Turning Complex Derivative Data into Clear Market Insights

Nifty Gains 0.69% as FII Buying Boosts Market Sentiment

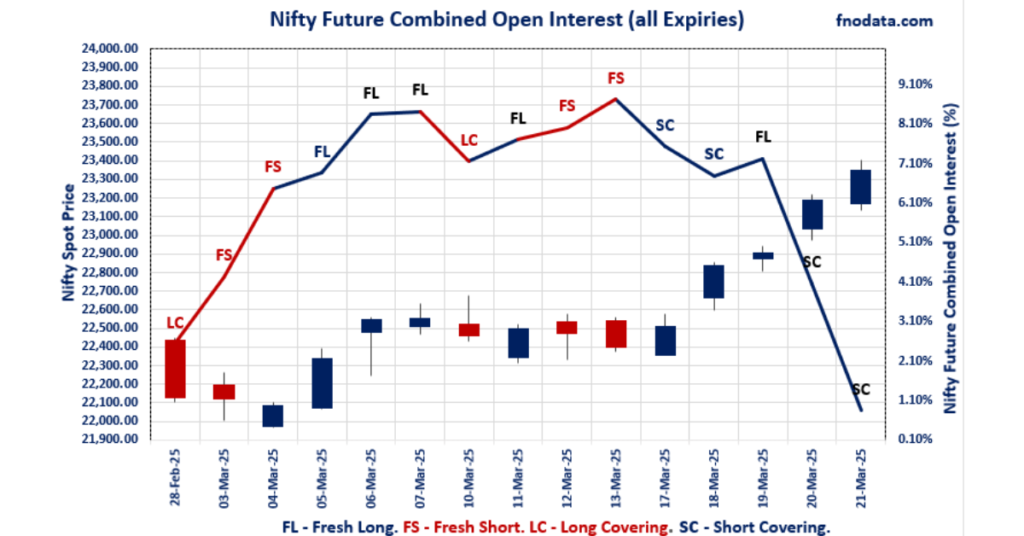

The Indian stock market continued its positive momentum, with Nifty closing at 23,350.4, up 0.69%. Nifty March futures settled at 23,379.85, gaining 0.77% and maintaining a 29.45-point premium over the spot price. The Nifty futures premium expanded by 19.85 points, accompanied by a 3.21% decline in combined open interest (March, April & May), indicating more short covering. However, Nifty futures volume saw an 8.8% decline, suggesting lower participation with probable lack of fresh bullish positions in future market.

Nifty Put-Call Ratio (PCR) Insights

Nifty March PCR: 1.093 (down from 1.117)

Nifty April PCR: 1.400 (up from 1.389)

Nifty May PCR: 1.458 (up from 1.340)

Nifty Total PCR (All Expiries): 1.147 (unchanged)

The increase in PCR near & far month expiries suggests put writing activity, indicating bullish bias. However, decrease in March PCR suggests Call writing at higher levels. The unchanged total PCR hints at neutral sentiment in the broader market.

FII & DII Activity in Cash Market

Foreign Institutional Investors (FIIs) were net buyers, purchasing ₹7,470.36 Cr in the cash market.

Domestic Institutional Investors (DIIs) booked profits, selling ₹3,202.26 Cr worth of equities.

FII Derivative Positioning

FII Index Future Open Interest Long Ratio: 31.79% (up from 29.68%) – coupled with fall in Nifty total OI; showing sustained short-covering.

FII Index Future Volume Long Ratio: 63.47% (slightly down from 63.82%) – indicating a stable futures trading volume.

FII Call Option Open Interest Long Ratio: 55.78% (down from 57.94%) – suggesting a reduction in bullish call positions.

FII Put Option Open Interest Long Ratio: 54.23% (down from 57.47%) – indicating a decline in put buying activity.

| FII Trading Stats | 21.03.25 | 20.03.25 | 19.03.25 |

| FII Cash (Provisional Data) | 7,470.36 | 3239.14 | -1096.5 |

| Index Future Open Interest Long Ratio | 31.79% | 29.68% | 26.82% |

| Index Future Volume Long Ratio | 63.47% | 63.82% | 62.32% |

| Call Option Open Interest Long Ratio | 55.78% | 57.94% | 59.20% |

| Call Option Volume Long Ratio | 49.85% | 49.34% | 50.78% |

| Put Option Open Interest Long Ratio | 54.23% | 57.47% | 59.00% |

| Put Option Volume Long Ratio | 49.54% | 49.16% | 50.40% |

| Stock Future Open Interest Long Ratio | 64.93% | 64.85% | 64.48% |

| Stock Future Volume Long Ratio | 51.10% | 52.88% | 50.48% |

| Index Futures | Short Covering | Short Covering | Fresh Long |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Short Covering | Fresh Long | Fresh Long |

| Nifty Options | Fresh Short | Long Covering | Fresh Long |

| BankNifty Futures | Fresh Long | Short Covering | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Long Covering | Short Covering | Fresh Short |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

Major Indices | Options Insights

SENSEX Monthly Expiry (25.03.2025)

The SENSEX index closed at 76905.51. The SENSEX monthly expiry for March 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.180 against previous 1.385. The 75000PE option holds the maximum open interest, followed by the 78500CE and 73000PE options. Market participants have shown increased interest with significant open interest additions in the 75000PE option, with open interest additions also seen in the 79000CE and 79500CE options. On the other hand, open interest reductions were prominent in the 71000PE, 74000PE, and 71500PE options. Trading volume was highest in the 77000CE option, followed by the 78000CE and 77500CE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 25-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 76905.51 | 1.180 | 1.385 | 0.826 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,46,18,160 | 92,13,440 | 54,04,720 |

| PUT: | 1,72,49,020 | 1,27,63,589 | 44,85,431 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78500 | 11,52,360 | 1,84,520 | 2,05,46,500 |

| 79000 | 10,07,240 | 4,57,840 | 1,13,70,320 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 10,07,240 | 4,57,840 | 1,13,70,320 |

| 79500 | 6,28,280 | 4,21,580 | 61,37,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 2,42,940 | -1,27,580 | 18,07,940 |

| 76400 | 85,880 | -1,18,500 | 58,08,720 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 5,88,360 | 2,16,620 | 3,86,39,880 |

| 78000 | 8,85,440 | 27,580 | 3,57,45,480 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 12,05,500 | 6,51,520 | 1,69,97,960 |

| 73000 | 10,15,420 | 4,17,980 | 64,61,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 12,05,500 | 6,51,520 | 1,69,97,960 |

| 73000 | 10,15,420 | 4,17,980 | 64,61,860 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 71000 | 4,24,120 | -2,34,940 | 28,32,760 |

| 74000 | 9,67,520 | -2,20,000 | 89,87,180 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 8,29,700 | 2,39,440 | 2,83,49,200 |

| 76500 | 4,41,720 | 2,71,940 | 2,43,55,980 |

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at 23350.4. The NIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.093 against previous 1.117. The 23000PE option holds the maximum open interest, followed by the 22000PE and 24000CE options. Market participants have shown increased interest with significant open interest additions in the 24100CE option, with open interest additions also seen in the 23600CE and 24200CE options. On the other hand, open interest reductions were prominent in the 23200CE, 23900CE, and 22800PE options. Trading volume was highest in the 23500CE option, followed by the 23400CE and 23300CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,350.40 | 1.093 | 1.117 | 0.836 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,22,24,100 | 12,28,11,925 | 3,94,12,175 |

| PUT: | 17,73,52,550 | 13,71,48,300 | 4,02,04,250 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,17,38,050 | 12,27,675 | 14,61,751 |

| 24,100 | 95,94,975 | 54,17,325 | 8,37,783 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 95,94,975 | 54,17,325 | 8,37,783 |

| 23,600 | 84,20,850 | 52,83,300 | 20,20,364 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 41,75,025 | -12,49,200 | 15,03,326 |

| 23,900 | 39,93,000 | -11,65,950 | 10,43,381 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 69,92,550 | -7,71,075 | 31,89,965 |

| 23,400 | 48,26,175 | 2,92,125 | 28,25,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,29,38,775 | 36,49,900 | 21,25,243 |

| 22,000 | 1,25,35,600 | 13,07,400 | 6,46,449 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,29,38,775 | 36,49,900 | 21,25,243 |

| 23,300 | 44,97,300 | 34,23,525 | 24,11,210 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 59,54,325 | -9,58,950 | 10,10,050 |

| 21,800 | 28,00,800 | -9,20,625 | 2,80,569 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 71,07,675 | 25,68,375 | 24,56,076 |

| 23,300 | 44,97,300 | 34,23,525 | 24,11,210 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at 50593.55. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.343 against previous 1.277. The 49000PE option holds the maximum open interest, followed by the 48000PE and 52000CE options. Market participants have shown increased interest with significant open interest additions in the 50500PE option, with open interest additions also seen in the 47500PE and 49000PE options. On the other hand, open interest reductions were prominent in the 46000PE, 47000PE, and 50000CE options. Trading volume was highest in the 50500CE option, followed by the 51000CE and 50000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 50,593.55 | 1.343 | 1.277 | 0.860 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,51,61,450 | 2,42,10,114 | 9,51,336 |

| PUT: | 3,37,89,285 | 3,09,20,190 | 28,69,095 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 17,75,820 | 1,29,660 | 3,77,895 |

| 53,000 | 14,35,980 | 60,030 | 2,12,630 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 5,72,730 | 2,67,870 | 1,00,287 |

| 50,600 | 4,16,250 | 1,93,290 | 3,57,021 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 9,80,760 | -3,62,580 | 5,13,316 |

| 50,100 | 1,55,340 | -2,69,490 | 3,05,631 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,500 | 9,70,920 | -1,03,740 | 9,16,521 |

| 51,000 | 12,39,810 | -2,24,895 | 7,17,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 25,42,500 | 3,49,230 | 3,69,848 |

| 48,000 | 18,81,600 | -95,610 | 2,58,592 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,500 | 8,02,890 | 6,08,490 | 5,82,735 |

| 47,500 | 14,81,820 | 4,13,160 | 2,17,175 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 46,000 | 6,89,220 | -6,82,500 | 1,26,913 |

| 47,000 | 14,53,200 | -3,92,490 | 2,12,913 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 15,37,920 | 2,17,440 | 6,64,145 |

| 50,500 | 8,02,890 | 6,08,490 | 5,82,735 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at 24567.95. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.152 against previous 1.293. The 24800CE option holds the maximum open interest, followed by the 23500PE and 24600CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24400PE and 23500PE options. On the other hand, open interest reductions were prominent in the 23000PE, 23200PE, and 23800CE options. Trading volume was highest in the 25000CE option, followed by the 24800CE and 24600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,567.95 | 1.152 | 1.293 | 0.740 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 36,00,740 | 28,10,145 | 7,90,595 |

| PUT: | 41,49,600 | 36,33,500 | 5,16,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 3,48,985 | 1,77,125 | 42,796 |

| 24,600 | 2,70,725 | 16,575 | 38,981 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 3,48,985 | 1,77,125 | 42,796 |

| 25,500 | 1,45,535 | 1,04,715 | 8,455 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 47,840 | -43,810 | 1,441 |

| 24,400 | 84,955 | -33,930 | 23,204 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,93,830 | 24,765 | 52,659 |

| 24,800 | 3,48,985 | 1,77,125 | 42,796 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 2,97,960 | 1,10,110 | 24,460 |

| 23,000 | 2,56,425 | -1,04,845 | 9,212 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,41,830 | 1,28,765 | 17,434 |

| 23,500 | 2,97,960 | 1,10,110 | 24,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 2,56,425 | -1,04,845 | 9,212 |

| 23,200 | 1,13,945 | -66,300 | 7,899 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 2,97,960 | 1,10,110 | 24,460 |

| 24,000 | 1,49,240 | -31,265 | 24,188 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 11507. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.195 against previous 1.069. The 12000CE option holds the maximum open interest, followed by the 11000PE and 11300PE options. Market participants have shown increased interest with significant open interest additions in the 11100PE option, with open interest additions also seen in the 11800CE and 11500PE options. On the other hand, open interest reductions were prominent in the 61000CE, 60000PE, and 60000PE options. Trading volume was highest in the 11300PE option, followed by the 11500CE and 11600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,507.00 | 1.195 | 1.069 | 0.990 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,33,61,280 | 1,34,90,520 | -1,29,240 |

| PUT: | 1,59,61,080 | 1,44,20,040 | 15,41,040 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 15,10,800 | 1,12,920 | 42,974 |

| 11,800 | 9,47,880 | 3,64,920 | 71,202 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 9,47,880 | 3,64,920 | 71,202 |

| 11,700 | 8,96,760 | 2,11,200 | 77,574 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,750 | 2,57,400 | -4,32,960 | 32,650 |

| 11,400 | 5,02,080 | -2,03,280 | 47,850 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 7,97,400 | -1,55,880 | 1,15,640 |

| 11,600 | 6,05,040 | -1,56,240 | 79,565 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 13,61,280 | 15,000 | 66,219 |

| 11,300 | 13,21,920 | 2,94,840 | 1,31,154 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,100 | 12,48,720 | 4,05,840 | 38,814 |

| 11,500 | 4,97,640 | 3,52,080 | 75,358 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,950 | 2,82,240 | -4,74,600 | 19,061 |

| 10,500 | 10,63,800 | -2,70,600 | 24,595 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,300 | 13,21,920 | 2,94,840 | 1,31,154 |

| 11,500 | 4,97,640 | 3,52,080 | 75,358 |

Conclusion

The rise in Nifty futures premium and the drop in open interest suggest that short sellers are covering their positions, leading to the recent upside. Strong FII buying in the cash market is supporting the index, while DIIs are booking profits. The decrease in March PCR levels indicates limited upside before Expiry. However, the decline in FII options positioning signals some uncertainty in market direction.

Traders should keep an eye on key resistance levels near 23,500-23,600 and support at 23,000.

[…] Check Previous Day’s Data […]