Turning Complex Derivative Data into Clear Market Insights

Nifty nears Resistances at 23,100 – 23,300 | Falling Volume Shows Uncertainty Before FED Decision Tonight

Nifty Ends Higher, But Futures Activity Shows Caution

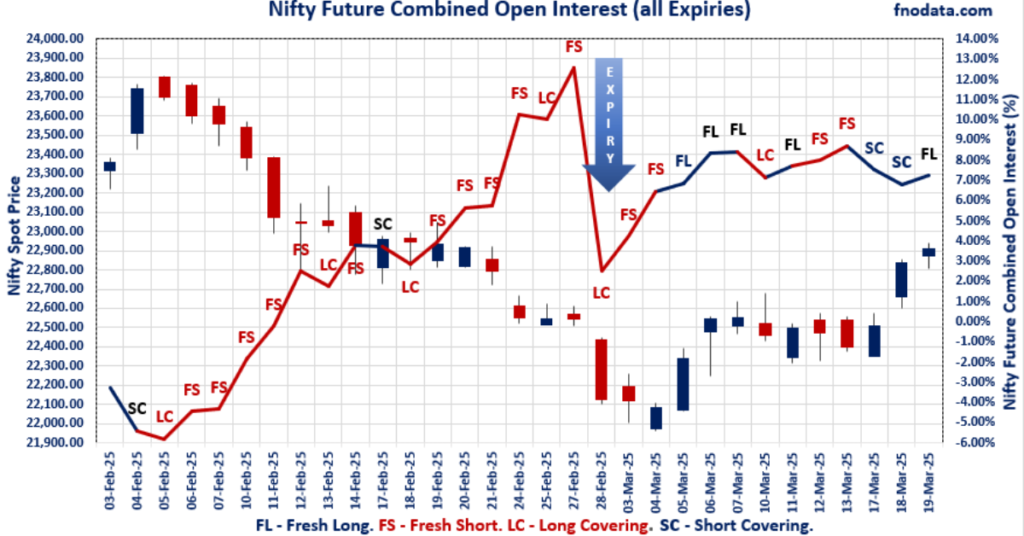

The Indian stock market saw a mild positive session as Nifty spot closed at 22,907.6, gaining 0.32%. Meanwhile, Nifty March futures settled at 22,972.95, up 0.34%, maintaining a 65.35-point premium over the spot price.

- Nifty futures premium increased by 4.25 points, indicating a slight bullish sentiment.

- However, combined Nifty futures open interest (March, April & May) increased by 0.44%, suggesting a build-up of fresh positions.

- Futures volume dropped by 27.3%, hinting at lower participation in derivatives trading.

Put-Call Ratio (PCR) Trends Indicate Shifting Market Sentiment

Nifty Put-Call Ratio (PCR) Insights:

Nifty March PCR: 1.138 (up from 1.116)

Nifty April PCR: 1.235 (up from 1.215)

Nifty May PCR: 1.282 (up from 1.244)

Nifty Total PCR (all Expiries): 1.204 (down from 1.291)

March, April, and May PCR levels increased, indicating more put buying or call unwinding, which can suggest downside protection by traders. Total PCR declined from 1.291 to 1.204, hinting at a slight reduction in bullish momentum in Weekly Nifty Contract with Call writing in 23,100 – 23,300 levels.

FII & DII Market Activity: Institutional Divergence Continues

Institutional investors showed divergent positioning in the cash market:

FIIs net sold ₹1,096.5 Cr, continuing their cautious approach.

DIIs net bought ₹2,140.76 Cr, providing much-needed market support.

This suggests that while foreign investors remain cautious, domestic investors continue to provide stability, preventing any sharp correction.

FII Derivatives Positioning: Increased Longs in Futures & Options

Foreign Institutional Investors (FIIs) made notable changes in their F&O positions:

- FII Index Future Open Interest Long Ratio rose to 26.82% (from 24%), indicating an increase in bullish positions.

- FII Index Future Volume Long Ratio fell to 62.32% (from 73.23%), showing a decline in overall futures trading activity.

- FII Call Option Open Interest Long Ratio increased to 59.2% (from 57.15%), suggesting more interest in Call writing at 23,100 – 23,300 Strikes.

- FII Put Option Open Interest Long Ratio also moved up to 59% (from 57.76%), signaling hedging activity and probable Put writing at 22,800 – 22,900 Strikes.

| FII Trading Stats | 19.03.25 | 18.03.25 | 17.03.25 |

| FII Cash (Provisional Data) | -1096.5 | 694.57 | -4488.45 |

| Index Future Open Interest Long Ratio | 26.82% | 24.00% | 20.17% |

| Index Future Volume Long Ratio | 62.32% | 73.23% | 71.26% |

| Call Option Open Interest Long Ratio | 59.20% | 57.15% | 58.41% |

| Call Option Volume Long Ratio | 50.78% | 49.92% | 50.79% |

| Put Option Open Interest Long Ratio | 59.00% | 57.76% | 60.35% |

| Put Option Volume Long Ratio | 50.40% | 49.43% | 50.11% |

| Stock Future Open Interest Long Ratio | 64.48% | 64.41% | 63.87% |

| Stock Future Volume Long Ratio | 50.48% | 55.00% | 55.68% |

| Index Futures | Fresh Long | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Long | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Long | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Long Covering |

| FinNifty Futures | Long Covering | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Long | Short Covering | Short Covering |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Short Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Short | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Major Indices | Options Insights

SENSEX Monthly Expiry (25.03.2025)

The SENSEX index closed at 75449.05. The SENSEX Monthly expiry for March 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.253 against previous 1.811. The 76500CE option holds the maximum open interest, followed by the 71000PE and 72000PE options. Market participants have shown increased interest with significant open interest additions in the 76500CE option, with open interest additions also seen in the 75500PE and 68000PE options. On the other hand, open interest reductions were prominent in the 75100CE, 75000CE, and 75200CE options. Trading volume was highest in the 75500CE option, followed by the 75500PE and 75400PE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 25-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 75449.05 | 1.253 | 1.811 | 0.968 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 42,88,640 | 14,55,840 | 28,32,800 |

| PUT: | 53,73,300 | 26,36,509 | 27,36,791 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 4,36,980 | 3,37,660 | 42,67,880 |

| 78000 | 2,65,260 | 1,50,100 | 25,67,780 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 4,36,980 | 3,37,660 | 42,67,880 |

| 78500 | 2,54,740 | 2,17,960 | 29,61,400 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 75100 | 17,340 | -22,320 | 3,87,940 |

| 75000 | 83,240 | -19,640 | 7,49,280 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 2,29,680 | 1,40,580 | 71,93,940 |

| 77000 | 2,37,240 | 94,680 | 53,91,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 71000 | 3,73,040 | 59,760 | 14,79,080 |

| 72000 | 3,41,620 | 1,90,760 | 21,81,240 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 2,95,320 | 2,45,740 | 69,31,240 |

| 68000 | 2,53,440 | 2,45,000 | 10,12,120 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 71500 | 2,43,580 | -1,500 | 23,81,040 |

| 78000 | 7,060 | -80 | 260 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 2,95,320 | 2,45,740 | 69,31,240 |

| 75400 | 1,20,040 | 1,00,040 | 58,76,640 |

NIFTY Weekly Expiry (20.03.2025)

The NIFTY index closed at 22907.6. The NIFTY weekly expiry for March 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.246 against previous 1.426. The 23300CE option holds the maximum open interest, followed by the 22500PE and 22000PE options. Market participants have shown increased interest with significant open interest additions in the 23300CE option, with open interest additions also seen in the 22900PE and 23100CE options. On the other hand, open interest reductions were prominent in the 22850CE, 21800PE, and 23500CE options. Trading volume was highest in the 22900CE option, followed by the 23000CE and 22900PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 20-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,907.60 | 1.246 | 1.426 | 0.951 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,64,14,725 | 12,51,36,900 | 1,12,77,825 |

| PUT: | 16,99,13,325 | 17,84,77,125 | -85,63,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 1,46,24,025 | 91,93,125 | 19,42,543 |

| 23,000 | 1,21,60,125 | -10,57,575 | 61,48,712 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 1,46,24,025 | 91,93,125 | 19,42,543 |

| 23,100 | 99,62,100 | 46,80,375 | 39,90,560 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,850 | 21,01,275 | -41,27,400 | 30,57,383 |

| 23,500 | 80,07,150 | -26,98,650 | 10,90,465 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 84,26,100 | 38,73,525 | 62,45,044 |

| 23,000 | 1,21,60,125 | -10,57,575 | 61,48,712 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 1,35,59,025 | 9,81,900 | 22,09,735 |

| 22,000 | 1,23,92,625 | 2,03,475 | 11,07,943 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 74,84,925 | 55,66,950 | 52,50,513 |

| 22,800 | 92,08,050 | 29,46,900 | 44,29,118 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,800 | 38,97,750 | -34,84,725 | 6,07,140 |

| 21,700 | 26,62,500 | -25,76,925 | 4,52,905 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 74,84,925 | 55,66,950 | 52,50,513 |

| 22,800 | 92,08,050 | 29,46,900 | 44,29,118 |

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at 22907.6. The NIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.138 against previous 1.116. The 22000PE option holds the maximum open interest, followed by the 22500PE and 31000CE options. Market participants have shown increased interest with significant open interest additions in the 21000PE option, with open interest additions also seen in the 24000CE and 23200CE options. On the other hand, open interest reductions were prominent in the 22500CE, 22800CE, and 22700CE options. Trading volume was highest in the 23000CE option, followed by the 22900PE and 23200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,907.60 | 1.138 | 1.116 | 1.139 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,93,29,700 | 7,04,93,500 | 88,36,200 |

| PUT: | 9,03,04,225 | 7,86,63,950 | 1,16,40,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 31,000 | 72,05,375 | 5,84,700 | 18,919 |

| 23,000 | 60,07,125 | 57,425 | 2,90,329 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 57,51,550 | 18,44,025 | 1,04,326 |

| 23,200 | 37,33,050 | 11,86,200 | 1,88,399 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 39,93,225 | -3,86,025 | 31,093 |

| 22,800 | 21,03,600 | -3,04,200 | 1,08,698 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 60,07,125 | 57,425 | 2,90,329 |

| 23,200 | 37,33,050 | 11,86,200 | 1,88,399 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 83,58,425 | 1,84,525 | 1,60,626 |

| 22,500 | 77,54,475 | -35,475 | 1,70,160 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 66,79,650 | 18,74,750 | 1,05,589 |

| 22,900 | 19,02,450 | 11,38,275 | 1,91,960 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,200 | 6,16,125 | -1,57,725 | 24,515 |

| 21,400 | 8,51,700 | -1,55,400 | 44,624 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 19,02,450 | 11,38,275 | 1,91,960 |

| 22,800 | 31,57,500 | 6,21,450 | 1,81,413 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at 49702.6. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.294 against previous 1.249. The 49000PE option holds the maximum open interest, followed by the 48000PE and 47000PE options. Market participants have shown increased interest with significant open interest additions in the 49500PE option, with open interest additions also seen in the 52000CE and 49800PE options. On the other hand, open interest reductions were prominent in the 44500PE, 45500PE, and 49000CE options. Trading volume was highest in the 50000CE option, followed by the 49500CE and 49500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 49,702.60 | 1.294 | 1.249 | 0.919 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,35,52,640 | 2,32,56,804 | 2,95,836 |

| PUT: | 3,04,71,840 | 2,90,53,980 | 14,17,860 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 16,23,150 | 3,66,120 | 1,79,321 |

| 51,000 | 14,08,155 | -28,305 | 3,08,554 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 16,23,150 | 3,66,120 | 1,79,321 |

| 52,500 | 7,16,505 | 2,55,915 | 77,457 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 12,41,280 | -2,14,950 | 92,593 |

| 51,500 | 9,13,890 | -1,53,510 | 1,99,512 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 12,70,440 | -52,140 | 4,22,677 |

| 49,500 | 8,53,290 | -1,51,410 | 4,07,351 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 21,84,780 | 2,05,650 | 2,68,318 |

| 48,000 | 19,80,675 | 14,250 | 2,16,272 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 49,500 | 10,11,330 | 4,97,130 | 3,58,221 |

| 49,800 | 3,44,250 | 3,10,590 | 1,75,206 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 44,500 | 3,93,690 | -3,05,010 | 67,070 |

| 45,500 | 3,79,110 | -2,21,850 | 85,682 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 49,500 | 10,11,330 | 4,97,130 | 3,58,221 |

| 49,000 | 21,84,780 | 2,05,650 | 2,68,318 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at 24140.35. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.376 against previous 1.557. The 22000PE option holds the maximum open interest, followed by the 23000PE and 19500PE options. Market participants have shown increased interest with significant open interest additions in the 24400CE option, with open interest additions also seen in the 24000PE and 23000PE options. On the other hand, open interest reductions were prominent in the 19500PE, 24300CE, and 22500PE options. Trading volume was highest in the 24500CE option, followed by the 24100CE and 24000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,140.35 | 1.376 | 1.557 | 0.774 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,23,200 | 19,97,190 | 4,26,010 |

| PUT: | 33,33,395 | 31,09,275 | 2,24,120 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,64,320 | 1,03,480 | 8,343 |

| 24,500 | 1,54,700 | -7,800 | 26,105 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,64,320 | 1,03,480 | 8,343 |

| 24,800 | 1,20,445 | 77,025 | 9,115 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 72,020 | -52,910 | 7,905 |

| 24,000 | 1,14,855 | -12,610 | 12,991 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,54,700 | -7,800 | 26,105 |

| 24,100 | 91,650 | 33,150 | 17,072 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 3,51,325 | 40,235 | 3,594 |

| 23,000 | 3,26,755 | 78,650 | 11,926 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,40,465 | 93,795 | 16,852 |

| 23,000 | 3,26,755 | 78,650 | 11,926 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 19,500 | 2,00,460 | -97,305 | 3,894 |

| 22,500 | 1,00,815 | -45,890 | 4,257 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,40,465 | 93,795 | 16,852 |

| 23,000 | 3,26,755 | 78,650 | 11,926 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 11352.1. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.100 against previous 0.958. The 12000CE option holds the maximum open interest, followed by the 10500PE and 11000PE options. Market participants have shown increased interest with significant open interest additions in the 11300PE option, with open interest additions also seen in the 10500PE and 11200PE options. On the other hand, open interest reductions were prominent in the 60000CE, 59500CE, and 61000CE options. Trading volume was highest in the 11500CE option, followed by the 11400CE and 11300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,352.10 | 1.100 | 0.958 | 0.836 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,13,60,400 | 1,02,25,680 | 11,34,720 |

| PUT: | 1,24,94,040 | 97,94,160 | 26,99,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 12,99,120 | 2,86,440 | 27,401 |

| 11,500 | 9,09,840 | 1,29,720 | 56,235 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 12,99,120 | 2,86,440 | 27,401 |

| 11,900 | 4,48,920 | 2,04,600 | 17,229 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,100 | 3,54,960 | -2,40,480 | 9,262 |

| 11,000 | 4,86,840 | -1,57,680 | 6,595 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 9,09,840 | 1,29,720 | 56,235 |

| 11,400 | 5,65,440 | 79,200 | 47,634 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,500 | 12,59,040 | 4,92,120 | 29,001 |

| 11,000 | 12,43,200 | -19,320 | 32,003 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,300 | 7,10,400 | 6,17,880 | 31,757 |

| 10,500 | 12,59,040 | 4,92,120 | 29,001 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,000 | 7,20,360 | -1,18,320 | 10,672 |

| 10,100 | 1,24,920 | -77,040 | 5,793 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 8,70,960 | 4,29,960 | 37,818 |

| 11,000 | 12,43,200 | -19,320 | 32,003 |

Market Outlook: What’s Next for Nifty?

Nifty Futures Premium Increase: The rising premium suggests optimism, but not extreme bullishness.

Higher PCR in March-April-May Expiries: Indicates Put writing and bullish positioning, with support at lower levels. Cautious with Call writing in Weekly Contracts.

FII Cash Selling vs. DII Buying: Domestic investors are holding the market steady, despite FII outflows.

FII Derivatives Data: Increased long positions in both futures and options indicate selective bullish bets; cautious with lower volume.

Key Nifty Levels to Watch:

- Immediate Resistance: 23,100 – 23,300

- Strong Support: 22,800 – 22,900

Final Thoughts

The market remains resilient despite FII selling, thanks to DII support and increased F&O long positions. However, lower futures volume and a slight drop in total PCR suggest that momentum needs to pick up for a stronger rally.