Turning Complex Derivative Data into Clear Market Insights

Nifty/Sensex F&O Analysis | Critical Market Shifts Ahead of Expiry on 27th March

As Nifty F&O expiry approaches, the market experienced notable volatility, with a decline in spot prices and shifts in futures premiums and open interest.

As Nifty F&O expiry approaches, the market experienced notable volatility, with a decline in spot prices and shifts in futures premiums and open interest.

Table of Contents

Nifty Futures Performance & Premium Contraction

Nifty spot closed at 23,486.85, down 0.77%.

Nifty March futures ended at 23,521.9, reflecting a 0.77% decline.

Nifty futures premium narrowed slightly to 35.05 points, down by 1.65 points from the previous session.

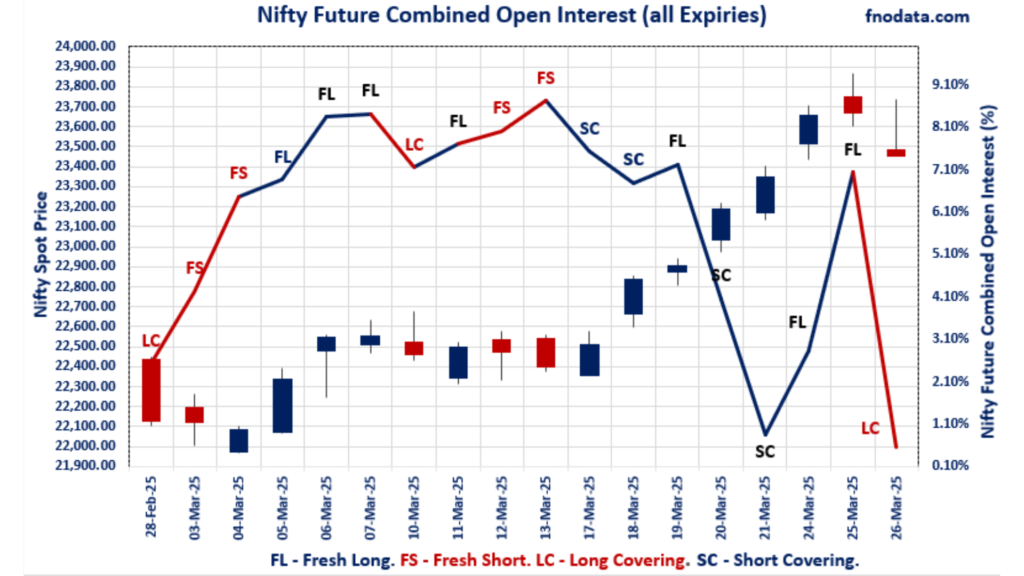

Combined Nifty futures open interest (March, April & May) fell by 6.49%, indicating unwinding of Long positions ahead of expiry.

Futures trading volume rose by 14%, suggesting increased participation despite declining OI.

Nifty Put-Call Ratio (PCR) Insights

Nifty March PCR dropped to 0.820 (from 0.956), indicating a shift in sentiment toward bearish positioning.

Nifty April PCR decreased to 1.363 (from 1.415), reflecting reduced put writing.

Nifty May PCR declined to 1.414 (from 1.561), suggesting reduced confidence in long-term put positions.

Overall PCR for all expiries fell to 0.919 (from 1.038), signaling an increase in call writing and lower put demand.

Institutional Activity: FIIs & DIIs Flow in capital Markets

Foreign Institutional Investors (FIIs) remained net buyers, purchasing ₹2,240.55 Cr worth of equities.

Domestic Institutional Investors (DIIs) were net sellers, offloading ₹696.37 Cr in the cash market.

FII Derivatives Positioning

FII Index Future Open Interest Long Ratio rose to 33.58% (from 32.94%), showing slight strengthening of bullish bets with probable positive rollover.

FII Index Future Volume Long Ratio decreased to 51.88% (from 52.32%), indicating reduced conviction in long trades.

FII Call Option Open Interest Long Ratio climbed to 55.43% (from 53.83%), signaling interest in call buying.

FII Put Option Open Interest Long Ratio improved to 56.61% (from 54.49%), suggesting increased hedging activity.

| FII Trading Stats | 26.03.25 | 25.03.25 | 24.03.25 |

| FII Cash (Provisional Data) | 2,240.55 | 5,371.57 | 3,055.76 |

| Index Future Open Interest Long Ratio | 33.58% | 32.94% | 32.13% |

| Index Future Volume Long Ratio | 51.88% | 52.32% | 50.83% |

| Call Option Open Interest Long Ratio | 55.43% | 53.83% | 53.34% |

| Call Option Volume Long Ratio | 50.34% | 50.19% | 49.69% |

| Put Option Open Interest Long Ratio | 56.61% | 54.49% | 52.02% |

| Put Option Volume Long Ratio | 50.34% | 50.56% | 49.63% |

| Stock Future Open Interest Long Ratio | 65.22% | 65.16% | 65.06% |

| Stock Future Volume Long Ratio | 50.17% | 50.30% | 50.16% |

| Index Futures | Short Covering | Short Covering | Fresh Long |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Short Covering | Fresh Long | Fresh Long |

| Nifty Options | Short Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Long Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Long Covering | Long Covering |

| MidcpNifty Options | Long Covering | Short Covering | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Short Covering | Fresh Long |

| NiftyNxt50 Options | Short Covering | Fresh Long | Long Covering |

| Stock Futures | Short Covering | Fresh Long | Fresh Long |

| Stock Options | Long Covering | Fresh Short | Fresh Long |

Nifty/Sensex F&O Analysis : Major Indices | Options Insights

SENSEX Weekly Expiry (01.04.2025)

The SENSEX index closed at 77288.5. The SENSEX weekly expiry for April 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.726 against previous 0.758. The 82000CE option holds the maximum open interest, followed by the 83000CE and 81000CE options. Market participants have shown increased interest with significant open interest additions in the 82000CE option, with open interest additions also seen in the 83000CE and 68000PE options. On the other hand, open interest reductions were prominent in the 79000PE, 79100PE, and 74900CE options. Trading volume was highest in the 78000PE option, followed by the 78000CE and 77500PE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 01-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 77288.5 | 0.726 | 0.758 | 1.327 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 69,16,260 | 28,14,769 | 41,01,491 |

| PUT: | 50,18,940 | 21,32,880 | 28,86,060 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,55,940 | 3,89,640 | 45,44,420 |

| 83000 | 5,14,660 | 2,98,140 | 45,82,380 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,55,940 | 3,89,640 | 45,44,420 |

| 83000 | 5,14,660 | 2,98,140 | 45,82,380 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 74900 | 440 | -760 | 1,160 |

| 75100 | 680 | -680 | 1,380 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 3,53,340 | 1,86,780 | 85,17,740 |

| 81000 | 4,31,660 | 2,33,060 | 49,48,560 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 4,27,840 | 1,19,640 | 78,57,940 |

| 76500 | 3,47,180 | 1,10,840 | 40,10,480 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 2,47,540 | 2,39,120 | 11,16,980 |

| 72000 | 2,46,240 | 1,84,060 | 16,34,360 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 11,800 | -2,120 | 1,00,820 |

| 79100 | 5,300 | -1,800 | 17,220 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 2,19,120 | 20,980 | 1,09,41,240 |

| 77500 | 1,47,440 | 66,240 | 84,55,900 |

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at 23486.85. The NIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.820 against previous 0.956. The 24000CE option holds the maximum open interest, followed by the 24100CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 23600CE option, with open interest additions also seen in the 23500CE and 23700CE options. On the other hand, open interest reductions were prominent in the 21000PE, 25000CE, and 22000PE options. Trading volume was highest in the 23700CE option, followed by the 23500PE and 23600PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,486.85 | 0.820 | 0.956 | 1.024 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,52,59,100 | 20,28,44,800 | 24,14,300 |

| PUT: | 16,83,33,050 | 19,38,68,275 | -2,55,35,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,56,93,325 | 28,62,550 | 35,09,101 |

| 24,100 | 1,21,05,750 | -1,82,625 | 21,25,861 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 71,07,150 | 40,11,825 | 31,89,973 |

| 23,500 | 65,49,675 | 33,63,675 | 15,41,058 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,18,38,950 | -21,91,350 | 7,19,567 |

| 24,800 | 22,41,300 | -17,46,225 | 3,65,496 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 1,02,52,125 | 30,85,500 | 55,43,730 |

| 23,800 | 1,06,91,625 | 22,72,800 | 37,74,411 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,17,75,725 | -13,08,800 | 12,99,972 |

| 22,500 | 1,06,37,400 | -21,35,400 | 9,15,094 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,600 | 68,20,950 | 18,64,800 | 4,71,752 |

| 23,400 | 60,25,050 | 10,52,850 | 32,45,465 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 62,76,350 | -24,69,825 | 2,30,664 |

| 22,000 | 71,71,900 | -21,43,725 | 3,69,352 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 71,00,850 | -12,46,200 | 53,82,462 |

| 23,600 | 39,42,525 | -15,71,775 | 53,26,750 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at 51209. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.855 against previous 1.034. The 53000CE option holds the maximum open interest, followed by the 52000CE and 49000PE options. Market participants have shown increased interest with significant open interest additions in the 51500CE option, with open interest additions also seen in the 52500CE and 51300CE options. On the other hand, open interest reductions were prominent in the 48500PE, 49000PE, and 48000PE options. Trading volume was highest in the 51000PE option, followed by the 51500PE and 52000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,209.00 | 0.855 | 1.034 | 1.119 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,51,44,610 | 3,26,59,965 | 24,84,645 |

| PUT: | 3,00,62,745 | 3,37,56,189 | -36,93,444 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 26,62,110 | 4,68,720 | 8,45,659 |

| 52,000 | 19,86,510 | 1,27,320 | 16,15,094 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 15,75,990 | 7,19,820 | 13,07,805 |

| 52,500 | 18,21,420 | 6,53,085 | 10,54,072 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 61,500 | 10,93,110 | -2,85,795 | 2,34,113 |

| 54,500 | 5,73,180 | -2,80,290 | 2,09,461 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 19,86,510 | 1,27,320 | 16,15,094 |

| 51,500 | 15,75,990 | 7,19,820 | 13,07,805 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 18,84,510 | -5,31,120 | 4,10,617 |

| 50,000 | 17,42,220 | -47,970 | 8,28,490 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,200 | 6,76,590 | 2,96,010 | 13,80,330 |

| 51,300 | 4,91,550 | 1,98,030 | 11,98,987 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 48,500 | 9,37,500 | -6,09,510 | 2,48,412 |

| 49,000 | 18,84,510 | -5,31,120 | 4,10,617 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 11,69,370 | -91,215 | 20,29,084 |

| 51,500 | 8,84,910 | -1,52,700 | 16,37,097 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at 24829.6. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.801 against previous 0.859. The 25000CE option holds the maximum open interest, followed by the 25200CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 25200CE and 25100CE options. On the other hand, open interest reductions were prominent in the 26500CE, 25100PE, and 25900CE options. Trading volume was highest in the 25000PE option, followed by the 24800PE and 25200CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,829.60 | 0.801 | 0.859 | 1.044 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 65,22,230 | 57,29,555 | 7,92,675 |

| PUT: | 52,23,140 | 49,24,010 | 2,99,130 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 4,59,615 | 2,15,995 | 1,08,694 |

| 25,200 | 4,31,730 | 1,71,665 | 1,30,284 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 4,59,615 | 2,15,995 | 1,08,694 |

| 25,200 | 4,31,730 | 1,71,665 | 1,30,284 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,87,330 | -87,555 | 12,386 |

| 25,900 | 96,330 | -79,235 | 27,019 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 4,31,730 | 1,71,665 | 1,30,284 |

| 25,100 | 2,76,705 | 1,50,280 | 1,09,843 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 2,83,985 | 1,12,190 | 1,33,791 |

| 24,400 | 2,83,465 | 1,03,740 | 47,994 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,850 | 2,19,895 | 1,15,570 | 78,916 |

| 24,800 | 2,83,985 | 1,12,190 | 1,33,791 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 84,695 | -80,015 | 68,306 |

| 23,500 | 1,20,575 | -56,160 | 9,279 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 2,71,960 | -37,960 | 1,84,862 |

| 24,800 | 2,83,985 | 1,12,190 | 1,33,791 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 11502.15. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.908 against previous 0.970. The 12000CE option holds the maximum open interest, followed by the 10900PE and 11700CE options. Market participants have shown increased interest with significant open interest additions in the 11600CE option, with open interest additions also seen in the 11375PE and 11700CE options. On the other hand, open interest reductions were prominent in the 64000CE, 63800CE, and 62000PE options. Trading volume was highest in the 11500PE option, followed by the 11700CE and 11600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,502.15 | 0.908 | 0.970 | 1.034 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,76,69,040 | 1,61,97,000 | 14,72,040 |

| PUT: | 1,60,44,840 | 1,57,07,040 | 3,37,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 14,08,440 | 76,800 | 1,09,817 |

| 11,700 | 12,48,480 | 4,50,000 | 2,11,195 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,600 | 11,64,960 | 5,93,880 | 2,11,191 |

| 11,700 | 12,48,480 | 4,50,000 | 2,11,195 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 11,26,920 | -4,36,680 | 1,43,486 |

| 12,500 | 4,20,840 | -1,19,160 | 9,287 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,700 | 12,48,480 | 4,50,000 | 2,11,195 |

| 11,600 | 11,64,960 | 5,93,880 | 2,11,191 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,900 | 13,49,280 | 3,14,280 | 28,456 |

| 11,300 | 11,33,400 | -46,560 | 98,833 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,375 | 5,53,200 | 4,87,920 | 51,349 |

| 10,900 | 13,49,280 | 3,14,280 | 28,456 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 8,95,920 | -5,31,840 | 1,67,121 |

| 10,500 | 4,96,080 | -2,68,680 | 14,039 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 7,25,640 | -1,53,600 | 2,37,018 |

| 11,600 | 7,00,560 | 37,440 | 2,08,355 |

Market Outlook Ahead of Expiry

With Nifty futures open interest declining sharply, traders are unwinding positions before expiry, likely due to uncertainty and profit booking. The contraction in PCR suggests higher call writing, indicating resistance levels are being reinforced. Additionally, despite an increase in Long Index Future positions; FIIs increasing their call and put open interest ratios hints at hedging strategies rather than directional bets.

The highest Nifty open interest (OI) addition in Call options is observed at the 23,600 strike, while the highest OI addition in Put options is at 23,400. This suggests that traders are actively building positions around these levels, indicating a potential short-term trading range. Additionally, the largest Call open interest is concentrated at the 24,000 strike, implying strong resistance, as option sellers anticipate limited upside movement beyond this level. On the downside, the top Put open interest is at 23,000, signaling a strong support zone where traders expect the market to find buying interest.

This positioning suggests that Nifty is likely to consolidate within the 23,600–23,400 range for tomorrow; which is also the Expiry day. A breakout/breakdown in either direction potentially triggering further momentum towards either 24,000 on the upside or towards 23,000 on the downside.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]