Turning Complex Derivative Data into Clear Market Insights

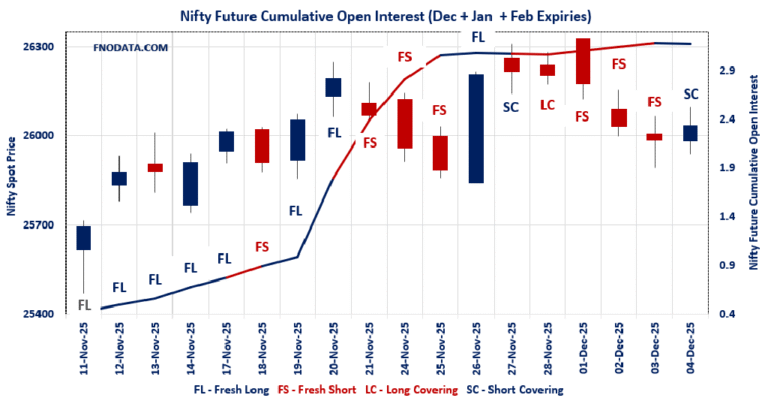

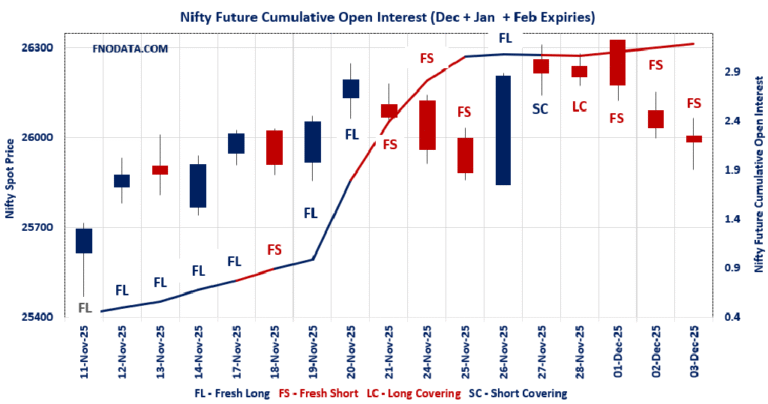

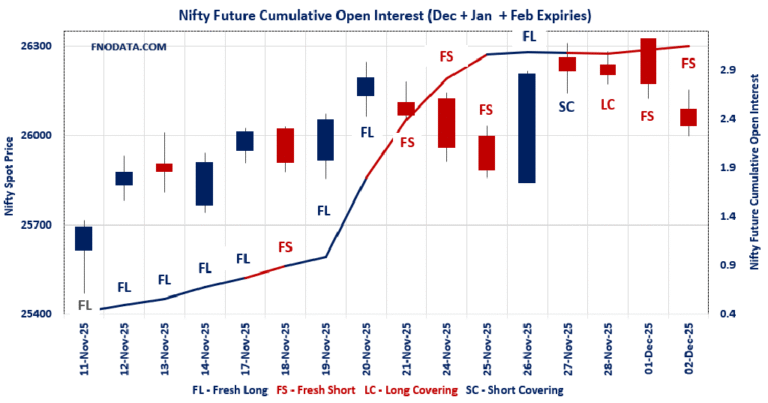

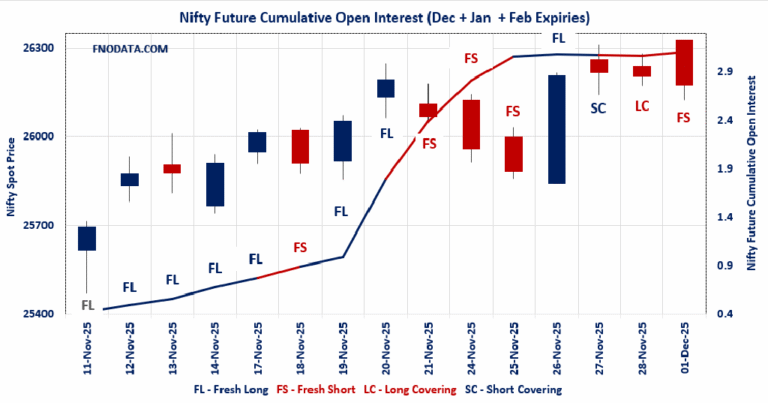

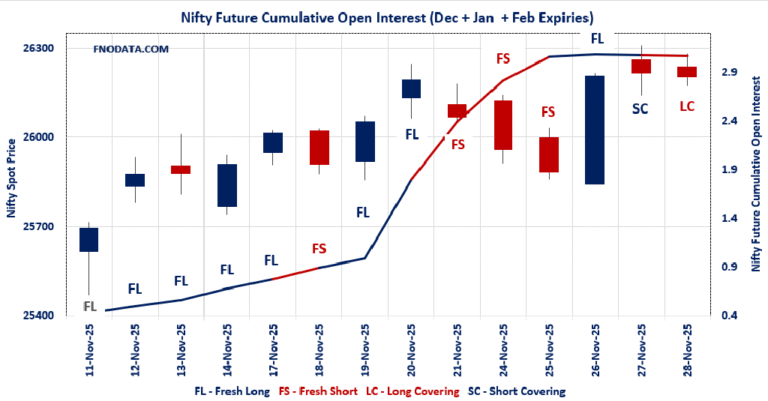

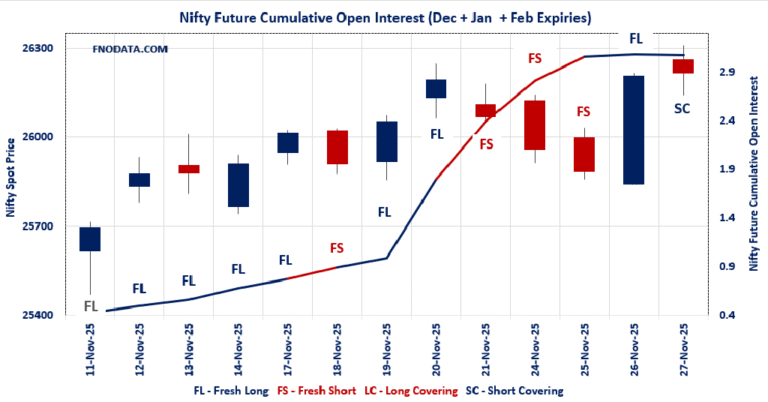

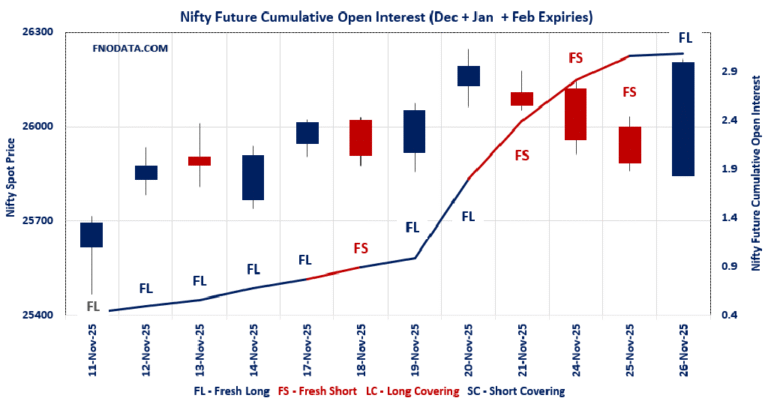

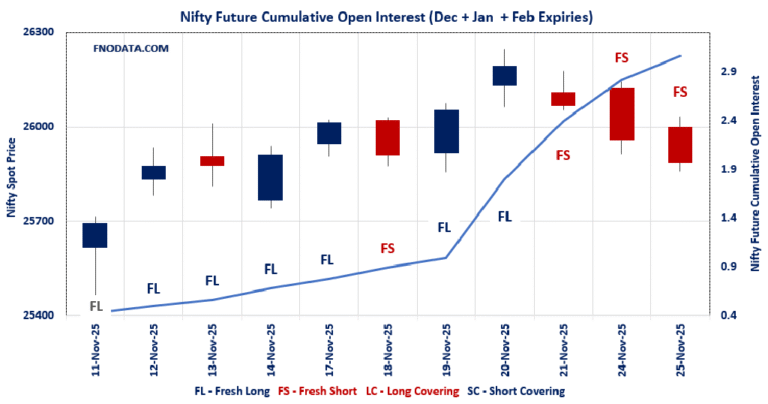

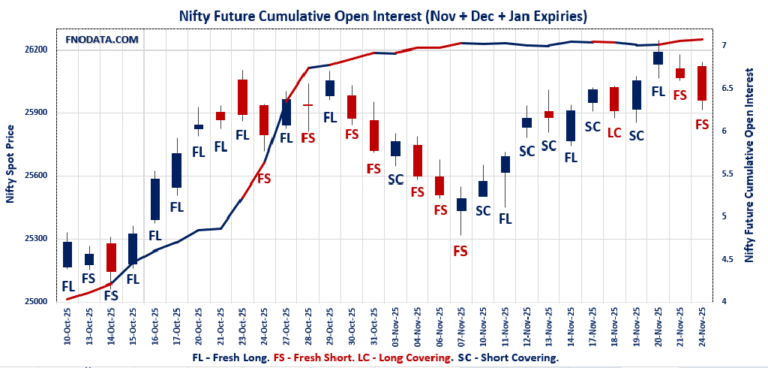

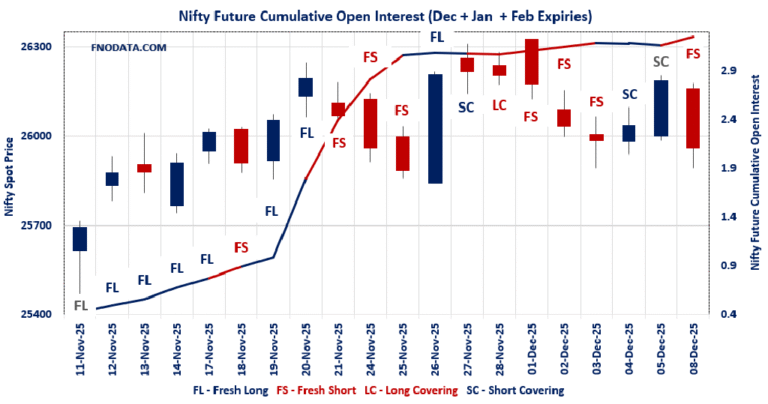

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 8/12/2025

Monday’s Open Interest Volume Analysis for 8/12/2025 flips the script hard—broad fresh short buildup across combined NIFTY, BANKNIFTY, FINNIFTY, and MIDCPNIFTY futures with hefty OI spikes amid red closes, screaming bearish conviction as weekend gains evaporate fast. Volumes mostly backed…