Turning Complex Derivative Data into Clear Market Insights

NSE & BSE F&O Insights : May 5, 2025 | mixed market sentiment

Table of Contents

NSE & BSE F&O Insights shows that on May 5, 2025 the Nifty 50 index powered ahead, closing at 24,461.15 (up 0.47%), while the Sensex similarly rose 0.37% (to about 80,797). In contrast, BankNifty lagged, slipping 0.36% to 54,919.50. The Nifty Financial Services index held near flat (26,164.90, +0.05%), and midcaps outperformed. In the futures and options pits, Nifty futures traded around 24,585 for the June contract (premium over spot increased by 38.55 points to 92.55). NIFTY Volume fell by 52.3% where OI rose by 4.5%, with Max Pain levels clustering near the 24,400–24,100 strikes (heavy call interest at 25,000 and put interest at 24,000), highlighting the key price zones where most traders were positioned.

Derivative Trends | NSE & BSE

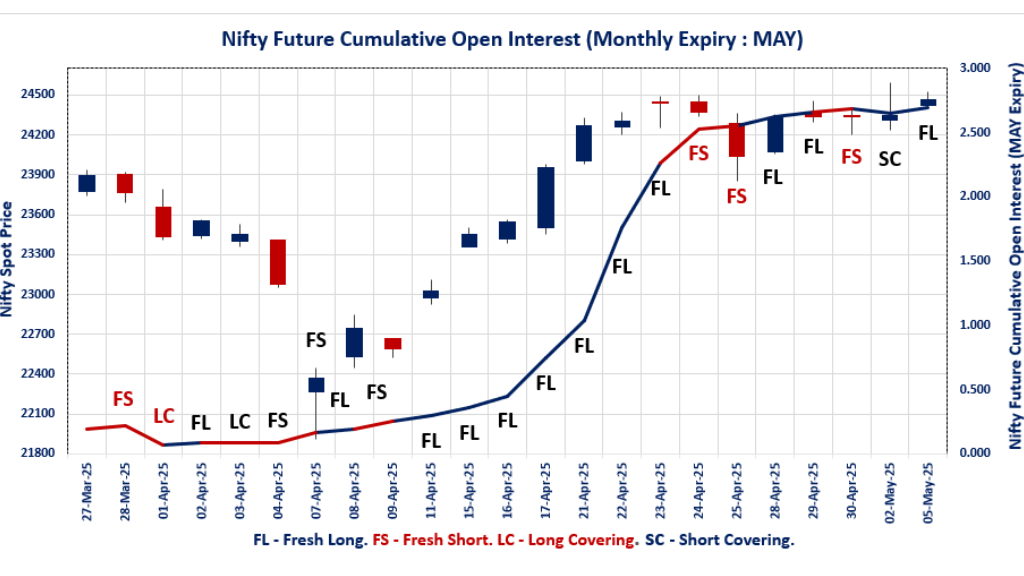

NIFTY MAY Future

NIFTY Spot closed at: 24,461.15 (0.47%)

NIFTY MAY Future closed at: 24,553.70 (0.63%)

Premium: 92.55 (Increased by 38.55 points)

Open Interest Change: 4.5%

Volume Change: -52.3%

NIFTY Weekly Expiry (8/05/2025) Option Analysis

Put-Call Ratio (OI): 0.811 (Increased from 0.695)

Put-Call Ratio (Volume): 0.872

Max Pain Level: 24400

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24400

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.373 (Increased from 1.367)

Put-Call Ratio (Volume): 1.123

Max Pain Level: 24100

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24500

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,919.50 (-0.36%)

BANKNIFTY MAY Future closed at: 55,080.60 (-0.23%)

Premium: 161.1 (Increased by 66.65 points)

Open Interest Change: -3.3%

Volume Change: -36.0%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.892 (Decreased from 0.903)

Put-Call Ratio (Volume): 0.899

Max Pain Level: 54800

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 63000

Highest PUT Addition: 55000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,164.90 (0.05%)

FINNIFTY MAY Future closed at: 26,246.60 (0.20%)

Premium: 81.7 (Increased by 40.35 points)

Open Interest Change: 0.2%

Volume Change: -44.2%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.786 (Increased from 0.734)

Put-Call Ratio (Volume): 0.716

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 29500

Highest PUT Addition: 25000

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,242.35 (2.22%)

MIDCPNIFTY MAY Future closed at: 12,291.85 (2.46%)

Premium: 49.5 (Increased by 29.6 points)

Open Interest Change: 2.4%

Volume Change: -30.1%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.073 (Increased from 0.984)

Put-Call Ratio (Volume): 0.847

Max Pain Level: 12200

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12300

Highest PUT Addition: 12200

SENSEX Weekly Expiry (6.05.25) Future

SENSEX Spot closed at: 80,796.84 (0.37%)

SENSEX Weekly Future closed at: 80,810.45 (0.51%)

Premium: 13.61 (Increased by 112.1 points)

Open Interest Change: -4.4%

Volume Change: -47.5%

SENSEX Weekly Expiry (29/04/2025) Option Analysis

Put-Call Ratio (OI): 0.847 (Increased from 0.708)

Put-Call Ratio (Volume): 0.943

Max Pain Level: 80500

Maximum CALL OI: 82000

Maximum PUT OI: 80000

Highest CALL Addition: 81000

Highest PUT Addition: 80800

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 497.79 Cr

DIIs Net Buy: ₹ 2,788.66 Cr

FII Derivatives Activity

| FII Trading Stats | 5.05.25 | 2.05.25 | 30.04.25 |

| FII Cash (Provisional Data) | 497.79 | 2,769.81 | 50.57 |

| Index Future Open Interest Long Ratio | 48.51% | 47.37% | 46.88% |

| Index Future Volume Long Ratio | 53.49% | 51.33% | 60.39% |

| Call Option Open Interest Long Ratio | 49.89% | 53.21% | 62.90% |

| Call Option Volume Long Ratio | 49.25% | 49.09% | 50.32% |

| Put Option Open Interest Long Ratio | 46.61% | 51.65% | 55.17% |

| Put Option Volume Long Ratio | 48.91% | 49.65% | 50.19% |

| Stock Future Open Interest Long Ratio | 65.26% | 64.85% | 64.92% |

| Stock Future Volume Long Ratio | 53.96% | 49.93% | 53.01% |

| Index Futures | Fresh Long | Fresh Long | Fresh Long |

| Index Options | Fresh Short | Fresh Short | Short Covering |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Long |

| Nifty Options | Fresh Short | Fresh Short | Short Covering |

| BankNifty Futures | Long Covering | Long Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Options | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Long Covering |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

NSE & BSE Options Analysis | Options Insights

NIFTY Weekly Expiry (8.05.2025)

The NIFTY index closed at 24461.15. The NIFTY weekly expiry for May 8, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.811 against previous 0.695. The 26000CE option holds the maximum open interest, followed by the 24500CE and 26100CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 24400PE and 24500PE options. On the other hand, open interest reductions were prominent in the 23500PE, 24300CE, and 23600PE options. Trading volume was highest in the 24500CE option, followed by the 24400PE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 08-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,461.15 | 0.811 | 0.695 | 0.872 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,39,44,650 | 13,69,75,800 | 3,69,68,850 |

| PUT: | 14,10,57,600 | 9,51,54,600 | 4,59,03,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,29,78,975 | 26,17,125 | 5,45,234 |

| 24,500 | 1,27,43,325 | 53,78,550 | 45,16,593 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,27,43,325 | 53,78,550 | 45,16,593 |

| 24,600 | 89,30,625 | 33,95,025 | 23,65,429 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 22,72,125 | -6,09,675 | 5,46,904 |

| 24,250 | 5,26,500 | -1,76,100 | 83,115 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,27,43,325 | 53,78,550 | 45,16,593 |

| 24,450 | 37,37,925 | 14,11,575 | 26,94,204 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 89,40,450 | 21,38,700 | 12,27,679 |

| 24,400 | 80,60,100 | 43,43,250 | 33,88,816 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 80,60,100 | 43,43,250 | 33,88,816 |

| 24,500 | 64,62,300 | 41,04,825 | 29,94,405 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 42,16,500 | -9,38,250 | 5,08,152 |

| 23,600 | 14,44,125 | -5,14,800 | 2,87,109 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 80,60,100 | 43,43,250 | 33,88,816 |

| 24,500 | 64,62,300 | 41,04,825 | 29,94,405 |

SENSEX Weekly Expiry (6.05.2025)

The SENSEX index closed at 80796.84. The SENSEX weekly expiry for May 6, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.847 against previous 0.708. The 82000CE option holds the maximum open interest, followed by the 83000CE and 81000CE options. Market participants have shown increased interest with significant open interest additions in the 80800PE option, with open interest additions also seen in the 81000CE and 83600CE options. On the other hand, open interest reductions were prominent in the 74000PE, 73500PE, and 75000PE options. Trading volume was highest in the 81000CE option, followed by the 80800PE and 81500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 06-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80796.84 | 0.847 | 0.708 | 0.943 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,24,70,980 | 1,58,90,560 | 65,80,420 |

| PUT: | 1,90,32,020 | 1,12,56,789 | 77,75,231 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 13,13,180 | 4,02,080 | 3,71,77,120 |

| 83000 | 10,80,720 | -82,360 | 1,18,09,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 10,67,320 | 5,75,560 | 5,76,07,060 |

| 83600 | 5,86,820 | 5,00,880 | 16,03,200 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85600 | 24,160 | -1,07,260 | 2,90,360 |

| 87800 | 4,36,120 | -84,160 | 10,96,560 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 10,67,320 | 5,75,560 | 5,76,07,060 |

| 81500 | 10,05,580 | 4,51,740 | 4,41,76,860 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,23,100 | 4,82,220 | 4,00,03,380 |

| 77000 | 8,24,160 | 3,43,720 | 79,16,100 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 6,98,360 | 6,10,320 | 4,46,49,320 |

| 80000 | 9,23,100 | 4,82,220 | 4,00,03,380 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 2,73,080 | -2,27,960 | 19,44,040 |

| 73500 | 1,16,740 | -2,20,000 | 13,29,200 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 6,98,360 | 6,10,320 | 4,46,49,320 |

| 80500 | 7,24,960 | 4,38,240 | 4,01,55,180 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24461.15. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.373 against previous 1.367. The 24000PE option holds the maximum open interest, followed by the 24500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 24500CE and 24000PE options. On the other hand, open interest reductions were prominent in the 23000PE, 23000CE, and 26000CE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,461.15 | 1.373 | 1.367 | 1.123 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,57,35,775 | 3,43,94,325 | 13,41,450 |

| PUT: | 4,90,62,975 | 4,70,21,400 | 20,41,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,08,675 | 3,36,900 | 52,789 |

| 25,000 | 39,89,400 | -54,225 | 58,513 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,08,675 | 3,36,900 | 52,789 |

| 25,500 | 25,47,450 | 2,16,375 | 33,402 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 11,70,300 | -68,850 | 1,743 |

| 26,000 | 20,78,850 | -67,875 | 35,582 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,89,400 | -54,225 | 58,513 |

| 24,500 | 43,08,675 | 3,36,900 | 52,789 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 62,03,925 | 2,89,725 | 54,337 |

| 23,000 | 42,08,100 | -98,775 | 33,779 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 28,77,750 | 4,30,200 | 54,473 |

| 24,000 | 62,03,925 | 2,89,725 | 54,337 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 42,08,100 | -98,775 | 33,779 |

| 22,500 | 26,82,900 | -30,300 | 13,512 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 28,77,750 | 4,30,200 | 54,473 |

| 24,000 | 62,03,925 | 2,89,725 | 54,337 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 54919.5. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.892 against previous 0.903. The 63000CE option holds the maximum open interest, followed by the 53000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 55000PE and 55000CE options. On the other hand, open interest reductions were prominent in the 60000CE, 55500PE, and 51000PE options. Trading volume was highest in the 55000PE option, followed by the 55000CE and 54000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,919.50 | 0.892 | 0.903 | 0.899 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,07,34,530 | 1,94,16,369 | 13,18,161 |

| PUT: | 1,84,92,480 | 1,75,38,510 | 9,53,970 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 26,73,780 | 4,62,840 | 1,09,937 |

| 60,000 | 12,40,230 | -2,18,160 | 70,778 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 26,73,780 | 4,62,840 | 1,09,937 |

| 55,000 | 8,61,660 | 1,36,530 | 1,61,318 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,40,230 | -2,18,160 | 70,778 |

| 53,000 | 8,82,990 | -23,730 | 2,025 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 8,61,660 | 1,36,530 | 1,61,318 |

| 63,000 | 26,73,780 | 4,62,840 | 1,09,937 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 16,36,230 | -26,250 | 83,847 |

| 54,000 | 11,74,080 | 16,110 | 1,11,070 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 11,05,770 | 1,62,720 | 2,22,474 |

| 53,500 | 10,06,590 | 77,400 | 47,313 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 8,24,310 | -45,870 | 38,349 |

| 51,000 | 8,11,830 | -31,110 | 36,573 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 11,05,770 | 1,62,720 | 2,22,474 |

| 54,000 | 11,74,080 | 16,110 | 1,11,070 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26164.9. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.786 against previous 0.734. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 29500CE option, with open interest additions also seen in the 25000PE and 28000CE options. On the other hand, open interest reductions were prominent in the 27000CE, 26150CE, and 27300CE options. Trading volume was highest in the 27000CE option, followed by the 26200CE and 26200PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,164.90 | 0.786 | 0.734 | 0.716 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,76,235 | 9,54,005 | 22,230 |

| PUT: | 7,67,000 | 7,00,505 | 66,495 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,74,785 | 32,695 | 1,693 |

| 27,000 | 1,59,185 | -33,605 | 3,912 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,74,785 | 32,695 | 1,693 |

| 28,000 | 37,180 | 12,545 | 1,087 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,59,185 | -33,605 | 3,912 |

| 26,150 | 14,625 | -5,460 | 1,386 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,59,185 | -33,605 | 3,912 |

| 26,200 | 38,090 | 1,105 | 3,590 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,900 | 3,380 | 2,088 |

| 25,000 | 76,375 | 16,575 | 1,732 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 76,375 | 16,575 | 1,732 |

| 26,200 | 44,720 | 10,075 | 2,787 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 60,385 | -1,040 | 816 |

| 25,500 | 60,385 | -1,040 | 816 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 44,720 | 10,075 | 2,787 |

| 26,000 | 1,20,900 | 3,380 | 2,088 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 12242.35. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.073 against previous 0.984. The 12000PE option holds the maximum open interest, followed by the 13000CE and 11500PE options. Market participants have shown increased interest with significant open interest additions in the 12200PE option, with open interest additions also seen in the 12300CE and 11700PE options. On the other hand, open interest reductions were prominent in the 65000CE, 65000CE, and 61200CE options. Trading volume was highest in the 12200CE option, followed by the 12000PE and 12200PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,242.35 | 1.073 | 0.984 | 0.847 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 38,77,200 | 33,60,360 | 5,16,840 |

| PUT: | 41,59,320 | 33,06,120 | 8,53,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,52,280 | 20,760 | 8,311 |

| 13,500 | 3,22,680 | 20,760 | 2,676 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 2,32,560 | 87,720 | 7,693 |

| 12,200 | 2,62,320 | 68,640 | 12,514 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 1,68,840 | -17,160 | 5,572 |

| 12,000 | 2,50,680 | -10,680 | 4,057 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,62,320 | 68,640 | 12,514 |

| 12,500 | 2,94,240 | 59,040 | 8,589 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,85,960 | 41,280 | 11,655 |

| 11,500 | 4,20,360 | 58,680 | 5,867 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,87,880 | 1,39,920 | 11,168 |

| 11,700 | 1,83,840 | 79,560 | 2,230 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,000 | 1,13,520 | -27,600 | 1,908 |

| 10,700 | 9,840 | -4,800 | 66 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,85,960 | 41,280 | 11,655 |

| 12,200 | 2,87,880 | 1,39,920 | 11,168 |

Conclusion: Muted Momentum | High Volume Within Tight Range

In conclusion, the May 5, 2025 derivatives data paints a nuanced picture of market sentiment. While NIFTY and MIDCPNIFTY showed strength with rising premiums and open interest, BANKNIFTY exhibited weakness, hinting at sector-specific caution. FINNIFTY stayed muted, reflecting indecision in the financial space. SENSEX futures, despite a price uptick, saw falling OI and volume, signaling profit booking. The rise in Put-Call Ratios across most indices indicates growing hedging activity, even as Max Pain levels cluster around current spot zones. Traders appear cautiously bullish, but selective positioning and sector rotation remain key as we move deeper into May expiry.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice

[…] Check Previous Day’s Nifty Indices F&O Analysis […]