Turning Complex Derivative Data into Clear Market Insights

Nifty F&O Analysis | Critical Expiry on 27th March | Volatility & Key Market Insights

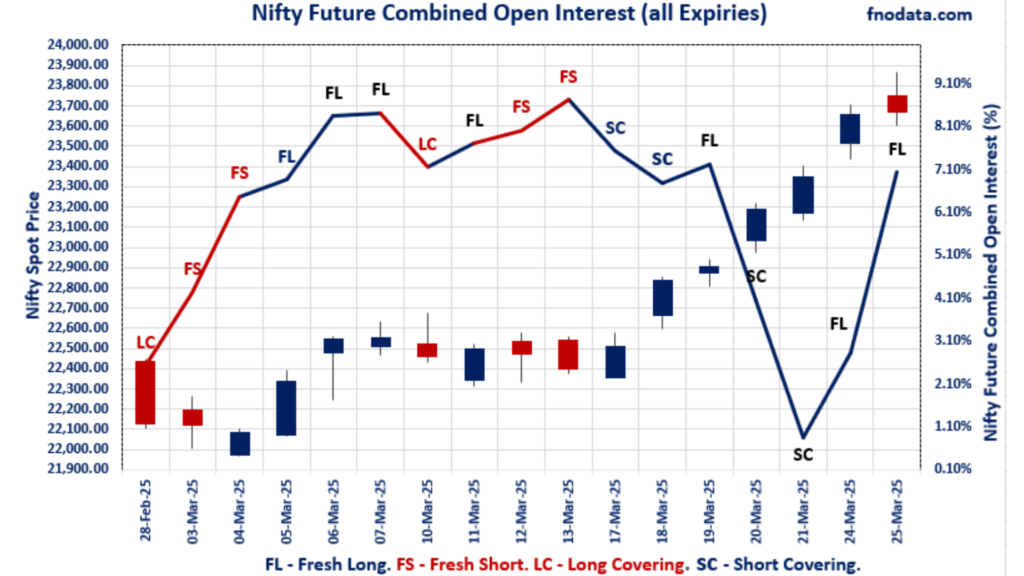

As we approach the Nifty F&O expiry in just two days, market participants are adjusting their positions, leading to heightened volatility. Nifty F&O analysis points towards more short-covering ahead of Expiry on 27th March. The Nifty 50 index closed at 23,668.65, registering a marginal gain of 0.04%. Meanwhile, Nifty March futures ended at 23,705.35, posting a 0.03% increase while maintaining a 36.7-point premium over the spot price.

A notable shift was observed in the Nifty futures premium, which contracted by 4.3 points, signaling caution among traders. Additionally, combined open interest (OI) in Nifty futures (March, April & May contracts) surged by 4.2%, indicating fresh positioning ahead of expiry. Meanwhile, trading volume jumped by 21.68%, reflecting increased activity in the derivatives segment.

Table of Contents

Nifty F&O Analysis : Nifty Put-Call Ratio (PCR) Insights

The Put-Call Ratio (PCR) serves as a crucial indicator of market sentiment, especially during expiry week:

Nifty March PCR: 0.956 (declined from 1.170)

Nifty April PCR: 1.415 (rose from 1.400)

Nifty May PCR: 1.561 (declined from 1.566)

Total Nifty PCR (all expiries): 1.038 (fell from 1.220)

A sharp drop in March PCR signals unwinding of put positions, which often happens as traders roll over their contracts to the next series ahead of expiry. The rise in April PCR suggests traders are starting to accumulate positions in the new contract cycle.

FII & DII Activity in Cash Market

FIIs remained strong net buyers, infusing ₹5,371.57 Cr into the cash market.

DIIs booked profits, leading to net selling of ₹2,768.87 Cr.

The persistent FII buying trend highlights continued institutional confidence in the Indian markets, even as DIIs capitalize on recent gains.

Nifty F&O Analysis : FII Derivatives Market Activity

With March F&O expiry approaching, FIIs made significant adjustments in their derivatives positions:

FII Index Future Open Interest Long Ratio: 32.94% (up from 32.13%)

FII Index Future Volume Long Ratio: 52.32% (up from 50.83%)

FII Call Option Open Interest Long Ratio: 53.83% (up from 53.34%)

FII Put Option Open Interest Long Ratio: 54.49% (up from 52.02%)

The rise in Index Future Long Ratio suggests that FIIs are increasing long positions, possibly anticipating continued strength post-expiry. The uptick in put option holdings indicates a mixed sentiment, where some traders may be hedging against potential volatility.

Market Outlook & Expiry Considerations

With Nifty F&O expiry just two days away, increased volatility is expected as traders adjust their positions.

The contraction in Nifty futures premium, despite an increase in OI, suggests that traders are rolling over positions cautiously, possibly due to uncertainty regarding post-expiry momentum.

The decline in March PCR indicates that short-term put sellers are unwinding positions, which often happens as contracts near expiry.

Check Previous Day’s Data: Nifty Futures Analysis – March 24, 2025

| FII Trading Stats | 25.03.25 | 24.03.25 | 21.03.25 |

| FII Cash (Provisional Data) | 5,371.57 | 3,055.76 | 7,470.36 |

| Index Future Open Interest Long Ratio | 32.94% | 32.13% | 31.79% |

| Index Future Volume Long Ratio | 52.32% | 50.83% | 63.47% |

| Call Option Open Interest Long Ratio | 53.83% | 53.34% | 55.78% |

| Call Option Volume Long Ratio | 50.19% | 49.69% | 49.85% |

| Put Option Open Interest Long Ratio | 54.49% | 52.02% | 54.23% |

| Put Option Volume Long Ratio | 50.56% | 49.63% | 49.54% |

| Stock Future Open Interest Long Ratio | 65.16% | 65.06% | 64.93% |

| Stock Future Volume Long Ratio | 50.30% | 50.16% | 51.10% |

| Index Futures | Short Covering | Fresh Long | Short Covering |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Short | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Long Covering | Short Covering |

| MidcpNifty Options | Short Covering | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Short Covering |

| NiftyNxt50 Options | Fresh Long | Long Covering | Long Covering |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

Nifty F&O Analysis : Major Indices | Options Insights

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at 23668.65. The NIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.956 against previous 1.170. The 25000CE option holds the maximum open interest, followed by the 23000PE and 24000CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24000CE and 23800CE options. On the other hand, open interest reductions were prominent in the 31000CE, 22500PE, and 23300PE options. Trading volume was highest in the 23700PE option, followed by the 23800CE and 24000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,668.65 | 0.956 | 1.170 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,28,44,800 | 16,71,57,550 | 3,56,87,250 |

| PUT: | 19,38,68,275 | 19,55,88,650 | -17,20,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,40,30,300 | 32,87,825 | 7,69,442 |

| 24,000 | 1,28,30,775 | 28,54,300 | 29,03,264 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,40,30,300 | 32,87,825 | 7,69,442 |

| 24,000 | 1,28,30,775 | 28,54,300 | 29,03,264 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 31,000 | 56,28,025 | -17,78,325 | 3,67,197 |

| 24,200 | 70,72,425 | -10,62,750 | 17,44,359 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 84,18,825 | 26,99,550 | 31,46,428 |

| 24,000 | 1,28,30,775 | 28,54,300 | 29,03,264 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,30,84,525 | 12,68,500 | 11,00,439 |

| 22,500 | 1,27,72,800 | -15,59,625 | 5,86,824 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 50,52,375 | 20,63,475 | 33,99,899 |

| 23,800 | 25,23,525 | 16,35,450 | 19,19,243 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 1,27,72,800 | -15,59,625 | 5,86,824 |

| 23,300 | 72,34,500 | -13,78,050 | 11,83,066 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 50,52,375 | 20,63,475 | 33,99,899 |

| 23,600 | 55,14,300 | 4,40,775 | 21,70,486 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at 51607.95. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.035 against previous 1.300. The 49000PE option holds the maximum open interest, followed by the 53000CE and 52000CE options. Market participants have shown increased interest with significant open interest additions in the 53000CE option, with open interest additions also seen in the 52000CE and 51900CE options. On the other hand, open interest reductions were prominent in the 47000PE, 49500PE, and 50000PE options. Trading volume was highest in the 52000CE option, followed by the 51800CE and 51000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,607.95 | 1.035 | 1.300 | 0.887 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,26,59,965 | 2,82,20,829 | 44,39,136 |

| PUT: | 3,37,88,190 | 3,66,90,690 | -29,02,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 21,93,390 | 5,54,250 | 5,95,773 |

| 52,000 | 18,59,190 | 4,71,060 | 10,63,970 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 21,93,390 | 5,54,250 | 5,95,773 |

| 52,000 | 18,59,190 | 4,71,060 | 10,63,970 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 5,34,855 | -96,810 | 57,023 |

| 50,500 | 4,33,410 | -92,280 | 9,189 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 18,59,190 | 4,71,060 | 10,63,970 |

| 51,800 | 7,49,220 | 2,29,290 | 6,18,490 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 24,15,630 | -2,08,830 | 2,76,995 |

| 50,000 | 17,90,190 | -2,74,530 | 4,35,889 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,900 | 2,39,370 | 1,49,940 | 3,59,549 |

| 51,800 | 4,05,630 | 1,46,130 | 5,15,256 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 47,000 | 8,31,690 | -4,69,830 | 1,23,988 |

| 49,500 | 14,69,310 | -3,16,170 | 2,73,639 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 12,60,585 | -1,27,230 | 5,96,313 |

| 51,500 | 10,37,610 | 1,34,700 | 5,91,246 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at 25086. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.859 against previous 1.096. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25450CE option, with open interest additions also seen in the 26500CE and 25350CE options. On the other hand, open interest reductions were prominent in the 24000PE, 24200PE, and 24800PE options. Trading volume was highest in the 25000PE option, followed by the 25200CE and 25500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,086.00 | 0.859 | 1.096 | 0.786 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 57,29,555 | 45,79,380 | 11,50,175 |

| PUT: | 49,24,010 | 50,20,145 | -96,135 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,94,320 | 46,735 | 35,543 |

| 25,500 | 2,79,110 | 1,11,800 | 54,943 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,450 | 2,68,580 | 2,44,920 | 30,575 |

| 26,500 | 2,74,885 | 1,53,595 | 18,774 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,26,425 | -58,955 | 38,438 |

| 25,000 | 2,43,620 | -40,300 | 17,756 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 2,60,065 | 25,740 | 65,389 |

| 25,500 | 2,79,110 | 1,11,800 | 54,943 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 3,09,920 | 1,12,320 | 66,364 |

| 24,500 | 2,42,125 | 53,625 | 26,715 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 3,09,920 | 1,12,320 | 66,364 |

| 25,100 | 1,64,710 | 1,01,920 | 49,321 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,48,590 | -1,45,860 | 17,676 |

| 24,200 | 1,40,205 | -86,385 | 11,738 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 3,09,920 | 1,12,320 | 66,364 |

| 25,100 | 1,64,710 | 1,01,920 | 49,321 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 11581.4. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.970 against previous 1.175. The 11800CE option holds the maximum open interest, followed by the 11400PE and 12000CE options. Market participants have shown increased interest with significant open interest additions in the 11800CE option, with open interest additions also seen in the 11400PE and 11600CE options. On the other hand, open interest reductions were prominent in the 63000PE, 55000PE, and 63500PE options. Trading volume was highest in the 11700CE option, followed by the 12000CE and 11800CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,581.40 | 0.970 | 1.175 | 0.875 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,61,97,000 | 1,42,60,680 | 19,36,320 |

| PUT: | 1,57,07,040 | 1,67,56,680 | -10,49,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 15,63,600 | 7,72,920 | 1,08,415 |

| 12,000 | 13,31,640 | 1,74,840 | 1,14,566 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 15,63,600 | 7,72,920 | 1,08,415 |

| 11,600 | 5,71,080 | 2,23,440 | 85,488 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,850 | 4,05,120 | -3,75,000 | 47,624 |

| 12,100 | 5,88,000 | -1,43,040 | 49,745 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,700 | 7,98,480 | 1,49,520 | 1,22,841 |

| 12,000 | 13,31,640 | 1,74,840 | 1,14,566 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 14,27,760 | 6,02,640 | 62,705 |

| 11,000 | 11,85,600 | -77,520 | 42,777 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 14,27,760 | 6,02,640 | 62,705 |

| 10,800 | 9,35,040 | 68,520 | 16,857 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,450 | 3,56,760 | -4,28,160 | 35,756 |

| 11,700 | 3,07,800 | -2,79,360 | 60,841 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,600 | 6,63,120 | 56,880 | 99,762 |

| 11,500 | 8,79,240 | 43,080 | 95,816 |

More Short Covering expected ahead of Expiry on 27th March

With March expiry just around the corner, traders should brace for heightened volatility as positions are rolled over and profit booking kicks in. The uptick in FII long positions provides some support, but mixed PCR trends suggest lingering uncertainty.

Notably, there has been high open interest addition in the 24,000 Call, indicating strong resistance at that level, while 23700-23800 Puts have also seen significant OI buildup, suggesting a potential support zone. This range-bound positioning could lead to a tug-of-war between bulls and bears in the final sessions before expiry.

FII / FPI trading activity in Capital Market Segment

[…] Check Previous Day’s Nifty Indices F&O Analysis […]