Turning Complex Derivative Data into Clear Market Insights

Powerful F&O Market Signals: Is Nifty’s 24,800 Support About to Crack?

Table of Contents

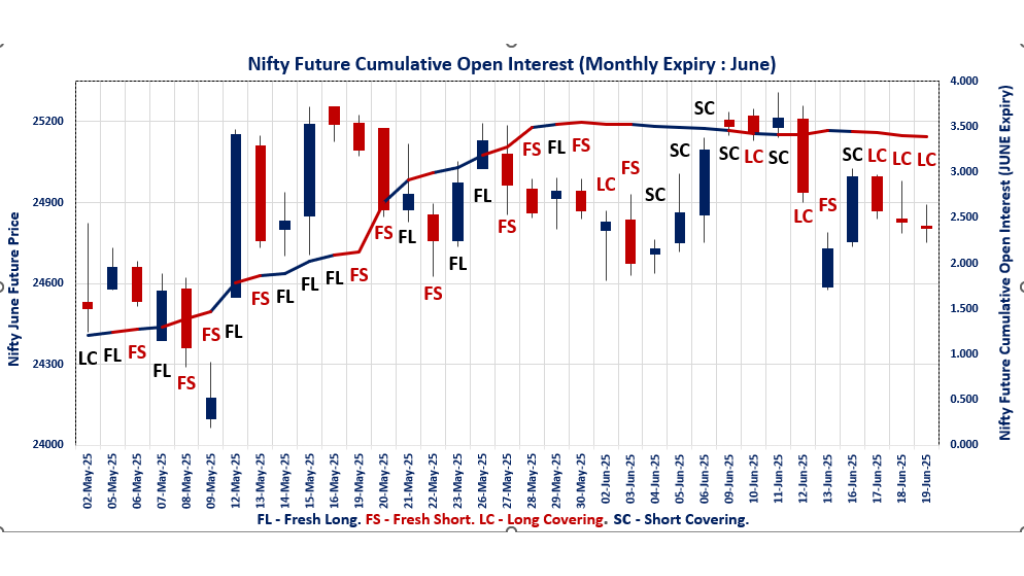

The F&O market signals on 19th June 2025 reveal a market teetering at a key inflection point. Nifty futures slipped 0.10% to 24,803.10, with spot closing just below 24,800 and a shrinking premium of 9.85, while open interest dropped by 1%. This combination of declining prices, falling open interest, and a Put-Call Ratio (OI) of 0.919 suggests mild bearish sentiment and unwinding of long positions. Max pain is clustered at 24,800, reinforcing this as a critical support level, but heavy call open interest at 26,000 and put open interest at 24,000 highlight a broad resistance-support band for the coming sessions.

BankNifty futures mirrored this caution, falling 0.44% to 55,655.00 with a notable drop in open interest (-2.7%) and a low PCR (OI) of 0.655, indicating persistent bearish pressure. Max pain is at 55,800, with both call and put open interest peaking at 56,000, suggesting a tight trading range. FINNIFTY and MIDCPNIFTY both posted sharper declines, with FINNIFTY’s PCR (OI) at just 0.587 and MIDCPNIFTY’s at 0.731, signaling that bearish sentiment is spreading into the broader market. Meanwhile, SENSEX futures were relatively stable, but a sharp premium jump (+79.99 points) and a modest PCR (OI) rebound to 0.843 suggest a phase of consolidation near the 81,500 mark.

NSE & BSE F&O Market Signals

NIFTY JUNE Future

NIFTY Spot closed at: 24,793.25 (-0.08%)

NIFTY JUNE Future closed at: 24,803.10 (-0.10%)

Premium: 9.85 (Decreased by -5 points)

Open Interest Change: -1.0%

Volume Change: -24.2%

NIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.919 (Decreased from 0.968)

Put-Call Ratio (Volume): 1.016

Max Pain Level: 24800

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 26000

Highest PUT Addition: 23500

BANKNIFTY JUNE Future

BANKNIFTY Spot closed at: 55,577.45 (-0.45%)

BANKNIFTY JUNE Future closed at: 55,655.00 (-0.44%)

Premium: 77.55 (Increased by 7.3 points)

Open Interest Change: -2.7%

Volume Change: -5.7%

BANKNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.655 (Decreased from 0.729)

Put-Call Ratio (Volume): 0.884

Max Pain Level: 55800

Maximum CALL OI: 56000

Maximum PUT OI: 56000

Highest CALL Addition: 59000

Highest PUT Addition: 54400

FINNIFTY JUNE Future

FINNIFTY Spot closed at: 26,299.65 (-0.38%)

FINNIFTY JUNE Future closed at: 26,323.70 (-0.39%)

Premium: 24.05 (Decreased by -2.1 points)

Open Interest Change: -4.1%

Volume Change: 9.3%

FINNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.587 (Decreased from 0.679)

Put-Call Ratio (Volume): 0.842

Max Pain Level: 26500

Maximum CALL OI: 27000

Maximum PUT OI: 26500

Highest CALL Addition: 27300

Highest PUT Addition: 24900

MIDCPNIFTY JUNE Future

MIDCPNIFTY Spot closed at: 12,727.70 (-1.67%)

MIDCPNIFTY JUNE Future closed at: 12,750.10 (-1.57%)

Premium: 22.4 (Increased by 12.5 points)

Open Interest Change: -0.8%

Volume Change: 57.5%

MIDCPNIFTY Monthly Expiry (26/06/2025) Option Analysis

Put-Call Ratio (OI): 0.731 (Decreased from 0.921)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 12875

Maximum CALL OI: 13500

Maximum PUT OI: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 12000

SENSEX Weekly Expiry (24/06/2025) Future

SENSEX Spot closed at: 81,361.87 (-0.10%)

SENSEX Weekly Future closed at: 81,465.70 (0.00%)

Premium: 103.83 (Increased by 79.99 points)

Open Interest Change: -4.0%

Volume Change: -29.4%

SENSEX Weekly Expiry (24/06/2025) Option Analysis

Put-Call Ratio (OI): 0.843 (Increased from 0.640)

Put-Call Ratio (Volume): 0.985

Max Pain Level: 81500

Maximum CALL OI: 84000

Maximum PUT OI: 81500

Highest CALL Addition: 81500

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 934.62 Cr

DIIs Net Buy: ₹ 605.97 Cr

FII Derivatives Activity

| FII Trading Stats | 19.06.25 | 18.06.25 | 17.06.25 |

| FII Cash (Provisional Data) | 934.62 | 890.93 | 1,482.77 |

| Index Future Open Interest Long Ratio | 22.35% | 20.47% | 20.90% |

| Index Future Volume Long Ratio | 53.14% | 50.50% | 53.05% |

| Call Option Open Interest Long Ratio | 62.71% | 56.20% | 59.06% |

| Call Option Volume Long Ratio | 50.26% | 49.70% | 50.14% |

| Put Option Open Interest Long Ratio | 63.52% | 58.52% | 60.19% |

| Put Option Volume Long Ratio | 50.21% | 49.81% | 50.27% |

| Stock Future Open Interest Long Ratio | 61.67% | 61.72% | 62.03% |

| Stock Future Volume Long Ratio | 49.51% | 47.40% | 47.31% |

| Index Futures | Fresh Long | Short Covering | Short Covering |

| Index Options | Short Covering | Fresh Short | Short Covering |

| Nifty Futures | Fresh Long | Long Covering | Fresh Long |

| Nifty Options | Short Covering | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Short | Short Covering | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Short Covering |

| Stock Futures | Short Covering | Fresh Short | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE & BSE F&O market Trends : Options Insights

SENSEX Weekly Expiry (24/06/2025)

The SENSEX index closed at 81361.87. The SENSEX weekly expiry for JUNE 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.843 against previous 0.640. The 84000CE option holds the maximum open interest, followed by the 85000CE and 81500CE options. Market participants have shown increased interest with significant open interest additions in the 81500CE option, with open interest additions also seen in the 81500PE and 81400PE options. On the other hand, open interest reductions were prominent in the 88000CE, 85500CE, and 88500CE options. Trading volume was highest in the 81500PE option, followed by the 81500CE and 81400PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 24-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81361.87 | 0.843 | 0.640 | 0.985 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,05,66,100 | 69,58,660 | 36,07,440 |

| PUT: | 89,07,240 | 44,53,329 | 44,53,911 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 9,63,620 | 3,04,440 | 39,30,640 |

| 85000 | 7,39,740 | 1,74,560 | 25,09,360 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 7,30,360 | 4,41,740 | 85,29,440 |

| 84000 | 9,63,620 | 3,04,440 | 39,30,640 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 2,00,660 | -44,060 | 12,10,360 |

| 85500 | 2,09,500 | -26,020 | 12,01,020 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 7,30,360 | 4,41,740 | 85,29,440 |

| 81400 | 3,34,940 | 2,28,500 | 57,60,980 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 6,26,160 | 4,12,360 | 87,54,400 |

| 76000 | 5,35,820 | 2,23,120 | 26,07,180 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 6,26,160 | 4,12,360 | 87,54,400 |

| 81400 | 4,01,920 | 3,06,100 | 72,13,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77200 | 11,180 | -12,140 | 2,45,000 |

| 79900 | 48,920 | -10,120 | 10,00,080 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 6,26,160 | 4,12,360 | 87,54,400 |

| 81400 | 4,01,920 | 3,06,100 | 72,13,040 |

NIFTY Monthly Expiry (26/06/2025)

The NIFTY index closed at 24793.25. The NIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.919 against previous 0.968. The 26000CE option holds the maximum open interest, followed by the 25000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 23500PE and 24800CE options. On the other hand, open interest reductions were prominent in the 25000PE, 19000PE, and 22350PE options. Trading volume was highest in the 24800PE option, followed by the 24800CE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,793.25 | 0.919 | 0.968 | 1.016 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,83,34,800 | 7,75,56,250 | 3,07,78,550 |

| PUT: | 9,95,40,275 | 7,50,42,950 | 2,44,97,325 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,28,93,350 | 45,31,900 | 2,54,277 |

| 25,000 | 75,52,725 | 7,97,550 | 3,11,641 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,28,93,350 | 45,31,900 | 2,54,277 |

| 24,800 | 48,40,425 | 24,43,875 | 3,76,221 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 1,95,825 | -38,250 | 837 |

| 21,000 | 3,51,375 | -21,675 | 348 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 48,40,425 | 24,43,875 | 3,76,221 |

| 25,000 | 75,52,725 | 7,97,550 | 3,11,641 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 74,61,375 | 18,60,850 | 2,14,357 |

| 23,000 | 61,69,475 | 16,78,975 | 1,64,694 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 60,39,450 | 28,91,550 | 1,67,862 |

| 24,800 | 56,86,350 | 22,66,950 | 4,54,765 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,69,925 | -1,55,025 | 1,07,847 |

| 19,000 | 7,05,850 | -1,43,175 | 7,373 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 56,86,350 | 22,66,950 | 4,54,765 |

| 24,500 | 60,96,450 | 4,42,575 | 2,94,321 |

BANKNIFTY Monthly Expiry (26/06/2025)

The BANKNIFTY index closed at 55577.45. The BANKNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.655 against previous 0.729. The 56000CE option holds the maximum open interest, followed by the 56000PE and 59000CE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 58500CE and 58000CE options. On the other hand, open interest reductions were prominent in the 56000PE, 54200PE, and 55900PE options. Trading volume was highest in the 56000CE option, followed by the 55700PE and 55800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,577.45 | 0.655 | 0.729 | 0.884 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,76,06,375 | 2,50,49,235 | 25,57,140 |

| PUT: | 1,80,87,840 | 1,82,51,019 | -1,63,179 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 25,40,220 | 1,50,150 | 2,63,773 |

| 59,000 | 17,69,700 | 3,26,700 | 1,24,929 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 17,69,700 | 3,26,700 | 1,24,929 |

| 58,500 | 11,97,825 | 2,88,360 | 1,01,951 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 9,07,200 | -73,920 | 80,203 |

| 57,500 | 10,50,360 | -73,440 | 1,09,110 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 25,40,220 | 1,50,150 | 2,63,773 |

| 55,700 | 3,99,120 | 2,00,910 | 1,74,442 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 18,81,840 | -1,28,790 | 1,66,939 |

| 55,000 | 13,30,950 | -99,900 | 1,45,893 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,400 | 2,19,870 | 1,36,140 | 22,384 |

| 51,500 | 3,80,940 | 86,760 | 38,358 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 18,81,840 | -1,28,790 | 1,66,939 |

| 54,200 | 1,53,270 | -1,22,400 | 28,303 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 2,60,460 | 9,420 | 2,03,515 |

| 55,800 | 3,38,880 | -15,780 | 1,91,106 |

FINNIFTY Monthly Expiry (26/06/2025)

The FINNIFTY index closed at 26299.65. The FINNIFTY monthly expiry for JUNE 26, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.587 against previous 0.679. The 27000CE option holds the maximum open interest, followed by the 28000CE and 28500CE options. Market participants have shown increased interest with significant open interest additions in the 27300CE option, with open interest additions also seen in the 28000CE and 27500CE options. On the other hand, open interest reductions were prominent in the 26500PE, 24200PE, and 29000CE options. Trading volume was highest in the 26400PE option, followed by the 26400CE and 26300PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,299.65 | 0.587 | 0.679 | 0.842 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 20,05,055 | 16,46,450 | 3,58,605 |

| PUT: | 11,77,475 | 11,18,195 | 59,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,93,830 | 29,965 | 2,246 |

| 28,000 | 1,72,055 | 42,965 | 2,666 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,13,230 | 53,105 | 2,417 |

| 28,000 | 1,72,055 | 42,965 | 2,666 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 39,130 | -20,280 | 985 |

| 26,500 | 92,040 | -8,775 | 4,851 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 41,210 | 8,970 | 5,949 |

| 26,500 | 92,040 | -8,775 | 4,851 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,16,025 | -36,465 | 3,604 |

| 25,000 | 73,450 | 14,820 | 2,019 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 35,100 | 15,470 | 1,433 |

| 25,000 | 73,450 | 14,820 | 2,019 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,16,025 | -36,465 | 3,604 |

| 24,200 | 3,965 | -27,235 | 1,183 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 38,285 | -3,835 | 6,477 |

| 26,300 | 61,750 | -780 | 5,649 |

MIDCPNIFTY Monthly Expiry (26/06/2025)

The MIDCPNIFTY index closed at 12727.7. The MIDCPNIFTY monthly expiry for JUNE 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.731 against previous 0.921. The 13500CE option holds the maximum open interest, followed by the 14000CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 13500CE option, with open interest additions also seen in the 12800CE and 13300CE options. On the other hand, open interest reductions were prominent in the 68000PE, 68000PE, and 69500PE options. Trading volume was highest in the 12800PE option, followed by the 13000CE and 12750PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 26-06-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,727.70 | 0.731 | 0.921 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,10,17,680 | 72,22,680 | 37,95,000 |

| PUT: | 80,49,600 | 66,54,840 | 13,94,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 12,54,240 | 4,81,800 | 28,107 |

| 14,000 | 9,34,680 | 2,97,360 | 14,567 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 12,54,240 | 4,81,800 | 28,107 |

| 12,800 | 5,26,680 | 4,26,480 | 30,978 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,57,080 | -36,600 | 12,423 |

| 13,900 | 1,57,440 | -32,760 | 5,650 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,46,480 | 1,67,520 | 38,992 |

| 12,800 | 5,26,680 | 4,26,480 | 30,978 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,85,240 | 3,01,320 | 20,553 |

| 12,500 | 6,78,120 | 82,080 | 23,028 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,85,240 | 3,01,320 | 20,553 |

| 12,800 | 5,05,320 | 1,95,840 | 46,853 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,81,320 | -2,19,000 | 15,295 |

| 12,200 | 2,69,400 | -97,680 | 10,845 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 5,05,320 | 1,95,840 | 46,853 |

| 12,750 | 2,68,200 | 1,80,240 | 35,764 |

Conclusion: What the Future & Option Chain Analysis Tells Us

The 19th June F&O data underscores a market at a delicate crossroads. Nifty’s 24,800–24,850 zone remains the key battleground: if this support cracks, a slide toward 24,700 or even 24,500 could quickly follow. BankNifty’s 56,000 level is acting as a magnet for both call and put writers, pointing to rangebound action unless a decisive breakout occurs. FINNIFTY and MIDCPNIFTY’s weak PCRs and continued OI drops highlight growing caution in financials and midcaps, while SENSEX’s consolidation hints that broader market conviction is lacking.

Traders should consider hedged strategies—such as 24,800 puts or 25,000 straddles in Nifty—and monitor the 24,800 support closely. A sustained rebound above 24,850 could spark a relief rally, but a failure to hold may trigger further unwinding. As expiry nears, aligning with these F&O market signals—PCR shifts, max pain levels, and OI trends—will be crucial for navigating the next move.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]