Turning Complex Derivative Data into Clear Market Insights

Nifty Rallies 1.24% as FIIs Turn Buyers | Futures Premium Contracts

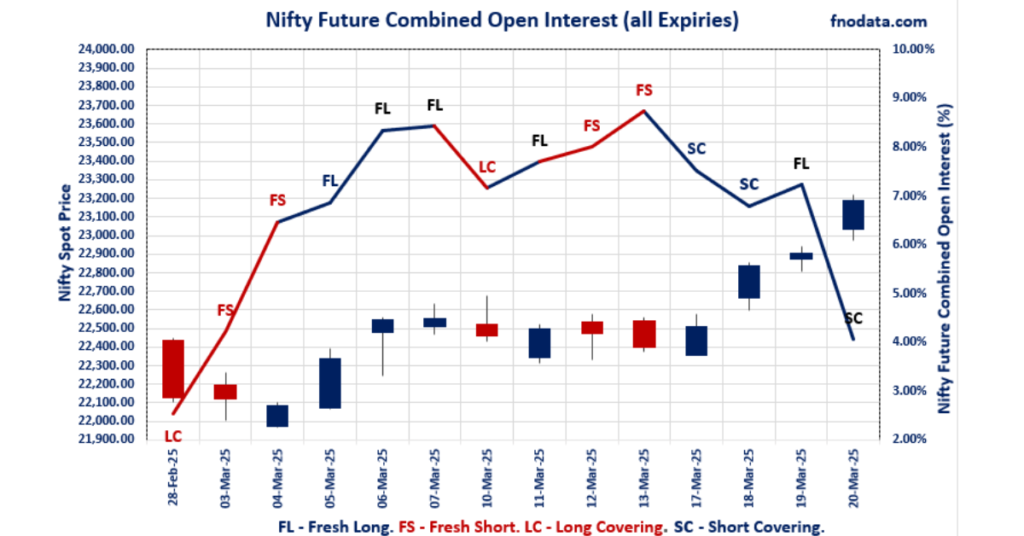

The Indian stock market witnessed a strong session as Nifty closed at 23,190.65, marking a 1.24% gain. Nifty March futures ended at 23,200.25, up 0.99%, but the futures premium contracted sharply to 9.6 points from the previous 65.35 points. This was accompanied by a 3.17% decline in combined Nifty Futures open interest (March, April & May), while Nifty futures volume surged 68%, indicating strong participation.

Put-Call Ratio (PCR) Insights

Nifty March PCR: 1.117 (up from 1.138)

Nifty April PCR: 1.389 (up from 1.235)

Nifty May PCR: 1.340 (up from 1.282)

Nifty Total PCR (all expiries): 1.147 (down from 1.204)

The rise in monthly expiry PCR suggests increased put writing, which can indicate bullish sentiment. However, the drop in overall PCR hints at a potential shift in market positioning.

Institutional Activity – FIIs Turn Buyers, DIIs Book Profits

In the cash market, institutional flows reflected a reversal in trends:

FIIs net bought ₹3,239.14 Cr, providing a strong boost to the market.

DIIs net sold ₹3,136.02 Cr, possibly booking profits after the recent rally.

FII Derivatives Positioning – Mixed Signals

FII Index Futures Open Interest Long Ratio: Improved to 29.68% (from 26.82%), indicating an increase in long positions.

FII Index Futures Volume Long Ratio: Slightly up to 63.82% (from 62.32%), showing sustained activity.

FII Call Option Open Interest Long Ratio: Decreased to 57.94% (from 59.2%), signaling reduced confidence in aggressive upside moves.

FII Put Option Open Interest Long Ratio: Improved to 57.47% (from 57.76%), indicating hedging activity remains strong.

| FII Trading Stats | 20.03.25 | 19.03.25 | 18.03.25 |

| FII Cash (Provisional Data) | 3239.14 | -1096.5 | 694.57 |

| Index Future Open Interest Long Ratio | 29.68% | 26.82% | 24.00% |

| Index Future Volume Long Ratio | 63.82% | 62.32% | 73.23% |

| Call Option Open Interest Long Ratio | 57.94% | 59.20% | 57.15% |

| Call Option Volume Long Ratio | 49.34% | 50.78% | 49.92% |

| Put Option Open Interest Long Ratio | 57.47% | 59.00% | 57.76% |

| Put Option Volume Long Ratio | 49.16% | 50.40% | 49.43% |

| Stock Future Open Interest Long Ratio | 64.85% | 64.48% | 64.41% |

| Stock Future Volume Long Ratio | 52.88% | 50.48% | 55.00% |

| Index Futures | Short Covering | Fresh Long | Short Covering |

| Index Options | Long Covering | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Short Covering |

| Nifty Options | Long Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Long | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Long Covering | Long Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Long | Short Covering |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Short Covering | Fresh Short | Long Covering |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Major Indices | Options Insights

SENSEX Monthly Expiry (25.03.2025)

The SENSEX index closed at 76348.06. The SENSEX Monthly expiry for March 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.385 against previous 1.253. The 74000PE option holds the maximum open interest, followed by the 78500CE and 78000CE options. Market participants have shown increased interest with significant open interest additions in the 74000PE option, with open interest additions also seen in the 78500CE and 78000CE options. On the other hand, open interest reductions were prominent in the 75500CE, 76500CE, and 75400CE options. Trading volume was highest in the 76000PE option, followed by the 76000CE and 77000CE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 25-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 76348.06 | 1.385 | 1.253 | 0.988 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 92,13,440 | 42,88,640 | 49,24,800 |

| PUT: | 1,27,63,820 | 53,73,300 | 73,90,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78500 | 9,67,840 | 7,13,100 | 54,79,780 |

| 78000 | 8,57,860 | 5,92,600 | 62,88,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78500 | 9,67,840 | 7,13,100 | 54,79,780 |

| 78000 | 8,57,860 | 5,92,600 | 62,88,480 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 87,640 | -1,42,040 | 12,80,480 |

| 76500 | 3,14,280 | -1,22,700 | 68,25,560 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 3,70,520 | 2,15,080 | 80,76,860 |

| 77000 | 3,71,740 | 1,34,500 | 72,54,120 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 11,87,520 | 9,22,220 | 50,91,700 |

| 71000 | 6,59,060 | 2,86,020 | 22,18,380 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 11,87,520 | 9,22,220 | 50,91,700 |

| 76000 | 5,90,260 | 5,55,000 | 88,91,960 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 2,18,060 | -35,380 | 9,97,400 |

| 71200 | 16,980 | -4,980 | 1,26,100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 5,90,260 | 5,55,000 | 88,91,960 |

| 75900 | 2,70,080 | 2,56,440 | 65,51,220 |

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at 23190.65. The NIFTY Monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.117 against previous 1.138. The 22000PE option holds the maximum open interest, followed by the 24000CE and 21000PE options. Market participants have shown increased interest with significant open interest additions in the 23000PE option, with open interest additions also seen in the 24000CE and 23900CE options. On the other hand, open interest reductions were prominent in the 22900CE, 22800CE, and 22700CE options. Trading volume was highest in the 23000PE option, followed by the 23500CE and 23200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,190.65 | 1.117 | 1.138 | 1.111 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,28,11,925 | 7,93,29,700 | 4,34,82,225 |

| PUT: | 13,71,48,300 | 9,03,04,225 | 4,68,44,075 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,05,10,375 | 47,58,825 | 3,58,616 |

| 23,500 | 77,63,625 | 28,01,625 | 5,88,773 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,05,10,375 | 47,58,825 | 3,58,616 |

| 23,900 | 51,58,950 | 42,18,825 | 2,21,367 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 14,84,925 | -3,92,475 | 96,487 |

| 22,800 | 17,47,950 | -3,55,650 | 50,130 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 77,63,625 | 28,01,625 | 5,88,773 |

| 23,200 | 54,24,225 | 16,91,175 | 5,72,841 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 1,12,28,200 | 28,69,775 | 3,95,455 |

| 21,000 | 96,48,225 | 29,68,575 | 2,28,054 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 92,88,875 | 57,30,100 | 7,45,630 |

| 23,200 | 45,39,300 | 41,97,450 | 3,54,731 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,650 | 3,17,550 | -1,07,475 | 33,741 |

| 23,900 | 62,550 | -89,550 | 1,444 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 92,88,875 | 57,30,100 | 7,45,630 |

| 22,800 | 69,13,275 | 37,55,775 | 4,05,012 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at 50062.85. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.239 against previous 1.281. The 49000PE option holds the maximum open interest, followed by the 48000PE and 47000PE options. Market participants have shown increased interest with significant open interest additions in the 50000PE option, with open interest additions also seen in the 50100CE and 50100PE options. On the other hand, open interest reductions were prominent in the 49000CE, 45500PE, and 46000PE options. Trading volume was highest in the 50000CE option, followed by the 50000PE and 49900CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 50,062.85 | 1.239 | 1.281 | 0.942 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,49,61,635 | 2,35,52,640 | 14,08,995 |

| PUT: | 3,09,20,190 | 3,01,60,239 | 7,59,951 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 16,46,160 | 23,010 | 2,44,339 |

| 51,000 | 14,64,705 | 56,550 | 2,73,034 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,100 | 4,24,830 | 2,22,390 | 2,26,305 |

| 53,000 | 13,75,950 | 1,76,130 | 1,07,759 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 10,74,420 | -1,66,860 | 33,551 |

| 49,700 | 1,93,800 | -1,13,100 | 1,39,007 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 13,43,340 | 72,900 | 6,53,559 |

| 49,900 | 3,16,890 | 91,410 | 3,12,988 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 21,93,270 | 8,490 | 2,56,372 |

| 48,000 | 19,77,210 | -3,465 | 2,14,789 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 13,20,480 | 5,78,100 | 4,60,535 |

| 50,100 | 2,68,380 | 2,14,980 | 1,69,351 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 45,500 | 2,22,360 | -1,56,750 | 39,371 |

| 46,000 | 13,71,720 | -1,46,220 | 99,018 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 13,20,480 | 5,78,100 | 4,60,535 |

| 49,900 | 3,12,060 | 1,88,460 | 2,77,351 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at 24309. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.293 against previous 1.376. The 23000PE option holds the maximum open interest, followed by the 22000PE and 24600CE options. Market participants have shown increased interest with significant open interest additions in the 24600CE option, with open interest additions also seen in the 23200PE and 24750CE options. On the other hand, open interest reductions were prominent in the 22000PE, 22900PE, and 24400CE options. Trading volume was highest in the 24000PE option, followed by the 24200PE and 24500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,309.00 | 1.293 | 1.376 | 0.961 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 28,10,145 | 24,23,200 | 3,86,945 |

| PUT: | 36,33,500 | 33,33,395 | 3,00,105 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 2,54,150 | 1,50,865 | 15,696 |

| 24,800 | 1,71,860 | 51,415 | 9,260 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 2,54,150 | 1,50,865 | 15,696 |

| 24,750 | 82,290 | 64,285 | 3,261 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 1,18,885 | -45,435 | 12,584 |

| 24,200 | 68,965 | -21,320 | 17,278 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,40,855 | -13,845 | 17,833 |

| 24,200 | 68,965 | -21,320 | 17,278 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 3,61,270 | 34,515 | 11,132 |

| 22,000 | 2,55,840 | -95,485 | 5,507 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 1,80,245 | 1,04,000 | 7,972 |

| 23,300 | 1,24,540 | 53,300 | 3,855 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 2,55,840 | -95,485 | 5,507 |

| 22,900 | 46,735 | -60,255 | 3,575 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,80,505 | 40,040 | 18,393 |

| 24,200 | 93,860 | 51,740 | 17,968 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 11364.65. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.069 against previous 1.100. The 12000CE option holds the maximum open interest, followed by the 11000PE and 10500PE options. Market participants have shown increased interest with significant open interest additions in the 11750CE option, with open interest additions also seen in the 10950PE and 11300PE options. On the other hand, open interest reductions were prominent in the 63000CE, 61000CE, and 66000CE options. Trading volume was highest in the 11400CE option, followed by the 11500CE and 11300PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,364.65 | 1.069 | 1.100 | 0.901 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,34,90,520 | 1,13,60,400 | 21,30,120 |

| PUT: | 1,44,20,040 | 1,24,94,040 | 19,26,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 13,97,880 | 98,760 | 32,820 |

| 11,500 | 9,53,280 | 43,440 | 60,636 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,750 | 6,90,360 | 6,36,240 | 14,072 |

| 11,600 | 7,61,280 | 2,75,640 | 34,201 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,900 | 5,81,880 | -59,520 | 656 |

| 11,000 | 4,28,760 | -58,080 | 1,746 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 7,05,360 | 1,39,920 | 64,027 |

| 11,500 | 9,53,280 | 43,440 | 60,636 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 13,46,280 | 1,03,080 | 35,424 |

| 10,500 | 13,34,400 | 75,360 | 25,303 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 10,950 | 7,56,840 | 6,36,120 | 13,567 |

| 11,300 | 10,27,080 | 3,16,680 | 46,914 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,300 | 3,09,360 | -92,880 | 5,327 |

| 10,200 | 3,16,200 | -69,960 | 4,364 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,300 | 10,27,080 | 3,16,680 | 46,914 |

| 11,400 | 4,74,600 | 2,53,080 | 40,981 |

Conclusion – Strong Momentum, But Signs of Profit Booking Emerge

The market’s strong rally was supported by robust FII buying and increased put writing, indicating confidence among traders. However, the sharp contraction in Nifty futures premium suggests that long positions are being unwound, possibly due to profit booking at higher levels. Additionally, the drop in Nifty March PCR indicates that traders might be shifting their focus towards April contracts, rolling over positions ahead of expiry or reducing bullish bets in the near term. The range for Nifty has been shifted to 23,000 – 23,500 levels. Strong Open Interest built-up at 23,000 – 22,900 levels suggests support zones. Any break below 22,900 should bring the Bears in the fight again.

While the broader trend remains positive, the reduction in open interest and mixed FII derivatives positioning suggest some caution. Traders should closely track institutional flows and key support/resistance levels to gauge whether the momentum can sustain or if a short-term consolidation is on the horizon.