Turning Complex Derivative Data into Clear Market Insights

NSE & BSE F&O Analysis – Contracting Volume before Liberation Day Event | 2/04/2025

In today’s dynamic market, NSE & BSE F&O analysis plays a crucial role in identifying trends and opportunities for traders. With shifting open interest, fluctuating put-call ratios, and evolving max pain levels, traders need to stay ahead to make informed decisions. This analysis provides a deep dive into NIFTY, SENSEX, BANKNIFTY, FINNIFTY, and MIDCPNIFTY futures and options to help traders strategize effectively.

Table of Contents

NSE F&O Analysis | Short Covering with Low Volume

NIFTY F&O Analysis

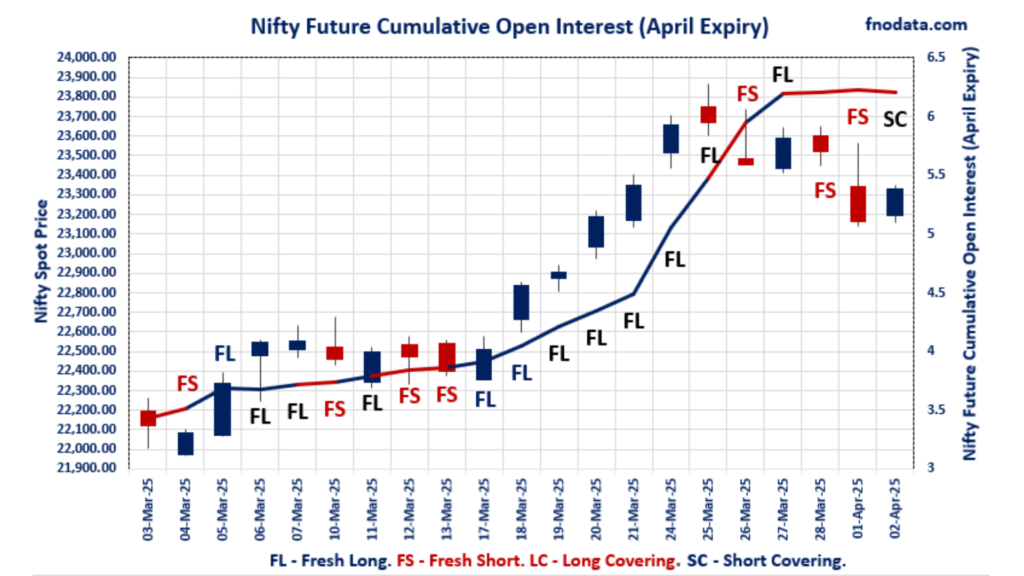

NIFTY April Future

NIFTY Spot closed at 23332.35; up by 0.72%. NIFTY April Future closed at 23438.95; registering a 0.5% gain while maintaining a 106.6-point premium over the spot price. NIFTY April Future premium contracted by 49.1 points.

NIFTY Option Weekly Expiry (3/04/2025)

NIFTY Option Weekly Expiry (3/04/2025) Put-Call ratio (PCR) decreased to 0.629 from 0.876. Max pain level was at 23250. Maximum CALL Open Interest was at 23500 while maximum PUT Open Interest was at 23000. Maximum CALL Open Interest addition was at 23300 while maximum PUT Open Interest addition was at 23200.

NIFTY Option Monthly Expiry (24/04/2025)

NIFTY Option Monthly Expiry (24/04/2025) Put-Call ratio (PCR) decreased from 1.202 to 1.185. Max pain level is at 23500. Maximum CALL Open Interest was at 23500 while maximum PUT Open Interest was at 23500. Maximum CALL Open Interest addition was at 24900 while maximum PUT Open Interest addition was at 23300.

BANKNIFTY F&O Analysis

BANKNIFTY April Future

BANKNIFTY Spot closed at 51348.05; up by 1.02%. BANKNIFTY April Future closed at 51581.15; registering a 0.77% gain while maintaining a 233.1-point premium over the spot price. BANKNIFTY April Future premium contracted by 126.5 points.

BANKNIFTY Option Monthly Expiry (24/04/2025):

BANKNIFTY Option Monthly Expiry (24/04/2025) Put-Call ratio (PCR) increased from 0.906 to 0.991. Max pain level was at 51500. Maximum CALL Open Interest was at 53000 while maximum PUT Open Interest was at 53000. Maximum CALL Open Interest addition was at 52000 while maximum PUT Open Interest addition was at 51000.

FINNIFTY F&O Analysis

FINNIFTY April Future

FINNIFTY Spot closed at 24750.05; up by 0.9%. FINNIFTY April Future closed at 24859.5; registering a 0.7% gain while maintaining a 109.45-point premium over the spot price. FINNIFTY April Future premium contracted by 47.35 points.

FINNIFTY Option Monthly Expiry (24/04/2025)

FINNIFTY Option Monthly Expiry (24/04/2025) Put-Call ratio (PCR) increased from 0.535 to 0.711. Max pain level was at 24900. Maximum CALL Open Interest was at 25500 while maximum PUT Open Interest was at 25000. Maximum CALL Open Interest addition was at 25000 while maximum PUT Open Interest addition was at 23500.

MIDCPNIFTY F&O Analysis

MIDCPNIFTY April Future

MIDCPNIFTY Spot closed at 11606.45; up by 1.95%. MIDCPNIFTY April Future closed at 11637.95; registering a 2.09% gain while maintaining a 31.5-point premium over the spot price. MIDCPNIFTY April Future premium expanded by 15.8 points.

MIDCPNIFTY Option Monthly Expiry (24/04/2025)

MIDCPNIFTY Option Monthly Expiry (24/04/2025) Put-Call ratio (PCR) increased from 0.800 to 0.898. Max pain level was at 11500. Maximum CALL Open Interest was at 12000 while maximum PUT Open Interest was at 11000. Maximum CALL Open Interest addition was at 11600 while maximum PUT Open Interest addition was at 11000.

FII & DII Cash Market Activity

- FIIs Net Sell: ₹1,538.88 Cr

- DIIs Net Buy: ₹2,808.83 Cr

FII Derivative Positioning: Signs of Caution

- FII Index Future OI Long Ratio: 32.37% (increased from 30.62%)

- FII Index Future Volume Long Ratio: 57.6% (increased from 33.99%)

- FII Call Option OI Long Ratio: 50.69% (decreased from 52.6%)

- FII Put Option OI Long Ratio: 53.05% (decreased from 57.47%)

| FII Trading Stats | 2.04.25 | 1.04.25 | 28.03.25 |

| FII Cash (Provisional Data) | -1,538.88 | -5,901.63 | -4,352.82 |

| Index Future Open Interest Long Ratio | 32.37% | 30.62% | 35.02% |

| Index Future Volume Long Ratio | 57.60% | 33.99% | 33.72% |

| Call Option Open Interest Long Ratio | 50.69% | 52.60% | 53.89% |

| Call Option Volume Long Ratio | 49.69% | 49.98% | 49.33% |

| Put Option Open Interest Long Ratio | 53.05% | 57.47% | 56.47% |

| Put Option Volume Long Ratio | 49.39% | 50.34% | 49.65% |

| Stock Future Open Interest Long Ratio | 64.70% | 64.07% | 63.89% |

| Stock Future Volume Long Ratio | 55.76% | 51.54% | 46.79% |

| Index Futures | Fresh Long | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Short Covering | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Long | Short Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & BSE F&O Analysis | Options Insights

NIFTY Weekly Expiry (3.04.2025)

The NIFTY index closed at 23332.35. The NIFTY weekly expiry for April 3, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.876 against previous 0.629. The 23500CE option holds the maximum open interest, followed by the 25400CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 23200PE option, with open interest additions also seen in the 23300PE and 23000PE options. On the other hand, open interest reductions were prominent in the 25400CE, 20350PE, and 24500CE options. Trading volume was highest in the 23300CE option, followed by the 23200PE and 23300PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 03-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,332.35 | 0.876 | 0.629 | 0.928 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,52,65,250 | 21,71,82,900 | -1,19,17,650 |

| PUT: | 17,97,79,425 | 13,66,12,800 | 4,31,66,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,48,13,250 | 14,76,675 | 41,08,646 |

| 25,400 | 1,30,77,525 | -34,38,225 | 7,02,519 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 1,14,94,500 | 40,69,875 | 74,21,569 |

| 23,350 | 67,70,625 | 37,54,950 | 39,08,055 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,30,77,525 | -34,38,225 | 7,02,519 |

| 24,500 | 78,83,550 | -29,24,625 | 5,26,555 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 1,14,94,500 | 40,69,875 | 74,21,569 |

| 23,400 | 76,78,125 | -2,58,825 | 46,54,628 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,17,07,800 | 42,89,400 | 31,88,820 |

| 23,200 | 1,13,09,325 | 63,72,675 | 59,93,048 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 1,13,09,325 | 63,72,675 | 59,93,048 |

| 23,300 | 90,19,875 | 54,50,475 | 53,57,739 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,350 | 33,12,450 | -30,72,975 | 3,70,721 |

| 20,400 | 6,92,400 | -12,26,850 | 1,26,328 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 1,13,09,325 | 63,72,675 | 59,93,048 |

| 23,300 | 90,19,875 | 54,50,475 | 53,57,739 |

SENSEX Weekly Expiry (8.04.2025)

The SENSEX index closed at 76617.44. The SENSEX weekly expiry for April 8, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.989 against previous 0.691. The 81000CE option holds the maximum open interest, followed by the 71000PE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 83000CE and 71000PE options. On the other hand, open interest reductions were prominent in the 76000CE, 76100CE, and 78000PE options. Trading volume was highest in the 76500CE option, followed by the 76500PE and 76000PE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 08-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 76617.44 | 0.989 | 0.691 | 0.925 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 58,09,100 | 22,90,689 | 35,18,411 |

| PUT: | 57,42,640 | 15,83,520 | 41,59,120 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 6,64,280 | 4,75,120 | 30,60,240 |

| 83000 | 4,54,500 | 4,21,500 | 23,38,100 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 6,64,280 | 4,75,120 | 30,60,240 |

| 83000 | 4,54,500 | 4,21,500 | 23,38,100 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 65,640 | -46,880 | 12,36,720 |

| 76100 | 43,200 | -3,620 | 13,50,880 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 2,20,320 | 1,42,040 | 92,51,020 |

| 77000 | 2,24,700 | 60,720 | 65,94,200 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 71000 | 4,96,300 | 3,63,400 | 23,78,860 |

| 72000 | 3,92,200 | 3,00,820 | 29,02,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 71000 | 4,96,300 | 3,63,400 | 23,78,860 |

| 68000 | 3,42,140 | 3,38,360 | 15,95,920 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 14,120 | -840 | 15,280 |

| 78900 | 220 | -180 | 800 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 3,15,840 | 2,46,880 | 85,01,180 |

| 76000 | 2,68,180 | 1,07,440 | 76,70,560 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 23332.35. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.185 against previous 1.202. The 23500PE option holds the maximum open interest, followed by the 23500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 23300PE option, with open interest additions also seen in the 24900CE and 23400PE options. On the other hand, open interest reductions were prominent in the 23500PE, 21000CE, and 24400CE options. Trading volume was highest in the 24000CE option, followed by the 23500CE and 23000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,332.35 | 1.185 | 1.202 | 0.823 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,00,28,925 | 3,81,91,350 | 18,37,575 |

| PUT: | 4,74,42,525 | 4,58,97,375 | 15,45,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 42,85,350 | 76,650 | 52,923 |

| 24,000 | 33,08,025 | -45,300 | 55,020 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 6,64,500 | 4,47,075 | 14,873 |

| 25,000 | 29,81,325 | 3,93,525 | 32,600 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 8,96,925 | -1,32,900 | 2,838 |

| 24,400 | 4,48,800 | -1,15,500 | 16,491 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 33,08,025 | -45,300 | 55,020 |

| 23,500 | 42,85,350 | 76,650 | 52,923 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 45,77,700 | -1,69,650 | 39,545 |

| 23,000 | 34,69,200 | -51,150 | 50,477 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 19,85,400 | 4,82,175 | 41,229 |

| 23,400 | 19,32,225 | 4,05,825 | 22,276 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 45,77,700 | -1,69,650 | 39,545 |

| 24,000 | 19,33,350 | -61,125 | 7,155 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 34,69,200 | -51,150 | 50,477 |

| 23,300 | 19,85,400 | 4,82,175 | 41,229 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 51348.05. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.991 against previous 0.906. The 53000CE option holds the maximum open interest, followed by the 53000PE and 52000CE options. Market participants have shown increased interest with significant open interest additions in the 51000PE option, with open interest additions also seen in the 50000PE and 51200PE options. On the other hand, open interest reductions were prominent in the 52500CE, 53000PE, and 49000CE options. Trading volume was highest in the 51000PE option, followed by the 51500CE and 51200PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,348.05 | 0.991 | 0.906 | 0.900 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,59,98,430 | 1,55,09,499 | 4,88,931 |

| PUT: | 1,58,59,500 | 1,40,55,930 | 18,03,570 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 13,33,860 | 21,690 | 1,44,282 |

| 52,000 | 10,84,350 | 1,26,150 | 1,47,333 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 10,84,350 | 1,26,150 | 1,47,333 |

| 55,200 | 1,13,850 | 71,340 | 9,747 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 6,07,680 | -71,820 | 95,677 |

| 49,000 | 4,35,450 | -54,780 | 5,348 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 7,51,140 | 2,400 | 1,62,938 |

| 52,000 | 10,84,350 | 1,26,150 | 1,47,333 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 11,73,780 | -66,390 | 4,820 |

| 50,000 | 10,73,790 | 1,53,360 | 99,456 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 9,81,420 | 1,99,050 | 2,15,169 |

| 50,000 | 10,73,790 | 1,53,360 | 99,456 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 11,73,780 | -66,390 | 4,820 |

| 41,000 | 1,99,050 | -31,620 | 13,858 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 9,81,420 | 1,99,050 | 2,15,169 |

| 51,200 | 2,39,640 | 1,36,470 | 1,52,307 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 24750.05. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.711 against previous 0.535. The 25500CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 23500PE option, with open interest additions also seen in the 24700PE and 25000CE options. On the other hand, open interest reductions were prominent in the 25500CE, 25700CE, and 24550CE options. Trading volume was highest in the 24700PE option, followed by the 25000CE and 24700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,750.05 | 0.711 | 0.535 | 0.775 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,25,015 | 9,16,630 | 8,385 |

| PUT: | 6,57,670 | 4,90,035 | 1,67,635 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,13,555 | -17,550 | 3,134 |

| 26,000 | 98,280 | 1,885 | 3,159 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 84,825 | 16,445 | 4,991 |

| 27,500 | 39,650 | 13,195 | 690 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,13,555 | -17,550 | 3,134 |

| 25,700 | 23,270 | -12,350 | 545 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 84,825 | 16,445 | 4,991 |

| 24,700 | 23,985 | 2,600 | 3,254 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 60,515 | 52,260 | 1,938 |

| 24,000 | 57,785 | 2,405 | 1,533 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 60,515 | 52,260 | 1,938 |

| 24,700 | 44,980 | 21,385 | 5,683 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 3,640 | -4,355 | 148 |

| 25,000 | 41,275 | -2,860 | 904 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 44,980 | 21,385 | 5,683 |

| 24,600 | 19,760 | 6,500 | 2,167 |

MIDCPNIFTY Monthly Expiry (24.04.2025)

The MIDCPNIFTY index closed at 11606.45. The MIDCPNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.898 against previous 0.800. The 11000PE option holds the maximum open interest, followed by the 12000CE and 11500PE options. Market participants have shown increased interest with significant open interest additions in the 11000PE option, with open interest additions also seen in the 11600PE and 11600CE options. On the other hand, open interest reductions were prominent in the 54300PE, 54300PE, and 54300PE options. Trading volume was highest in the 11400PE option, followed by the 12000CE and 11500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,606.45 | 0.898 | 0.800 | 1.002 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 43,92,120 | 38,38,080 | 5,54,040 |

| PUT: | 39,43,320 | 30,68,640 | 8,74,680 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,02,520 | 81,720 | 18,673 |

| 11,500 | 4,25,640 | -6,000 | 18,283 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,600 | 4,10,040 | 1,40,040 | 14,199 |

| 13,000 | 3,95,280 | 1,01,160 | 4,906 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,81,880 | -40,920 | 6,360 |

| 11,550 | 70,560 | -32,400 | 6,385 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,02,520 | 81,720 | 18,673 |

| 11,500 | 4,25,640 | -6,000 | 18,283 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 6,20,760 | 1,96,080 | 17,379 |

| 11,500 | 5,14,320 | 1,24,320 | 17,764 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 6,20,760 | 1,96,080 | 17,379 |

| 11,600 | 3,30,120 | 1,45,680 | 8,044 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,500 | 2,34,000 | -60,600 | 8,654 |

| 11,550 | 1,27,200 | -33,960 | 5,883 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,400 | 3,08,880 | 61,320 | 19,119 |

| 11,500 | 5,14,320 | 1,24,320 | 17,764 |

Market Outlook: Uncertainty Looms Amid Weak Global Cues & Trump Liberation Day Event

The latest F&O data suggests mixed signals in market sentiment. NIFTY and BANKNIFTY premium contraction indicates cautious optimism, while the put-call ratio in key indices suggests neutral to bearish positioning. FIIs’ selling in the cash market and their decreasing put option long ratio highlight risk aversion. The max pain levels and highest OI additions suggest potential resistance levels for upcoming expiries.

Adding to global uncertainty, traders are also factoring in external events such as the Trump Liberation Day event on April 3, 2025, which could influence global market sentiment and volatility. For a sustained bullish trend, NIFTY must hold above its 100-DMA at 23,477, while BANKNIFTY needs to stay above its 200-DMA at 51,015.

For the bullish bias to continue, Nifty must sustain above the 100-DMA at 23,466, and Bank Nifty must hold above the 200-DMA at 51,023.

Traders should remain vigilant, adapt to evolving market conditions, and keep an eye on global macroeconomic cues.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]