Turning Complex Derivative Data into Clear Market Insights

Is a Market Crash Looming? Index Future & Option Chain Analysis For 3/06/2025

Table of Contents

The Index Future & Option Chain Analysis on 3rd June 2025 flashed alarming signals as Nifty futures slumped to 24,675.30 (-0.61%), with spot closing below 24,600 (-0.70%) amid aggressive call writing at 25,500 and a weekly PCR (OI) crash to 0.497. BankNifty futures mirrored the selloff, closing at 55,931.00 (-0.44%) with monthly PCR (OI) plunging to 0.830, reflecting bearish call accumulation. Nifty’s max pain held at 24,800, but FIIs slashed Index Future long positions to 16.67%, while MIDCPNIFTY’s premium surge (+5.05 points) hinted at fleeting midcap resilience. With global trade tensions and RBI policy ahead, let’s decode whether these Future & Option trends foreshadow a deeper correction.

NSE Index Future & Option Chain Analysis

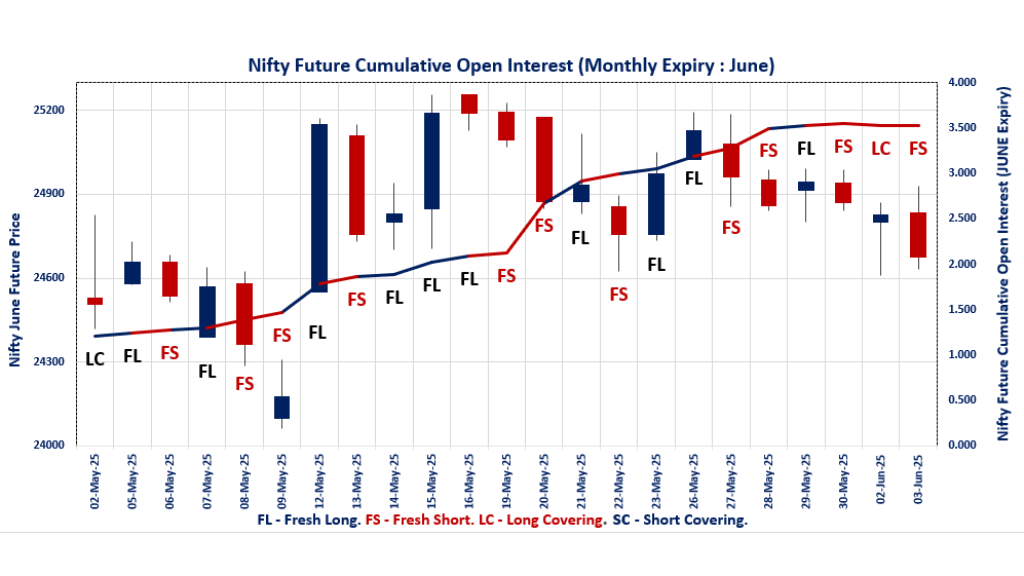

NIFTY JUNE Future

NIFTY Spot closed at: 24,542.50 (-0.70%)

NIFTY JUNE Future closed at: 24,675.30 (-0.61%)

Premium: 132.8 (Increased by 23.1 points)

Open Interest Change: 0.5%

Volume Change: 13.4%

NIFTY Weekly Expiry (05/06/2025) Option Analysis

Put-Call Ratio (OI): 0.497 (Decreased from 0.676)

Put-Call Ratio (Volume): 0.822

Max Pain Level: 24600

Maximum CALL OI: 25500

Maximum PUT OI: 24000

Highest CALL Addition: 25500

Highest PUT Addition: 22250

NIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.043 (Decreased from 1.097)

Put-Call Ratio (Volume): 0.858

Max Pain Level: 24800

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24500

BANKNIFTY JUNE Future

BANKNIFTY Spot closed at: 55,599.95 (-0.54%)

BANKNIFTY JUNE Future closed at: 55,931.00 (-0.44%)

Premium: 331.05 (Increased by 54.05 points)

Open Interest Change: 5.9%

Volume Change: 8.4%

BANKNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.830 (Decreased from 1.001)

Put-Call Ratio (Volume): 0.892

Max Pain Level: 55600

Maximum CALL OI: 56000

Maximum PUT OI: 56000

Highest CALL Addition: 63000

Highest PUT Addition: 40500

FINNIFTY JUNE Future

FINNIFTY Spot closed at: 26,254.95 (-0.73%)

FINNIFTY JUNE Future closed at: 26,423.80 (-0.67%)

Premium: 168.85 (Increased by 15.15 points)

Open Interest Change: 5.1%

Volume Change: -25.6%

FINNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.636 (Decreased from 0.780)

Put-Call Ratio (Volume): 0.920

Max Pain Level: 26400

Maximum CALL OI: 27500

Maximum PUT OI: 26500

Highest CALL Addition: 27500

Highest PUT Addition: 26500

MIDCPNIFTY JUNE Future

MIDCPNIFTY Spot closed at: 12,688.60 (-0.65%)

MIDCPNIFTY JUNE Future closed at: 12,739.95 (-0.60%)

Premium: 51.35 (Increased by 5.05 points)

Open Interest Change: -1.6%

Volume Change: -3.9%

MIDCPNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 1.014 (Decreased from 1.170)

Put-Call Ratio (Volume): 1.141

Max Pain Level: 12700

Maximum CALL OI: 14000

Maximum PUT OI: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12500

FII & DII Cash Market Activity

FIIs Net Sell: ₹ 2,853.83 Cr

DIIs Net Buy: ₹ 5,907.97 Cr

FII Derivatives Activity

| FII Trading Stats | 3.06.25 | 2.06.25 | 30.05.25 |

| FII Cash (Provisional Data) | -2,853.83 | -2,589.47 | -6,449.74 |

| Index Future Open Interest Long Ratio | 16.67% | 18.73% | 19.23% |

| Index Future Volume Long Ratio | 36.67% | 43.93% | 43.14% |

| Call Option Open Interest Long Ratio | 56.27% | 61.47% | 58.91% |

| Call Option Volume Long Ratio | 49.43% | 50.71% | 50.92% |

| Put Option Open Interest Long Ratio | 59.43% | 64.62% | 61.55% |

| Put Option Volume Long Ratio | 49.53% | 51.03% | 50.64% |

| Stock Future Open Interest Long Ratio | 63.69% | 64.11% | 64.00% |

| Stock Future Volume Long Ratio | 46.42% | 50.59% | 49.34% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Short Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE Future & Option Chain Analysis : Options Insights

NIFTY Weekly Expiry (05/06/2025)

The NIFTY index closed at 24542.5. The NIFTY weekly expiry for JUNE 5, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.497 against previous 0.676. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 24600CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24100PE, 24500PE, and 25700CE options. Trading volume was highest in the 24600PE option, followed by the 25000CE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 05-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,542.50 | 0.497 | 0.676 | 0.822 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 23,16,91,725 | 16,46,77,875 | 6,70,13,850 |

| PUT: | 11,50,49,625 | 11,13,91,725 | 36,57,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,61,61,300 | 68,61,825 | 15,04,009 |

| 26,000 | 1,51,82,250 | 20,90,400 | 9,23,308 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,61,61,300 | 68,61,825 | 15,04,009 |

| 24,600 | 75,59,175 | 53,72,700 | 16,51,606 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 66,85,650 | -8,80,200 | 8,29,608 |

| 26,600 | 17,02,875 | -2,28,600 | 1,39,464 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,32,46,875 | 45,91,350 | 20,84,406 |

| 24,700 | 72,60,225 | 33,77,775 | 19,90,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 76,06,725 | -1,51,125 | 16,76,893 |

| 23,500 | 70,29,225 | 3,58,425 | 6,95,945 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,250 | 62,54,175 | 22,89,600 | 3,50,058 |

| 22,300 | 32,50,875 | 14,61,450 | 2,08,889 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 21,79,575 | -14,32,650 | 8,42,357 |

| 24,500 | 54,29,775 | -13,33,650 | 20,24,820 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 56,51,250 | 2,57,700 | 20,90,811 |

| 24,500 | 54,29,775 | -13,33,650 | 20,24,820 |

NIFTY Monthly Expiry (26/06/2025)

The NIFTY index closed at 24542.5. The NIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.043 against previous 1.097. The 26000CE option holds the maximum open interest, followed by the 25000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 26500CE and 24500PE options. On the other hand, open interest reductions were prominent in the 25000PE, 23200PE, and 22000CE options. Trading volume was highest in the 25000CE option, followed by the 26000CE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,542.50 | 1.043 | 1.097 | 0.858 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,75,11,425 | 4,35,66,775 | 39,44,650 |

| PUT: | 4,95,45,250 | 4,77,77,800 | 17,67,450 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 55,99,150 | 3,49,500 | 83,573 |

| 25,000 | 54,34,775 | 6,46,325 | 93,713 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,34,775 | 6,46,325 | 93,713 |

| 26,500 | 22,37,475 | 4,53,900 | 35,692 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 9,72,000 | -47,775 | 802 |

| 24,850 | 2,35,575 | -29,325 | 5,199 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,34,775 | 6,46,325 | 93,713 |

| 26,000 | 55,99,150 | 3,49,500 | 83,573 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 51,01,775 | 30,275 | 59,893 |

| 24,500 | 47,04,825 | 4,02,825 | 67,305 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 47,04,825 | 4,02,825 | 67,305 |

| 24,700 | 10,77,150 | 2,82,150 | 38,655 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 32,18,600 | -1,59,975 | 41,336 |

| 23,200 | 3,60,375 | -50,025 | 5,522 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 47,04,825 | 4,02,825 | 67,305 |

| 24,000 | 51,01,775 | 30,275 | 59,893 |

BANKNIFTY Monthly Expiry (26/06/2025)

The BANKNIFTY index closed at 55599.95. The BANKNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.830 against previous 1.001. The 56000CE option holds the maximum open interest, followed by the 56000PE and 63000CE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 63500CE and 56000CE options. On the other hand, open interest reductions were prominent in the 55500PE, 54000PE, and 55600PE options. Trading volume was highest in the 56000CE option, followed by the 56000PE and 55500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,599.95 | 0.830 | 1.001 | 0.892 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,52,74,710 | 1,28,72,889 | 24,01,821 |

| PUT: | 1,26,75,360 | 1,28,89,110 | -2,13,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 22,17,990 | 1,95,540 | 1,61,307 |

| 63,000 | 11,27,400 | 4,04,160 | 51,220 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 11,27,400 | 4,04,160 | 51,220 |

| 63,500 | 3,21,000 | 3,21,000 | 22,650 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 5,99,880 | -25,470 | 15,872 |

| 58,200 | 48,450 | -10,950 | 7,706 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 22,17,990 | 1,95,540 | 1,61,307 |

| 57,000 | 9,25,950 | 1,18,020 | 93,175 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,37,670 | -18,450 | 1,15,488 |

| 55,000 | 10,24,260 | -52,260 | 85,588 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 3,15,210 | 1,07,820 | 30,101 |

| 53,000 | 7,58,730 | 63,510 | 39,737 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 5,43,480 | -1,07,220 | 93,598 |

| 54,000 | 7,74,240 | -64,380 | 63,165 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 16,37,670 | -18,450 | 1,15,488 |

| 55,500 | 5,43,480 | -1,07,220 | 93,598 |

FINNIFTY Monthly Expiry (26/06/2025)

The FINNIFTY index closed at 26254.95. The FINNIFTY monthly expiry for JUNE 26, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.636 against previous 0.780. The 27500CE option holds the maximum open interest, followed by the 26500PE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 26400CE and 26500PE options. On the other hand, open interest reductions were prominent in the 25500PE, 26350PE, and 26450PE options. Trading volume was highest in the 26500CE option, followed by the 26500PE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,254.95 | 0.636 | 0.780 | 0.920 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,73,205 | 5,06,935 | 1,66,270 |

| PUT: | 4,27,830 | 3,95,265 | 32,565 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,17,390 | 46,865 | 3,056 |

| 26,500 | 63,245 | 16,640 | 3,820 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,17,390 | 46,865 | 3,056 |

| 26,400 | 48,295 | 26,910 | 2,540 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 5,525 | -4,160 | 258 |

| 26,800 | 11,895 | -3,315 | 658 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 63,245 | 16,640 | 3,820 |

| 27,500 | 1,17,390 | 46,865 | 3,056 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 70,265 | 23,335 | 3,737 |

| 24,000 | 50,245 | 12,350 | 507 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 70,265 | 23,335 | 3,737 |

| 24,000 | 50,245 | 12,350 | 507 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 43,160 | -17,680 | 2,508 |

| 26,350 | 7,020 | -7,670 | 585 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 70,265 | 23,335 | 3,737 |

| 25,500 | 43,160 | -17,680 | 2,508 |

MIDCPNIFTY Monthly Expiry (26/06/2025)

The MIDCPNIFTY index closed at 12688.6. The MIDCPNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.014 against previous 1.170. The 12000PE option holds the maximum open interest, followed by the 14000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 12500PE and 10500PE options. On the other hand, open interest reductions were prominent in the 72000CE, 72000CE, and 72000PE options. Trading volume was highest in the 12500PE option, followed by the 12700PE and 12800CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,688.60 | 1.014 | 1.170 | 1.141 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,32,760 | 21,49,320 | 2,83,440 |

| PUT: | 24,66,600 | 25,14,480 | -47,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 3,40,200 | 17,640 | 2,125 |

| 13,500 | 2,77,680 | 24,960 | 4,091 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 2,74,080 | 47,640 | 6,397 |

| 13,500 | 2,77,680 | 24,960 | 4,091 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 48,960 | -8,880 | 1,314 |

| 13,300 | 54,840 | -6,000 | 1,387 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,01,480 | 17,880 | 7,497 |

| 13,000 | 2,74,080 | 47,640 | 6,397 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 3,51,240 | -12,960 | 3,526 |

| 12,500 | 2,85,600 | 38,520 | 12,124 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 2,85,600 | 38,520 | 12,124 |

| 10,500 | 88,680 | 25,800 | 380 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,750 | 69,000 | -75,600 | 5,043 |

| 12,700 | 1,86,000 | -47,040 | 8,274 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 2,85,600 | 38,520 | 12,124 |

| 12,700 | 1,86,000 | -47,040 | 8,274 |

Conclusion:

The June Index Future & Option Chain Analysis reveal a market on edge: Nifty’s 24,700 breakdown risks a slide to 24,500–24,000, while BankNifty’s 55,500–56,000 range faces a bearish bias unless it sustains above 56,000. Despite historical June bullishness, the PCR collapse across all Index options signals eroding confidence. Traders should hedge with 24,500 PUT and 55,500 BankNifty PUT, tracking RBI policy on Friday (10 A.M.) and monsoon progress. While midcaps (MIDCPNIFTY max pain: 12,700) may offer tactical plays, the broader Index Future & Option Chain Analysis — FII caution, PCR implosions, and premium volatility—warn of turbulence ahead. Survival hinges on strict stop-losses and sector rotation.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]