Turning Complex Derivative Data into Clear Market Insights

What’s Cooking in the Markets? Let’s Decode the NSE & BSE F&O trends for 19 May 2025

Table of Contents

In today’s volatile market landscape, understanding the NSE & BSE F&O trends are essential for any smart trader or investor. On 19 May 2025, derivatives data revealed a cautious yet calculated shift in sentiment, with declining premiums, narrowing OI levels, and skewed Put-Call Ratios suggesting heightened market uncertainty ahead of the weekly expiry. Let’s dive deep into the data to spot what’s shifting beneath the surface.

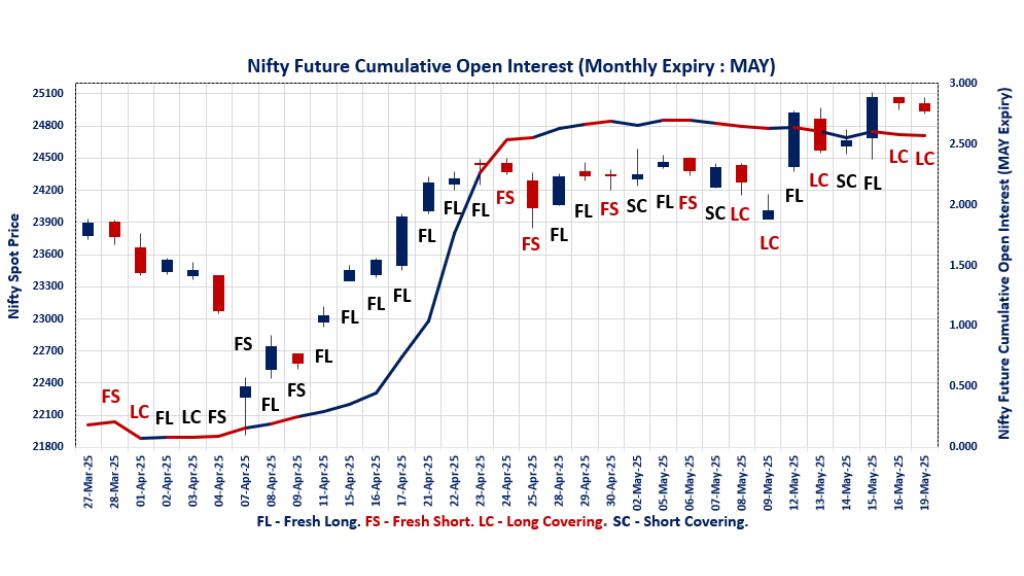

The NIFTY MAY Future witnessed a drop in premium by 27.95 points, now standing at 30.95, while OI dropped by -1.7%, signaling unwinding of long positions. With the spot closing at 24,945.45 (-0.30%), the trend appears to be slightly bearish in tone.

Weekly PCR (OI) fell sharply to 0.603 from 0.761, showing a tilt towards call writing dominance.

Max pain for the weekly expiry is at 24,950, aligning closely with the spot, suggesting a possible pin.

Strongest PUT buildup at 24,200 shows minor support developing, while 25,000 saw the highest CALL additions—indicating a probable short-term ceiling.

Monthly outlook also weakens slightly as PCR (OI) slips to 1.170 and strong CALL additions at 26,800 imply resistance building for a longer time-frame with PUT writing supports at 24,500 – 24,000 levels.

NSE & BSE F&O Trends

NIFTY MAY Future

NIFTY Spot closed at: 24,945.45 (-0.30%)

NIFTY MAY Future closed at: 24,976.40 (-0.41%)

Premium: 30.95 (Decreased by -27.95 points)

Open Interest Change: -1.7%

Volume Change: -14.9%

NIFTY Weekly Expiry (22/05/2025) Option Analysis

Put-Call Ratio (OI): 0.603 (Decreased from 0.761)

Put-Call Ratio (Volume): 0.955

Max Pain Level: 24950

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24200

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.170 (Decreased from 1.210)

Put-Call Ratio (Volume): 1.116

Max Pain Level: 24600

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 26800

Highest PUT Addition: 24500

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,420.70 (0.12%)

BANKNIFTY MAY Future closed at: 55,514.80 (0.02%)

Premium: 94.1 (Decreased by -54.2 points)

Open Interest Change: 1.5%

Volume Change: 42.4%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.853 (Increased from 0.844)

Put-Call Ratio (Volume): 0.754

Max Pain Level: 55000

Maximum CALL OI: 63000

Maximum PUT OI: 55000

Highest CALL Addition: 59500

Highest PUT Addition: 49500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,507.80 (0.13%)

FINNIFTY MAY Future closed at: 26,563.50 (0.03%)

Premium: 55.7 (Decreased by -24.1 points)

Open Interest Change: 0.5%

Volume Change: -4.2%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.739 (Increased from 0.736)

Put-Call Ratio (Volume): 0.654

Max Pain Level: 26350

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 26800

Highest PUT Addition: 26500

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,761.85 (-0.39%)

MIDCPNIFTY MAY Future closed at: 12,782.90 (-0.51%)

Premium: 21.05 (Decreased by -15.45 points)

Open Interest Change: -1.8%

Volume Change: -1.3%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.086 (Increased from 1.054)

Put-Call Ratio (Volume): 1.170

Max Pain Level: 12500

Maximum CALL OI: 13500

Maximum PUT OI: 12000

Highest CALL Addition: 13100

Highest PUT Addition: 11800

SENSEX Weekly Expiry (20.05.25) Future

SENSEX Spot closed at: 82,059.42 (-0.33%)

SENSEX Weekly Future closed at: 82,057.00 (-0.41%)

Discount: -2.42 (Decreased by -68.38 points)

Open Interest Change: -11.3%

Volume Change: -39.9%

SENSEX Weekly Expiry (20/05/2025) Option Analysis

Put-Call Ratio (OI): 0.709 (Decreased from 0.989)

Put-Call Ratio (Volume): 1.038

Max Pain Level: 82000

Maximum CALL OI: 85000

Maximum PUT OI: 80000

Highest CALL Addition: 84000

Highest PUT Addition: 80000

fII & DII Cash Market Activity

FIIs Net Sell: ₹ 525.95 Cr

DIIs Net Sell: ₹ 237.93 Cr

FII Derivatives Activity

| FII Trading Stats | 19.05.25 | 16.05.25 | 15.05.25 |

| FII Cash (Provisional Data) | -525.95 | 8,831.05 | 5,392.94 |

| Index Future Open Interest Long Ratio | 42.32% | 42.37% | 45.60% |

| Index Future Volume Long Ratio | 49.55% | 37.65% | 63.18% |

| Call Option Open Interest Long Ratio | 55.53% | 56.75% | 58.95% |

| Call Option Volume Long Ratio | 49.91% | 49.78% | 50.20% |

| Put Option Open Interest Long Ratio | 56.55% | 56.17% | 58.09% |

| Put Option Volume Long Ratio | 50.14% | 49.56% | 49.90% |

| Stock Future Open Interest Long Ratio | 65.37% | 65.84% | 66.07% |

| Stock Future Volume Long Ratio | 45.53% | 47.56% | 56.20% |

| Index Futures | Fresh Short | Long Covering | Fresh Long |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Long Covering | Fresh Short | Fresh Long |

| Nifty Options | Fresh Short | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Long |

| BankNifty Options | Fresh Long | Short Covering | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Short | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Futures | Short Covering | Short Covering | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Short Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Fresh Short | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & bSE F&O Trends | Options Insights

NIFTY Weekly Expiry (22/05/2025)

The NIFTY index closed at 24945.45. The NIFTY weekly expiry for May 22, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.603 against previous 0.761. The 26000CE option holds the maximum open interest, followed by the 25000CE and 26800CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 25200CE and 26800CE options. On the other hand, open interest reductions were prominent in the 23000PE, 22500PE, and 22700PE options. Trading volume was highest in the 25000PE option, followed by the 25000CE and 25100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 22-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,945.45 | 0.603 | 0.761 | 0.955 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,16,01,350 | 12,59,02,800 | 4,56,98,550 |

| PUT: | 10,34,08,875 | 9,57,71,325 | 76,37,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,48,87,650 | 25,23,075 | 7,59,006 |

| 25,000 | 1,10,91,150 | 52,39,650 | 27,88,243 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,10,91,150 | 52,39,650 | 27,88,243 |

| 25,200 | 74,49,825 | 28,69,050 | 15,54,015 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,450 | 16,46,175 | -1,78,125 | 4,48,315 |

| 24,600 | 9,28,800 | -28,350 | 13,558 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,10,91,150 | 52,39,650 | 27,88,243 |

| 25,100 | 72,68,700 | 16,83,375 | 16,29,659 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 64,92,375 | 5,14,800 | 5,64,301 |

| 25,000 | 64,30,050 | -24,750 | 29,61,745 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 34,41,525 | 13,31,025 | 3,40,085 |

| 23,500 | 53,46,450 | 8,86,950 | 4,02,497 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 48,49,050 | -5,15,175 | 2,90,573 |

| 22,500 | 38,83,500 | -5,03,850 | 1,45,463 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 64,30,050 | -24,750 | 29,61,745 |

| 24,900 | 31,47,150 | 7,81,500 | 15,10,859 |

SENSEX Weekly Expiry (20/05/2025)

The SENSEX index closed at 82059.42. The SENSEX weekly expiry for May 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.709 against previous 0.989. The 85000CE option holds the maximum open interest, followed by the 84000CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 80000PE and 84500CE options. On the other hand, open interest reductions were prominent in the 76000PE, 76500PE, and 88000CE options. Trading volume was highest in the 82000PE option, followed by the 83000CE and 81500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 20-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82059.42 | 0.709 | 0.989 | 1.038 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,43,44,500 | 1,37,83,669 | 1,05,60,831 |

| PUT: | 1,72,55,760 | 1,36,32,480 | 36,23,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 21,20,320 | 6,49,240 | 1,46,73,520 |

| 84000 | 17,65,260 | 9,85,560 | 2,57,16,260 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 17,65,260 | 9,85,560 | 2,57,16,260 |

| 84500 | 11,86,380 | 6,76,660 | 1,27,51,320 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 4,86,540 | -2,22,040 | 21,81,920 |

| 84700 | 1,86,800 | -79,920 | 35,52,940 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 10,29,560 | 4,97,740 | 3,21,86,520 |

| 82500 | 8,66,480 | 4,37,840 | 3,04,38,260 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 13,13,300 | 6,99,020 | 2,04,42,420 |

| 82000 | 10,62,000 | 6,55,260 | 4,26,99,000 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 13,13,300 | 6,99,020 | 2,04,42,420 |

| 82000 | 10,62,000 | 6,55,260 | 4,26,99,000 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 2,99,100 | -3,20,160 | 17,22,760 |

| 76500 | 1,62,080 | -2,28,460 | 12,39,080 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 10,62,000 | 6,55,260 | 4,26,99,000 |

| 81500 | 7,98,520 | 3,99,740 | 3,07,84,620 |

NIFTY Monthly Expiry (29/05/2025)

The NIFTY index closed at 24945.45. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.170 against previous 1.210. The 24000PE option holds the maximum open interest, followed by the 25000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 26800CE and 24600PE options. On the other hand, open interest reductions were prominent in the 24000PE, 24100PE, and 22800PE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,945.45 | 1.170 | 1.210 | 1.116 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,29,18,575 | 4,91,43,375 | 37,75,200 |

| PUT: | 6,18,90,975 | 5,94,73,725 | 24,17,250 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,93,425 | 3,97,725 | 1,41,932 |

| 26,000 | 43,68,225 | 4,05,825 | 65,980 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 6,61,125 | 4,96,800 | 18,452 |

| 26,000 | 43,68,225 | 4,05,825 | 65,980 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 14,71,800 | -56,925 | 5,340 |

| 24,400 | 7,46,025 | -48,375 | 1,919 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,93,425 | 3,97,725 | 1,41,932 |

| 25,500 | 41,18,025 | 3,18,000 | 96,141 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 58,68,225 | -4,73,850 | 70,124 |

| 24,500 | 55,50,525 | 5,83,500 | 75,686 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 55,50,525 | 5,83,500 | 75,686 |

| 24,600 | 19,94,100 | 4,81,275 | 34,043 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 58,68,225 | -4,73,850 | 70,124 |

| 24,100 | 9,00,975 | -2,28,225 | 17,562 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 42,74,175 | 2,85,375 | 1,33,283 |

| 24,500 | 55,50,525 | 5,83,500 | 75,686 |

BANKNIFTY Monthly Expiry (29/05/2025)

The BANKNIFTY index closed at 55420.7. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.853 against previous 0.844. The 63000CE option holds the maximum open interest, followed by the 55000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 49500PE and 50500PE options. On the other hand, open interest reductions were prominent in the 50000PE, 54000PE, and 40500PE options. Trading volume was highest in the 55500CE option, followed by the 55500PE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,420.70 | 0.853 | 0.844 | 0.754 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,49,65,580 | 2,34,21,060 | 15,44,520 |

| PUT: | 2,13,07,920 | 1,97,58,279 | 15,49,641 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,78,740 | -23,580 | 1,00,362 |

| 60,000 | 16,47,630 | 33,570 | 84,226 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 7,31,400 | 2,66,940 | 51,479 |

| 59,000 | 10,38,720 | 1,85,070 | 80,031 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,300 | 2,74,560 | -70,110 | 93,139 |

| 55,000 | 8,37,540 | -50,460 | 79,311 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 12,79,650 | 43,890 | 3,43,812 |

| 56,000 | 12,52,680 | 46,980 | 2,37,967 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 20,25,840 | 70,410 | 1,85,404 |

| 53,000 | 12,33,150 | -62,520 | 77,555 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 49,500 | 4,50,750 | 2,25,150 | 41,828 |

| 50,500 | 4,97,040 | 1,95,120 | 52,416 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 10,72,230 | -3,23,280 | 72,277 |

| 54,000 | 11,74,560 | -83,700 | 1,03,112 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,63,040 | 50,760 | 2,60,105 |

| 55,000 | 20,25,840 | 70,410 | 1,85,404 |

FINNIFTY Monthly Expiry (29/05/2025)

The FINNIFTY index closed at 26507.8. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.739 against previous 0.736. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 26500PE and 26500CE options. On the other hand, open interest reductions were prominent in the 26450CE, 26000PE, and 27000CE options. Trading volume was highest in the 26500CE option, followed by the 26500PE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,507.80 | 0.739 | 0.736 | 0.654 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,38,940 | 14,47,095 | 91,845 |

| PUT: | 11,37,760 | 10,65,090 | 72,670 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,88,110 | -5,070 | 1,868 |

| 27,000 | 1,55,415 | -10,985 | 7,537 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 50,765 | 29,835 | 2,703 |

| 26,500 | 1,24,995 | 21,255 | 7,972 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,450 | 23,595 | -12,025 | 1,390 |

| 27,000 | 1,55,415 | -10,985 | 7,537 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,24,995 | 21,255 | 7,972 |

| 27,000 | 1,55,415 | -10,985 | 7,537 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,235 | -11,050 | 3,016 |

| 26,500 | 82,095 | 25,350 | 7,576 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 82,095 | 25,350 | 7,576 |

| 26,550 | 20,995 | 11,115 | 2,731 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,235 | -11,050 | 3,016 |

| 26,300 | 50,635 | -2,405 | 815 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 82,095 | 25,350 | 7,576 |

| 26,600 | 28,340 | 6,630 | 3,125 |

MIDCPNIFTY Monthly Expiry (29/05/2025)

The MIDCPNIFTY index closed at 12761.85. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.086 against previous 1.054. The 12000PE option holds the maximum open interest, followed by the 13500CE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 11800PE option, with open interest additions also seen in the 13100CE and 13900CE options. On the other hand, open interest reductions were prominent in the 63000PE, 67000CE, and 69700CE options. Trading volume was highest in the 12800PE option, followed by the 12800CE and 12350PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,761.85 | 1.086 | 1.054 | 1.170 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 68,50,680 | 66,19,680 | 2,31,000 |

| PUT: | 74,38,080 | 69,79,560 | 4,58,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,37,680 | -12,120 | 9,856 |

| 13,000 | 6,31,680 | 45,120 | 16,873 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 2,52,960 | 87,960 | 7,008 |

| 13,900 | 68,640 | 65,280 | 1,171 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 2,88,720 | -90,120 | 7,442 |

| 13,400 | 2,17,440 | -37,080 | 4,893 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,28,800 | 59,400 | 23,557 |

| 13,000 | 6,31,680 | 45,120 | 16,873 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,87,960 | -2,280 | 6,647 |

| 11,000 | 5,86,320 | 62,280 | 2,512 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 2,81,400 | 1,00,080 | 3,140 |

| 12,350 | 1,20,120 | 63,720 | 19,197 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 80,520 | -51,600 | 2,275 |

| 12,600 | 3,56,040 | -21,240 | 6,690 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,84,080 | -16,680 | 25,357 |

| 12,350 | 1,20,120 | 63,720 | 19,197 |

Conclusion – What Does This Mean for the Coming Week?

The Nifty and BankNifty Futures and Options Analysis for 19 May 2025 points to a market in consolidation, with a slight negative bias heading into the weekly expiry. The drop in premiums and PCR (OI) across key indices reflects a defensive setup, hinting that traders are unwilling to bet aggressively on the bullish side.

However, with strong PUT additions at lower strikes and OI stability in FINNIFTY and MIDCPNIFTY, there could be stock-specific or sectoral opportunities emerging under the surface.

Traders should prepare for volatility, adopt a hedged strategy, and watch 25,000 on NIFTY and 55,000 on BANKNIFTY as key battle zones.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]