Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/02/2026

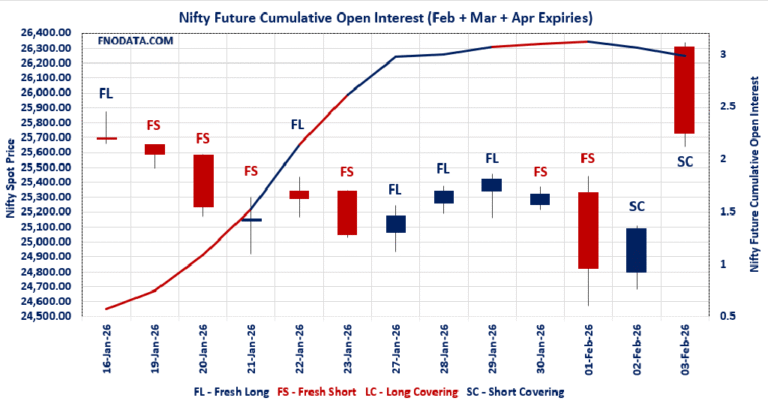

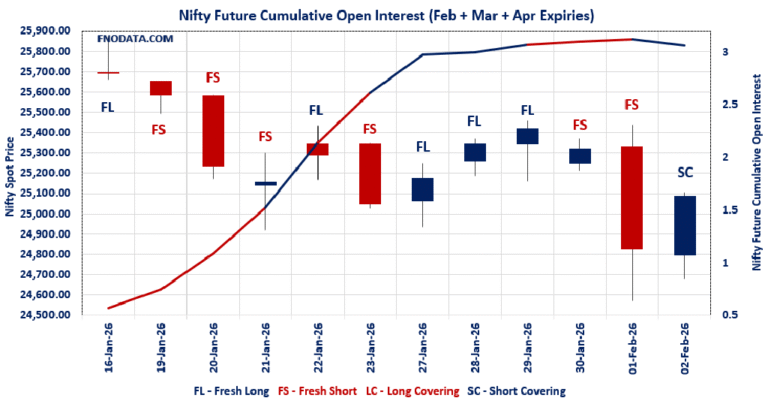

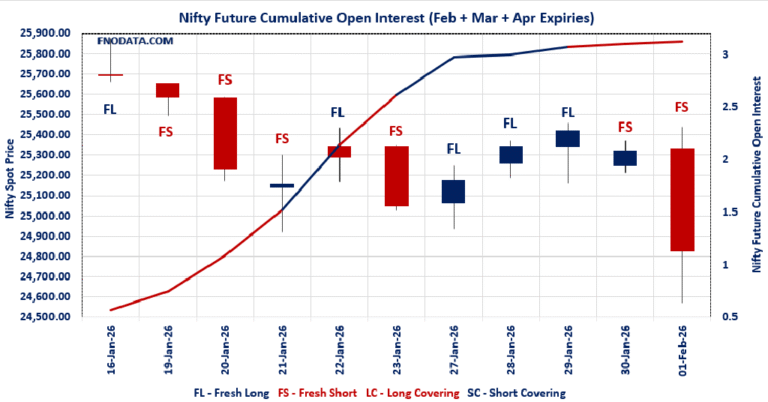

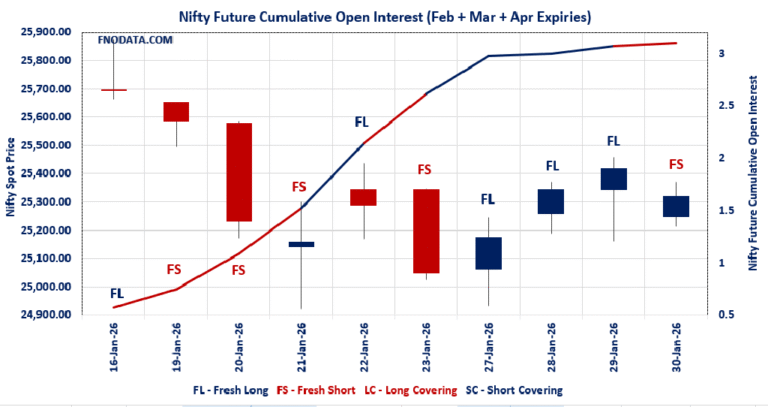

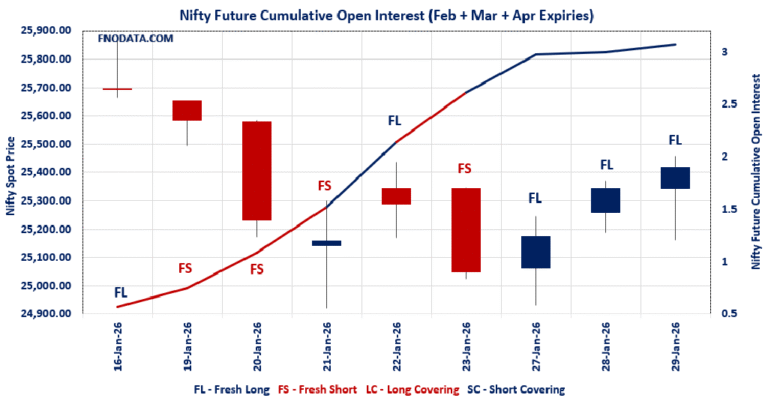

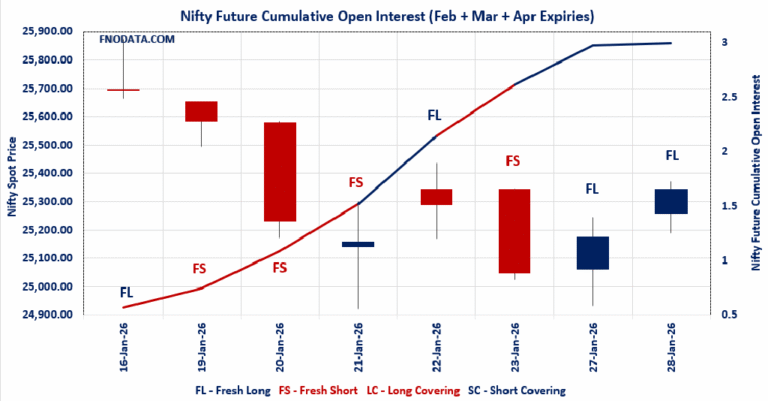

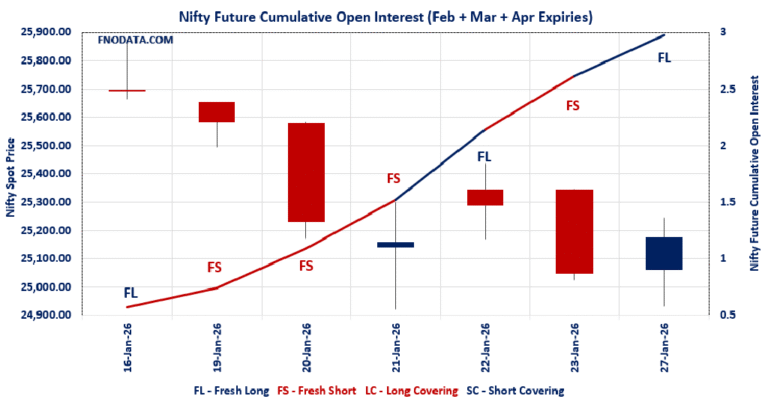

Today’s Open Interest Volume Analysis clearly shows a divergent derivative structure across indices, with NIFTY and SENSEX attracting fresh long participation, while BANKNIFTY shows profit booking through long covering and MIDCPNIFTY remains structurally weak with fresh shorts. In NIFTY, rising…