Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/01/2026

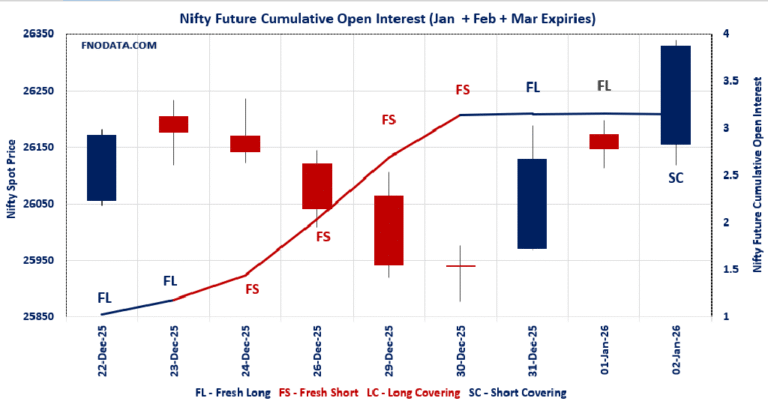

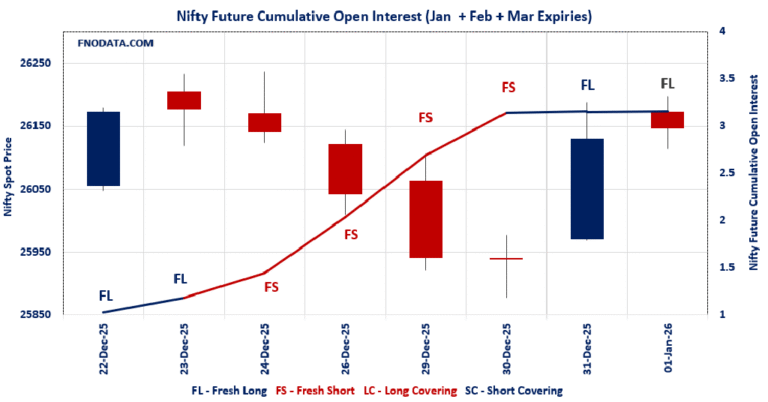

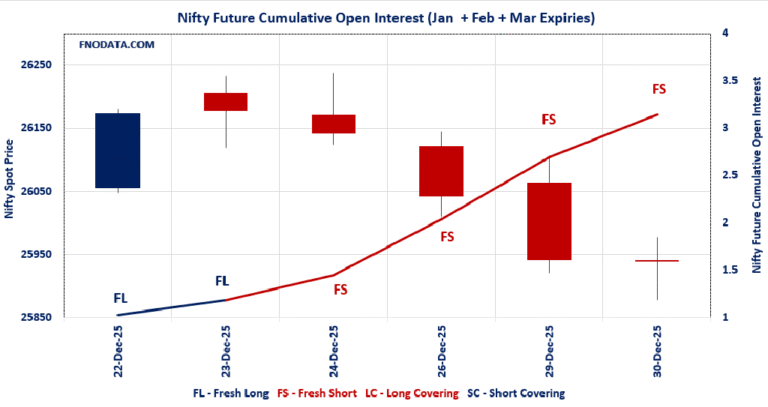

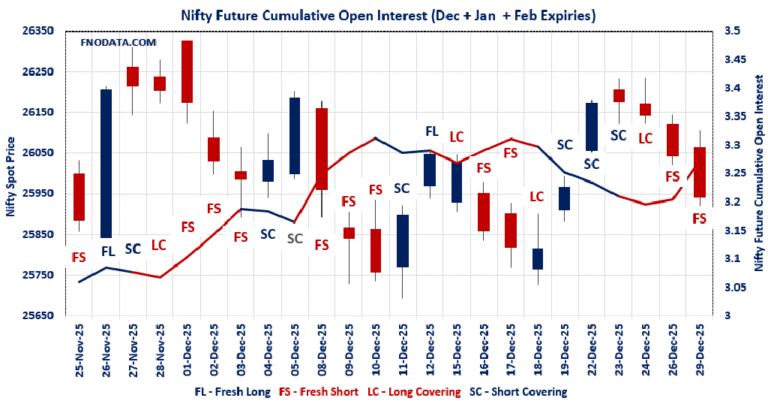

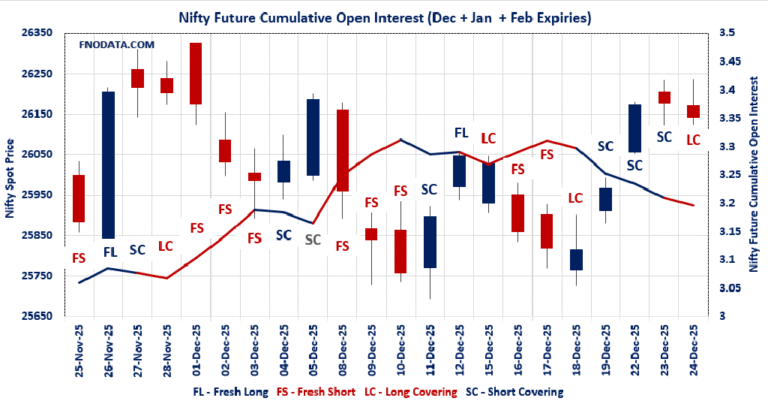

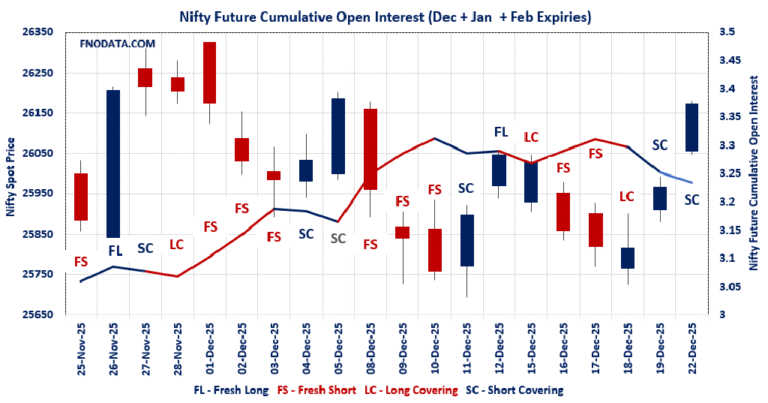

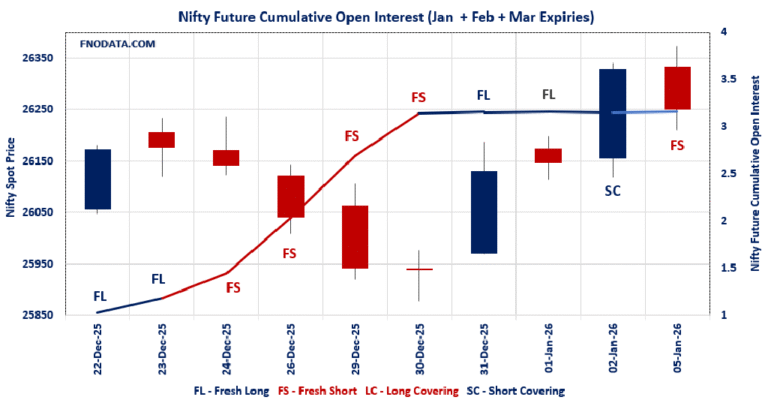

Markets took a breather today with NIFTY dipping 0.30% after last week’s fireworks, and this Open Interest Volume Analysis across combined futures (Jan+Feb+Mar) reveals the classic post-rally profit-taking—NIFTY shorts nibbling while others cover longs amid healthy volume pickup. NIFTY combined…