Turning Complex Derivative Data into Clear Market Insights

What’s Driving This Market? A Tactical Look at Options Open Interest Trends on April 23, 2025

Table of Contents

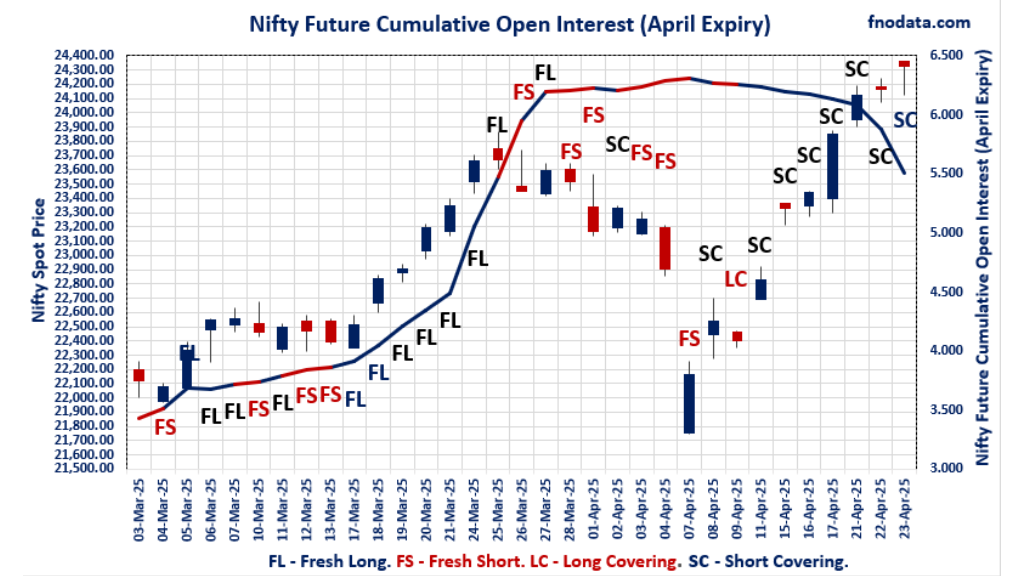

In today’s flat-to-volatile session, market participants remained cautious yet strategic, reflected in shifting positions across index futures and options. Using Options Open Interest Trends as our focus keyword, we saw NIFTY scale new highs but with a sharp 37% drop in open interest coupled with deep discount in NIFTY Future, pointing toward Short Covering as well as Long Covering rather than fresh longs. NIFTY max pain level shifted to 24150 along with high Open Interest in 24200 – 24000 PUTs should act as support.

Meanwhile, FINNIFTY and BANKNIFTY corrected mildly, and MIDCPNIFTY surged, yet all showed heavy OI unwinding—a classic case of profit booking. BANKNIFTY max pain level shifted to 53000. High PUT Open Interests at 55300-55000 levels should act as support. A deep dive into PCR levels, max pain shifts, and premium/discount behavior reveals subtle, tactical moves by smart money.

Derivative Trends | NSE

NIFTY April Future

NIFTY Spot closed at: 24,328.95 (0.67%)

NIFTY April Future closed at: 24,312.70 (0.59%)

Discount: -16.25 (Decreased by -18 points)

Open Interest Change: -37.1%

Volume Change: 13.7%

NIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 1.078 (Increased from 1.066)

Put-Call Ratio (Volume): 0.953

Max Pain Level: 24150

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 24300

Highest PUT Addition: 24200

BANKNIFTY April Future

BANKNIFTY Spot closed at: 55,370.05 (-0.50%)

BANKNIFTY April Future closed at: 55,400.60 (-0.32%)

Premium: 30.55 (Increased by 100.95 points)

Open Interest Change: -23.8%

Volume Change: -6.1%

BANKNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 1.004 (Decreased from 1.137)

Put-Call Ratio (Volume): 1.104

Max Pain Level: 55000

Maximum CALL OI: 56000

Maximum PUT OI: 55000

Highest CALL Addition: 56500

Highest PUT Addition: 55300

FINNIFTY April Future

FINNIFTY Spot closed at: 26,446.20 (-0.67%)

FINNIFTY April Future closed at: 26,453.80 (-0.58%)

Premium: 7.6 (Increased by 25.4 points)

Open Interest Change: -20.9%

Volume Change: 61.0%

FINNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.723 (Decreased from 0.897)

Put-Call Ratio (Volume): 1.013

Max Pain Level: 26150

Maximum CALL OI: 26500

Maximum PUT OI: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 26400

MIDCPNIFTY April Future

MIDCPNIFTY Spot closed at: 12,266.15 (1.41%)

MIDCPNIFTY April Future closed at: 12,256.75 (1.23%)

Discount: -9.4 (Decreased by -21.75 points)

Open Interest Change: -44.0%

Volume Change: -32.0%

MIDCPNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.931 (Increased from 0.891)

Put-Call Ratio (Volume): 0.802

Max Pain Level: 12000

Maximum CALL OI: 12500

Maximum PUT OI: 12000

Highest CALL Addition: 12350

Highest PUT Addition: 12200

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 3,332.93 Cr

DIIs Net Sell: ₹ 1,234.46 Cr

FII Derivatives Activity

| FII Trading Stats | 23.04.25 | 22.04.25 | 21.04.25 |

| FII Cash (Provisional Data) | 3,332.93 | 1,290.43 | 1,970.17 |

| Index Future Open Interest Long Ratio | 33.04% | 31.60% | 31.64% |

| Index Future Volume Long Ratio | 53.10% | 49.59% | 52.77% |

| Call Option Open Interest Long Ratio | 53.67% | 54.64% | 55.19% |

| Call Option Volume Long Ratio | 49.95% | 49.92% | 49.56% |

| Put Option Open Interest Long Ratio | 52.32% | 54.39% | 55.32% |

| Put Option Volume Long Ratio | 49.77% | 49.92% | 49.50% |

| Stock Future Open Interest Long Ratio | 64.92% | 64.27% | 64.61% |

| Stock Future Volume Long Ratio | 51.04% | 49.92% | 50.06% |

| Index Futures | Short Covering | Fresh Short | Fresh Long |

| Index Options | Fresh Short | Fresh Short | Fresh Short |

| Nifty Futures | Short Covering | Long Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Long | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Long | Long Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Options | Short Covering | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

NSE F&O Analysis | Options Insights

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 24328.95. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.078 against previous 1.066. The 24000PE option holds the maximum open interest, followed by the 25000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24200PE option, with open interest additions also seen in the 24300PE and 24300CE options. On the other hand, open interest reductions were prominent in the 25500CE, 23000PE, and 24200CE options. Trading volume was highest in the 24300CE option, followed by the 24200PE and 24200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,328.95 | 1.078 | 1.066 | 0.953 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,39,52,375 | 16,35,98,550 | 1,03,53,825 |

| PUT: | 18,75,10,050 | 17,43,19,500 | 1,31,90,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,25,95,950 | 82,500 | 14,56,048 |

| 25,500 | 1,21,29,975 | -48,59,775 | 10,14,677 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,06,36,575 | 41,48,850 | 66,73,106 |

| 25,100 | 65,63,550 | 37,24,650 | 7,34,909 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,21,29,975 | -48,59,775 | 10,14,677 |

| 24,200 | 63,52,800 | -29,10,975 | 46,08,272 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 1,06,36,575 | 41,48,850 | 66,73,106 |

| 24,200 | 63,52,800 | -29,10,975 | 46,08,272 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,32,34,650 | 22,63,125 | 34,37,725 |

| 24,200 | 1,10,67,375 | 60,06,600 | 58,18,847 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 1,10,67,375 | 60,06,600 | 58,18,847 |

| 24,300 | 62,88,750 | 46,88,550 | 44,01,869 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 82,19,400 | -36,14,850 | 9,15,199 |

| 22,000 | 51,59,775 | -18,91,650 | 3,60,516 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 1,10,67,375 | 60,06,600 | 58,18,847 |

| 24,300 | 62,88,750 | 46,88,550 | 44,01,869 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 55370.05. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.004 against previous 1.137. The 56000CE option holds the maximum open interest, followed by the 55000PE and 53500PE options. Market participants have shown increased interest with significant open interest additions in the 56500CE option, with open interest additions also seen in the 55300PE and 56000CE options. On the other hand, open interest reductions were prominent in the 50000PE, 49000PE, and 40500PE options. Trading volume was highest in the 55000PE option, followed by the 55300PE and 55500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,370.05 | 1.004 | 1.137 | 1.104 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,05,62,010 | 3,35,67,660 | 69,94,350 |

| PUT: | 4,07,37,570 | 3,81,63,759 | 25,73,811 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 32,90,070 | 7,67,880 | 16,55,076 |

| 57,000 | 21,63,840 | 2,15,520 | 7,64,278 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 18,60,750 | 9,15,660 | 9,37,662 |

| 56,000 | 32,90,070 | 7,67,880 | 16,55,076 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,67,100 | -1,74,240 | 4,04,558 |

| 60,000 | 6,12,180 | -1,73,340 | 1,57,617 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 16,87,050 | 5,56,650 | 16,93,004 |

| 56,000 | 32,90,070 | 7,67,880 | 16,55,076 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 28,30,470 | 4,51,770 | 21,63,274 |

| 53,500 | 23,10,000 | 2,91,390 | 5,98,135 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,300 | 15,56,790 | 7,75,230 | 17,10,322 |

| 54,000 | 21,35,970 | 6,15,390 | 7,52,239 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 10,79,850 | -5,44,950 | 1,69,397 |

| 49,000 | 6,58,110 | -3,12,780 | 78,040 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 28,30,470 | 4,51,770 | 21,63,274 |

| 55,300 | 15,56,790 | 7,75,230 | 17,10,322 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 26446.2. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.723 against previous 0.897. The 26500CE option holds the maximum open interest, followed by the 28000CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 26400PE and 26800CE options. On the other hand, open interest reductions were prominent in the 25000PE, 27400CE, and 26900CE options. Trading volume was highest in the 26400PE option, followed by the 26500CE and 26300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,446.20 | 0.723 | 0.897 | 1.013 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 51,84,595 | 40,69,000 | 11,15,595 |

| PUT: | 37,47,770 | 36,47,865 | 99,905 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 3,85,190 | 2,42,775 | 1,24,323 |

| 28,000 | 3,75,960 | -60,970 | 15,026 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 3,85,190 | 2,42,775 | 1,24,323 |

| 26,800 | 2,68,580 | 1,22,005 | 73,390 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,400 | 73,190 | -75,335 | 15,481 |

| 26,900 | 1,23,565 | -74,425 | 37,571 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 3,85,190 | 2,42,775 | 1,24,323 |

| 26,600 | 2,16,255 | 1,03,285 | 92,289 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,84,830 | 68,640 | 72,321 |

| 26,400 | 2,68,255 | 1,72,510 | 1,64,625 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 2,68,255 | 1,72,510 | 1,64,625 |

| 20,000 | 1,64,710 | 86,450 | 8,886 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 2,27,435 | -81,770 | 11,230 |

| 26,600 | 48,880 | -64,805 | 48,323 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 2,68,255 | 1,72,510 | 1,64,625 |

| 26,300 | 1,44,625 | 37,830 | 1,13,862 |

MIDCPNIFTY Monthly Expiry (24.04.2025)

The MIDCPNIFTY index closed at 12266.15. The MIDCPNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.931 against previous 0.891. The 12000PE option holds the maximum open interest, followed by the 12500CE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12200PE option, with open interest additions also seen in the 12000PE and 12350CE options. On the other hand, open interest reductions were prominent in the 65500CE, 60000CE, and 64500CE options. Trading volume was highest in the 12200CE option, followed by the 12300CE and 12100PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,266.15 | 0.931 | 0.891 | 0.802 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,35,96,960 | 1,24,99,560 | 10,97,400 |

| PUT: | 1,26,55,080 | 1,11,32,520 | 15,22,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 10,67,280 | 40,440 | 1,23,098 |

| 13,000 | 9,64,440 | 2,32,560 | 19,500 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,350 | 6,62,160 | 3,34,080 | 96,705 |

| 12,800 | 5,89,080 | 2,68,920 | 27,249 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 2,46,840 | -5,64,600 | 1,53,537 |

| 12,000 | 3,56,040 | -1,44,480 | 34,215 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 5,95,080 | -1,44,000 | 3,30,694 |

| 12,300 | 7,86,480 | 2,54,160 | 2,36,375 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 11,33,040 | 4,69,560 | 2,16,157 |

| 11,600 | 7,65,600 | -76,320 | 35,798 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 6,42,720 | 5,52,600 | 1,61,390 |

| 12,000 | 11,33,040 | 4,69,560 | 2,16,157 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 7,34,160 | -1,44,600 | 37,104 |

| 11,200 | 2,94,240 | -1,02,360 | 9,674 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 7,41,720 | 2,43,120 | 2,25,268 |

| 12,000 | 11,33,040 | 4,69,560 | 2,16,157 |

Conclusion: Why Today’s Options Open Interest Trends Signal a Tactical Pause

Options Open Interest Trends for April 23, 2025, point to one major theme—profit-taking in Longs as well as Short-Covering across the board. While NIFTY looks strong technically, the sharp fall in open interest and rising discount suggest caution is warranted. FINNIFTY and BANKNIFTY are showing signs of fatigue, while MIDCPNIFTY’s rally may be unsustainable unless backed by volume. As we approach monthly expiry, the shift in max pain levels and strike-wise buildup will offer more clues—watch those levels closely.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]