Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 21/08/2025

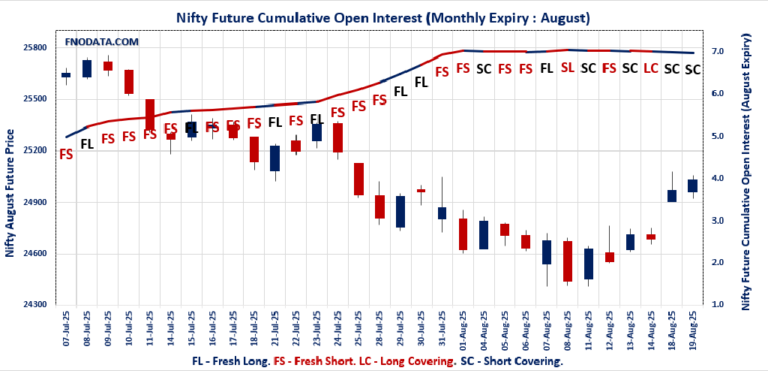

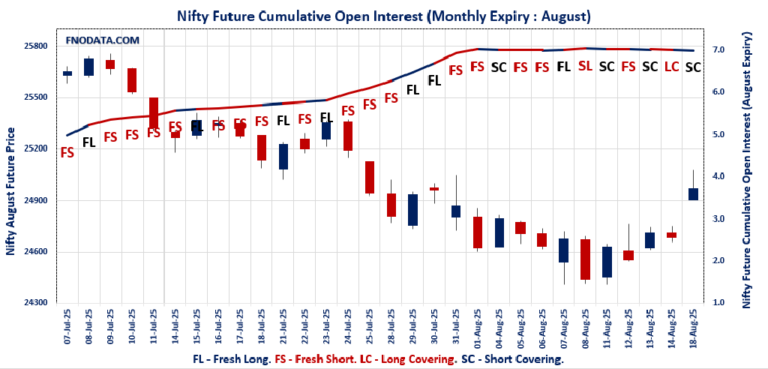

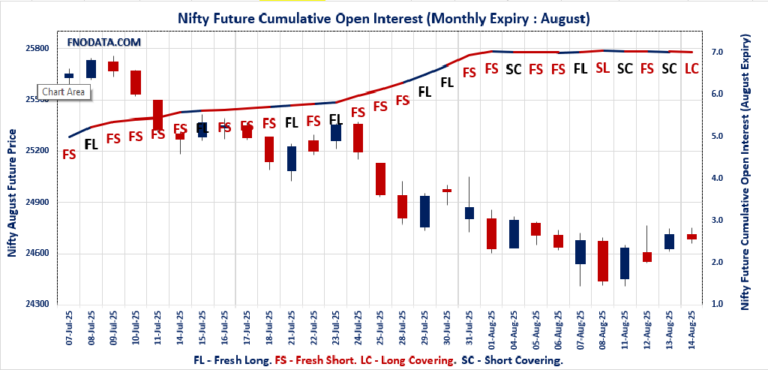

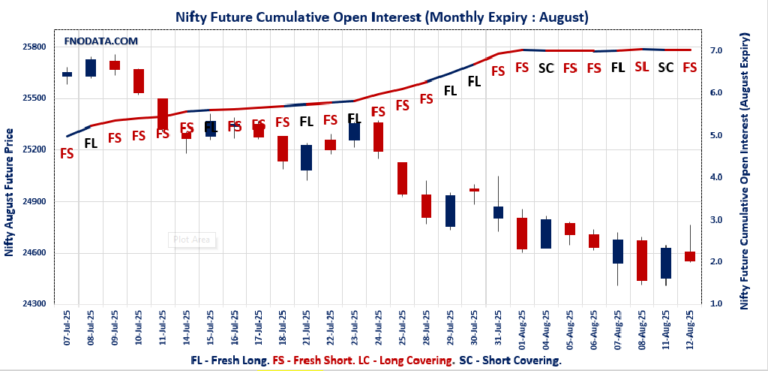

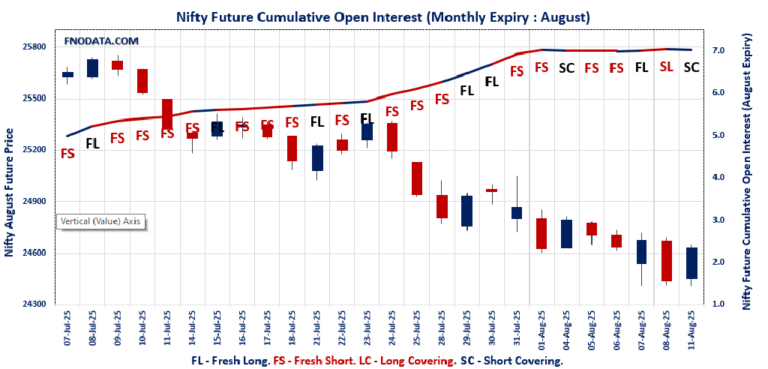

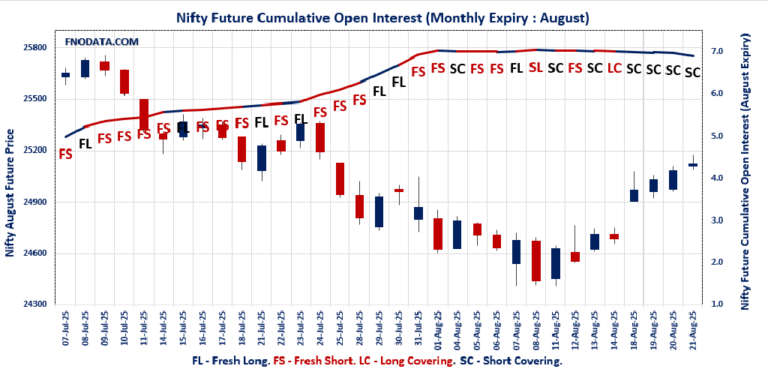

The Open Interest Volume Analysis for 21st August 2025 shows a market taking a well-earned breather after hitting fresh highs, with expiry week volatility beginning to cool. Nifty August futures finished at 25,122.50, up just 0.16%, even as open interest…