Turning Complex Derivative Data into Clear Market Insights

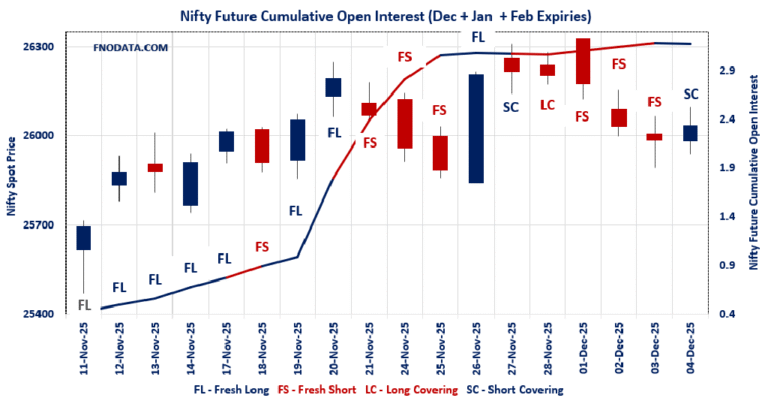

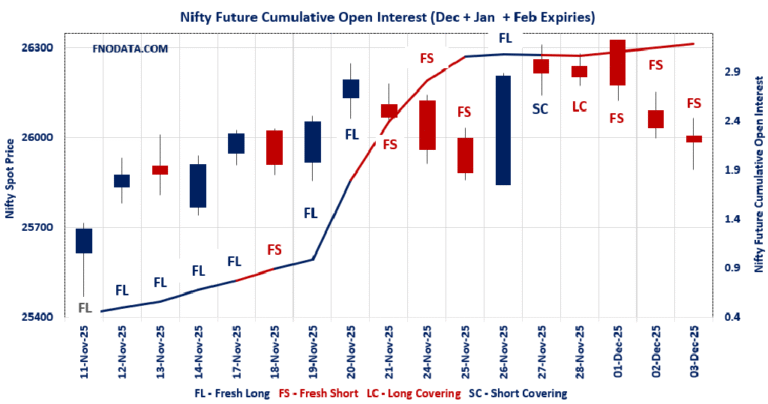

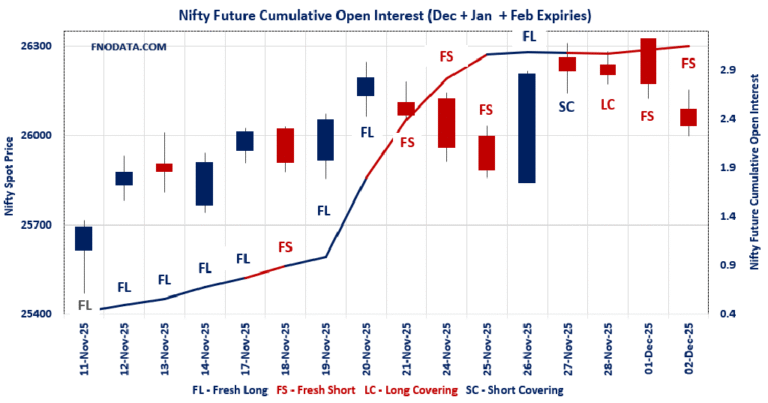

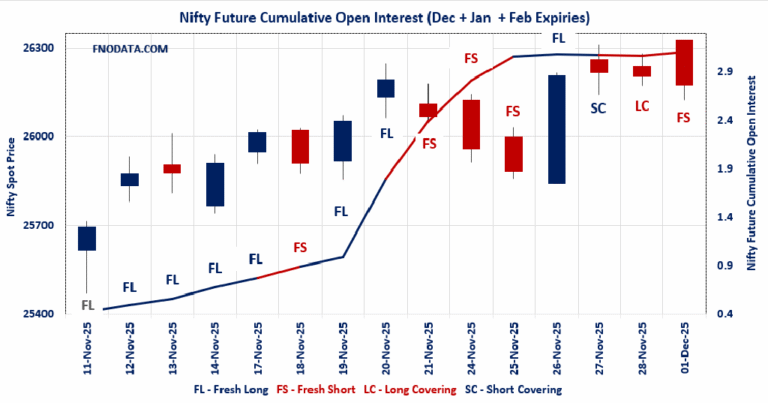

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/12/2025

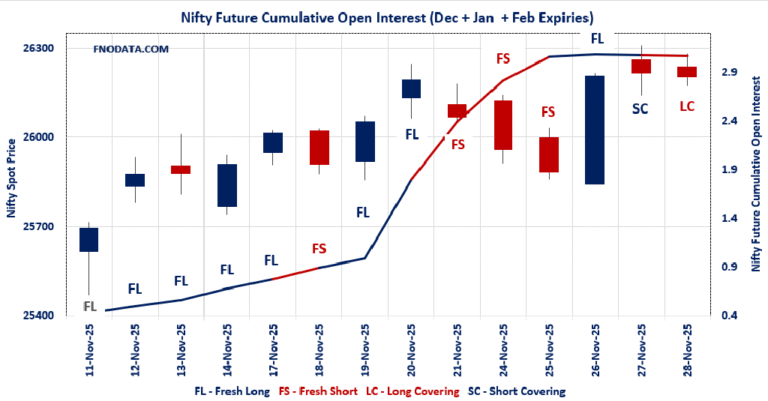

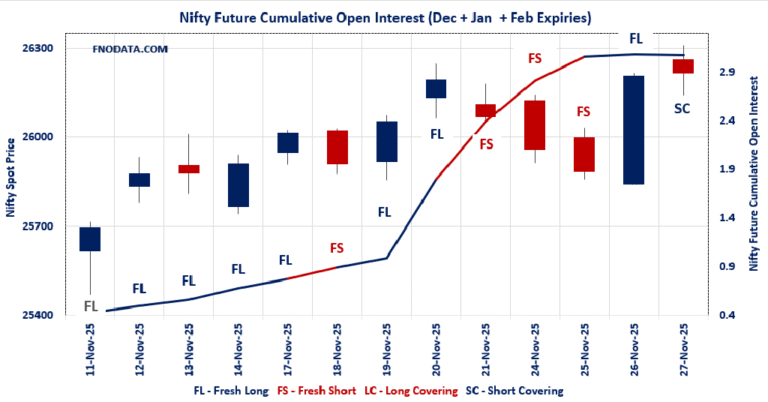

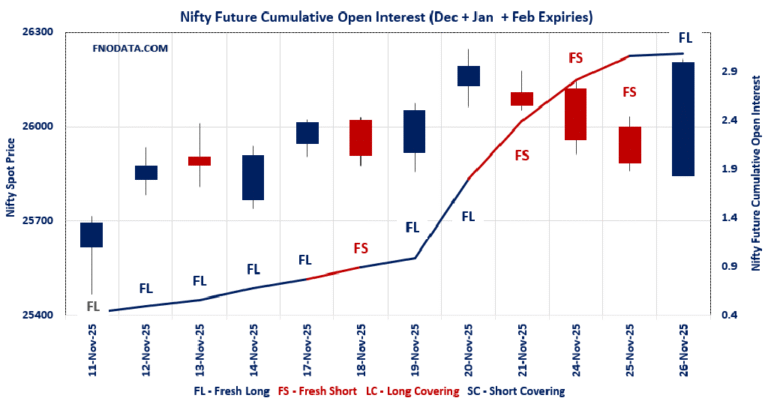

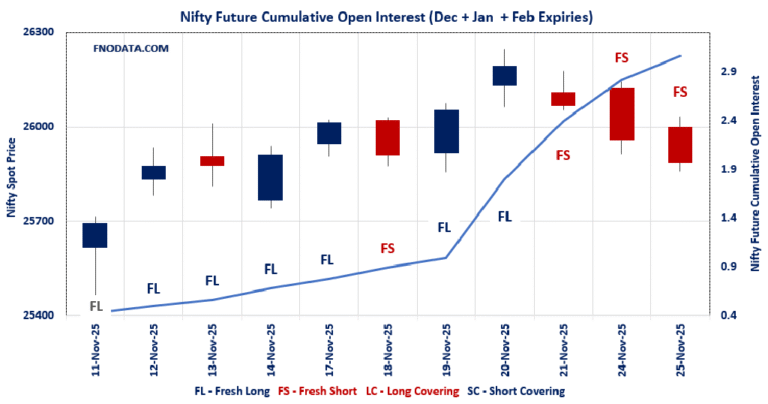

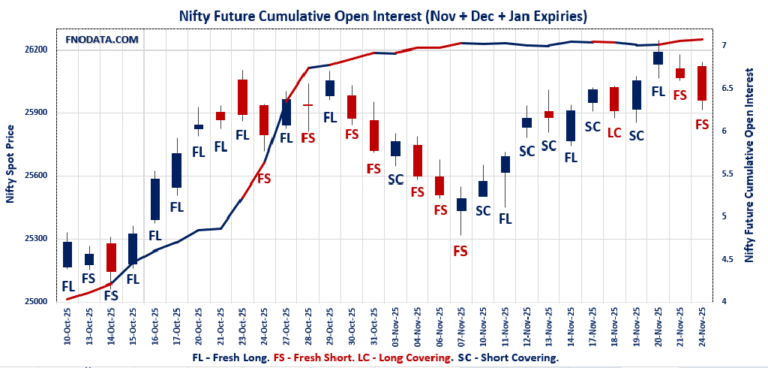

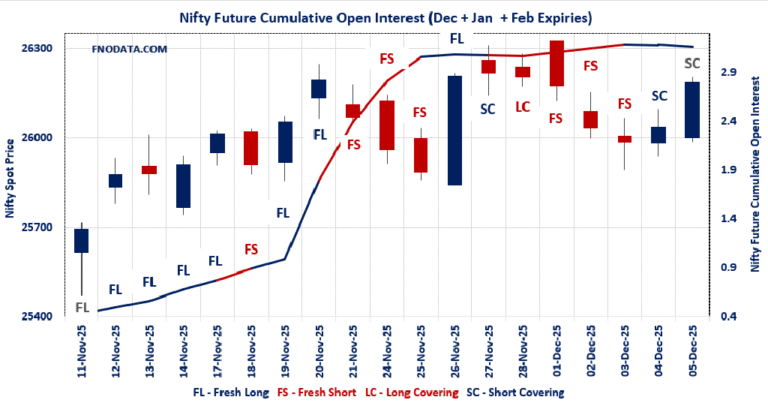

NIFTY futures combined OI fell -1.91% on short covering, but volume jumped 29.88%—this combo with spot up 0.587% means sellers covered aggressively on conviction, easing downside and fueling the bounce toward 26200. BANKNIFTY mirrored with -7.74% OI drop and massive…