Turning Complex Derivative Data into Clear Market Insights

What the Index Derivatives Trend Today Reveals – 21 May 2025

Table of Contents

The markets showed signs of a cautious rebound on 21st May 2025, but the real pulse of the market is captured in the Index Derivatives Trend Today. While headline indices like NIFTY, BANKNIFTY, FINNIFTY, MIDCPNIFTY, and SENSEX closed slightly higher, the derivatives data unveils a story of fading conviction, profit booking, and repositioning ahead of the weekly expiry. Shrinking premiums, falling open interest, and selective strike-level activity across options hint that traders are approaching the market with guarded optimism and expiry-centric strategies. Let’s decode what smart money is up to across each index.

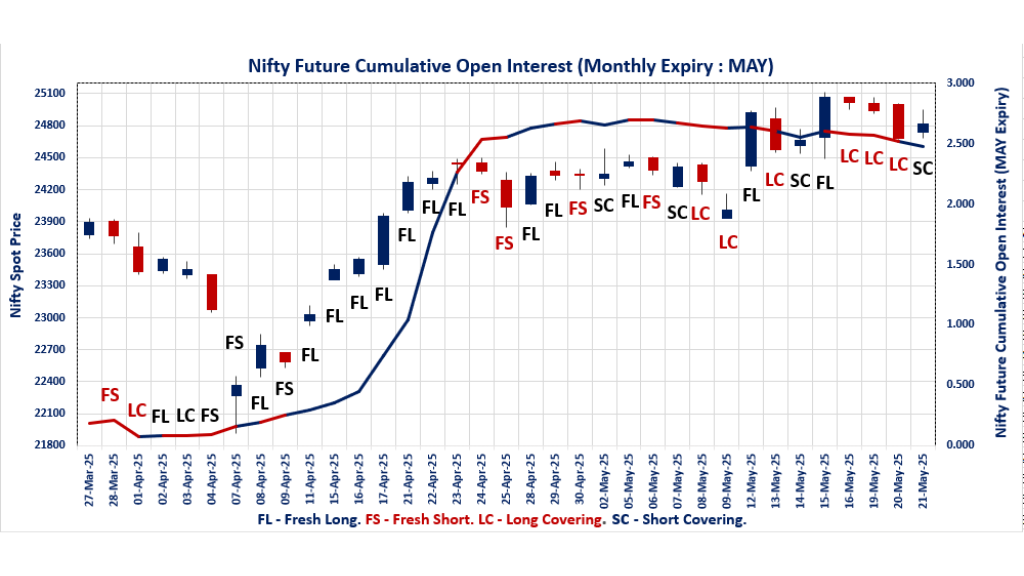

NIFTY Spot moved up 0.52%, while the May Future under-performed slightly, rising just 0.23%. The premium dropped sharply by 71.95 points, down to 18.75 along with a -3.5% dip in Open Interest with moderate volume increase, signaling that longs are being cut or unwound. Weekly PCR (OI) rose to 0.640, suggesting PUT writers are cautiously returning near 24,000. Max Pain remains at 24,800, acting as the expiry magnet.

NIFTY remains range-bound between 24,000 and 25,300. Lack of strong OI support above 24,800 indicates traders are playing expiry with a neutral bias.

Index Derivatives Trend Today

NIFTY MAY Future

NIFTY Spot closed at: 24,813.45 (0.52%)

NIFTY MAY Future closed at: 24,832.20 (0.23%)

Premium: 18.75 (Decreased by -71.95 points)

Open Interest Change: -3.5%

Volume Change: 7.9%

NIFTY Weekly Expiry (22/05/2025) Option Analysis

Put-Call Ratio (OI): 0.640 (Increased from 0.491)

Put-Call Ratio (Volume): 0.848

Max Pain Level: 24800

Maximum CALL OI: 25500

Maximum PUT OI: 24000

Highest CALL Addition: 25300

Highest PUT Addition: 24000

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.982 (Decreased from 1.036)

Put-Call Ratio (Volume): 0.786

Max Pain Level: 24700

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 26300

Highest PUT Addition: 24800

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,075.10 (0.36%)

BANKNIFTY MAY Future closed at: 55,142.00 (0.07%)

Premium: 66.9 (Decreased by -159.55 points)

Open Interest Change: -0.8%

Volume Change: 23.8%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.760 (Increased from 0.742)

Put-Call Ratio (Volume): 0.949

Max Pain Level: 55000

Maximum CALL OI: 63000

Maximum PUT OI: 55000

Highest CALL Addition: 60000

Highest PUT Addition: 40500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,339.65 (0.56%)

FINNIFTY MAY Future closed at: 26,367.60 (0.21%)

Premium: 27.95 (Decreased by -91.1 points)

Open Interest Change: -3.1%

Volume Change: 30.1%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.710 (Increased from 0.627)

Put-Call Ratio (Volume): 0.810

Max Pain Level: 26300

Maximum CALL OI: 27000

Maximum PUT OI: 26000

Highest CALL Addition: 27300

Highest PUT Addition: 26000

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,620.80 (0.30%)

MIDCPNIFTY MAY Future closed at: 12,649.75 (0.30%)

Premium: 28.95 (Increased by 0.7 points)

Open Interest Change: 1.0%

Volume Change: -34.7%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.920 (Increased from 0.887)

Put-Call Ratio (Volume): 0.818

Max Pain Level: 12500

Maximum CALL OI: 13500

Maximum PUT OI: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 11000

SENSEX Weekly Expiry (27/05/25) Future

SENSEX Spot closed at: 81,596.63 (0.51%)

SENSEX Weekly Future closed at: 81,631.15 (0.20%)

Premium: 34.52 (Decreased by -244.04 points)

Open Interest Change: -2.4%

Volume Change: 27.4%

SENSEX Weekly Expiry (27/05/2025) Option Analysis

Put-Call Ratio (OI): 0.657 (Decreased from 0.771)

Put-Call Ratio (Volume): 0.742

Max Pain Level: 82000

Maximum CALL OI: 85000

Maximum PUT OI: 78000

Highest CALL Addition: 86000

Highest PUT Addition: 65600

fII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,201.79 Cr

DIIs Net Buy: ₹ 683.77 Cr

FII Derivatives Activity

| FII Trading Stats | 21.05.25 | 20.05.25 | 19.05.25 |

| FII Cash (Provisional Data) | 2,201.79 | -10,016.10 | -525.95 |

| Index Future Open Interest Long Ratio | 37.43% | 37.04% | 42.32% |

| Index Future Volume Long Ratio | 51.48% | 33.68% | 49.55% |

| Call Option Open Interest Long Ratio | 59.83% | 55.50% | 55.53% |

| Call Option Volume Long Ratio | 50.53% | 50.11% | 49.91% |

| Put Option Open Interest Long Ratio | 59.17% | 56.86% | 56.55% |

| Put Option Volume Long Ratio | 50.48% | 50.16% | 50.14% |

| Stock Future Open Interest Long Ratio | 65.07% | 64.91% | 65.37% |

| Stock Future Volume Long Ratio | 52.13% | 45.79% | 45.53% |

| Index Futures | Fresh Long | Long Covering | Fresh Short |

| Index Options | Short Covering | Fresh Long | Fresh Long |

| Nifty Futures | Short Covering | Long Covering | Long Covering |

| Nifty Options | Short Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Long | Long Covering | Fresh Long |

| BankNifty Options | Long Covering | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Long | Short Covering |

| FinNifty Options | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Short Covering | Short Covering |

| MidcpNifty Options | Short Covering | Long Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & BSE F&O Trends | Options Insights

NIFTY Weekly Expiry (22/05/2025)

The NIFTY index closed at 24813.45. The NIFTY weekly expiry for May 15, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.640 against previous 0.491. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 24400PE and 24800PE options. On the other hand, open interest reductions were prominent in the 25000CE, 26000CE, and 26200CE options. Trading volume was highest in the 25000CE option, followed by the 24700PE and 24800PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 22-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,813.45 | 0.640 | 0.491 | 0.848 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,25,42,850 | 22,04,48,625 | -2,79,05,775 |

| PUT: | 12,31,33,575 | 10,81,52,100 | 1,49,81,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,35,37,650 | 4,68,600 | 29,02,268 |

| 26,000 | 1,25,34,900 | -43,28,400 | 11,81,969 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 89,41,725 | 13,47,225 | 27,92,562 |

| 25,600 | 73,17,975 | 11,81,325 | 16,08,640 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,17,16,425 | -52,66,275 | 59,64,898 |

| 26,000 | 1,25,34,900 | -43,28,400 | 11,81,969 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,17,16,425 | -52,66,275 | 59,64,898 |

| 24,800 | 68,23,200 | 2,93,325 | 54,14,077 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,11,16,725 | 36,28,050 | 17,58,178 |

| 24,800 | 67,55,775 | 33,56,925 | 54,14,584 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,11,16,725 | 36,28,050 | 17,58,178 |

| 24,400 | 63,66,525 | 35,31,600 | 21,43,073 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 32,14,350 | -16,36,650 | 2,71,939 |

| 23,700 | 27,24,075 | -14,02,125 | 4,66,747 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 59,69,625 | 14,26,650 | 55,86,139 |

| 24,800 | 67,55,775 | 33,56,925 | 54,14,584 |

NIFTY Monthly Expiry (29/05/2025)

The NIFTY index closed at 24813.45. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.982 against previous 1.036. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 26300CE option, with open interest additions also seen in the 26350CE and 26000CE options. On the other hand, open interest reductions were prominent in the 24600CE, 25000CE, and 24500CE options. Trading volume was highest in the 25000CE option, followed by the 24800PE and 24800CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,813.45 | 0.982 | 1.036 | 0.786 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,69,02,525 | 6,29,02,800 | 1,39,99,725 |

| PUT: | 7,55,20,800 | 6,51,92,625 | 1,03,28,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 69,51,525 | -1,55,625 | 3,28,760 |

| 26,000 | 67,72,875 | 16,23,750 | 1,70,377 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 26,59,350 | 18,23,025 | 91,754 |

| 26,350 | 17,22,375 | 16,55,850 | 51,509 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 9,64,875 | -2,09,400 | 26,150 |

| 25,000 | 69,51,525 | -1,55,625 | 3,28,760 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 69,51,525 | -1,55,625 | 3,28,760 |

| 24,800 | 25,93,200 | 6,05,625 | 2,31,242 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 66,84,975 | 8,87,700 | 1,64,427 |

| 24,500 | 58,23,225 | 5,76,225 | 2,16,621 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 29,16,750 | 11,61,900 | 2,59,611 |

| 23,000 | 54,37,800 | 10,75,275 | 95,150 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 37,82,850 | -73,125 | 1,57,681 |

| 23,700 | 8,47,050 | -47,250 | 40,508 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 29,16,750 | 11,61,900 | 2,59,611 |

| 24,500 | 58,23,225 | 5,76,225 | 2,16,621 |

SENSEX Weekly Expiry (27/05/2025)

The SENSEX index closed at 81596.63. The SENSEX weekly expiry for May 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.657 against previous 0.771. The 85000CE option holds the maximum open interest, followed by the 86000CE and 85500CE options. Market participants have shown increased interest with significant open interest additions in the 86000CE option, with open interest additions also seen in the 89000CE and 65600PE options. On the other hand, open interest reductions were prominent in the 70000PE, 82000PE, and 81200CE options. Trading volume was highest in the 81500PE option, followed by the 85000CE and 82000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 27-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81596.63 | 0.657 | 0.771 | 0.742 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 62,26,720 | 24,67,989 | 37,58,731 |

| PUT: | 40,91,920 | 19,02,580 | 21,89,340 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,25,700 | 1,70,160 | 79,44,920 |

| 86000 | 4,54,960 | 3,15,820 | 69,14,560 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 4,54,960 | 3,15,820 | 69,14,560 |

| 89000 | 2,70,600 | 2,27,140 | 10,24,780 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81200 | 18,260 | -2,340 | 10,31,700 |

| 81300 | 43,340 | -340 | 20,62,660 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,25,700 | 1,70,160 | 79,44,920 |

| 82000 | 2,27,240 | 46,480 | 72,27,440 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 2,46,040 | 1,32,260 | 28,72,700 |

| 78500 | 2,29,080 | 83,080 | 24,01,360 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65600 | 2,08,620 | 2,05,800 | 7,57,000 |

| 75500 | 2,00,720 | 1,93,300 | 13,80,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 70000 | 46,340 | -61,560 | 9,17,520 |

| 82000 | 1,25,380 | -4,580 | 28,55,460 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 1,72,620 | 87,860 | 88,13,900 |

| 81000 | 1,93,600 | 20,360 | 59,50,800 |

BANKNIFTY Monthly Expiry (29/05/2025)

The BANKNIFTY index closed at 55075.1. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.760 against previous 0.742. The 63000CE option holds the maximum open interest, followed by the 60000CE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 60000CE option, with open interest additions also seen in the 58500CE and 40500PE options. On the other hand, open interest reductions were prominent in the 55500CE, 55000PE, and 60500CE options. Trading volume was highest in the 55000PE option, followed by the 55000CE and 55500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,075.10 | 0.760 | 0.742 | 0.949 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,71,12,050 | 2,75,88,309 | -4,76,259 |

| PUT: | 2,06,05,770 | 2,04,75,600 | 1,30,170 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,73,520 | 15,060 | 70,823 |

| 60,000 | 21,18,660 | 2,91,660 | 94,122 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 21,18,660 | 2,91,660 | 94,122 |

| 58,500 | 6,17,520 | 1,07,940 | 68,566 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 13,46,130 | -1,83,360 | 2,32,053 |

| 60,500 | 7,21,080 | -1,04,850 | 25,248 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,80,070 | -91,710 | 3,51,209 |

| 55,500 | 13,46,130 | -1,83,360 | 2,32,053 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,90,560 | -1,21,920 | 4,44,822 |

| 54,000 | 11,91,000 | 26,760 | 1,63,922 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 11,76,090 | 77,280 | 29,372 |

| 51,500 | 4,13,220 | 75,750 | 60,313 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,90,560 | -1,21,920 | 4,44,822 |

| 48,000 | 3,71,880 | -96,690 | 24,683 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,90,560 | -1,21,920 | 4,44,822 |

| 53,000 | 10,95,150 | -59,700 | 1,74,515 |

FINNIFTY Monthly Expiry (29/05/2025)

The FINNIFTY index closed at 26339.65. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.710 against previous 0.627. The 27000CE option holds the maximum open interest, followed by the 29500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 25500PE and 25000PE options. On the other hand, open interest reductions were prominent in the 27500CE, 28500CE, and 29000CE options. Trading volume was highest in the 26500CE option, followed by the 27000CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,339.65 | 0.710 | 0.627 | 0.810 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,77,550 | 16,95,265 | -1,17,715 |

| PUT: | 11,20,795 | 10,63,400 | 57,395 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,89,800 | -8,385 | 6,129 |

| 29,500 | 1,71,275 | 5,590 | 1,686 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 43,615 | 9,100 | 617 |

| 28,000 | 88,205 | 8,320 | 2,664 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 71,175 | -60,385 | 5,023 |

| 28,500 | 77,350 | -16,380 | 1,481 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 98,800 | -2,210 | 8,019 |

| 27,000 | 1,89,800 | -8,385 | 6,129 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,00,100 | 19,760 | 5,326 |

| 26,300 | 82,875 | 5,200 | 5,272 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,00,100 | 19,760 | 5,326 |

| 25,500 | 76,505 | 14,755 | 4,436 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 19,370 | -12,415 | 1,355 |

| 24,000 | 44,265 | -10,595 | 1,653 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,00,100 | 19,760 | 5,326 |

| 26,300 | 82,875 | 5,200 | 5,272 |

MIDCPNIFTY Monthly Expiry (29/05/2025)

The MIDCPNIFTY index closed at 12620.8. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.920 against previous 0.887. The 13500CE option holds the maximum open interest, followed by the 13000CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 13500CE option, with open interest additions also seen in the 11000PE and 12600PE options. On the other hand, open interest reductions were prominent in the 67000CE, 64000CE, and 69700CE options. Trading volume was highest in the 13000CE option, followed by the 12600PE and 12600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,620.80 | 0.920 | 0.887 | 0.818 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 79,36,920 | 75,94,320 | 3,42,600 |

| PUT: | 73,03,920 | 67,39,680 | 5,64,240 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,61,320 | 2,24,160 | 8,840 |

| 13,000 | 7,28,760 | -1,52,040 | 27,492 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,61,320 | 2,24,160 | 8,840 |

| 13,600 | 3,48,360 | 76,200 | 4,818 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,28,760 | -1,52,040 | 27,492 |

| 13,200 | 2,99,040 | -57,000 | 9,519 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,28,760 | -1,52,040 | 27,492 |

| 12,600 | 2,75,880 | 38,400 | 24,074 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,13,640 | 51,120 | 16,183 |

| 11,000 | 6,17,520 | 1,22,280 | 2,942 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 6,17,520 | 1,22,280 | 2,942 |

| 12,600 | 4,34,880 | 84,240 | 26,333 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 2,73,960 | -27,840 | 7,021 |

| 12,350 | 67,440 | -9,000 | 1,714 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 4,34,880 | 84,240 | 26,333 |

| 12,500 | 3,96,480 | 20,520 | 20,751 |

Conclusion: How to Read the Index Derivatives Trend Today

The Index Derivatives Trend Today for 21 May 2025 paints a picture of a market at a crossroads. Despite minor spot gains, the steep drop in futures premiums across NIFTY, BANKNIFTY, and FINNIFTY suggests profit booking and pullback from aggressive bullish positions.

Open Interest reduction, especially in the frontline indices, indicates lack of strong commitment. On the other hand, PUT additions near key support levels show traders are gearing up for expiry-centric consolidation plays rather than directional breakouts.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]