 27,19,175 | 4,10,125 | 15,242 |

| 23,500 | 25,65,675 | 3,51,525 | 36,674 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,71,500 | -1,97,625 | 55,528 |

| 25,000 | 33,78,575 | -1,29,525 | 35,385 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,71,500 | -1,97,625 | 55,528 |

| 24,500 | 43,02,000 | 1,22,325 | 51,637 |

BANKNIFTY Monthly Expiry (26/06/2025)

The BANKNIFTY index closed at 55903.4. The BANKNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.000 against previous 1.016. The 56000CE option holds the maximum open interest, followed by the 56000PE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 61000CE option, with open interest additions also seen in the 56000PE and 57000CE options. On the other hand, open interest reductions were prominent in the 49500PE, 61500CE, and 49000PE options. Trading volume was highest in the 56000CE option, followed by the 55500PE and 57000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,903.40 | 1.000 | 1.016 | 0.802 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,28,85,810 | 1,13,76,210 | 15,09,600 |

| PUT: | 1,28,89,110 | 1,15,55,169 | 13,33,941 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 20,22,450 | 1,03,590 | 1,66,043 |

| 60,000 | 8,57,700 | 42,480 | 86,139 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 61,000 | 4,97,940 | 1,63,770 | 41,075 |

| 57,000 | 8,07,930 | 1,45,140 | 1,12,208 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,500 | 1,15,740 | -19,650 | 14,878 |

| 55,700 | 1,16,460 | -17,190 | 60,322 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 20,22,450 | 1,03,590 | 1,66,043 |

| 57,000 | 8,07,930 | 1,45,140 | 1,12,208 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,56,120 | 1,53,240 | 87,872 |

| 55,000 | 10,76,520 | 88,110 | 89,244 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,56,120 | 1,53,240 | 87,872 |

| 53,000 | 6,95,220 | 1,03,050 | 70,309 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 49,500 | 1,75,260 | -40,620 | 8,143 |

| 49,000 | 2,54,880 | -19,530 | 10,758 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 6,50,700 | 1,02,960 | 1,20,652 |

| 55,000 | 10,76,520 | 88,110 | 89,244 |

FINNIFTY Monthly Expiry (26/06/2025)

The FINNIFTY index closed at 26448.4. The FINNIFTY monthly expiry for JUNE 26, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.780 against previous 0.775. The 27500CE option holds the maximum open interest, followed by the 25500PE and 29500CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 26500PE and 24000PE options. On the other hand, open interest reductions were prominent in the 27500CE, 26450CE, and 26600PE options. Trading volume was highest in the 27200CE option, followed by the 26500CE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,448.40 | 0.780 | 0.775 | 0.625 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,06,935 | 3,70,175 | 1,36,760 |

| PUT: | 3,95,265 | 2,87,040 | 1,08,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 70,525 | -28,210 | 3,267 |

| 29,500 | 50,180 | 8,060 | 871 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 46,605 | 22,750 | 4,265 |

| 27,200 | 22,100 | 18,200 | 5,450 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 70,525 | -28,210 | 3,267 |

| 26,450 | 9,945 | -7,085 | 844 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 22,100 | 18,200 | 5,450 |

| 26,500 | 46,605 | 22,750 | 4,265 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 60,840 | 3,120 | 2,494 |

| 26,500 | 46,930 | 22,165 | 2,935 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 46,930 | 22,165 | 2,935 |

| 24,000 | 37,895 | 18,330 | 859 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 10,920 | -1,625 | 690 |

| 26,200 | 22,100 | -1,365 | 1,734 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 46,930 | 22,165 | 2,935 |

| 25,500 | 60,840 | 3,120 | 2,494 |

MIDCPNIFTY Monthly Expiry (26/06/2025)

The MIDCPNIFTY index closed at 12771. The MIDCPNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.170 against previous 1.103. The 12000PE option holds the maximum open interest, followed by the 14000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12750PE option, with open interest additions also seen in the 12700PE and 12000PE options. On the other hand, open interest reductions were prominent in the 67200CE, 67200CE, and 60300CE options. Trading volume was highest in the 12800CE option, followed by the 12700PE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,771.00 | 1.170 | 1.103 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 21,49,320 | 17,12,040 | 4,37,280 |

| PUT: | 25,14,480 | 18,88,440 | 6,26,040 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 3,22,560 | 11,160 | 2,064 |

| 13,500 | 2,52,720 | 24,600 | 4,598 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,83,600 | 89,040 | 11,130 |

| 14,300 | 83,880 | 68,400 | 806 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 1,36,560 | -16,440 | 8,083 |

| 12,725 | 16,200 | -7,080 | 2,415 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,83,600 | 89,040 | 11,130 |

| 13,000 | 2,26,440 | 36,360 | 8,325 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 3,64,200 | 98,880 | 6,666 |

| 11,500 | 2,50,680 | 11,160 | 3,444 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,750 | 1,44,600 | 1,10,160 | 4,356 |

| 12,700 | 2,33,040 | 1,01,040 | 10,290 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 1,70,040 | -50,640 | 1,881 |

| 12,725 | 87,120 | -16,680 | 2,876 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,33,040 | 1,01,040 | 10,290 |

| 12,500 | 2,47,080 | 78,960 | 6,942 |

Conclusion : What the Future & Option Chain Analysis Tells Us

The 2nd June F&O data underscores a fragile market equilibrium: NIFTY’s 24,700 spot Technical support faces a litmus test, with bears targeting 24,500 if the 24,700–24,800 zone breaks. BANKNIFTY witnessing highest CALL & PUT Open Interest at 56,000 level with heavy CALL writing as the PCR declines. Next resistance at 61,000. Sustenance below Max Pain at 55,700 will result in more PUT unwinding. MIDCPNIFTY’s 12,725 max pain and FINNIFTY’s 26,450 support favor selective midcap/financial strategies, while Sensex pointing to a range of 79,000 – 84,000 zones. Traders should hedge with 24,500 PUT in Nifty and 55,700 PUT in BANKNIFTY, tracking PCR swings and institutional activity. As June expiry nears, F&O market signals—max pain shifts, sectoral divergences, and premium trends—will dictate whether bulls defend key supports or cede ground to bears.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]