Turning Complex Derivative Data into Clear Market Insights

Deep dive Into NIFTY Derivative Trends for April 29, 2025!

Explore deep dive Into NIFTY Derivative Trends for April 29, 2025, including BANKNIFTY, FINNIFTY, and MIDCPNIFTY. Understand the market tone through PCR, OI shifts, and max pain insights.

Table of Contents

The NIFTY Derivative Trends for April 28, 2025, highlights a market losing steam after a brief recovery rally. A noticeable decline in put-call ratios across major indices—especially NIFTY, BANKNIFTY, and FINNIFTY—signals fading bullish sentiment as traders trim long positions ahead of the weekly expiry. Despite minimal index moves, derivative cues point to a cautious undertone, with max pain levels consolidating near key support zones. Flat closing along with decrease in Nifty premium and low volume suggests lack of demand and underlying bearish sentiment. Let’s decode what this means for the upcoming sessions.

Derivative Trends | NSE

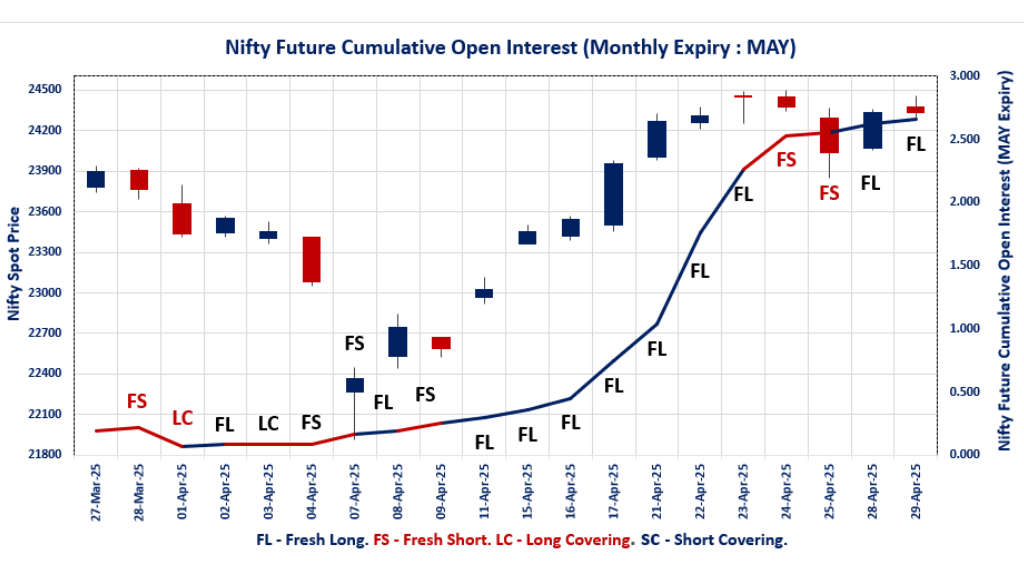

NIFTY MAY Future

NIFTY Spot closed at: 24,335.95 (0.03%)

NIFTY MAY Future closed at: 24,425.30 (-0.11%)

Premium: 89.35 (Decreased by -34.95 points)

Open Interest Change: 3.5%

Volume Change: -24.2%

NIFTY Weekly Expiry (30/04/2025) Option Analysis

Put-Call Ratio (OI): 0.846 (Decreased from 1.186)

Put-Call Ratio (Volume): 0.928

Max Pain Level: 24300

Maximum CALL OI: 24500

Maximum PUT OI: 24300

Highest CALL Addition: 24400

Highest PUT Addition: 24300

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.407 (Decreased from 1.431)

Put-Call Ratio (Volume): 1.286

Max Pain Level: 24000

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24500

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,391.25 (-0.07%)

BANKNIFTY MAY Future closed at: 55,509.60 (-0.29%)

Premium: 118.35 (Decreased by -120.05 points)

Open Interest Change: -4.0%

Volume Change: -4.6%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.910 (Decreased from 0.993)

Put-Call Ratio (Volume): 0.959

Max Pain Level: 54600

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 63000

Highest PUT Addition: 54000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,193.85 (-0.37%)

FINNIFTY MAY Future closed at: 26,249.80 (-0.62%)

Premium: 55.95 (Decreased by -66.1 points)

Open Interest Change: 2.4%

Volume Change: -2.9%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.934 (Decreased from 1.119)

Put-Call Ratio (Volume): 1.114

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 25500

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,195.00 (-0.04%)

MIDCPNIFTY MAY Future closed at: 12,200.20 (-0.36%)

Premium: 5.2 (Decreased by -39.05 points)

Open Interest Change: 2.4%

Volume Change: -9.0%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.834 (Decreased from 0.873)

Put-Call Ratio (Volume): 0.614

Max Pain Level: 12175

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 11500

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,385.61 Cr

DIIs Net Buy: ₹ 1,369.19 Cr

FII Derivatives Activity

| FII Trading Stats | 29.04.25 | 28.04.25 | 25.04.25 |

| FII Cash (Provisional Data) | 2,385.61 | 2,474.10 | 2,952.33 |

| Index Future Open Interest Long Ratio | 44.30% | 42.33% | 37.63% |

| Index Future Volume Long Ratio | 56.54% | 64.44% | 44.34% |

| Call Option Open Interest Long Ratio | 49.36% | 52.16% | 51.89% |

| Call Option Volume Long Ratio | 49.53% | 50.07% | 48.72% |

| Put Option Open Interest Long Ratio | 48.43% | 48.73% | 50.31% |

| Put Option Volume Long Ratio | 49.94% | 49.70% | 48.87% |

| Stock Future Open Interest Long Ratio | 64.67% | 64.81% | 64.13% |

| Stock Future Volume Long Ratio | 49.68% | 56.14% | 50.87% |

| Index Futures | Fresh Long | Fresh Long | Fresh Short |

| Index Options | Fresh Short | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Short |

| Nifty Options | Fresh Short | Fresh Short | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Short | Fresh Long | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE Options Analysis | Options Insights

NIFTY Weekly Expiry (30.04.2025)

The NIFTY index closed at 24335.95. The NIFTY weekly expiry for April 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.846 against previous 1.186. The 24500CE option holds the maximum open interest, followed by the 24400CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 24400CE option, with open interest additions also seen in the 24500CE and 24350CE options. On the other hand, open interest reductions were prominent in the 22500PE, 22000PE, and 23500PE options. Trading volume was highest in the 24400CE option, followed by the 24300PE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 30-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,335.95 | 0.846 | 1.186 | 0.928 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,56,53,200 | 13,79,57,400 | 4,76,95,800 |

| PUT: | 15,71,36,100 | 16,35,63,900 | -64,27,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,64,56,725 | 61,08,975 | 33,48,290 |

| 24,400 | 1,50,76,050 | 93,50,850 | 45,86,474 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,50,76,050 | 93,50,850 | 45,86,474 |

| 24,500 | 1,64,56,725 | 61,08,975 | 33,48,290 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 25,92,525 | -8,85,825 | 3,18,003 |

| 25,800 | 32,20,500 | -5,75,325 | 2,47,735 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,50,76,050 | 93,50,850 | 45,86,474 |

| 24,500 | 1,64,56,725 | 61,08,975 | 33,48,290 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,15,91,250 | 49,85,775 | 44,57,376 |

| 24,000 | 1,10,02,125 | -12,78,825 | 16,54,178 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,15,91,250 | 49,85,775 | 44,57,376 |

| 24,200 | 91,58,325 | 15,18,450 | 22,28,802 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 50,85,750 | -19,68,300 | 4,74,812 |

| 22,000 | 49,84,950 | -18,59,100 | 3,21,672 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,15,91,250 | 49,85,775 | 44,57,376 |

| 24,350 | 45,84,675 | 12,32,625 | 30,16,800 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24335.95. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.407 against previous 1.431. The 24000PE option holds the maximum open interest, followed by the 23000PE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 24500CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24100PE, 21400PE, and 22700PE options. Trading volume was highest in the 24500CE option, followed by the 24000PE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,335.95 | 1.407 | 1.431 | 1.286 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,13,36,725 | 2,95,63,200 | 17,73,525 |

| PUT: | 4,40,82,375 | 4,23,05,250 | 17,77,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 39,78,150 | 3,33,075 | 51,527 |

| 24,000 | 32,20,650 | -35,625 | 14,360 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 39,78,150 | 3,33,075 | 51,527 |

| 25,000 | 30,15,675 | 3,24,225 | 45,974 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 32,20,650 | -35,625 | 14,360 |

| 24,150 | 48,525 | -14,100 | 655 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 39,78,150 | 3,33,075 | 51,527 |

| 25,000 | 30,15,675 | 3,24,225 | 45,974 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 48,66,075 | 2,04,375 | 51,224 |

| 23,000 | 40,59,750 | 3,24,150 | 34,937 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 22,56,975 | 4,02,075 | 40,698 |

| 23,000 | 40,59,750 | 3,24,150 | 34,937 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,100 | 7,45,650 | -1,02,375 | 10,102 |

| 21,400 | 1,24,050 | -50,700 | 2,945 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 48,66,075 | 2,04,375 | 51,224 |

| 24,500 | 22,56,975 | 4,02,075 | 40,698 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55391.25. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.910 against previous 0.993. The 63000CE option holds the maximum open interest, followed by the 53000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 57000CE and 56000CE options. On the other hand, open interest reductions were prominent in the 40500PE, 55000CE, and 55000PE options. Trading volume was highest in the 55500PE option, followed by the 55500CE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,391.25 | 0.910 | 0.993 | 0.959 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,78,32,900 | 1,61,76,789 | 16,56,111 |

| PUT: | 1,62,22,230 | 1,60,63,950 | 1,58,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 18,15,090 | 3,67,890 | 96,472 |

| 60,000 | 11,18,760 | -29,610 | 1,20,239 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 18,15,090 | 3,67,890 | 96,472 |

| 57,000 | 8,09,130 | 1,71,780 | 1,03,469 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,29,990 | -55,950 | 34,169 |

| 60,000 | 11,18,760 | -29,610 | 1,20,239 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,89,870 | 74,040 | 1,42,715 |

| 56,000 | 8,34,840 | 1,66,470 | 1,31,381 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 15,91,650 | 60,870 | 84,089 |

| 54,000 | 11,69,880 | 83,640 | 1,07,899 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 11,69,880 | 83,640 | 1,07,899 |

| 56,000 | 3,62,340 | 72,720 | 60,438 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 3,22,860 | -79,710 | 12,877 |

| 55,000 | 8,99,610 | -43,020 | 1,27,836 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,55,300 | -23,220 | 1,68,089 |

| 55,000 | 8,99,610 | -43,020 | 1,27,836 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26193.85. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.934 against previous 1.119. The 26000PE option holds the maximum open interest, followed by the 29500CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26200CE and 26300CE options. On the other hand, open interest reductions were prominent in the 25000PE, 29500CE, and 26250PE options. Trading volume was highest in the 26200PE option, followed by the 26000PE and 26300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,193.85 | 0.934 | 1.119 | 1.114 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,79,215 | 5,06,480 | 72,735 |

| PUT: | 5,41,060 | 5,66,995 | -25,935 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 67,470 | -13,845 | 1,636 |

| 27,000 | 63,960 | 17,160 | 1,638 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 63,960 | 17,160 | 1,638 |

| 26,200 | 28,730 | 15,015 | 1,436 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 67,470 | -13,845 | 1,636 |

| 26,500 | 45,825 | -1,885 | 2,040 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 34,385 | 7,670 | 2,425 |

| 26,500 | 45,825 | -1,885 | 2,040 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,07,445 | 3,770 | 2,478 |

| 25,000 | 54,795 | -33,020 | 1,888 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,050 | 7,930 | 1,735 |

| 23,000 | 28,795 | 4,550 | 381 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,795 | -33,020 | 1,888 |

| 26,250 | 8,125 | -5,850 | 905 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 23,010 | 715 | 2,532 |

| 26,000 | 1,07,445 | 3,770 | 2,478 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 12195. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.834 against previous 0.873. The 13000CE option holds the maximum open interest, followed by the 12800CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 12800CE option, with open interest additions also seen in the 13200CE and 12300CE options. On the other hand, open interest reductions were prominent in the 63000PE, 59100PE, and 59100PE options. Trading volume was highest in the 12800CE option, followed by the 12300CE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,195.00 | 0.834 | 0.873 | 0.614 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 28,67,760 | 23,48,520 | 5,19,240 |

| PUT: | 23,92,200 | 20,49,240 | 3,42,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 3,55,920 | 63,960 | 8,447 |

| 12,800 | 3,01,800 | 1,96,440 | 14,313 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,01,800 | 1,96,440 | 14,313 |

| 13,200 | 1,71,240 | 81,240 | 2,411 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 70,680 | -20,760 | 1,514 |

| 12,175 | 47,760 | -16,320 | 478 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,01,800 | 1,96,440 | 14,313 |

| 12,300 | 2,02,200 | 80,280 | 9,486 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 2,92,920 | 11,760 | 4,300 |

| 11,000 | 2,74,680 | 6,240 | 3,451 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 2,66,040 | 57,480 | 3,435 |

| 12,200 | 1,61,760 | 41,280 | 8,379 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 86,280 | -16,200 | 2,647 |

| 12,175 | 15,960 | -9,480 | 619 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 1,61,760 | 41,280 | 8,379 |

| 12,300 | 1,34,520 | 36,240 | 4,884 |

Conclusion: A Volatility Reset Is Brewing Across Indices

The NIFTY options data analysis for April 29, 2025, reveals a market on pause mode after the recent upmove. Across NIFTY, BANKNIFTY, FINNIFTY, and MIDCPNIFTY, we see consistent signs of cooling momentum, falling premiums, and cautious OI builds. With PCRs softening and max pain consolidating, traders should brace for a range-bound phase or even mild downside pressure in the near term. Monthly Max-Pain level for NIFTY stays at 24,000 which should be the trend deciding level. Open Interest addition with falling premium suggests some short built-up. Stay watchful of macro cues as we are trading near the upper-end of the trading range.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]